The market has taken a turn this past month, with volatility picking up and key technical indicators signaling caution. The S&P 500, which had been trading within a well-defined range (Darvas Box) for the past four months, has now fallen sharply, testing a critical support level that has been in place since November 2024. The decline over the past week has been particularly notable, with the index dropping over 4% on heavy selling volume.

While the market remains at a technical inflection point, recent price action has been decisively bearish. The failure to break out of the top of its trading range and the strong downside momentum suggest that the risk of further declines is rising. Additionally, market breadth has deteriorated, with key risk-on assets—such as semiconductors, small caps, and discretionary stocks—underperforming defensive sectors like consumer staples (NYSE:XLP.

In this month’s newsletter, we will examine three key charts that highlight the current state of the market: the S&P 500 Index ETF (SPY) chart below, which is testing a key support level, a market breadth chart that illustrates the weakening internal structure of the market, and a relative strength chart that confirms investors have been rotating into defensive sectors.

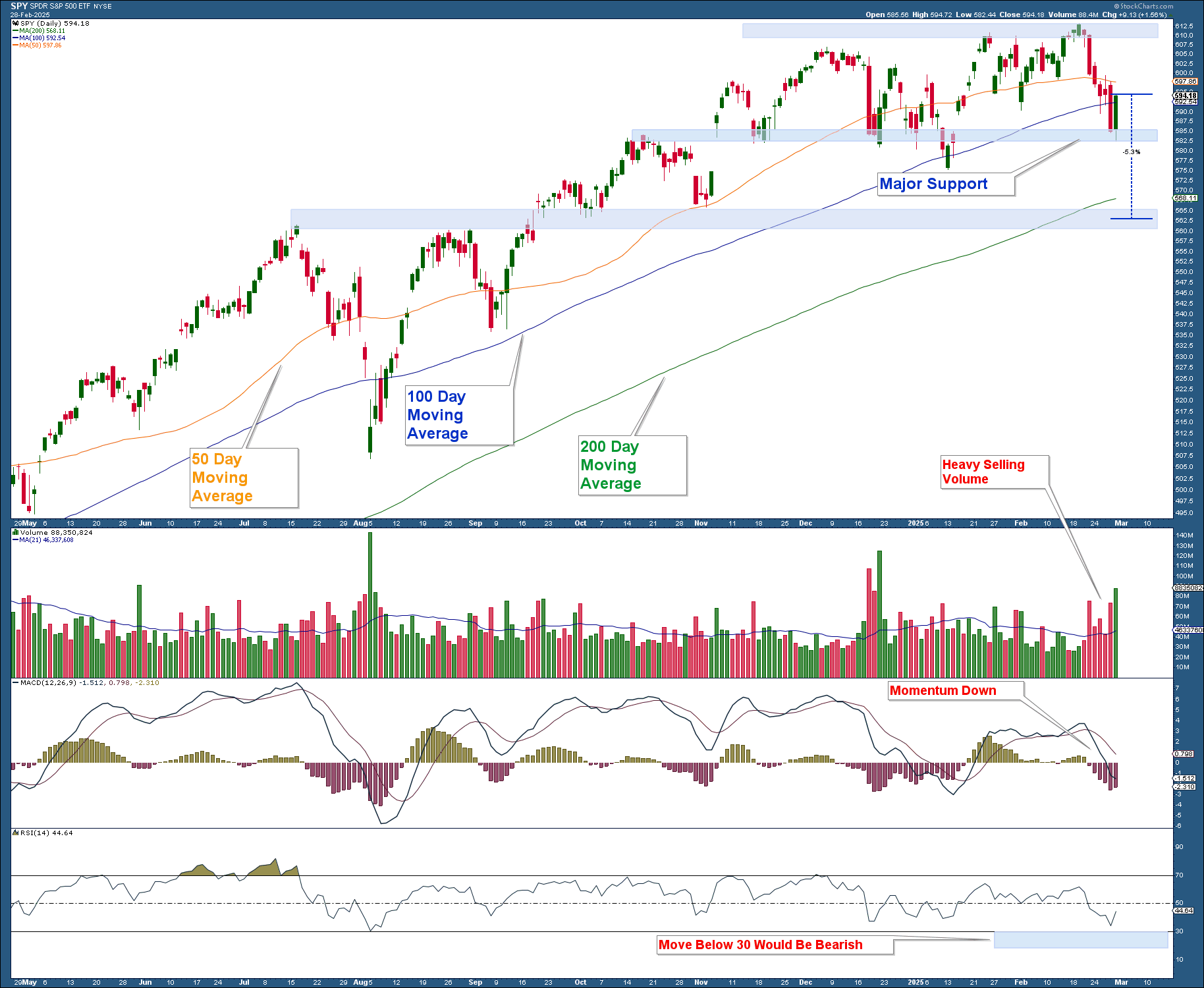

Chart #1: SPY—Breaking Below Key Moving Averages

SPY has fallen below its 50-day and 100-day moving averages (closed above), signaling a shift in momentum. The index has also dropped from the upper boundary of its four-month Darvas Box down to its lower boundary. A decisive break below this level would turn this pattern into a topping formation, increasing the odds of lower prices in the near-term.

Key concerns:

- The index has fallen over 4%, accompanied by heavy selling volume.

- Momentum (MACD) has turned sharply negative, signaling downside momentum.

- The RSI in the lowest panel is currently at 44—if further weakness pushes it below 30, it would have bearish implications.

- If the index falls below support, the next key level to watch is approximately 5% lower.

The market is at a critical inflection point. A breakdown below support would signal further stock market weakness, while a decisive advance above resistance would have bullish implications especially if accompanied by outperformance by growth stocks and other risk-on assets.

Chart #2: Market Breadth—Warning Signs Under the Surface

While the NYSE Composite Index has recently revisited its highs from late last year, market breadth is signaling a warning. Beneath the surface, breadth indicators have been deteriorating for months, raising concerns about the sustainability of the market’s current bull market advance.

This chart, which spans back to March 2020, includes the 2022 bear market and highlights a troubling pattern: negative divergences in key breadth indicators similar to those that preceded the last major market downturn.

-

NYSE New Highs – New Lows (Second Panel): While the index has reached levels comparable to previous highs, the number of stocks making new highs minus those making new lows has been trending downward since September 2024. This divergence suggests that fewer stocks are participating in the advance, a classic warning sign. Notably, a similar divergence in this indicator emerged months before the market topped in early 2022.

-

Percentage of Stocks Above Their 200-Day Moving Average (Third Panel): This measure has been declining since November 2024, despite the index remaining near its highs. Historically, when fewer stocks can stay above their long-term moving averages while the index holds steady, it signals internal market weakness. As with the New Highs – New Lows indicator, this type of divergence also appeared before the 2022 market peak.

-

Percentage of Stocks Above Their 50-Day Moving Average (Fourth Panel): This short-term breadth measure mirrors the behavior of the 200-day indicator. It, too, has been declining for months, reflecting near-term deterioration in individual stock performance. Like the longer-term indicator, a similar divergence appeared prior to the 2022 bear market.

These broad-based negative divergences suggest that the index’s recent strength has been driven by a narrowing group of stocks, a hallmark of a fragile market environment. While the NYSE Composite has not broken down yet, deteriorating participation increases the likelihood that weakness could spread more broadly.

Chart #3: Risk-On vs. Risk-Off—A Shift Toward Defensive Positioning

The final chart provides a crucial look at risk appetite in the market by comparing key risk-on areas of the market to the Consumer Staples ETF (XLP), a defensive sector. Recent shifts in these relationships suggest investors have been rotating out of riskier assets and into more defensive names, signaling a more cautious stance.

-

S&P 500 & Trendline Break (Top Panel): The S&P 500 had been respecting an uptrend support line that defined the bull market advance since November 2023. However, with the recent decline, the index has fallen below this trendline for the first time, suggesting a possible shift in market structure.

-

Consumer Discretionary vs. Consumer Staples (Second Panel): This relative strength line, which had been rising—indicating risk-on behavior—topped at the end of January 2025 and has been falling sharply since. This reversal suggests investors have been rotating out of discretionary stocks, which tend to perform well in bullish environments, and into staples, a more defensive sector.

-

Small Caps vs. Consumer Staples (Third Panel): Small-cap stocks, which typically lead in strong market environments, have been underperforming consumer staples since November 2024. This continued decline reflects weakening confidence in riskier assets.

-

Semiconductor Stocks vs. Consumer Staples (Fourth Panel): The relative strength of semiconductor stocks—a key growth sector—against consumer staples has been falling since July 2024. This extended underperformance further reinforces the shift away from risk and toward defensive positioning.

Taken together, these relative strength trends highlight a broad shift in market sentiment. Investors have been gradually rotating into safer, defensive sectors while moving away from riskier, growth-oriented areas.

Conclusion

The S&P 500 remains within a four-month consolidation pattern, despite testing the lower boundary of that range this week. If the index can regain strength and break above this consolidation, especially alongside renewed leadership in risk-on assets, it would signal market resilience and present a more favorable environment for adding equity exposure.

Conversely, a decisive move below support would suggest that this consolidation has been a topping formation, increasing the probability of further downside in the near term.

Current Account Update

As market technicals deteriorated, I quickly reduced our equity allocation to zero in both our Conservative and Aggressive models. If conditions improve, I will quickly add equity exposure.

For now, the focus is on protecting client portfolios from the risks associated with current market weakness. We are in an environment where risk is elevated, and until the technical backdrop stabilizes, a defensive approach remains prudent.