We’re a full week into the new Biden Administration, and the prevailing mood is one of relief. Politics has been turned down a couple of notches, giving real hope that, for the short term at least, we’ve got a boring time ahead of us. That’s really all that anyone wants, after the crazy roller coaster ride that was 2020.

A period of calm, when investors feel safe taking a deep breath and giving decisions the time they need, is the perfect moment to start buying into the market. Step back, take a look at the big picture, and know that now is the time for a well-considered move.

We’ve opened up the Investing Insights platform to find the details on three stocks that have gotten plenty of analyst love in this new year, and we’ve found a consistent pattern to them. All have a Strong Buy consensus rating, and a Perfect 10 from the Smart Score metric – but even better, a recent analyst review has presented an even more bullish upside picture. Here are the details.

SailPoint Technologies (SAIL)

First up, Sailpoint (NYSE:SAIL), focuses on access management for cloud computing systems, plugging a natural security weakness of the cloud. SailPoint’s solutions include, among other features, access certification, password, management, and cloud governance. The security products allow for tracking and managing traffic into and out of cloud systems – a vital component of network security.

SailPoint showed increases revenues in 2020. In Q1, the company registered a 25% yoy gain; in Q2, the gain was 46%. For the third quarter, SAIL’s year-over-year gain was again 25%. These increases come as the pandemic has pushed an increasing portion of office work online – and prompting more demand for access security to digital networks.

Wedbush analyst Daniel Ives notes the company’s increasing sales on increasing demand: “It’s clear the company’s product suite is in the sweet spot of spending as more enterprises move to the cloud with SAIL’s compelling footprint resonating with both new and existing customers… With our estimate that 33% of workloads are currently on the cloud moving to 55% by 2022, SAIL has a golden opportunity to gain share against legacy vendors as well as further penetrate IT budgets going forward in this fluid cloud shift.”

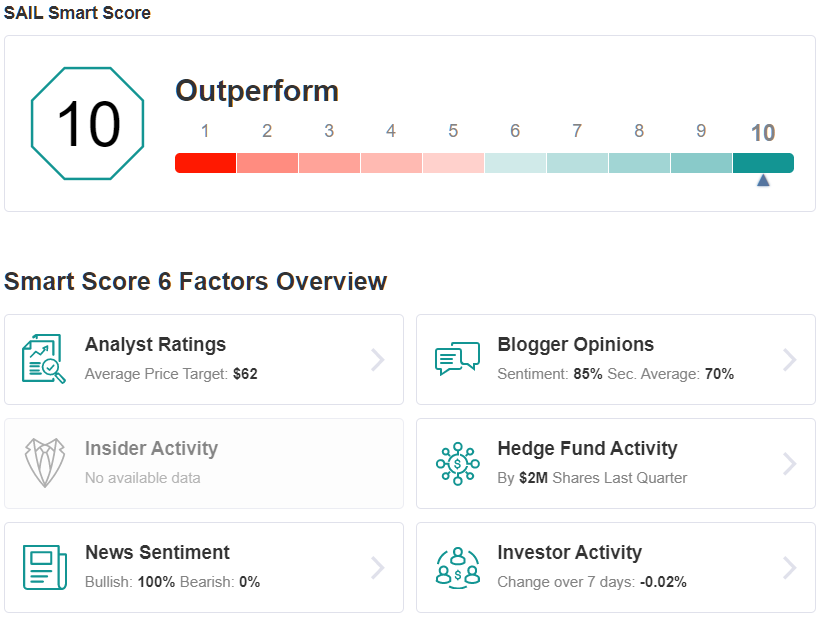

In line with this bullish stance, Ives rates SAIL shares an Outperform (i.e. Buy), and his $75 price target indicates confidence in 31% upside for the next 12 months.

Wall Street agrees with Ives, as shown by the Strong Buy analyst consensus rating. The rating is based on 11 recent reviews, including 9 Buys and 2 Holds. However, the recent share appreciation has pushed the price almost to the $60.50 average target, leaving room for 6% upside. (See SAIL stock analysis)

HubSpot (HUBS)

Next up, HubSpot (NYSE:HUBS), has made its name in tech as an innovator, specifically for its inbound marketing software products. HubSpot has made the lives of SEO optimizers, social media marketers, CRM experts, and content managers easier with products ranging from web analytics to software integration. The company has operated since its 2006 founding on the freemium model, by which customers can access basic services without charge, while keeping the option of buying a paid subscription for higher-level services and regular upgrades.

2020 was a good year for HubSpot, as the company is perfectly positioned to gain from an increase in remote office work and telecommuting. The company saw its revenue hit $228.4 million in 3Q20, the last quarter for which numbers are available, for a 32% year-over-year gain. That figure was driven by subscription revenue of $221.1 million, which was also up 32% yoy.

The #2 analyst in TipRanks database, Brent Bracelin of Piper Sandler, cast his eye on HubSpot, and the cloud software sector generally.

Of the cloud business, at the macro level, Bracelin says, “Coming off a record year for cloud software driven by an unprecedented digital awakening that propelled sector-wide valuations, including a doubling of our 2020 top picks, the 2021 setup gets trickier. Robust digital tailwinds are reflected in near peak valuation multiples with the road to recovery and cyclical rotation fears tempering further upside.”

Turning to HubSpot, the analyst lists the company as one of his ‘highest conviction cloud stocks for 2021.’

“HubSpot has a long runway to sustain high growth considering it has just 3% penetration (95K+ customers) across a global customer TAM in excess of 3 million,” Bracelin opined. “Untapped cross-sell opportunity across new CMS and Sales Hubs give us an upward bias to consensus estimates of 22% growth next year.”

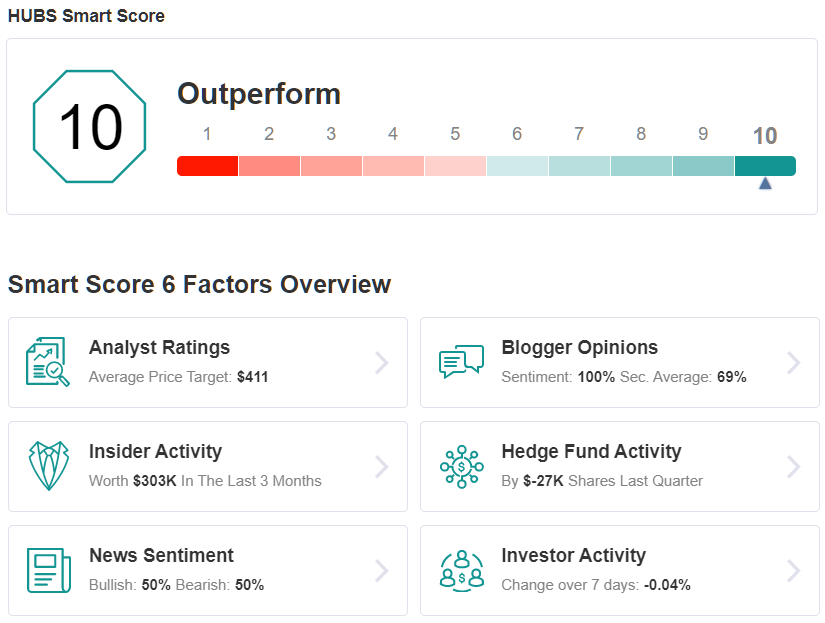

To this end, Bracelin rates HUBS shares an Overweight (i.e. Buy), along with a $488 price target. This figure suggests a 39% upside for the coming year.

Bracelin is certainly not the first analyst with an optimistic outlook for the software player, as TipRanks analytics showcasing HUBS stock as a Strong Buy. With an average price target of $411.93, analysts see ~18% growth for the stock. In total, the stock has received 12 Buy ratings vs. 4 Holds. (See HUBS stock analysis)

DCP Midstream Partners (DCP)

Based in Denver, Colorado, the next stock is one of the country’s largest natural gas midstream operators. DCP (NYSE:DCP) controls a network of gas pipelines, hubs, storage facilities, and plants stretching between the Rocky Mountain, Midcontinent, and Permian Basin production areas and the Gulf Coast of Texas and Louisiana. The company also operates in the Antrim gas region of Michigan.

In the most recent reported quarter – 3Q20 – DCP gathered and processed 4.5 billion cubic feet of gas per day, along with 375 thousand barrels of natural gas liquids. The company also reported $268 million in net cash generated, of which $130 million was free cash flow. The company reduced its debt load by $156 million in the quarter, and showed a 17% reduction in operating costs year-over-year.

All of this allowed DCP to maintain its dividend at 39 cents per share. Early in the corona crisis, the company had to cut back that payment – but only once. The recently declared 4Q20 dividend is the fourth in a row at 39 cents per common share. The annualized rate of $1.56 gives a respectable yield of 7.8%.

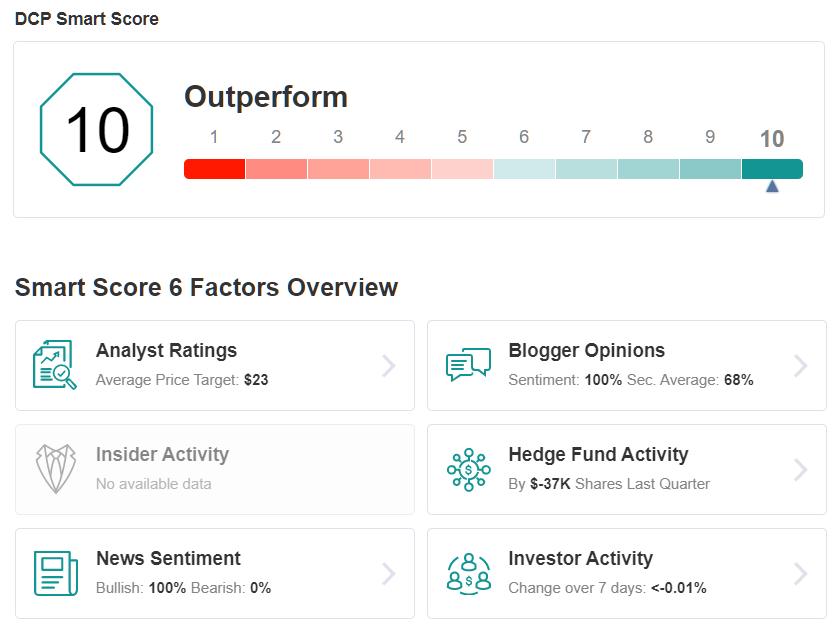

To this end Raymond James analyst James Weston bumps this stock up from Neutral to Outperform (i.e. Buy), while setting a $24 target price to imply 20% growth on the one-year time horizon.

“[We] expect DCP to post yet another solid quarter on sequential improvements in NGL prices, NGL market volatility, and positive upstream trends… we are not capitalizing current propane prices and anticipate a solid, but more normalized pricing regime over the next 12-18 months. In our view, this will create a beneficial operating environment for DCP cash flows that is not currently reflected in Street estimates,” Weston noted.

All in all, the Moderate Buy analyst consensus rating on DCP is based on 7 recent reviews, breaking down 4 to 3 Buy versus Hold. Shares are priced at $19.58 and the average target of $23 suggests an upside of ~15% from that level. (See DCP stock analysis)

To find more ideas for stocks trading at attractive valuations, visit Investing Insights.