As the market largely focuses upon the game being played over the potential for US rate hikes, a larger economic crisis is brewing within the world’s factory, China. Despite a range of supportive rhetoric from market pundits on the “sell” side, some fundamental indicators are signalling trouble ahead for the Asian powerhouse.

The past few months have seen a range of Chinese macroeconomic indicators slipping lower, in what many within the media have termed a “slowdown”. However, there are some serious questions over the reliability of the indicators, with a particular focus upon the unquantifiable growth rates. Subsequently, a review of some of the basic underlying measures appears to throw cold water on China’s recent growth claims of 7.3%.

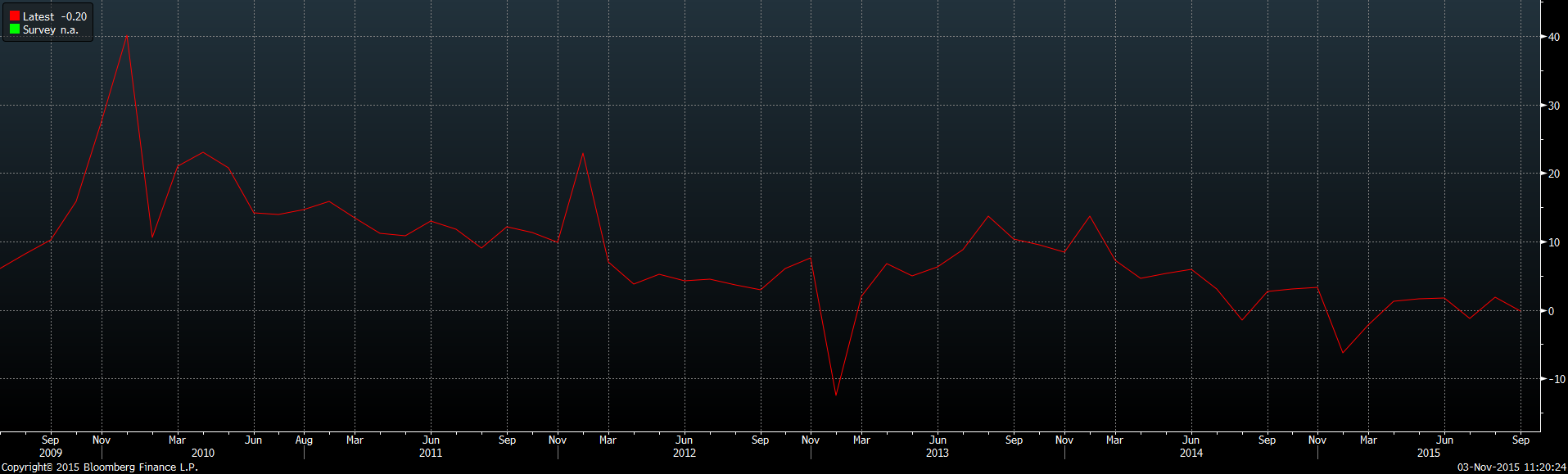

Electricity Consumption

The supply and use of electricity is one of the key determinants of economic activity occurring within a manufacturing base such as China. The commodity is an essential input into many of the manufacturing processes and factories typically are unable to run without it. Subsequently, it is a good measure of the amount of plant usage occurring within the sector.

Given that China is supposedly booming, albeit at a reduced growth rate, you would expect to see a robust level of demand for electricity. Otherwise, what are the various factories using to power their productive processes? Unfortunately a robust level of growth within electricity consumption is absent within the economy. Electricity consumption is growing at an incredibly weak 1.3% which represents some of the weakest growth in demand for the past 20 years. In addition, electricity consumption actually dropped 0.9% within the heavy industry sector.

Subsequently, the electricity consumption certainly doesn’t point to a rampant economy with 7.3% GDP growth. Instead it points to an economy that is suffering significant slack within their productive capacity.

China Electricity Consumption Y/Y

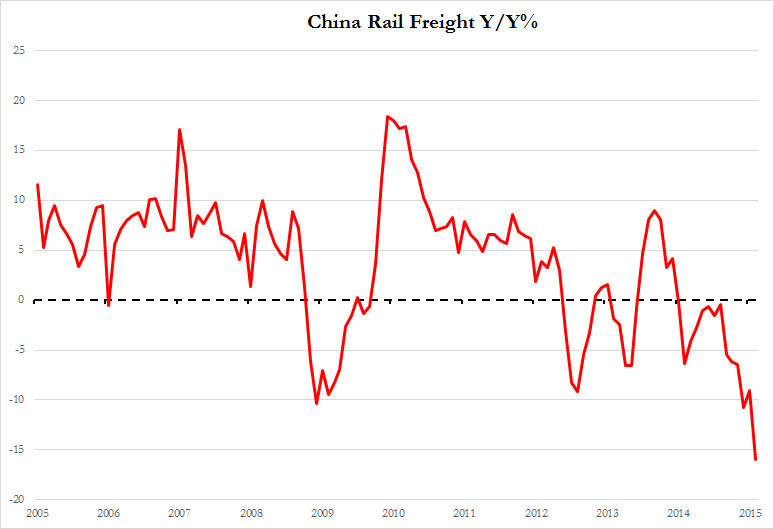

Rail Freight

Rail freight is a key component of an export dependent economy such as China’s and this critical metric is indicating some concerning results. This important economic indicator actually declined 10.1% from the same period in 2014, which casts doubt on the robustness of the Chinese manufacturing sector as well as its growth figures. Without the rail sector, how are manufactured products transported for export, given that the world's “factory” lives or dies based upon their export receipts.

Caixin Manufacturing PMI

The Caixin (Formerly HSBC) Manufacturing PMI is one of the critical gauges in the health of the Chinese manufacturing industry. Typically, this indicator is watched closely by those within both the capital markets and commodity industries for hints to the current trend within the sector. Currently, the monthly Caixin PMI has fallen to levels not seen since the height of the global financial crisis in 2009. In fact, the readings are firmly within contraction territory (below 50.0) which would seem unlikely to support an economy in significant expansion.

In conclusion, it would appear that the unassailable Chinese GDP growth figures are anything but accurate given the significant downturn that I have demonstrated within the key electricity and rail freight sectors. The fall in manufacturing is also reflected in the Caixin PMI data, as well as the fact that August exports fell by 5.5% Y/Y after crashing nearly 3.0% in July. Estimating China’s real GDP as an outsider is anything but practical, especially given the lack of quantifiable information. However, I would guestimate their current GDP growth as falling somewhere between 2.5% to 3.0% given the falls in the manufacturing sector.

Finally, my critics are likely to point to some mythical transition from a manufacturing to a service industry as the reason for the falls. However, historically these transitions have taken place over a decade, not suddenly. So in closing, if you believe this downturn to be transitional, I have a bridge to sell you.