- High-growth tech stocks are back in demand thanks to growing optimism that the Fed is all done raising interest rates.

- The Nasdaq will continue to lead the market higher as the start of the Fed’s rate-easing cycle approaches.

- As such, here are three leading growth stocks worth buying amid the current backdrop.

- Looking to beat the market in 2024? Let our AI-powered ProPicks do the leg work for you, and never miss another bull market again. Learn More »

The U.S. stock market looks set to extend its strong performance in the new year as investors eye multiple interest rate cuts from the Federal Reserve in 2024.

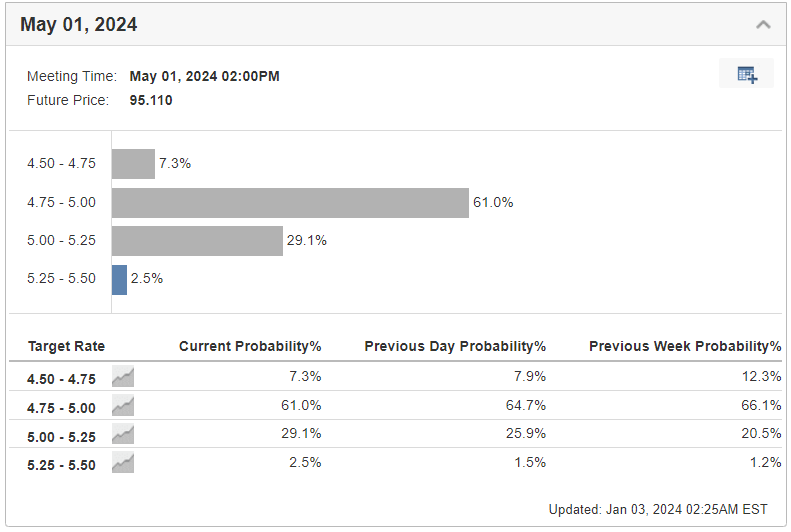

As of Wednesday morning, financial markets see a roughly 72.5% chance of the Fed cutting rates as early as its March policy meeting, according to Investing.com’s Fed Rate Monitor Tool.

Odds are even higher for May, with U.S. rate futures pricing in a 97%+ chance of a rate cut.

Source: InvestingPro

Taking that into consideration, I recommend buying shares of Arista Networks (NYSE:ANET), Fortinet (NASDAQ:FTNT), and Super Micro Computer (NASDAQ:SMCI) amid increasing odds that the Fed is done hiking interest rates and will pivot to easing monetary policy in 2024.

All three tech companies still offer further upside in my view, despite their impressive 2023 performance, and have plenty of room to grow their respective businesses, making them solid long-term investments.

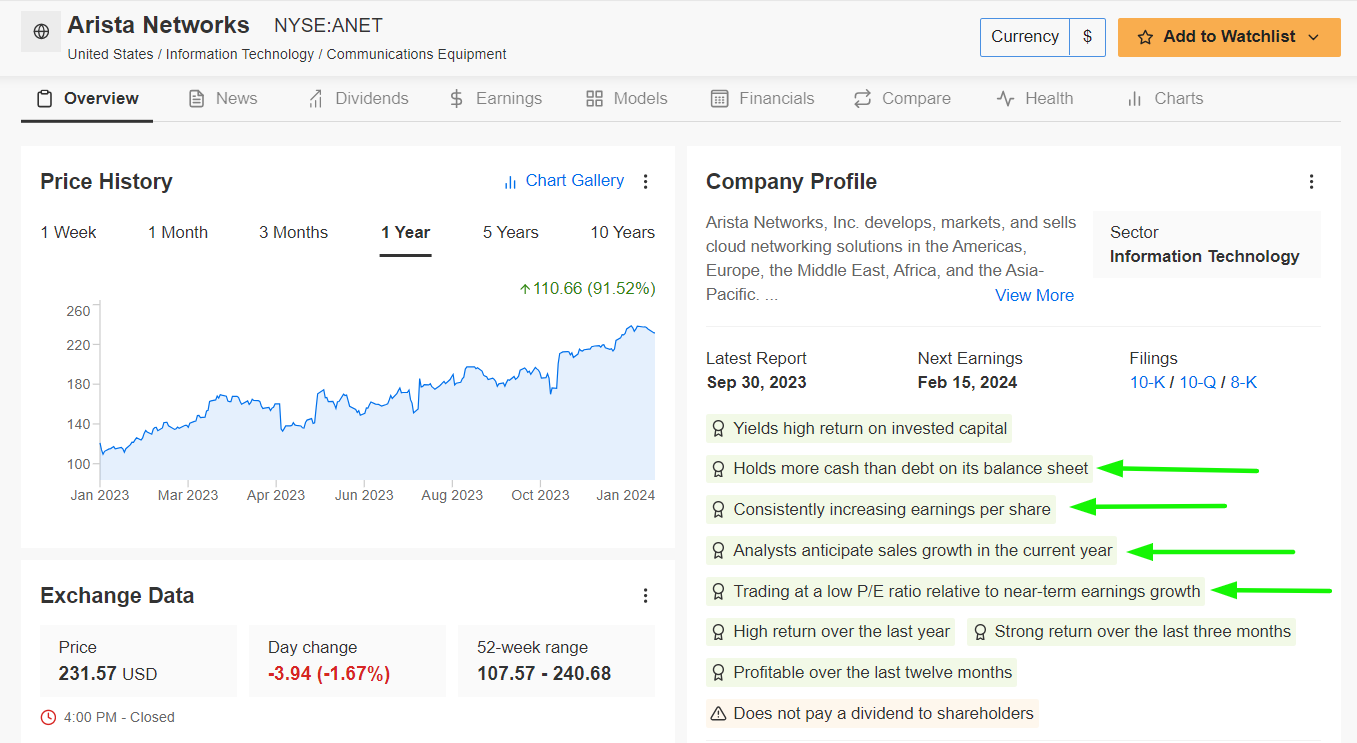

1. Arista Networks

Arista Networks, a leader in cloud networking solutions, looks like a smart buy heading into 2024 as the economy continues to undergo a sea change of digitization.

The Santa Clara, California-based company's expertise in cloud networking solutions aligns well with the expected surge in demand for cloud infrastructure in a lower interest rate environment from large companies, government agencies, and educational institutions.

Arista’s robust suite of cloud-based networking products and its strong market presence position it favorably to capitalize on this trend, potentially driving sustained growth in 2024.

Demonstrating the strength and resilience of its business, Arista Networks sports a near-perfect InvestingPro ‘Financial Health’ score thanks to its pristine balance sheet, robust cash flow, and strong earnings and sales growth trajectory.

Source: InvestingPro

ANET stock closed at $231.57 on Tuesday, just below its recent record high of $240.68 touched on December 26, earning the networking infrastructure company a valuation of $72 billion.

Shares ended 2023 with a whopping gain of 94%, making them one of the best performers on the S&P 500 for the year.

Arista is slated to report fourth-quarter earnings on Thursday, February 15. Not surprisingly, EPS estimates have seen 23 upward revisions in the past 90 days, as per data from InvestingPro, compared to just one downward revision.

Consensus estimates call for Arista to report a profit of $1.71 per share, rising 21.3% from EPS of $1.41 in the same quarter a year earlier. Revenue is forecast to increase 20.3% from the year-ago period to $1.54 billion.

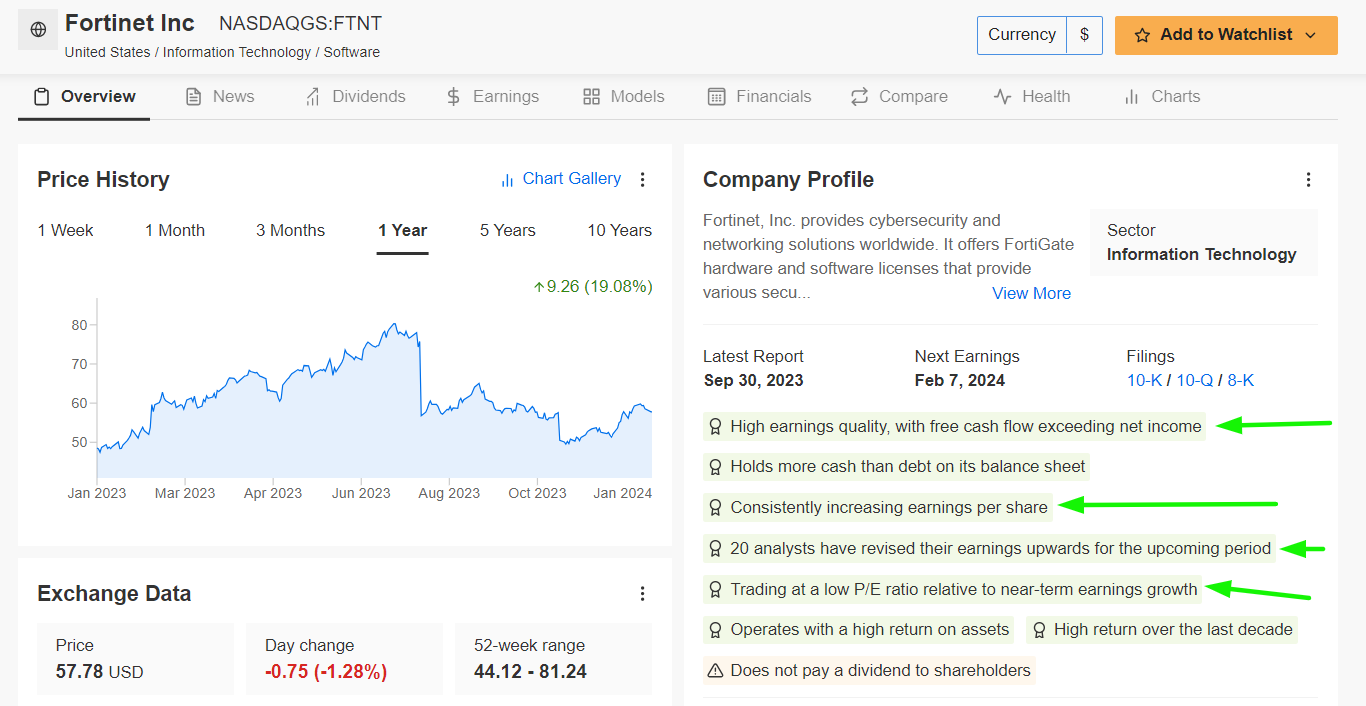

2. Fortinet

Fortinet, a leading cybersecurity solutions provider that develops and sells intrusion prevention systems and endpoint security components, remains a compelling choice in the tech sector as the new year kicks off.

The Sunnyvale, California-based company's potential to capitalize on increased spending on cybersecurity services positions it favorably for growth in 2024.

Indeed, anticipated rate cuts may encourage both small businesses and large enterprises to allocate more resources to fortify their cyber defense solutions amid an increasingly hostile geopolitical landscape.

As InvestingPro points out, Fortinet trades at a low forward price-to-earnings (P/E) ratio relative to near-term earnings growth.

Additional factors that would helpfully push the cybersecurity specialist forward in the new year include high earnings quality and robust free cash flow prospects.

Source: InvestingPro

FTNT stock ended at $57.78 yesterday, earning the network security firm a valuation of $44.4 billion. Shares closed 2023 with an annual gain of 19.7%.

It is worth noting that analysts are extremely bullish on Fortinet ahead of the company’s fourth-quarter update, which is due on Wednesday, February 7.

Profit estimates have been revised upward 20 times in the last 90 days, according to an InvestingPro survey, while only one revision has been downward.

Wall Street sees Fortinet delivering earnings per share of $0.43, increasing 30.3% from the year-ago period, while revenue is expected to climb roughly 10% year-over-year to $1.41 billion.

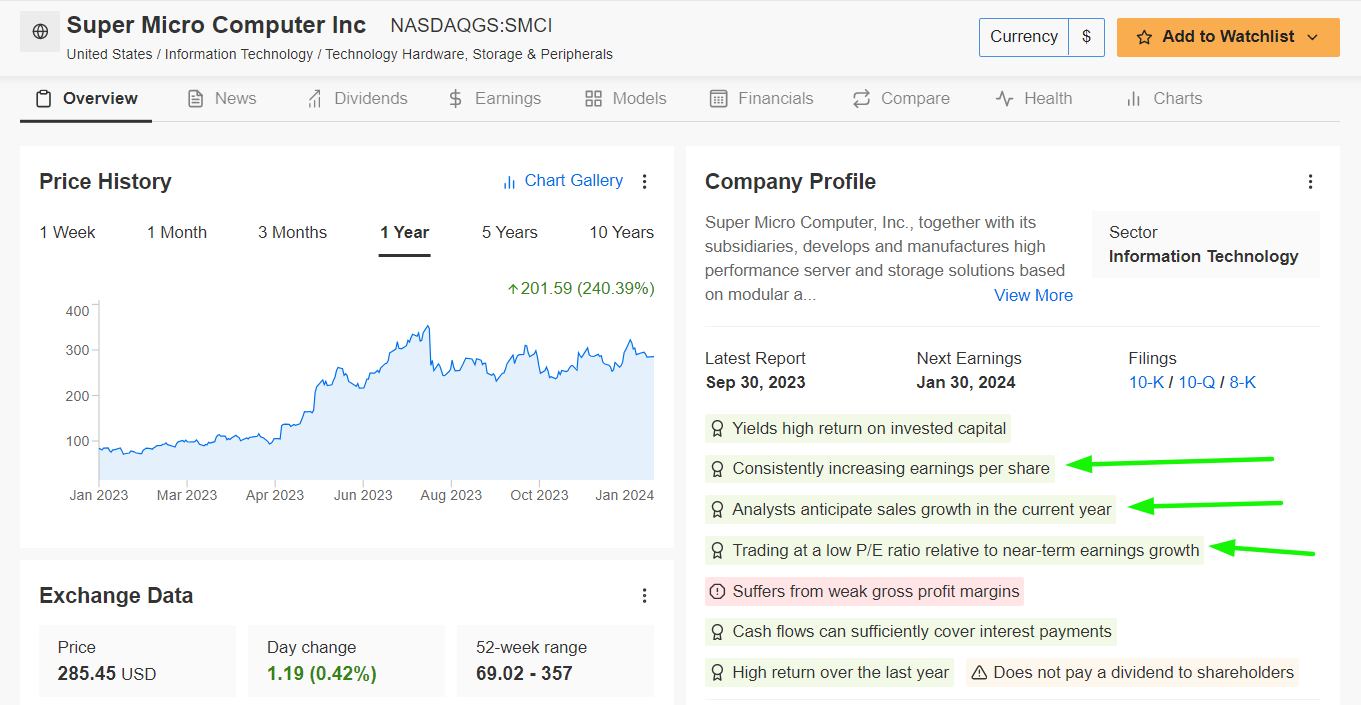

3. Super Micro Computer

Super Micro Computer, specializing in high-performance computing solutions, stands to benefit from an environment of easy monetary policy in 2024.

The San Jose, California-based company's focus on cutting-edge technology and its offerings in data center solutions align well with potential increased investment in tech infrastructure, positioning it for growth in a lower interest rate environment.

Tailwinds for the year ahead include expanded data center spending, advancements in computing technology, and potential upgrades in tech infrastructure.

According to insights from InvestingPro, the average ‘Fair Value’ price target for Supermicro’s stock implies a 14.3% upside over the next 12 months.

Additionally, InvestingPro highlights several tailwinds the information technology company has going for it, including consistently increasing earnings per share, accelerating sales growth, and a relatively low P/E ratio.

Source: InvestingPro

SMCI stock closed Tuesday’s session at $285.45, earning the company a market cap of about $16 billion. Shares soared by an astonishing 246% in 2023 amid the broad-based tech rally.

Super Micro Computer is scheduled to deliver financial results for its fiscal second quarter on Tuesday, January 30.

According to an InvestingPro survey, the company’s earnings estimates have been revised upward eight times in the past 90 days, compared to zero downward revisions.

Consensus expectations call for Supermicro to post earnings per share of $4.57, jumping 40.2% from EPS of $3.26 in the year-ago period. Meanwhile, revenue is anticipated to increase 57.8% year-over-year to $2.84 billion.

***

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. As with any investment, it's crucial to research extensively before making any decisions.

InvestingPro empowers investors to make informed decisions by providing a comprehensive analysis of undervalued stocks with the potential for significant upside in the market.

Have you ever found yourself faced with the question: which stock should I buy next?

Luckily, this feeling is long gone for ProPicks users. Using state-of-the-art AI technology, ProPicks provides six market-beating stock-picking strategies, including the flagship "Tech Titans," which outperformed the market by 670% over the last decade.

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR S&P 500 ETF (SPY (NYSE:SPY)), and the Invesco QQQ Trust ETF (NASDAQ:QQQ). I am also long on the Technology Select Sector SPDR ETF (NYSE:XLK). I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials. The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.