Wall Street’s major indices are on track to end the year at all-time highs as the "phase- one" U.S.-China trade deal appears to have eased some of the uncertainty on the global economic outlook. The benchmark S&P 500 Index is up almost 30% so far in 2019. A dovish Federal Reserve and mostly encouraging U.S. data have also helped push Wall Street stocks to record levels.

As 2019 wraps up, we thought it might be interesting to take a look at the highs and lows of the past year through the prism of Investing.com's weekly comics. Below, 12 comics and the market-related events that stood out during the past year.

Editor's Note: All dates reflect when the comic was posted.

1. January 16, 2019:

Markets Take Brexit Drama, U.S. Government Shutdown in Stride

Market focus was largely attuned to political developments in the U.K. and the U.S. as traders awaited further developments surrounding the latest Brexit drama and the U.S. government shutdown. Despite the political turmoil, global stocks largely weathered the storm as traders took solace in dovish comments made by Federal Reserve Chair Jerome Powell.

2. February 21, 2019:

Powell's Dovish Turn Fuels V-Shaped Recovery Much to Trump's Delight

Following a turbulent end to 2018, U.S. stocks made a stellar start to 2019. The rally was helped in the most part by a dovish shift from the Federal Reserve, which sent the clearest signal yet that its three-year drive to tighten monetary policy was close to an end.

The dovish shift came as President Donald Trump repeatedly attacked the Fed for raising rates.

3. March 20, 2019:

Trump Gets His Way as Powell Caves on Rate Hikes

Fed officials suggested no rate increases would come in 2019— after indicating in December 2018 that two could take place. The U.S. central bank also indicated it intended to end the reduction of its massive $4.2 trillion balance sheet by September, much to the satisfaction of President Trump.

4. April 30, 2019:

S&P 3,000? Powell And the Fed’s Dovish Policies Drive Wall Street To All-Time Highs

The S&P 500 rose to a fresh all-time high, with the benchmark index closing in on the key 3,000-mark for the first time in history, thanks in large part to the Federal Reserve's dovish turn regarding monetary policy.

5. May 7, 2019:

Trump Does It Again: Tweeter-in-Chief Unnerves Global Markets

U.S. President Donald Trump's threat to raise tariffs on Chinese goods shocked financial markets and fueled worries that trade talks may be derailed.

Trump sharply escalated tensions between the world's two largest economies when he tweeted that he would raise tariffs on $200 billion worth of Chinese goods to 25% from 10% by the end of the week and would "soon" target the remaining Chinese imports with tariffs.

6. June 11, 2019:

Addicted Markets Beg Powell For More Fed Rate Cuts As S&P 500 Charges Towards Record High

The S&P 500 charged back towards all-time high, as hopes that the Federal Reserve would cut interest rates as early as July boosted sentiment.

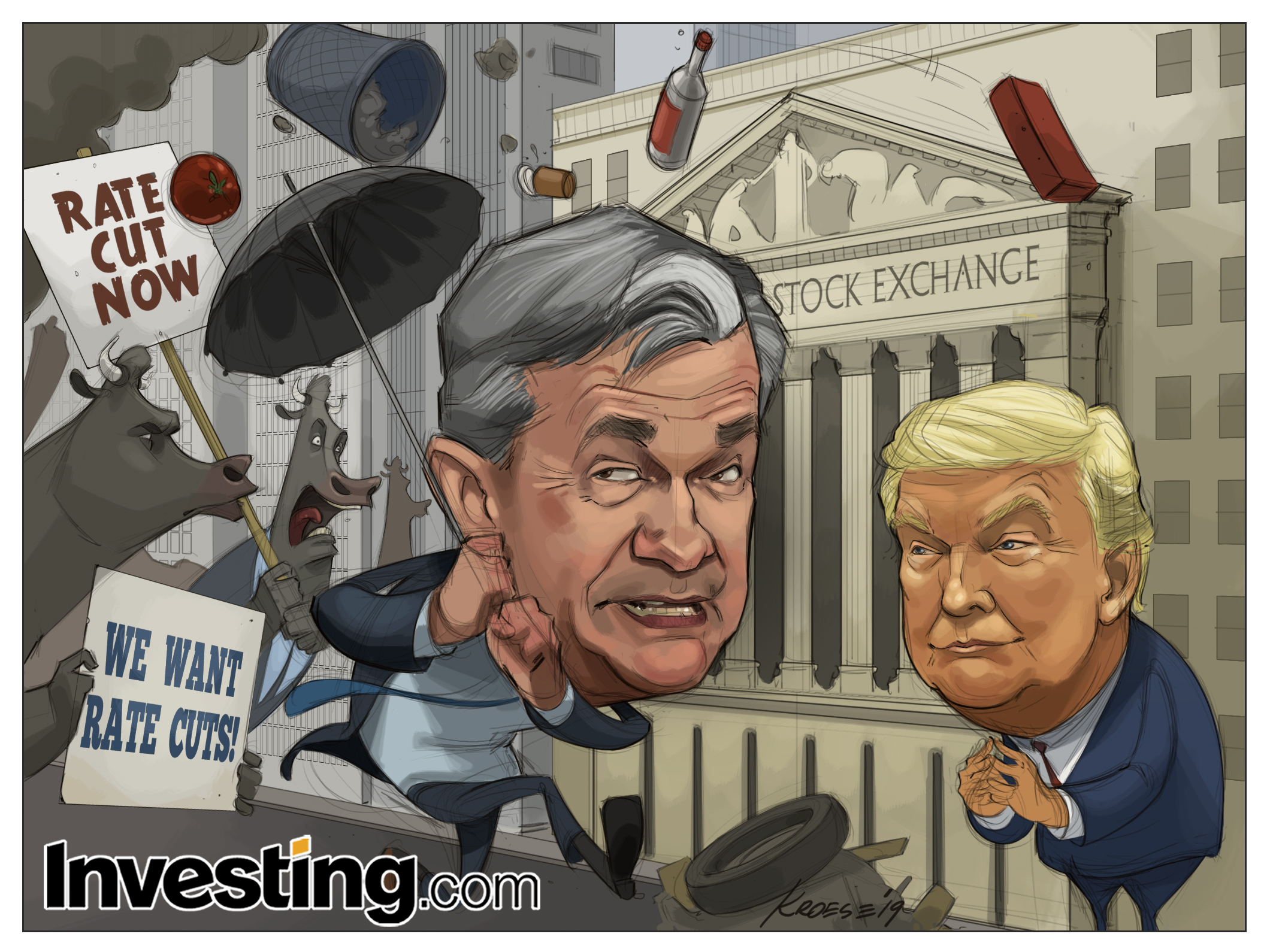

7. July 9, 2019:

Markets Freak Out As Big Fed Rate Cut Bets Fade

Market sentiment took a hit as expectations the Fed would deliver a large rate cut at its July 30-31 meeting faded following the release of upbeat U.S. jobs data.

U.S. President Donald Trump had repeatedly criticized the Fed for not lowering borrowing costs thus far in 2019 year.

8. August 6, 2019:

U.S.-China Trade Worries, Fed Concerns Trigger Volatility

Wall Street tumbled in the first trading week of August amid an escalation in the U.S.-China trade war.

The sell-off began when Federal Reserve Chair Jerome Powell struck a more hawkish tone than expected at the U.S. central bank’s post-meeting press conference on July 31 after he failed to signal a series of rate cuts.

Markets were then whipsawed by U.S. President Donald Trump, who shockingly announced fresh tariffs on an additional $300 billion in Chinese goods, starting on September 1.

Market reaction became even more negative when Chinese authorities let the yuan break past the symbolic 7-per-dollar level to reach its weakest level since the 2008 Global Financial Crisis.

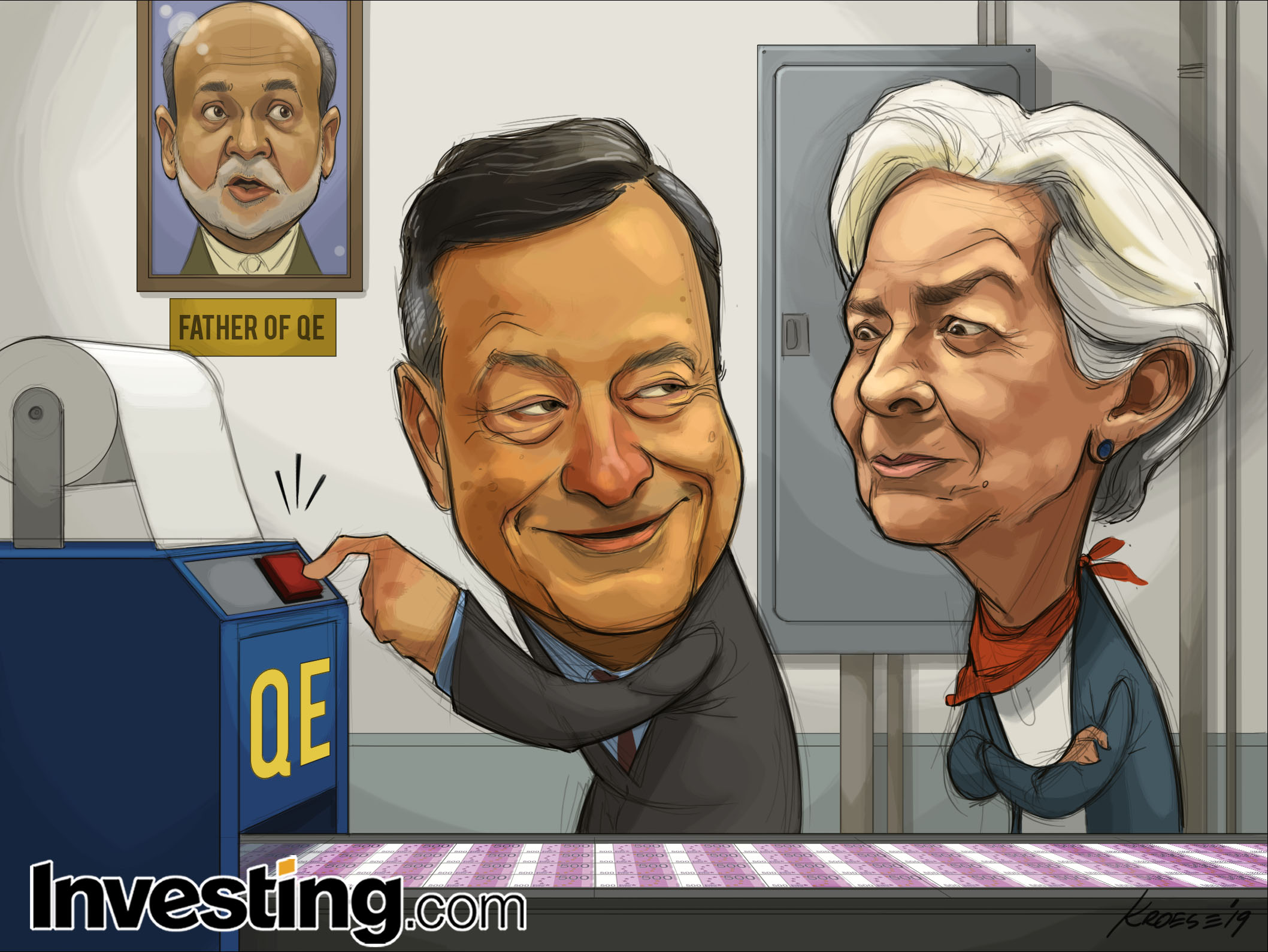

9. September 11, 2019:

ECB Cuts Rates, Restarts QE As Draghi Era Ends With A Bang

The European Central Bank (ECB) announced fresh stimulus measures in a bid to energize the ailing eurozone economy.

Mario Draghi, in his final meeting as ECB President before Christine Lagarde took over in November, announced that the central bank would cut its main deposit rate by 10 basis points to -0.5%, in line with expectations.

The ECB also announced that it would restart its quantitative easing (QE) program on Nov. 1 to the tune of €20B per month for as long as it deemed necessary.

10. October 29, 2019:

Despite Raft of Bad News, Markets Continue To Trade Near All-Time Highs

Financial markets had so far shrugged off the news of an impeachment inquiry into President Donald Trump, with investors discounting the prospect of the probe making much headway.

Markets appeared unfazed by a variety of geopolitical headwinds: the latest uncertainty on the U.S.-China trade front, global slowdown fears as well as concerns as tensions between the U.S., Saudi Arabia and Iran stayed elevated.

11. November 7, 2019:

Saudi Aramco Unveiled Its IPO, Becoming The World's Most Valuable Public Company

Saudi Aramco (SE:2222) touched the $2 trillion target sought by de-facto Saudi leader Crown Prince Mohammed bin Salman shortly after its trading debut, in what has become the biggest IPO in history.

12. December 18, 2019:

It’s Santa Rally Time On Wall Street!

The benchmark S&P 500 index gained over 27% so far this year, rising in all but two months as investors celebrated progress in trade relations between Washington and Beijing, three interest rate cuts by the Federal Reserve and upbeat economic data.

Meanwhile, the Dow Jones Industrial Average also achieved a new all-time high on Monday. The index is currently hovering at 28,300, having rallied by more than 21% year-to-date.