Investors in Alphabet (NASDAQ:GOOGL) (NASDAQ:GOOG) have had a stellar 2021. GOOGL shares, which hit a record high in late July, are up about 56% year-to-date (YTD). They now hover around $2,720.

Note that Alphabet is a holding company; Google is its most important business. Google also owns the video-sharing platform YouTube.

The business was founded in September 1998 and went public in August 2004, at an initial price of $85. Then, in April 2014, the stock split into two share classes:

- Class A (or GOOGL) shares with voting rights;

- Class C (or GOOG) shares without any voting rights.

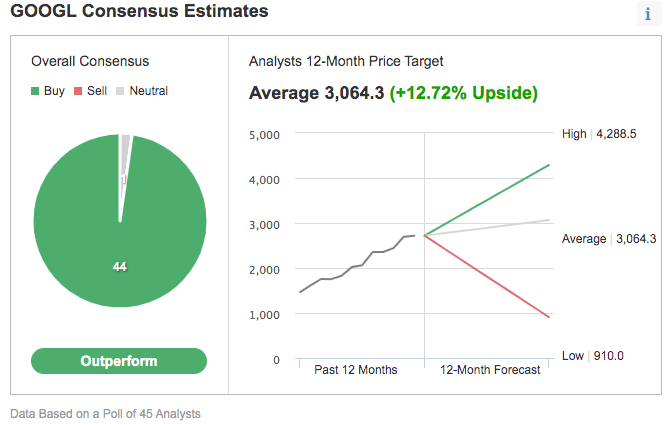

Among 45 analysts polled via Investing.com, GOOGL stock is expected to outperform in the coming months. With a market capitalization of around $1.86 billion, GOOGL stock gets significant interest on Wall Street.

Chart: Investing.com

The 12-month median price target of $3,064.3 from respondents of Investing.com's poll would represent a return of more than 13% from the current level. However, buying shares of the stock today might be quite expensive for most retail investors.

Therefore, we introduce two exchange-traded funds (ETFs) that hold GOOGL shares. For many market participants, they could act as proxy to investing in Alphabet stock, while also helping to avoid the volatility of GOOGL shares in their portfolios.

1. Invesco Dynamic Media ETF

Current Price: $52.99

52-Week Range: $34.53 - $58.80

Dividend Yield: 0.29%

Expense Ratio: 0.63% per year

The Invesco Dynamic Media ETF (NYSE:PBS) invests in 30 U.S. media businesses. Among the investment merit criteria used are price momentum, earnings strength, management action and valuation metrics. The fund started trading in June 2005.

PBS tracks the returns of the Dynamic Media Intellidex℠ Index. Both the index and the fund are rebalanced and reconstituted quarterly. In terms of the sub-sectoral breakdown, the communication services sector makes up the biggest portion, with 94.17%, followed by information technology (3.33%) and health care (2.42%).

The ETF’s top 10 holding account for about 48% of its $120.2 million in assets. In other words, it is a top-heavy fund. Twitter (NYSE:TWTR) and GOOGL stock have the top spots in the fund, with 5.71% and 5.55%, respectively. Among other names in PBS are Facebook (NASDAQ:FB), Netflix (NASDAQ:NFLX), Walt Disney (NYSE:DIS), and Spotify (NYSE:SPOT).

YTD, the fund is up about 15% and hit a record high in mid-March. Since then, PBS has declined about 10%. Forward P/E and P/B ratios stand at 24.70 and 4.07, respectively.

During the lockdown, most media companies, especially those with online platforms, have seen their revenue grow and margins expand, leading to strong shareholder returns. Therefore, some profit-taking in the sector is likely. A further decline toward $50 would improve the margin of safety.

2. ERShares Entrepreneur ETF

Current Price: $26.22

52-Week Range: $21.50 - $32.61

Dividend Yield: 0.67%

Expense Ratio: 0.49% per year

The ERShares Entrepreneur ETF (NYSE:ENTR) invests in entrepreneurial U.S. companies. In their decision-making process, fund managers also integrate other factors, like price momentum, sector, growth, value, market cap, as well as geographic orientation.

A large number of these firms have become public in recent years. As a result, one or more of their founders are typically leading their operations as executives. The ETF was originally listed in November 2017 as "The ERShares Entrepreneur 30 ETF." But in February 2021, its name was changed to The ERShares Entrepreneur ETF.

The fund's top sector allocation is IT, with more than 36%. That's followed by health care (23.1%), communications services (17.4%) and consumer discretionaries (12.2%). The top 10 holdings make up about 20% of net assets of $138.9 million.

ENTR's top two names are the software product development platform EPAM Systems (NYSE:EPAM) and GOOGL stock, with respective weightings of 2.92% and 2.82%. Other leading names on the roster include Bill Com Holdings (NYSE:BILL), Cloudflare (NYSE:NET), Datadog (NASDAQ:DDOG), DraftKings (NASDAQ:DKNG), and Etsy (NASDAQ:ETSY).

Year-to-date, ENTR is down about 1%. But the fund has returned around 12% in the past 12 months and hit a record high in mid-February. Since then the ETF has lost about 23% of its value. Potential investors could regard this decline as an opportunity to research the fund further, with a view to buy around $25.