Global financial markets were whipsawed this week, with Wall Street suffering its most crushing selloff in about four months on Jan. 27, as concerns grow over the coronavirus outbreak centered in Wuhan, China.

The number of total confirmed cases in China surged to 4,515 as of Tuesday and this figure could continue to rise as the virus's ability to spread is strengthening according to China's National Health Commission. There have been 106 confirmed deaths resulting from coronavirus, though none have been reported outside China.

A small number of cases linked to people who traveled from Wuhan have been confirmed in more than 10 countries, including the United States, Canada, France, Japan and South Korea.

As the virus expands its reach, concerns mount about the potential influence on global travel. Related stocks in the airline, cruise operation, casino and hotel industries are already sharply lower.

Since Jan. 21, Wynn Resorts (NASDAQ:WYNN) and Las Vegas Sands (NYSE:LVS), stocks with large operations in China, have dropped 12.30% and 7.35% respectively. While United Airlines (NASDAQ:UAL) fell 12.32% from Jan. 21.

However, companies producing safety equipment for high-risk workers and vaccines for infectious diseases are likely to gain in the short-term as demand for these products shoots higher.

Further escalation of the outbreak would spur even greater need for safety equipment and vaccine development. Here are 3 industry leaders in particular that stand to gain:

1. Lakeland Industries: Leading Hazmat Suit Manufacturer

Lakeland Industries (NASDAQ:LAKE), based in Ronkonkoma, New York, makes infection control gear, such as firefighting and heat protective apparel, disposable protective clothing, as well as chemical protective, clean-room and hazmat suits.

The company has seen its shares surge 27.6% since news of the virus outbreak sent shockwaves across financial markets on Jan. 21. The stock, which has rallied 30% YTD compared to the S&P 500’s 1.4% gain, closed at $14.00 on Tuesday with a market cap of $112.1 million.

The stock reached a fresh 52-week high of $16.28 on Monday and enjoyed a similar spike in late 2014, amid panic over an Ebola outbreak in Africa.

With the coronavirus threatening to turn into a full-blown epidemic, demand for this medical protective equipment maker’s products could grow.

Its customers are mainly industrial companies and governments from 40 foreign countries including China, the U.S., Canada and Europe. Additionally, the protective clothing provider is a vendor to federal, state and local governments, such as the United States Department of Defense, United States Department of Homeland Security and the Centers for Disease Control.

2. Alpha Pro Tech: Go-To Protective Face Mask Producer

Alpha Pro Tech (NYSE:APT) is in the business of protecting people, products and environments. The company, which operates entirely in the U.S. but supplies to the global market, makes protective clean-room suits, infection-control gear and air-filtration face masks that have become a common sight on the streets of China.

Shares are up a whopping 62.8% since Jan. 21. YTD and hit a 52-week high of $7.86 on Monday. The stock, which ended at $5.70 last night, has jumped 66% in 2020 and has a valuation of $74.2 million. Similar to Lakeland, Alpha Pro Tech also rose in late 2014 due to concerns over the Ebola outbreak in Africa.

After making its name during the SARS, Middle-East Respiratory Syndrome (MERS) and Ebola outbreaks Alpha Pro Tech has become the go-to name in times of global health crises. We’ve already seen face-mask shortages become more common across the globe. There has also been an increase in demand for eye shields and shoe covers for health-care workers in China exposed to infected patients.

3. Vir Biotechnology: Vaccine Prospects Drive Gains

Vir Biotechnology (NASDAQ:VIR) is a clinical-stage immunology company focused on combining immunologic insights with cutting-edge technologies to treat and prevent serious infectious diseases.

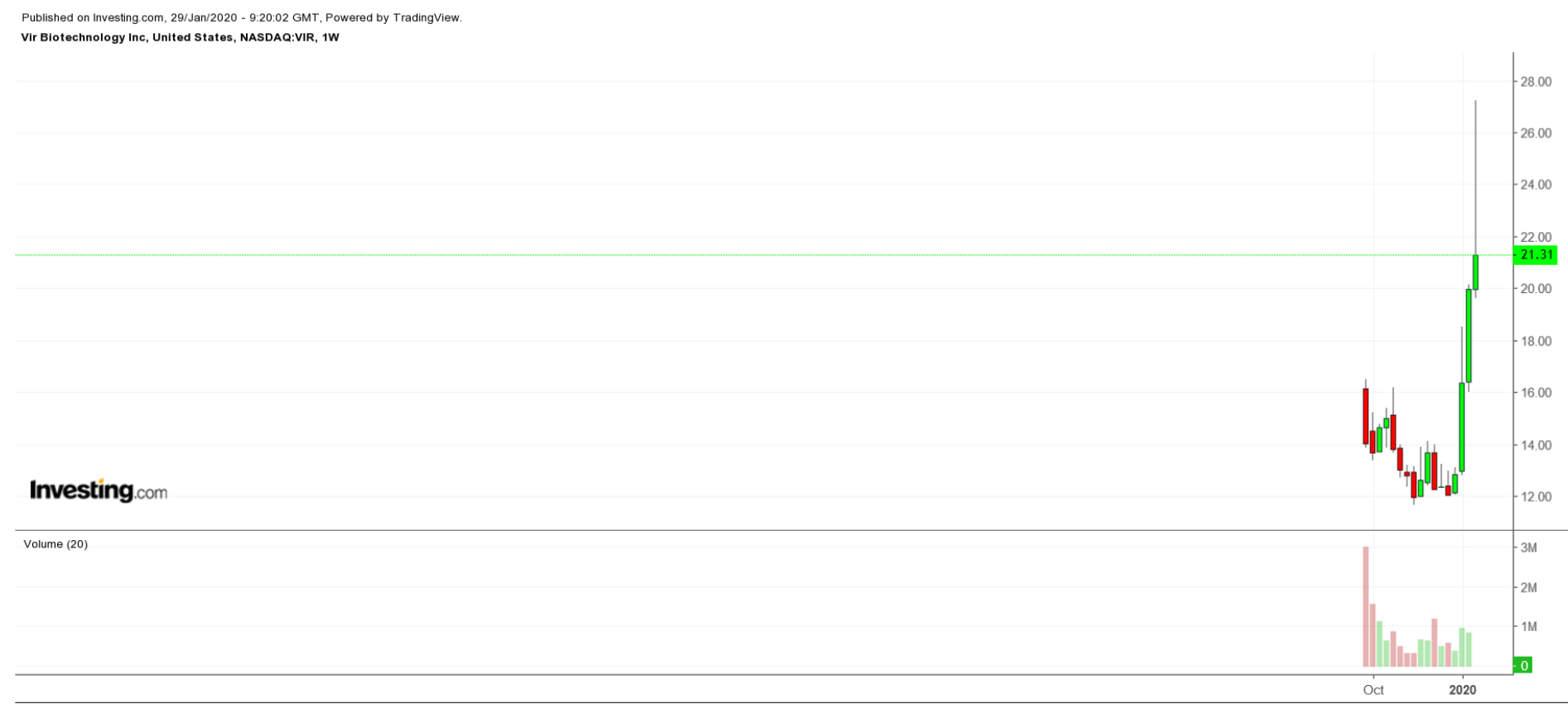

The San Francisco-based biotech firm, which went public in October 2019, has soared 30% since Jan. 21. The stock settled at $21.31 yesterday with a market cap of $2.34 billion. Shares, which are up nearly 70% YTD, climbed to an all-time high of $27.48 on Monday.

Vir Biotech is well-positioned to benefit from the coronavirus outbreak as it has four technology platforms that it is leveraging to develop treatments for infectious diseases, including influenza and tuberculosis. Investors perceive that it may have the ability to develop a vaccine given that it has already provided antibodies for other coronavirus strains in the past.