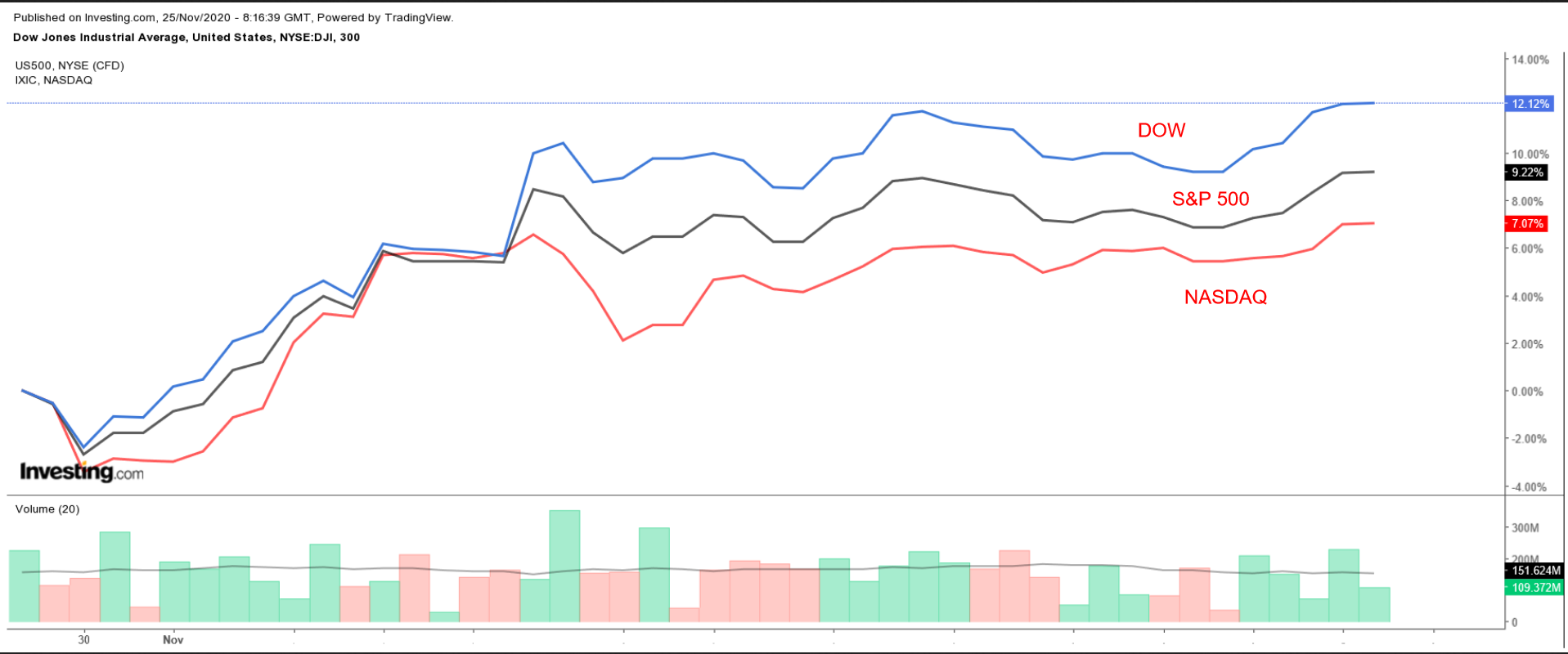

Positive news on COVID-19 vaccine progress has sparked a massive rally on Wall Street this month, with both the Dow Jones Industrial Average and S&P 500 notching a series of new record highs in recent days.

U.K.-based drugmaker AstraZeneca (NASDAQ:AZN) said at the start of the week that the COVID-19 vaccine candidate it was developing with the University of Oxford showed in Phase 3 trials that it can be as much as 90% effective.

That is the third vaccine candidate to show high levels of efficacy, following those from Moderna (NASDAQ:MRNA) and the Pfizer (NYSE:PFE) and BioNTech (NASDAQ:BNTX) team earlier this month.

Taking that into account, here are three stocks that stand to benefit from a vaccine-led return to normalcy in the months ahead:

1. Delta Air Lines

- Year-To-Date Performance: -29.4%

Perhaps one of the best stocks to buy for investors who want to play the ongoing rebound in domestic travel demand is Delta Air Lines (NYSE:DAL).

Shares of the airline company, which has hubs located in nine major cities across the U.S., including New York, Los Angeles, Atlanta, Detroit, and Seattle, have made an impressive recovery from the lows reached during their coronavirus-related selloff in May, rebounding an astonishing 135%. Despite the recent surge, shares are still down 29.4% year-to-date.

DAL stock ended at $41.26 on Tuesday, the highest close since Mar. 11 when the stock closed at $42.67. At current levels, the Atlanta-Georgia-based airliner has a market cap of $26.3 billion, making it the second-largest U.S. airline company behind Southwest Airlines (NYSE:LUV).

Data provided from the Transportation Security Administration (TSA) showed that nearly three million people went through TSA checkpoints over the three days through Monday, the highest number to travel over a weekend since mid-March, although this number is still muted when compared to last year.

Regardless, Sunday’s total of 1,047,934 was the highest single-day total since Mar. 16, despite calls from public health officials to avoid traveling for Thanksgiving.

The positive vaccine news could mean air-travel will improve at even more rapidly as we enter 2021, which should bode well for Delta.

2. Starbucks

- Year-To-Date Performance: +11.8%

Starbucks (NASDAQ:SBUX)—whose shares are up about 12% this year—has managed to weather the coronavirus health crisis with better success than most of its peers in the restaurant sector.

The coffee giant has taken steps to improve its digital ordering capabilities, drive-thru service and delivery and pickup options as it seeks to adapt to shifting consumer behavior amid the pandemic.

SBUX stock settled at $98.30 yesterday, not far from its all-time high of $99.72 reached in July 2019, giving the Seattle, Washington-based coffee chain a market cap of around $115.3 billion.

Starbucks suffered a sharp selloff in its stock from January through the end of March, taking prices back to 2018-levels, as it experienced huge sales declines due to coronavirus-related lockdowns.

However, shares have rallied almost 96% off the March lows as the coffee giant saw a swift recovery in traffic trends at both its U.S. and China stores—its two largest markets.

The chain reported fourth-quarter results that surpassed expectations in late October, thanks to robust digital sales growth and increased traffic at its suburban and drive-thru locations.

U.S. comparable-store sales fell 9% year-over-year, improving from a 41% drop in Q3. The corporation, which has nearly all of its stores in both the U.S. and China back up-and-running, said it would achieve double-digit comp sales growth in the second quarter of fiscal 2021.

3. Dave & Buster’s Entertainment

- Year-To-Date Performance: -32.7%

The final name to consider as we move closer to the roll-out of a vaccine is Dave & Buster’s Entertainment (NASDAQ:PLAY). The restaurant and video arcade business has been hard-hit from the effects of the pandemic as Americans avoid indoor activities and large gatherings.

The Dallas, Texas-based dining and entertainment venue operator, which has 137 locations across the U.S. and Canada, is likely to benefit from a return to normalcy when diners head back to its stores in greater numbers.

PLAY stock, which closed near a nine-month peak of $27.04 last night, has managed to stage a massive 485% rally since tumbling to a record low of $4.61 in mid-March. Shares are still down 32.7% so far this year.

Dave & Buster’s, which reported a sharp year-over-year decline in earnings and revenue in the second quarter, is projected to report third quarter results on Tuesday, Dec. 8 after the U.S. market closes.

Consensus estimates call for the company to post a loss of $1.08 per share, narrowing from a loss per share of $1.24 in the preceding quarter.

Revenue is forecast to clock in at around $116 million, which would indicate quarter-over-quarter sales growth of 128%, thanks to steadily improving sales at its reopened stores.

The arrival of a COVID-19 vaccine would likely result in a quicker recovery for the arcade-dining operator as consumers seeking a social-dining experience return to its locations.