- Amid upcoming central bank meetings and crucial macroeconomic data releases, market sentiment is poised for potential shifts.

- While broader market indexes may continue to consolidate sideways, specific stocks have shown remarkable gains and robust bullish momentum in recent sessions.

- This analysis, powered by InvestingPro insights, seeks to determine the fair valuation of these stocks and assess the bullish momentum's sustainability.

- In 2024, invest like the big funds from the comfort of your home with our AI-powered ProPicks stock selection tool. Learn more here>>

Key central bank meetings, including the Fed, and important macro data are on the agenda amid a busy week for the financial markets.

While indexes may consolidate sideways, certain stocks have recently experienced significant gains and demonstrate strong bullish momentum.

This analysis aims to assess whether these stocks are priced fairly and if they are likely to keep going up.

To access these stocks, we will use insights from InvestingPro. The three stocks we'll look at are:

1. 3M Company

3M Company (NYSE:MMM) has updated its earnings projections for the first quarter, raising its estimate per share to a high of $2.20 from the previously stated range of $2.00 to $2.15.

The increase in earnings estimates is due to the effects of the separation of 3M's healthcare business as of April 1 and the announced quarterly dividend of $1.51 per share, or $6.04 if annualized.

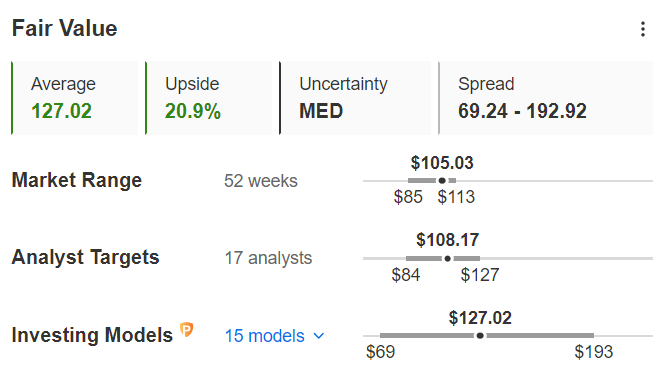

Source: InvestingPro

For 3M, the Fair Value from InvestingPro, which summarizes 15 investment models, stands at $127.02, or +20.9% above the current price.

Again InvestingPro subscribers were able to follow the development of the forecasts of the analysts interviewed, as for the target price they are bullish on the stock, at $108.17.

While analysts and Fair Value agree on the possibility of a rise, the risk profile is less reassuring; it has a fair level of financial health, with a score of 2 out of 5.

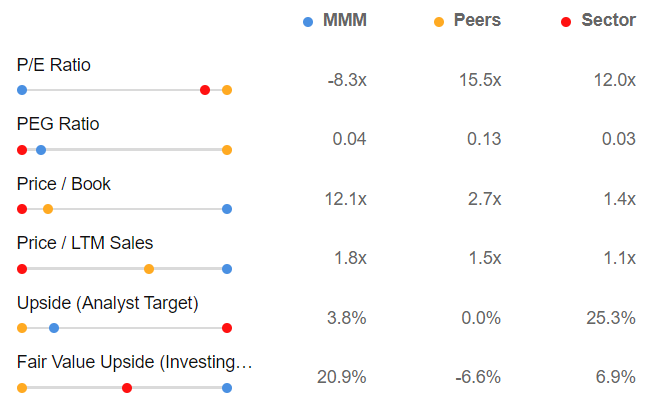

Comparing the stock with competitors, we have the confirmation we expected, the stock currently has a potentially undervalued valuation.

Source: InvestingPro

3M is now worth 1.8x times its revenue compared to 1.1x in the industry, and the Price/Earnings ratio at which the stock is trading is -8.3X against an industry average of 12x, again pointing to a slight undervaluation relative to the industry.

2. Oracle

Oracle (NYSE:ORCL) was influenced by recent growth in cRPO (current remaining performance obligations), a strong indicator of renewed momentum in the cloud business after a period of disappointing results in the previous two quarters.

This is supported by the company's solid operating margins, which are expected to remain above 40%.

The company's optimism is bolstered by stable growth in Infrastructure as a Service (IaaS), which recorded a 49% increase, closely aligned with the 50% growth observed in the previous quarter.

It recently reported a 16% increase in non-GAAP earnings per share and 7% revenue growth for the fiscal period, forecasting acceleration through fiscal year 2025.

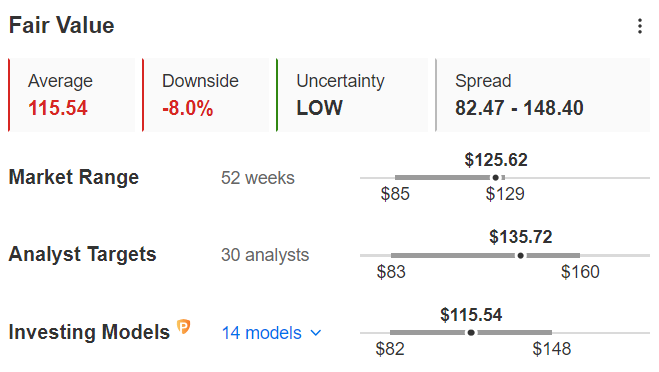

Source: InvestingPro

For Oracle, InvestingPro's Fair Value, which summarizes 14 investment models, stands at $115.54, which is -8 % less than the current price.

Thanks to InvestingPro it is possible to follow the development of the forecasts of the analysts interviewed, as for the target price they are bullish on the stock, at $135.72 and consequently far from the average Fair Value.

While analysts and Fair Value at the moment agree on the downside possibilities, the low-risk profile is positive it has a good financial health rating of 3 out of 5.

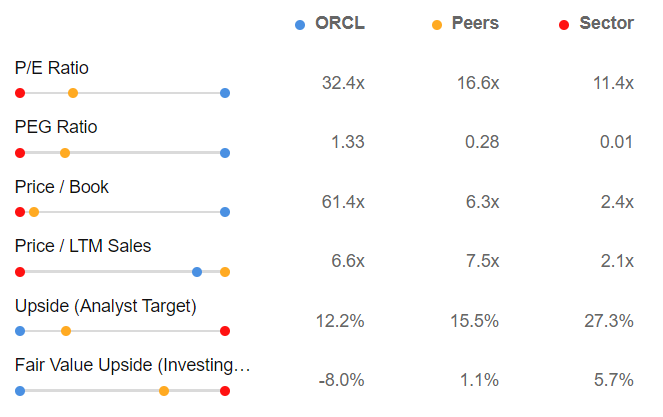

Delving deeper into the stock compared to its competitors, we have the confirmation we expected, the stock is currently highly overvalued

Source: InvestingPro

Oracle is now worth more than six times its revenue compared to more than two times in the industry, and the Price/Earnings ratio at which the stock is trading is 32.4x compared to an industry average of 11.4x, which stands to confirm here its current overvaluation even relative to the industry.

3. PayPal

PayPal (NASDAQ:PYPL) strategic shift and product improvements have been key, but the immediate impact on results may be limited, as evidenced by the recent decline in active customer accounts and cautious forecasts for 2024.

However, the transition under Chriss's leadership and the appointment of Aaron J. Webster as the company's new executive vice president means an increased focus on innovation and operational efficiency due to the positive industry outlook.

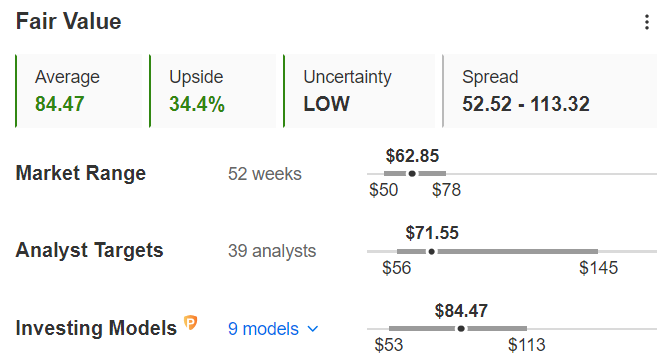

Source: InvestingPro

For PayPal, InvestingPro's Fair Value, which summarizes 9 investment models, stands at $84.47, or 34.4% higher than the current price.

InvestingPro subscribers were able to follow the analysts' forecasts easily, as they are bullish on the stock with the target price at $71.55.

Currently, analysts and Fair Value both agree on the likelihood of a rise. This is further supported by the company's strong financial health, rated at 3 out of 5 for its low-risk profile.

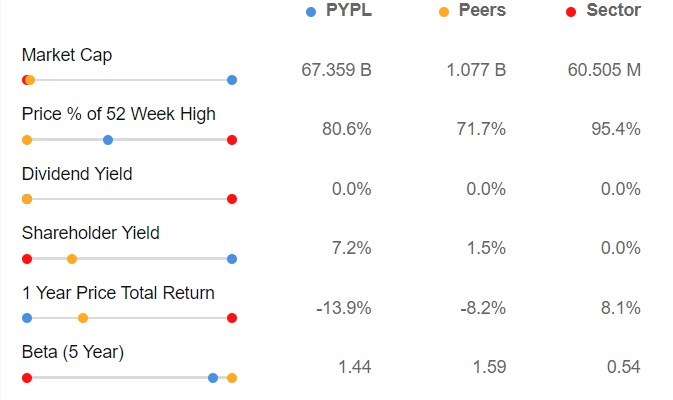

However, upon closer examination, comparing it with competitors reveals a potential overvaluation, which contradicts the anticipated upside.

Source: InvestingPro

PayPal is now worth more than two times its revenues compared to two and a half times in the industry, and the Price/Earnings ratio at which the stock is trading is 15.9X against an industry average of 8.3x, which stands to confirm its overvaluation relative to the industry.

***

Take your investing game to the next level in 2024 with ProPicks

Institutions and billionaire investors worldwide are already well ahead of the game when it comes to AI-powered investing, extensively using, customizing, and developing it to bulk up their returns and minimize losses.

Now, InvestingPro users can do just the same from the comfort of their own homes with our new flagship AI-powered stock-picking tool: ProPicks.

With our six strategies, including the flagship "Tech Titans," which outperformed the market by a lofty margin over the last decade, investors have the best selection of stocks in the market at the tip of their fingers every month.

Subscribe here and never miss a bull market again!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.