When markets are calm (read: boring), it’s easier to take a step back from the daily noise and ask ourselves the big picture questions like

Yes, but what’s the Macro EndGame?

It often feels like the way we are running our economies and financial system is unsustainable in the long run, so reflecting on how we got here and what’s the ultimate Macro EndGame is a great big-picture exercise.

Here is my framework to answer this Million Dollar Question.

In 1971, the Gold Standard effectively came to an end.

President Nixon ended the convertibility of USD into gold at a fixed price, and effectively introduced the fully elastic fiat system we have been living with since then.

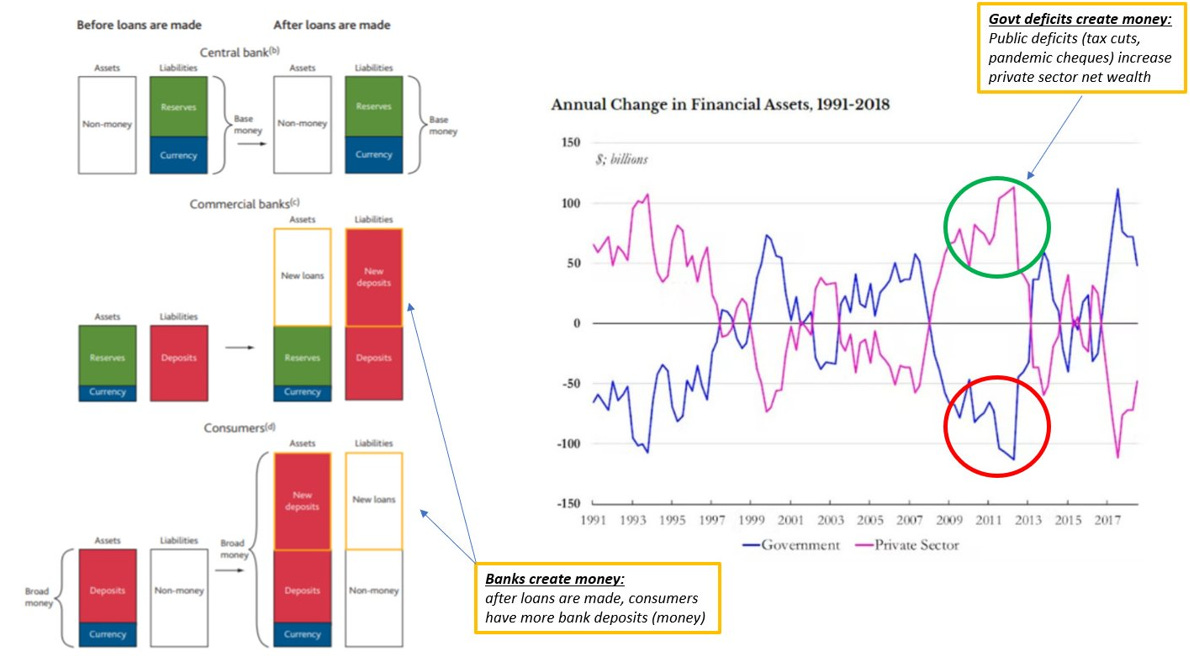

Commercial banks and governments can now create credit out of thin air and add net worth to the private sector without having to worry about the intrinsic value of the newly created money.

The peg to gold is gone, and the supply of fiat money can be extended in a fully elastic way:

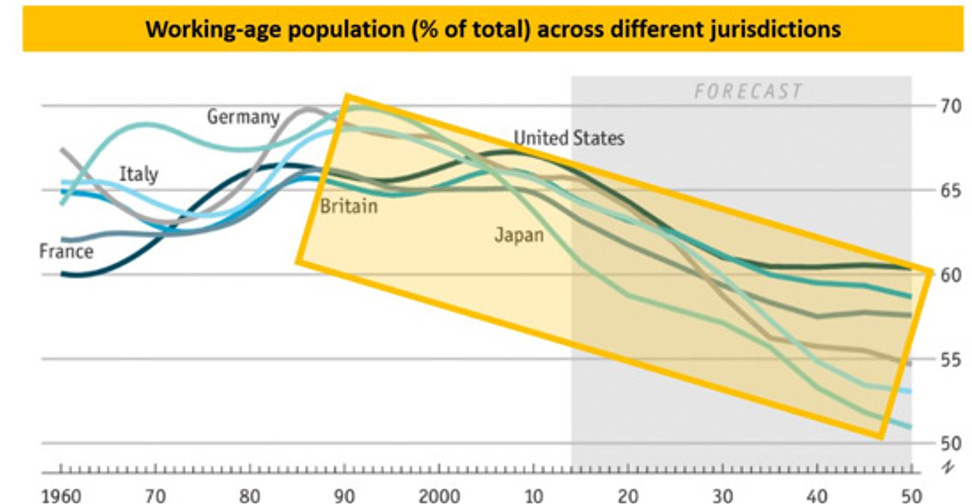

This new monetary system coincided with important economic changes in the 1980s: the main drivers of structural growth which are working-age population growth & productivity growth both peaked back then!

The post-WWII demographics boom that led to strong labor force growth in the 60s-70s had exhausted its effects in the late 80s:

Productivity growth had increased rapidly as well in the post-WWII period, but it was failing to keep a pace rapid enough to offset the demographics headwinds:

The trend was becoming clear, and politicians ''had to'' intervene: how?

With debt, of course.

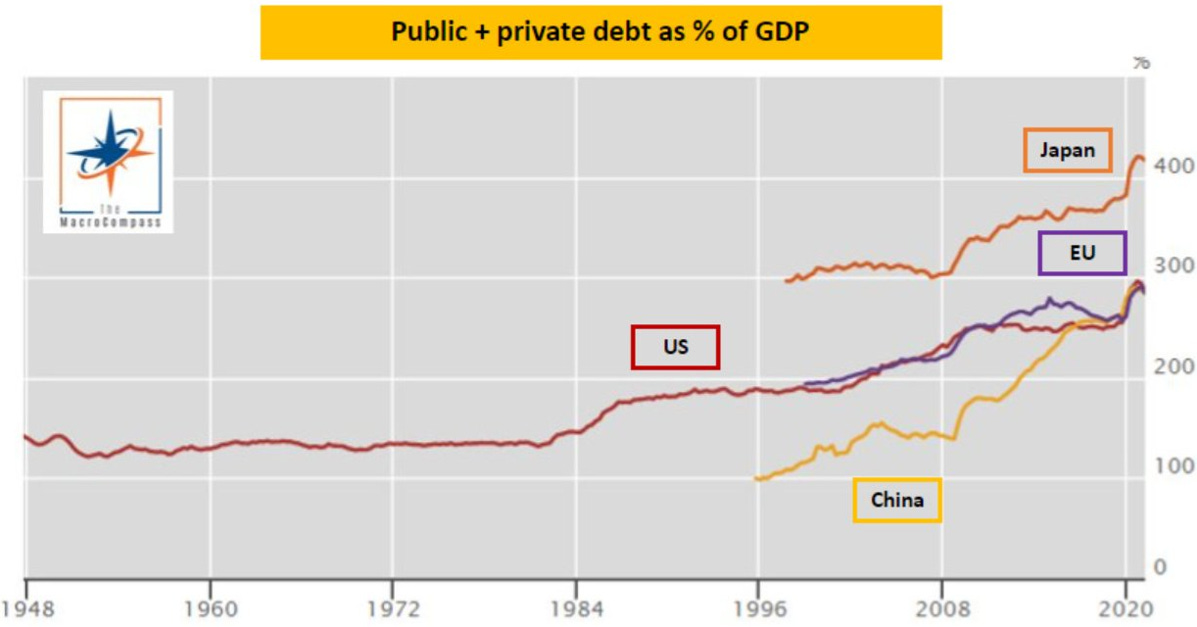

Healthy private sector balance sheets allowed for private sector debt expansion, and governments across the world started running more fiscal deficits too.

Notice that every jurisdiction in the world is doing the same, perhaps with a different mix between private and public sector leverage but we have all been levering up!

Cool, but servicing a mountain of (often unproductive) leverage is expensive.

The trick here is simple, but genius: lower real interest rates.

Let's recap:

-

Our economic system produces poorer & poorer long-term economic growth due to low population growth & stagnant productivity

-

To achieve politically acceptable growth rates in the short-term, we continue to leverage up both in the private and public sector

-

Real interest rates drop further to keep the system afloat: CBs accommodate this process with monetary policy actions

This ''prosperity'' model encourages the ''wealth illusion'' effect: asset prices rapidly increase as a result of cheaper and cheaper real interest rate.

All clear so far, but this system depends on one key factor.

Incremental leverage must be accessible at ever-lower real interest rates.

This ensures both the ‘‘affordability’’ of incrementally higher debt levels & the continuation of the wealth illusion paradigm:

Think about house prices.

Say you bought a house in the US during the early ‘90s and let’s assume the bank lent you 100% of the purchase value.

You wanted to spend about $1,000 per month in mortgage installments and given 30y mortgage rates at 10%, that meant you could buy a house worth approximately $120,000.

Now, fast forward to 2021.

You still want to spend $1k per month in mortgage installments, but now your 30-year mortgage rate is below 3%!

You can now ‘‘afford’’ a house worth $240.000: double the initial price.

Here is your wealth effect: the previous owner who paid $120,000 for the house now feels ‘‘richer’’ as his house is worth almost double the money, and the new buyer can afford it because of lower interest rates.

Again, all nice: but this system has limitations.

Specifically, Central Banks have been forced to hike rates to fight inflation and they are keen in keeping rates higher for longer. This means leverage isn’t accessible at lower rates anymore.

And while Central Banks can always cut rates again and governments proactively intervene with fiscal injections, what if:

-

Keeping rates higher for longer causes trouble before Central Banks turn dovish?

-

Fiscal injections are met with true skepticism by bond vigilantes?

-

None of the above happens, Central Banks can happily cut rates but we go back to a world where the zero lower bound prevents the continuation of the kick-the-can-down-the-road exercise (e.g. Japan)?

I see three potential routes ahead:

1) ‘’Gentle’’ deleveraging (politically unviable)

Policymakers could decide to actively deleverage the system in a (hypothetically) orderly way, but this is unlikely to be gentle given how much leverage sits in the system.

It would rather be a painful process that inflicts large losses to 2 generations of people that have lived and prospered through the wealth illusion effect.

What politician would volunteer to actively engineer this? Nobody.

2) Wealth redistribution (possible, but a very volatile process)

By 2028, the majority of US voters are going to be Millennials and Gen-Z and they are likely to push for wealth redistribution policies.

Politicians want to be elected, so I think they will be willing to accommodate such policies but this is easier said than done: wealth redistribution comes with deleveraging the rich and injecting resources to the poorer cohorts and this could accelerate money velocity.

Inflation and stagflation risks would materially increase.

3) Kick the can down the road until the system implodes (most likely, but destined to fail)

Policymakers’ objective #1 is to remain in power, and preserving the status quo works wonders for that.

This is the most likely short-term scenario where politicians use deficits to keep people reasonably happy without triggering bond vigilantes, and Central Banks go back to gentle easing as much as they are allowed by markets.

But at some point, this pretend-and-extend exercise will face some issues.

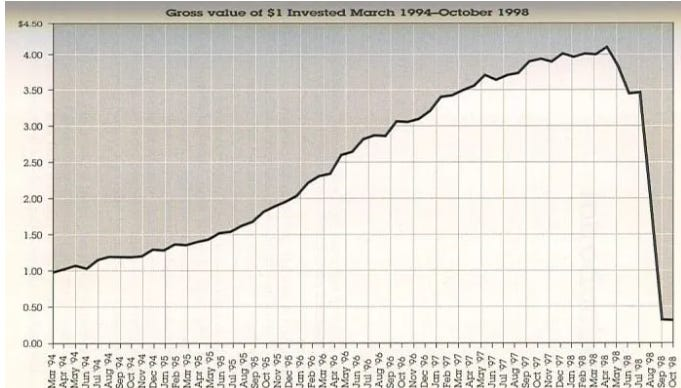

Trading the Macro EndGame is nearly impossible because if you go bananas and only position your portfolio for mayhem you might forego decades of positive returns while you wait, and wait, and wait.

It’s a bit like betting on the LTCM debacle, but having to wait potentially decades and not 4 years to cash in:

And indeed the Macro EndGame shouldn’t be ‘’traded’’, but kept in mind while constructing long-term macro portfolios – ideally by adding exposure which benefits from deleveraging, wealth distribution, or a more explosive system reset in a balanced way.

This is why in my Forever Portfolio I have exposure to different ‘’safe havens’’:

-

The US Dollar: which would work in case of deleveraging;

-

Commodities: which would work in stagflationary or inflationary environments;

-

Gold: which works as a hedge against a monetary system reset

I hope you enjoyed this big-picture macro piece, and (as an exception) feel free to share it with friends and colleagues if you think it can help them with their macro framework.

This article was originally published on The Macro Compass. Come join this vibrant community of macro investors, asset allocators and hedge funds - check out which subscription tier suits you the most using this link.