- Shell's stocks show a persistent upward trend.

- Equinor demonstrates stable growth prospects, although overcoming key resistance poses a challenge for potential buyers.

- Meanwhile, Southwestern Energy tries to benefit from increasing US LNG exports

Energy companies have seized the attention of investors over the last few months, as the prices of crude oil and, to a lesser extent, natural gas have jumped higher once again.

While this uptrend hasn't fully transmitted to energy stocks, savvy investors have begun to expect very positive earnings for the sector in the quarters ahead, likely pushing stocks upward.

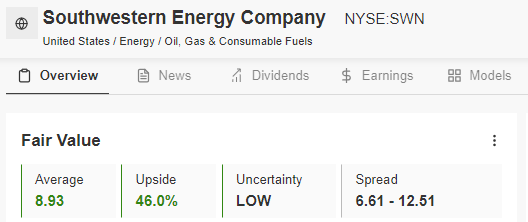

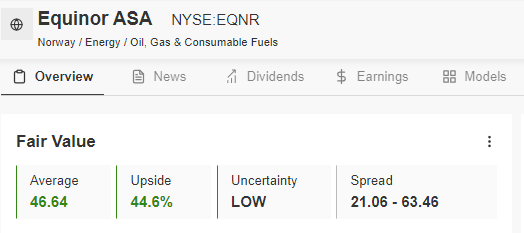

This outlook is further supported by our InvestingPro fair value indicator, which now anticipates a roughly 40% upside for three of the industry's players, namely: Southwestern Energy (NYSE:SWN), Shell (NYSE:SHEL), and Equinor (NYSE:EQNR).

Source: InvestingPro

In the context of our current analysis, it's crucial to consider the upcoming OPEC+ cartel meeting scheduled for October 4. However, while it's improbable that this meeting will bring about a significant breakthrough, it's also worth noting that the group's present strategy revolves around production reduction, with Saudi Arabia and Russia spearheading this effort by jointly committing to cut production by 1.3 million barrels per day by year-end. This concerted effort is contributing to the increase in oil prices.

1. Southwestern Energy: Attractive Valuation

Southwestern Energy is a U.S.-based upstream company that primarily focuses on natural gas production within the Appalachian Basin in Pennsylvania and West Virginia, accounting for 73% of its reserves. Additionally, it operates in the Haynesville Shale field, contributing to 27% of its reserves.

When considering a long-term perspective, the company is poised to benefit from the projected increase in demand for natural gas, making it an excellent energy source to complement renewable energy sources (RES). Furthermore, the company's exports are expected to play a pivotal role, with projections indicating a doubling of export volumes over the next two years from the current level of 12 BCF/d.

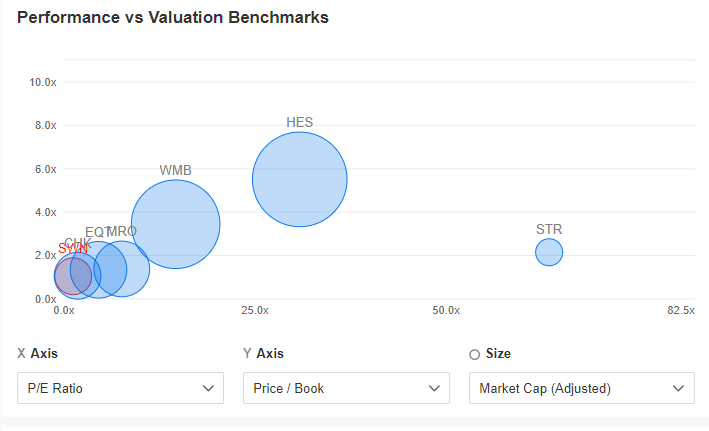

From a strictly fundamental standpoint, Southwestern Energy not only boasts a high fair value ratio but also ranks among the companies with the strongest financial health. Moreover, it offers an attractive price/earnings and price/book value valuation when compared to its competitors.

Source: InvestingPro

A positive technical development would be a dynamic breakout above $7 per share.

2. Shell: Bulls Keep Pushing Stock Upward

In an upward trajectory since October 2020, Shell has been garnering significant attention in recent weeks. This sustained growth is primarily attributed to the continual upward pressure on oil prices and the news regarding a substantial reduction in inventories at the storage center in Cushing, Oklahoma, which now stands at 22 million barrels, marking the lowest levels since last July.

Currently, buyers are testing the resistance of $65 per share. Breaking through this zone would pave the way for significantly higher price levels.

The key target for buyers is the all-time high located in the price region of $82 per share.

3. Equinor Continues to Expand Into Europe

Following the outbreak of the conflict in Ukraine, Norway, in collaboration with the United States, has emerged as a primary partner for European nations in the supply of natural gas. That trend has boosted Norway-based Equinor's participation and profits.

The company also took the opportunity to increase its influence in the old continent by signing a long-term raw material supply agreement with Austrian giant OMV (VIE:OMVV). The agreement will run for five years and calls for the supply of 12 terawatt-hours (TWh) per year.

Moreover, Equinor is also developing its oil production sector. The Breidablikk field in the North Sea, estimated at 190 million barrels, should begin production this month.

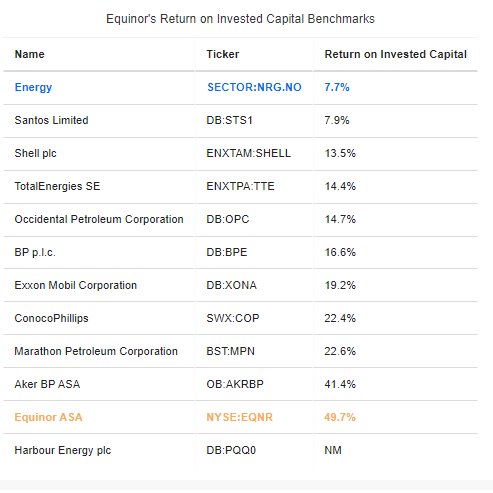

From a fundamental perspective, the company exhibits remarkable strength. Notably, the Return on Invested Capital ratio, standing at just under 50%, is the highest among its competitors.

Source: InvestingPro

On the technical chart, investors should closely monitor the tested zone around $33 per share. The breach of this level will serve as a significant signal indicating the potential for the upward trend to persist.