Energy stocks have been on a tear lately, with the latest boost coming from surging oil prices, which jumped after President Donald Trump pulled the United States out of the Iran nuclear deal earlier this month. Oil prices are currently trading close to their highest levels in around three-and-a-half years, with Brent crude futures, the global benchmark, not far from the $80-level.

Even before the US/Iran headlines, underlying sentiment in the oil market has been positive for quite some time, with prices up around 60% since last summer amid investor expectations that OPEC-led production cuts would rid the market of excess supplies. Saudi Arabia and Russia have been leading efforts to hold back oil output by around 1.8 million barrels per day (bpd) since the start of last year to slash global inventories to the five year-average.

The recent surge in oil prices has prompted renewed bets that Brent could again reach $100 a barrel—a level not seen since before the price crash of late 2014. Bank of America Merrill Lynch last week predicted a Brent price target of $90 a barrel by the second quarter of 2019, while noting a “risk of $100 a barrel” oil next year. “Although, we are concerned these market dynamics could unfold over a shorter time frame,” the analysts wrote in a note.

Famed technical investor Marc Chaikin, who is also the founder and CEO of Chaikin Analytics, said recently that, "energy is going to lead the market," while adding, "I don't think the current price of oil is pricing in the full ramifications of the Iran deal." Indeed, the S&P 500 energy sector is currently enjoying a five-week win streak, the longest run of weekly gains since September, during which it rose roughly 13%.

In addition to reaping the benefits of higher oil prices, energy firms have also posted impressive earnings, which further lifted optimism and bullish bets on the sector. According to Thomson Reuters data, companies in the sector have reported 86.5% earnings growth in the first quarter.

Higher oil prices may be the primary reason U.S. energy firms are on fire. But an underlying shift regarding which oil market players are now the biggest beneficiaries of current pricing trends adds fuel to the longer-term outlook for U.S. crude producers in particular. Last week, in New Oil Market Dynamic: Saudi Calls The Shots But Real Winner Isn't OPEC, we concluded that the biggest winners of the new paradigm currently operating in oil markets have been US shale drillers.

That's clearly illustrated below. We've taken a closer look at three stocks we believe are poised to outperform in the months ahead along with an additional group of runners-up that also look promising. Our list ranges from well known oil majors to mid-cap diamonds in the rough.

In order to weed out the thousands of energy-related names trading in the market, we'll only touch on companies in the sector that are U.S.-based and currently have a market capitalization of $2 billion and above.

1. Most Attractive Oil Drilling Company

Whiting Petroleum: +80% YTD

So far, 2018 has been a fantastic year for Whiting Petroleum (NYSE:WLL), the leader in oil production in the Baku Shale Deposit in North Dakota. This oil & gas exploration company is up around 80% so far this year.

It's not difficult to see why Whiting has been rallying so hard this year when you take into consideration the conclusion of our article from last week (link, above):

"Perhaps the biggest winner from the new paradigm has been the U.S. shale industry, which has reaped the benefits of higher oil prices."

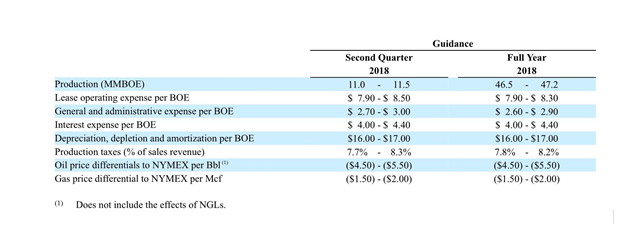

Indeed, Whiting has taken advantage of the uptick in crude prices by boosting production to 11.43 million bpd in the first quarter of 2018, according to figures in its latest earnings report published on April 30. Oil prices averaged $62.92 per barrel during the first quarter.

For the full year, Whiting's production guidance is roughly 9% higher than its 2017 production outlook, forecasting annual output in a range between 46.5-47.2 million bpd.

The company's fundamentals have also improved significantly. It posted a net profit of $15 million, or 16 cents per share, in the quarter ended March 31, compared with a loss of $87 million, or 96 cents per share, a year earlier.

Looking ahead, Whiting's share price is still dependent on crude market fundamentals. As long as OPEC continues cutting production levels, Whiting Petroleum will be boosting them in order to maximize profit.

Technically, the action looks constructive as long as prices remain above their 100- and 200-day moving averages, which shows complete dominance by the bulls. The support levels are at $40 and $35.

Honorable mentions: RSP Permian (NYSE:RSPP), up 18% YTD, and Diamond Offshore Drilling (NYSE:DO), up 3% YTD.

2. Hottest Oil Services Company

Baker Hughes: +13% YTD

Shares of General Electric-owned Baker Hughes (NYSE:BHGE) have been on the front foot lately as improving oil prices prompted companies to ramp up oil and gas production. The services company, which had been among the hardest hit by the oil price downturn that started in mid-2014, is now up 13% year-to-date.

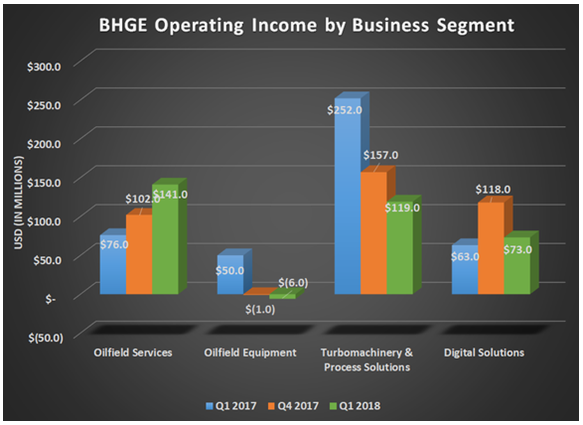

The company posted quarterly profits that beat Wall Street estimates on April 20. Earnings per share rose to 9 cents, beating analysts’ estimates by 3 cents, while revenue increased to $5.40 billion from $5.32 billion a year earlier.

In a promising sign for upcoming quarters, oilfield services revenue, which accounted for half of the company's overall sales, rose 10.1% to $2.64 billion in the quarter.

“Market fundamentals remain supportive, as crude oil prices are relatively rangebound, providing stability to customers as they evaluate projects,” said Baker Hughes Chief Executive Officer Lorenzo Simonelli in a statement accompanying the earnings release.

Looking ahead, the company was awarded a five-year contract by Kinder Morgan (NYSE:KMI) to provide artificial lift services in the Permian Basin as well as a subsea equipment contract for Phase II of Chevron’s (NYSE:CVX) project in Australia, it recently announced. Less than a year ago, conglomerate General Electric (NYSE:GE) combined its oilfield business with Baker Hughes, creating the second largest oilfield services company by revenue.

The combined company achieved $144 million in synergies in the first quarter of 2018, putting it on track to hit an expected $700 million by year-end, as the company is making progress on the integration of the two businesses and finds ways to cut costs.

Honorable mentions: Cactus (NYSE:WHD), up 62% YTD, Halliburton (NYSE:HAL)), up 8% YTD, and Schlumberger (NYSE:SLB), up 6% YTD.

3. Best Performing Oil Refiner

HollyFrontier: +35% YTD

Shares of HollyFrontier (NYSE:HFC) have built on their solid showing in the fourth quarter of 2017, during which they climbed by a whopping 64%, to put together another great performance so far in the first five months of 2018. HFC's stock is up around 35% so far this year.

The Dallas-based refiner posted a 70% rise in first-quarter refining margins when it reported results on May 2, benefiting from discounted costs of crude from the Texas-centered Permian basin and Canada. Refinery gross margins rose to $12.83 per barrel in the first quarter, up $5.29 from the year-ago period, outpacing margins at larger rivals such as Valero Energy (NYSE:VLO) and Marathon Petroleum (NYSE:MPC).

“HFC’s 74% index capture rate during the quarter was the highest quarterly average since the third quarter of 2015,” Jefferies analysts wrote in a post-earnings note titled ‘The Right Place at the Right Time’. HollyFrontier also provided strong guidance, saying it expects wider Permian and Canadian crude differentials to support margins even further in the second quarter. The company plans to run its six refineries up to 92% of their combined crude oil processing capacity of 489,630 bpd.

The company is well positioned for further gains thanks to its importance as one of the largest oil refiners in the United States.

A combination of a strong balance sheet, commitment to attractive dividend payouts, investment in strategic growth opportunities as well as a share buyback program make HollyFrontier a good bet going forward.

Honorable mentions: Valero Energy, up 26% YTD, and Phillips 66 (NYSE:PSX), up 17% YTD.