- Renewed fears that the Federal Reserve will have to keep interest rates higher for longer have rattled investor sentiment in recent days.

- The selloff has seen shares of several high-quality companies being unfairly punished despite their strong fundamentals, reasonable valuations, and growing dividend payouts.

- As such, I recommend buying shares in Chevron and Archer-Daniels-Midland as their current selloff has gone too far in my opinion.

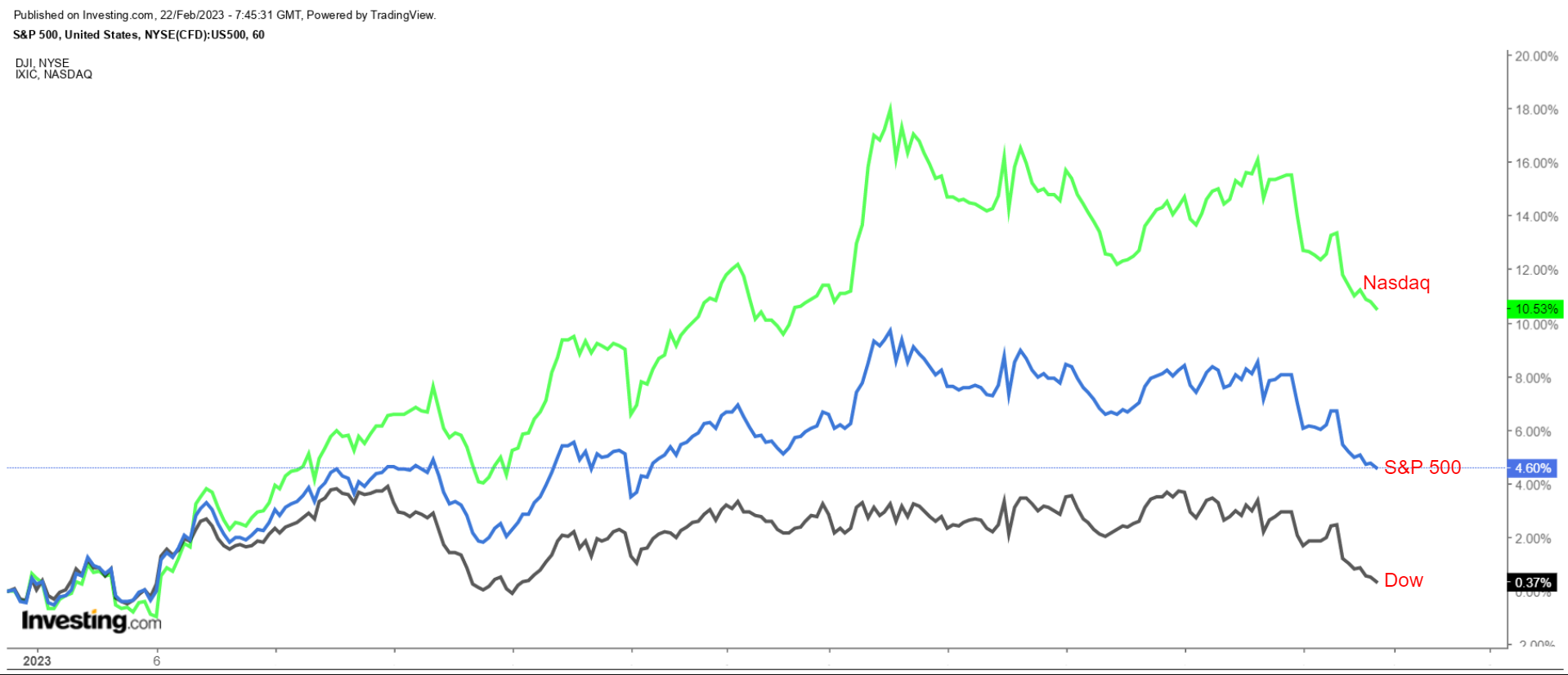

Cracks are starting to emerge in an early-year rally on Wall Street as sentiment continues to be dictated by worries over the Federal Reserve’s ongoing plans to raise interest rates.

While the major U.S. averages are still sitting on sizeable year-to-date gains, some of the rally has melted away in recent days on signs that a strong U.S. economy could put the Fed on pace for more rate hikes to combat persistently high inflation.

The benchmark S&P 500 is down 4.4% from its 2023 high, however, it remains up 4.1% year-to-date. The index tumbled more than 2% on Tuesday, the worst daily decline of 2023.

Taking that into account, I recommend buying shares of Chevron (NYSE:CVX) and Archer-Daniels-Midland (NYSE:ADM) to weather the current market volatility.

Chevron

- Year-To-Date Performance: -10.3%

- Market Cap: $311.1 Billion

Despite the recent downtrend in its shares, I believe that Chevron - which is one of the world’s leading integrated energy companies - is well-placed to provide significant long-term value for shareholders as it continues to deliver steady profit and sales growth despite a difficult macro setting.

In addition to its promising fundamentals, the San Ramon, California-based energy giant remains committed to returning excess capital to its stockholders in the form of increased cash dividends and share repurchases, thanks to its strong balance sheet and expected free cash flow growth.

Shares are down -10.3% since the start of the year, much worse than the -3.4% decline suffered by the Energy Select Sector SPDR Fund (NYSE:XLE) - which tracks a market-cap-weighted index of U.S. energy companies in the S&P 500.

CVX closed at $161.00 yesterday, its lowest level since October 18. At current levels, Chevron has a market cap of $311.1 billion, making it the world’s second most valuable energy company, trailing only ExxonMobil (NYSE:XOM).

All things considered, I believe CVX shares are well worth adding to your portfolio as they are still attractively valued and should offer further upside on a long-term basis.

In a sign of how well its business has performed in the existing economic climate, Chevron delivered record annual profit of $36.5 billion for 2022, exceeding its previous record set in 2011 by about $10 billion. The oil major’s bottom line was boosted by a potent combination of high energy prices, improving global oil and gas demand, and increased output at its stellar operations throughout the U.S. Permian basin.

“We delivered record earnings and cash flow in 2022, while increasing investments and growing U.S. production to a company record,” said Mike Wirth, Chevron’s chairman and chief executive officer.

Supported by its strong liquidity position, Chevron lifted its payout to shareholders, announcing plans to triple its spending on stock repurchases from $25 billion to $75 billion. The new buyback plan goes into effect on April 1, 2023, with no fixed expiration date.

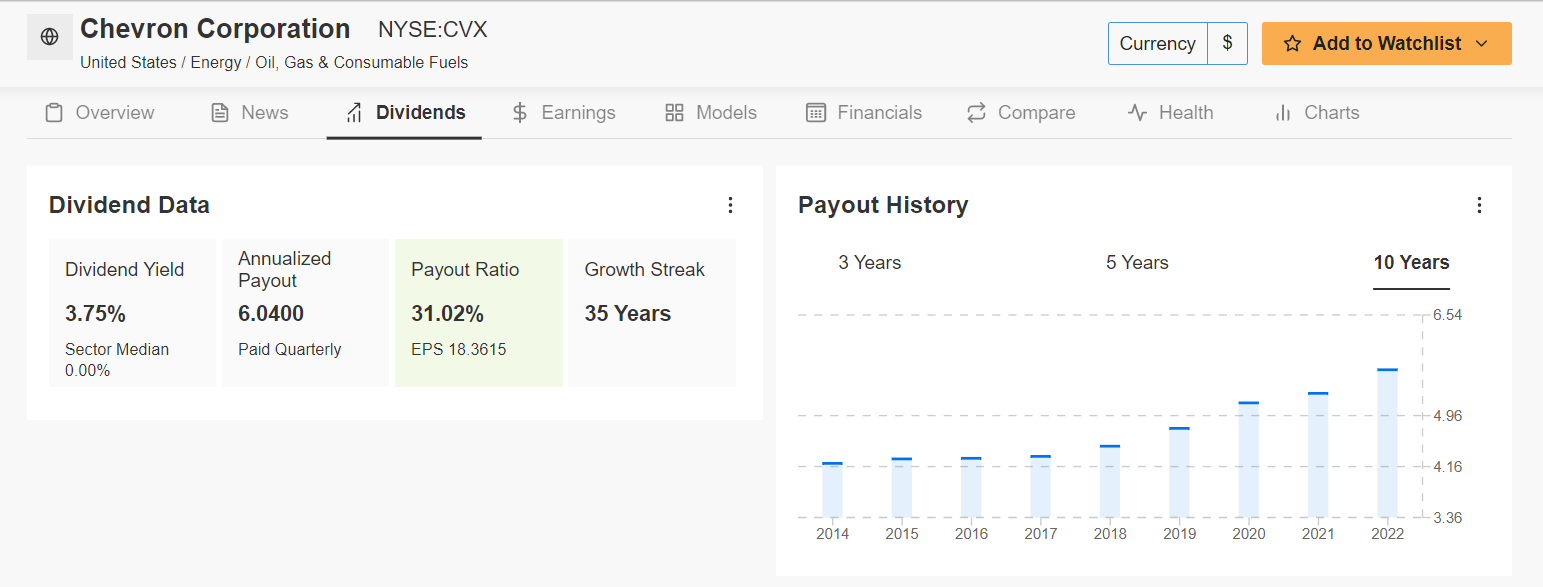

Source: InvestingPro

Additionally, Chevron’s board of directors raised its quarterly dividend by 6% to $1.51 a share, or $6.04 annualized. Not only do shares of the oil-and-gas behemoth currently yield a market-beating 3.75%, but the company has raised its annual dividend for 35 consecutive years, highlighting its exceptional track record when it comes to returning cash to investors.

Wall Street remains optimistic on the ‘Big Oil’ firm, with 23 out of 27 analysts surveyed by Investing.com rating CVX stock as either ‘buy’ or ‘hold’. Shares have an average price target of $193.64, representing an upside of 20.2% from current levels.

Archer-Daniels-Midland

- Year-To-Date Performance: -12.3%

- Market Cap: $44.6 Billion

Between its attractive valuation, encouraging fundamentals, dependably profitable business model, and enormous cash pile, I believe that shares of Archers-Daniels-Midland are a smart buy amid the current market backdrop.

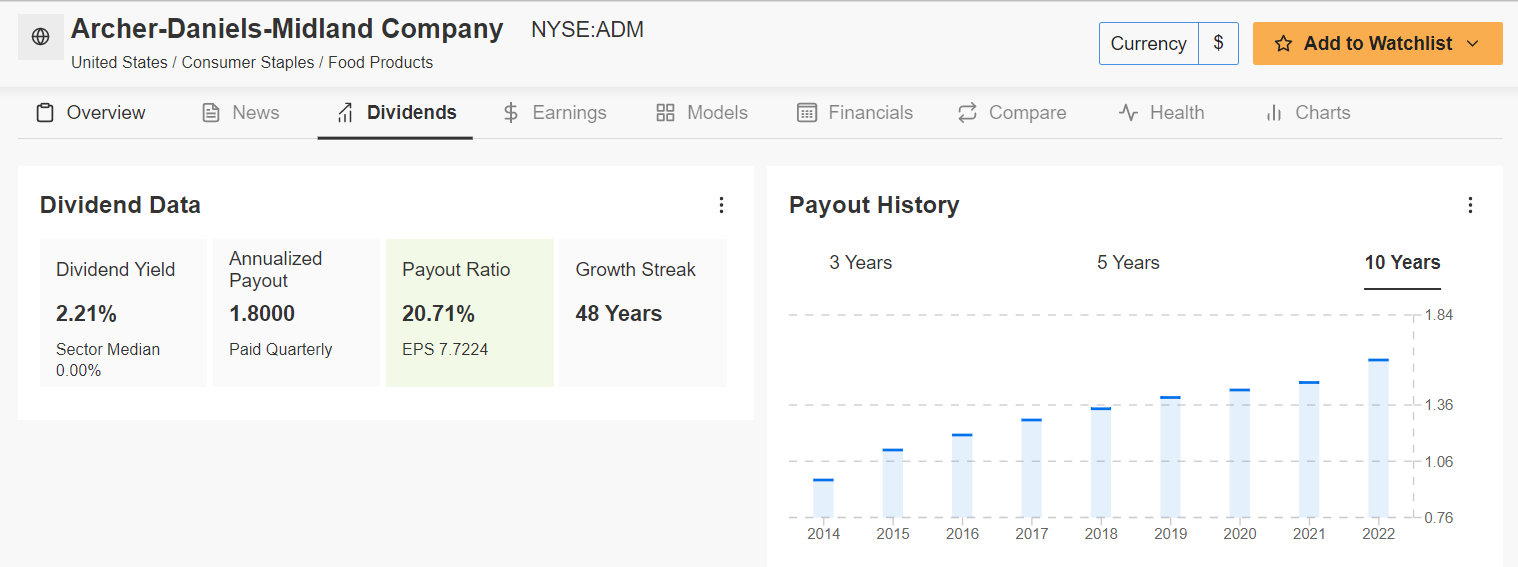

Despite recent volatility, I remain positive on the food processing and commodities trading giant, considering its exceptional track record when it comes to returning capital to shareholders, regardless of economic conditions. ADM has increased its annual dividend payout for 48 consecutive years, dating all the way back to 1974, proving over time that it can sustain a slowing economy and still provide investors with higher payouts.

ADM stock has significantly underperformed the broader market so far in 2023, tumbling -12.3% year-to-date. In contrast, the iShares MSCI Global Agriculture Producers ETF (NYSE:VEGI), which tracks the investment results of an index composed of leading global agricultural stocks, is up +0.2% over the same timeframe.

Shares ended at $81.40 last night, not far from their weakest level since late September. At current valuations, the Chicago-based company has a market cap of $44.6 billion, making it one of the world’s biggest agribusiness corporations.

I anticipate Archer-Daniels-Midland’s stock to regain its mojo in the months ahead as it benefits from favorable industry demand trends, which will help fuel future growth in earnings and allow it to maintain its focus on shareholder returns.

The global grains merchant, which makes money by processing, trading, and shipping crops around the world, reported record profit and upbeat sales growth when it delivered its fourth-quarter financial update last month. The solid results demonstrated the company’s resilience against higher energy costs and global supply chain disruptions.

ADM expects another “very strong year” looking forward to 2023 as it reaps the benefits of robust demand for its farm products amid lower Black Sea grain exports following Russia's invasion of Ukraine and smaller harvests in drought-hit Argentina.

Source: InvestingPro

In the latest shareholder-friendly move, ADM’s board of directors last month approved a 12.5% increase in its quarterly cash dividend from $0.40 to $0.45 per share, beginning in the current quarter. The new dividend results in an annualized cash payout of $1.80 per share, up from $1.60 presently. At current share prices, the annual dividend rate implies a dividend yield of 2.21%, which is soundly above the 1.58% implied yield for the S&P 500 index.

Not surprisingly, Wall Street has a long-term bullish view on ADM, as per an Investing.com survey, which revealed that all 15 analysts covering the stock rated it as either a ‘buy’ or ‘neutral’. Among those surveyed, shares had an upside potential of 26.4% from Tuesday’s closing price.

Disclosure: At the time of writing, I am short on the S&P 500 and Nasdaq 100 via the ProShares Short S&P 500 ETF (SH) and ProShares Short QQQ ETF (PSQ). I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials. The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.