- Earnings season is in full swing

- While some companies will disappoint, some will far exceed expectations

- Let's take a look at three stocks that might surpass expectations and rally

We find ourselves amidst the bustling quarterly earnings season, where reports are pouring in at a rapid pace. While presenting satisfactory results is undoubtedly commendable, what truly sparks investors' enthusiasm is witnessing companies exceed expectations and deliver remarkable numbers.

In this article, we will delve into an in-depth analysis of three companies anticipated to showcase impressive growth in their financial figures. Our primary focus revolves around a crucial metric known as earnings per share, or EPS, which reveals the portion of a company's net profit allocated to each outstanding share.

Calculating EPS is a straightforward process - it involves dividing the company's net profit by the total number of common shares. To aid us in this endeavor, we will harness the power of the InvestingPro tool to unearth fascinating insights. So, without further ado, let's embark on our exploration!

1. MGM Resorts

MGM Resorts International (NYSE:MGM) is a Nevada-based business group that's a major player in the casino, hotel, and entertainment industry worldwide.

The company came into existence on May 31, 2000, following the merger of MGM Grand and Mirage Resorts. Currently, it holds the title of being the second largest gaming company on the planet.

The good news is that the company's stock is performing really well, thanks to the ongoing recovery of the travel sector.

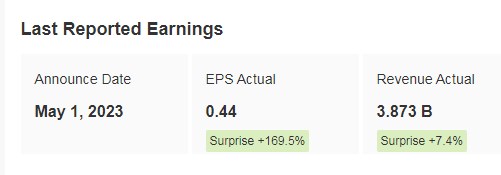

In its most recent earnings presented on May 1, the company surpassed market expectations by a significant margin in both earnings and EPS.

MGM Resorts stock seems to be on a winning streak, and investors are keeping a close eye on its growth.

Source: InvestingPro

On August 2, MGM Resorts is set to release its next results. Analysts are projecting earnings of 52 cents per share.

In the first quarter, the company exceeded forecasts by an impressive 170%, and now investors are cautiously optimistic that MGM Resorts might surprise us again.

Source: InvestingPro

Given the impressive performance, it's no surprise that MGM Resorts stock has already seen a remarkable increase of almost +60% in the last 12 months.

Source: InvestingPro

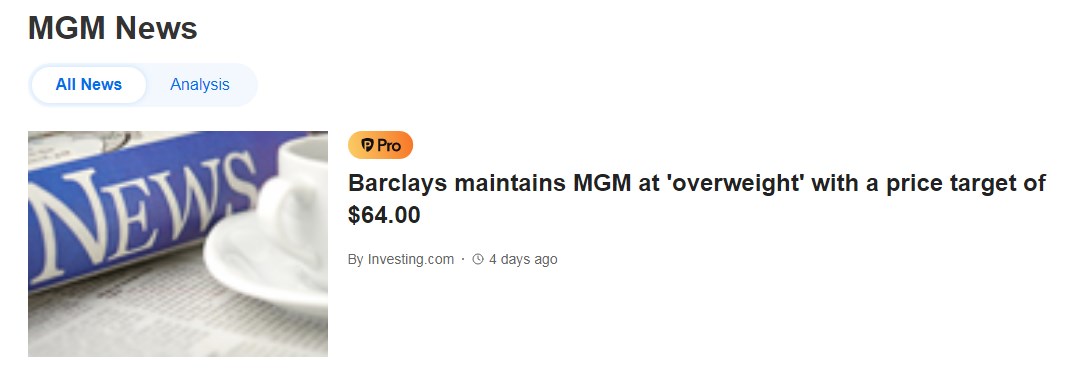

MGM Resorts has received a total of 18 ratings from analysts. Among these, 11 have given it a "buy" recommendation, 7 suggest "hold," and there are no "sell" ratings.

The latest statement comes from Barclays, who gave MGM Resorts a price target of $64, indicating their positive outlook for the stock.

However, the market sentiment appears to be slightly more conservative, with the general consensus leaning towards a price target of around $60 for MGM Resorts.

Source: InvestingPro

It maintains its current uptrend moving within an ascending channel and is very close to resistance.

2. Targa Resources

Founded on October 27, 2005, and headquartered in Houston, Texas, Targa Resources (NYSE:TRGP) stands as one of the largest infrastructure providers for natural gas in the United States.

On August 15, the company plans to pay out a dividend of $0.50 per share. Remember, if you want to be eligible to receive it, you must hold the shares before July 28.

For investors looking at potential returns, the dividend yield stands at a healthy +2.46%.

Source: InvestingPro

With earnings scheduled for August 3, the market is brimming with optimism when it comes to EPS. There's a strong belief among investors that the company will deliver impressive growth in this area.

Source: InvestingPro

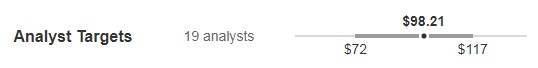

The company has received a total of 19 ratings from analysts, with an overwhelming majority of 18 "buy" recommendations, only 1 "hold," and no "sell" ratings.

Morgan Stanley is particularly bullish on the stock, giving it a price target of $106, indicating their confidence in its potential.

However, the market's overall sentiment is slightly more conservative, with a price target of $98.21 for the company.

Source: InvestingPro

The stock rose almost 30% in the last 12 months.

Source: InvestingPro

Its uptrend is supported by an ascending channel. It has just reached its resistance.

3. Aptiv

Aptiv (NYSE:APTV), formerly known as Delphi Automotive, is a prominent global technology company catering to the automotive sector. With its headquarters based in Michigan, USA, the company has been serving the industry since the late 1990s.

Specializing in designing and manufacturing vehicle components, Aptiv has become a significant player in the automotive tech space.

In their most recent financial results presented on May 4, Aptiv exceeded market expectations both in terms of earnings per share and overall earnings.

Source: InvestingPro

August 3, as Aptiv is set to report its next results. Analysts are expecting a positive increase in second quarter earnings, thanks to strong auto sales.

It'll be interesting to see how the company performed during this period, and investors will be keeping a close eye on the numbers.

Source: InvestingPro

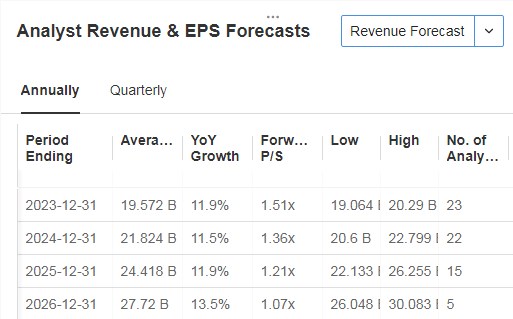

The revenue forecasts for both 2023 and the upcoming fiscal years are interesting.

Source: InvestingPro

According to Wolfe Research, the potential for this company stands at $130, while InvestingPro's models indicate a slightly higher potential at $131.39.

Both projections offer positive outlooks for the company's stock, and it will be intriguing to see how the market responds to these price targets.

Source: InvestingPro

The stock appreciated by almost 12% in the last 12 months.

Source: InvestingPro

Since the end of May, the stock has been showing significant strength, experiencing a notable upward trend that has pushed it above both the 50-day and 200-day moving averages.

***

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and, therefore, any investment decision and the associated risk remains with the investor.