- Market fears have intensified amid overheating recession fears.

- As markets continue to face uncertainty, it is important to maintain a long-term view.

- In this piece, we'll take a look at why you shouldn't panic during such declines and why you can remain bullish.

- For less than $8 a month, InvestingPro's Fair Value tool helps you find which stocks to hold and which to dump at the click of a button.

After a string of worse-than-expected macro data, the market feared that the Fed may have waited too long to start cutting interest rates, raising the risks of a recession in the world's leading economy.

But the risk signals were not limited to the U.S. alone, as eurozone business surveys showed that the region has been affected by geopolitical tensions, weaker global growth, and fragile consumer confidence.

In addition, activity in China's manufacturing sector also slowed in the three months leading up to July.

The Fed has been delaying the first rate cut of the new cycle and now the fear has arisen that it may have waited too long and the economy may be starting to stutter.

That is why there have been rumors that the Fed could call an emergency meeting and lower rates.

But that remains highly unlikely, given the fact that in the last 30 years, there have only been 9 emergency meetings, and all of them under more serious circumstances than the current one.

The decision to wait until September seems the most reasonable since cutting rates between meetings could provoke a sense of panic in the markets.

Despite the market turmoil, it's crucial to maintain perspective. Historical data reveals that market drawdowns are a normal part of the investment cycle.

While the current situation may feel alarming, it's important to remember that similar, or even more severe, declines have occurred in the past.

Why You Shouldn't Panic About the Recent Market Declines

Despite the strain of tight monetary policy, U.S. economic fundamentals remain strong and will soon benefit from easing measures.

Consider the recent spike in the VIX, often dubbed the 'fear gauge,' which surged to an unprecedented level above 65—a rare event typically signaling panic. However, there are doubts about whether the VIX was genuinely reflecting market sentiment.

A more accurate measure comes from VIX Futures, which showed much smaller increases. On Monday, the VIX rose by 42 points to 65.73 in less than five hours, yet the August futures linked to the VIX climbed far less during the same period.

While the drawdown may appear severe, it's essential to consider the broader historical context.

From 2000 to 2023, the S&P 500 experienced 16 drawdowns exceeding the current level of decline. This data underscores the fact that market corrections are not uncommon and often present buying opportunities for long-term investors.

Keeping that in mind, let us consider three reasons you can continue to remain bullish on the markets despite the recent roller-coaster ride.

1. Hedge Funds Betting on a Market Rebound

Interestingly, while individual investors may be fleeing the market, hedge funds have been actively buying US stocks at the fastest pace since March. This suggests that seasoned professionals believe the recent sell-off presents an attractive entry point.

2. Historical Trends Favor Recovery

Historically, a market pullback has often been a buying opportunity. Since 1980, the S&P 500 has delivered an average return of 6% in the three months following a 5% drop from a recent high.

3. Recent Drawdown Was Normal

In 2024, the S&P 500 experienced a maximum drawdown of 8.5%. Over the past 96 years, 68 years have seen greater drawdowns, meaning 70.8% of the time, the market has faced steeper declines.

While the most severe drawdowns occurred in the distant past (e.g., 1931: -57.5%, 1932: -51%), more recent years have also seen significant drops.

From 2000 to 2023, 16 out of 24 years experienced drawdowns greater than the current one, making this year’s decline far from extraordinary.

As we head into the week, all eyes will be on employment data to determine whether the macroeconomic landscape continues to complicate.

Bottom Line: Investors Remain Fearful, and This Could Signal an Opportunity

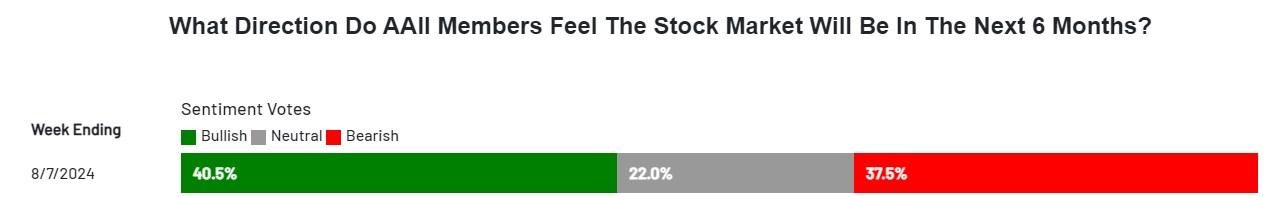

AAII reveals that investors are the most pessimistic they have been in the last nine months. This comes after the S&P 500 had its worst day in two years last Monday.

Source: AAII

The percentage of pessimists increased to 37.5%. Historically, that's above the 31% average, but still below November's pessimism, which peaked at 50.3%.

On the other hand, optimists fell from 44.9% to 40.5%.

While pessimism is on the rise, it is more important than ever to remember the broader historical context before deciding to panic sell your long-held positions.

***

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest and is not intended to incentivize asset purchases in any way. I would like to remind you that any type of asset is evaluated from multiple perspectives and is highly risky; therefore, any investment decision and associated risk remains with the investor.