- Today, we'll explore three ETFs offering exposure to robotics and artificial intelligence, simplifying investment in these sectors.

- Creating a diversified portfolio of shares or opting for funds and ETFs can be an intriguing option for long-term investors.

- These ETFs provide a cost-effective and straightforward approach to capitalize on the potential of robotics and AI.

- Investing in the stock market and want to get the most out of your portfolio? try InvestingPro. Sign up NOW and take advantage of up to 38% off for a limited time on your 1-year plan!

Robotics and Artificial intelligence (AI) are not just the future but also the present, and they are poised to revolutionize our world and daily lives, both personally and professionally.

Experts in these fields suggest that we are still in the early stages. It's akin to being able to invest in Internet-related stocks at the dawn of the Internet age. That's why allocating some of our capital to invest in robotics and AI for the medium to long term could be a rewarding idea.

There are two primary ways to do this:

- Create an investment portfolio by purchasing shares of companies in the robotics and AI sectors. However, this requires time, effort, and expertise to research, analyze, and select suitable companies. Additionally, monitoring and management of the portfolio are necessary, along with associated expenses like broker commissions for buying and selling.

- Invest in an ETF (Exchange-Traded Fund), which streamlines the process. An ETF handles everything, including research, analysis, buying, and selling shares, all for a lower commission than creating a portfolio of individual stocks. This is the option we'll explore today.

You might think you need to invest in two separate ETFs, one for robotics and one for AI. However, it's simpler than that. You can invest in an ETF that covers both sectors together.

Here are three such ETFs that combine both robotics and AI sectors:

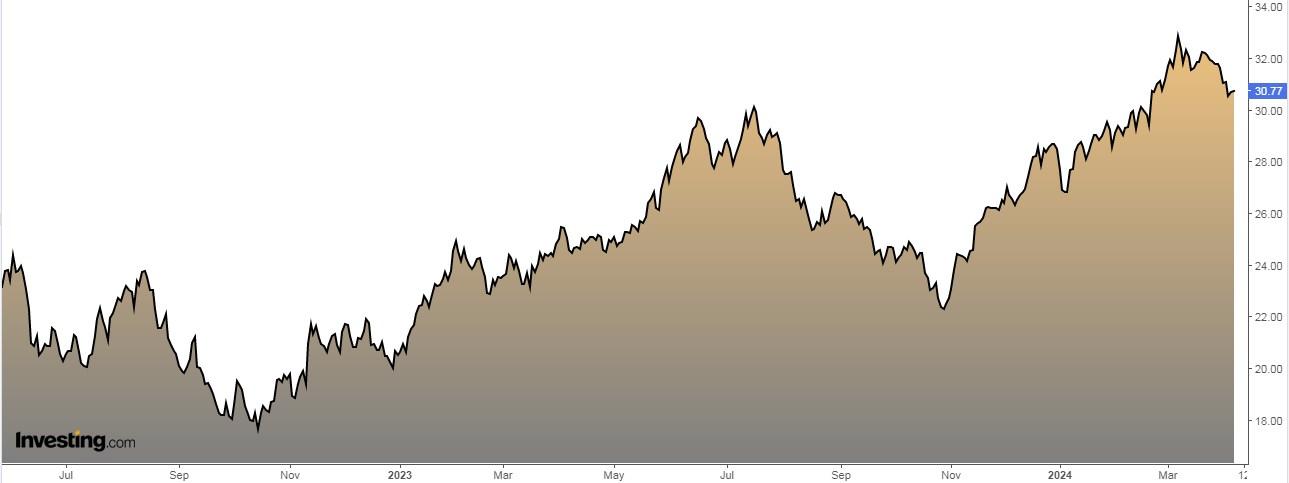

1. Global X Robotics & Artificial Intelligence ETF

Global X Robotics & Artificial Intelligence ETF (NASDAQ:BOTZ) replicates the Global Robotics & Artificial Intelligence Thematic index, which is made up of companies from around the world that stand to benefit from the rise of robotics and AI.

The ETF has a U.S. and a European version.

Total annual fees are 0.50% Dividends from the ETF are distributed to investors every six months.

The ETF was launched on November 16, 2021 and is domiciled in Ireland.

Its 1-year yield is 26.29%. It invests in 45 companies, with the following being the most heavily weighted:

- NVIDIA (NASDAQ:NVDA) 21.18%.

- Intuitive Surgical (NASDAQ:ISRG) 10.65

- ABB (ST:ABB) 8.57%

- Keyence (OTC:KYCCF)

- UiPath (NYSE:PATH) 4.33%

- Dynatrace (NYSE:DT)

- SMC 3.91%

- Daifuku 3.36%

- YASKAWA Electric 3.27%

By country, its investments are distributed as follows:

- United States 54.31% Japan

- Japan 25.72% Switzerland 10.62

- Switzerland 10.62% Norway

- Norway 2.27% United Kingdom 1.58

- United Kingdom 1.58% Finland 1.46

- Finland 1.46% Others

- Others 4.04% Others 4.04% Others 4.04% Others 4.04% Others 4.04% Others

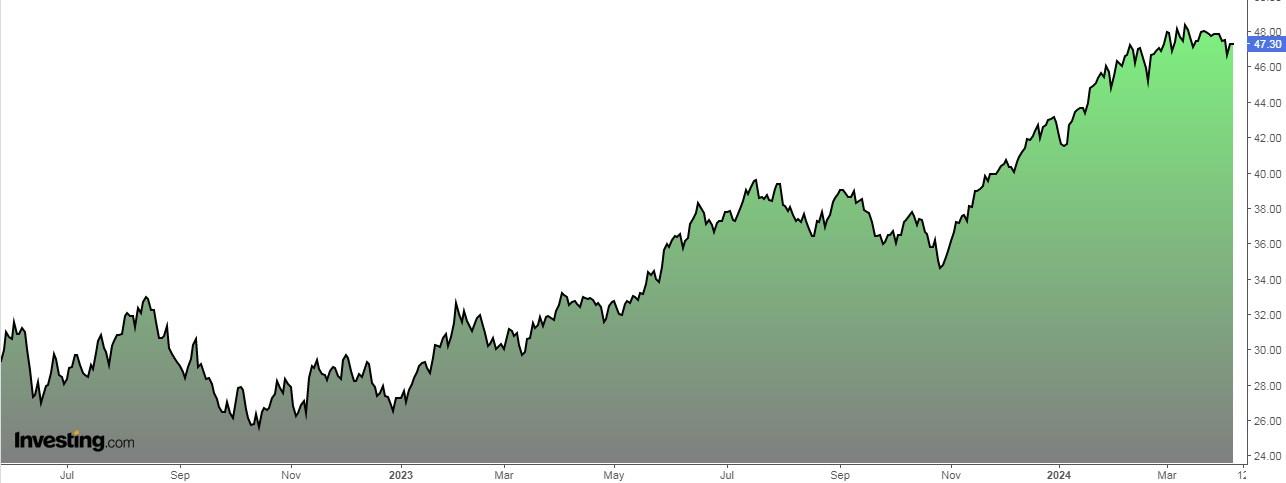

2. iShares U.S. Tech Breakthrough Multisector ETF

iShares U.S. Tech Breakthrough Multisector ETF (NYSE:TECB) was created in 2020. Dividends are paid quarterly.

Commissions are 0.40%. The yield since its creation is 10.80%. The ETF replicates the NYSE FactSet index (NYSE:FDS) U.S. Tech Breakthrough, which is Formed by U.S.-listed companies engaged in the research and development of cutting-edge products and services in the areas of robotics and artificial intelligence.

Its main positions are:

- NVIDIA 6.51%.

- Meta (NASDAQ:META) 5.62%

- Amazon (NASDAQ:AMZN) 4.36%

- Merck 4.28%

- Salesforce (NYSE:CRM) 4.02%

- Alphabet (NASDAQ:GOOGL) 4%

- Microsoft (NASDAQ:MSFT) 3.93%

- Netflix (NASDAQ:NFLX) 3.61%

- Advanced Micro Devices (NASDAQ:AMD)

- Oracle (NYSE:ORCL) 3.38%

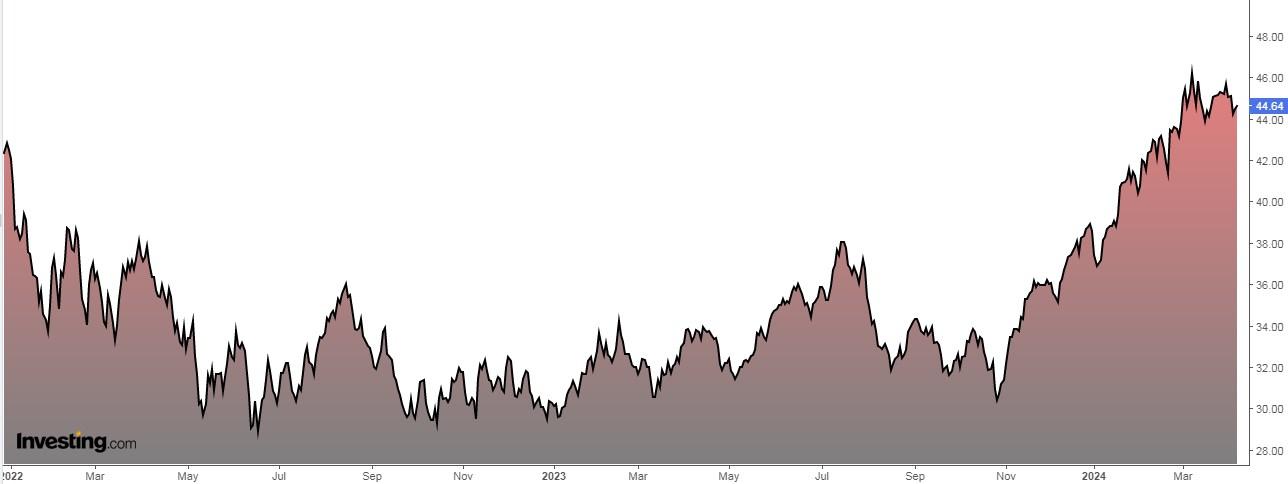

3. Invesco AI and Next Gen Software ETF

Invesco AI and Next Gen Software ETF (NYSE:IGPT) was launched in June 2005 and has fees of 0.60%. Its return since its inception is 15.26%.

The ETF replicates the Stoxx World AC NexGen index and invests at least 90% of its assets in the stocks that make up the index.

Its main positions are:

- Alphabet 9.47%.

- Meta Platforms 8.59%

- NVIDIA 7.92%

- Adobe (NASDAQ:ADBE) 7.08%

- Advanced Micro Devices 6.73%

- Intuitive Surgical 4.59%

- Qualcomm (NASDAQ:QCOM) 4.58%

- Micron (NASDAQ:MU)

- Intel (NASDAQ:INTC) 3.94%

- Keyence 2.98%

***

Want to try the tools that maximize your portfolio? Take advantage HERE AND NOW of the opportunity to get the InvestingPro annual plan for less than $10 per month.

Use the code INVESTINGPRO1 and get almost 40% off your 1-year subscription - less than what a Netflix subscription costs you! (And you get more out of your investments too). With it you'll get:

- ProPicks: AI-managed portfolios of stocks with proven performance.

- ProTips: digestible information to simplify a lot of complex financial data into a few words.

- Advanced Stock Finder: Search for the best stocks based on your expectations, taking into account hundreds of financial metrics.

- Historical financial data for thousands of stocks: So that fundamental analysis professionals can delve into all the details themselves.

- And many other services, not to mention those we plan to add in the near future.

- Act fast and join the investment revolution - get your OFFER HERE!