DXY was roughly flat last night:

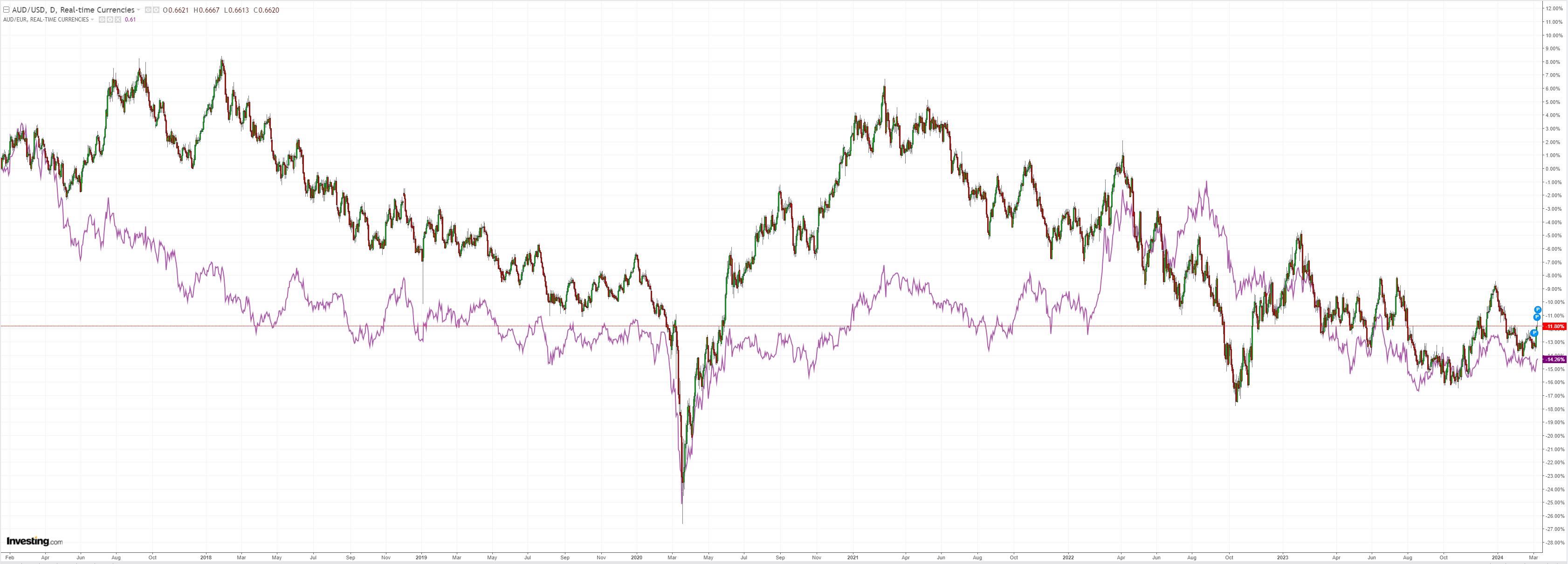

AUD was firm:

JPY is running:

Oil isn’t. Gold is:

Base metals were rejected:

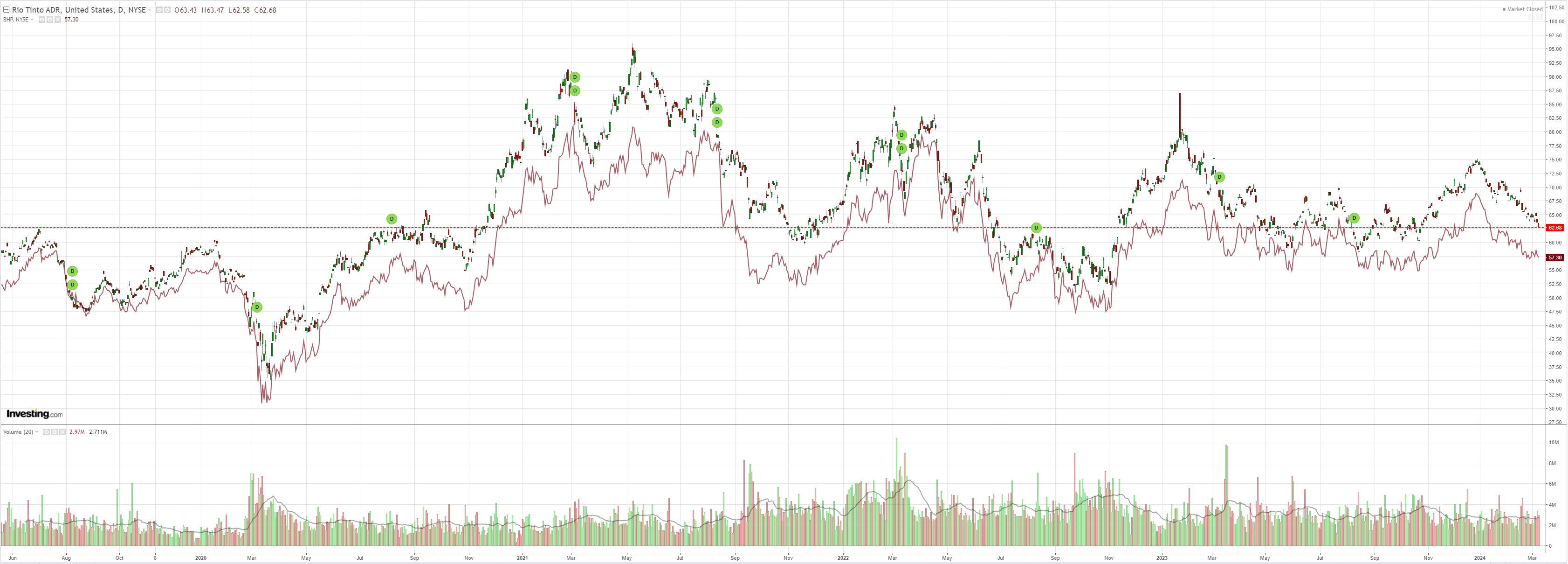

The big miner retest is coming:

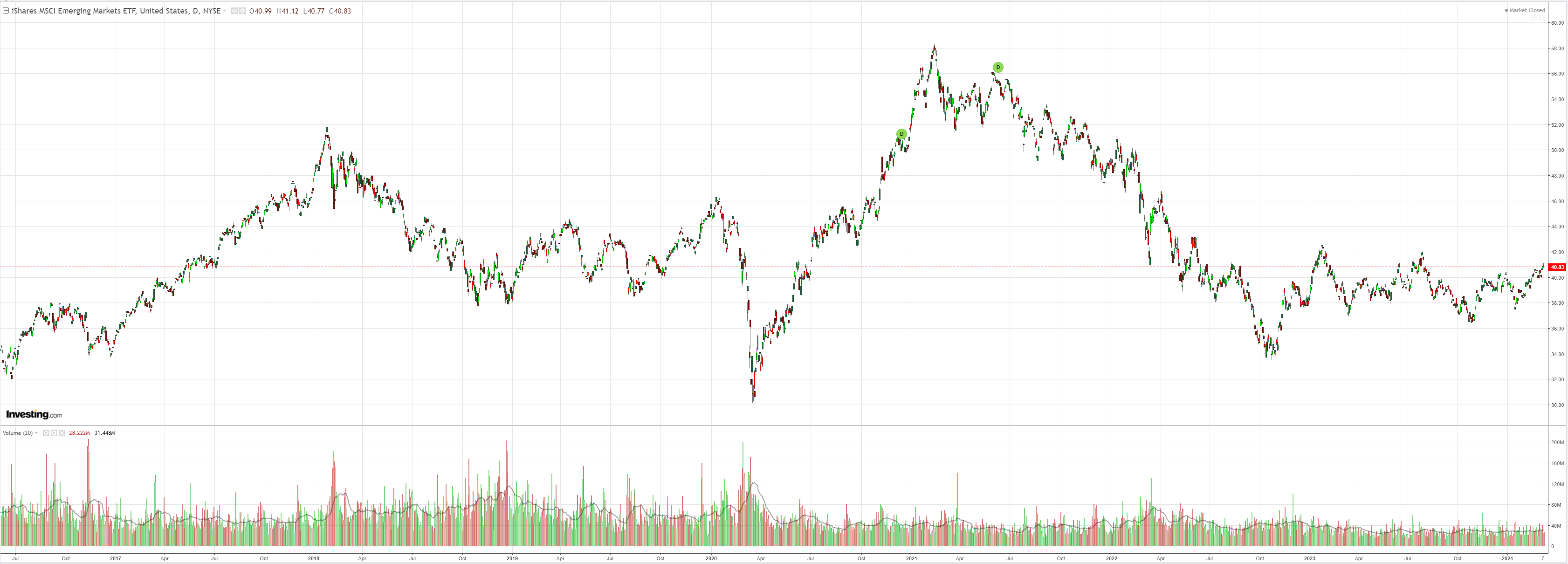

EM meh:

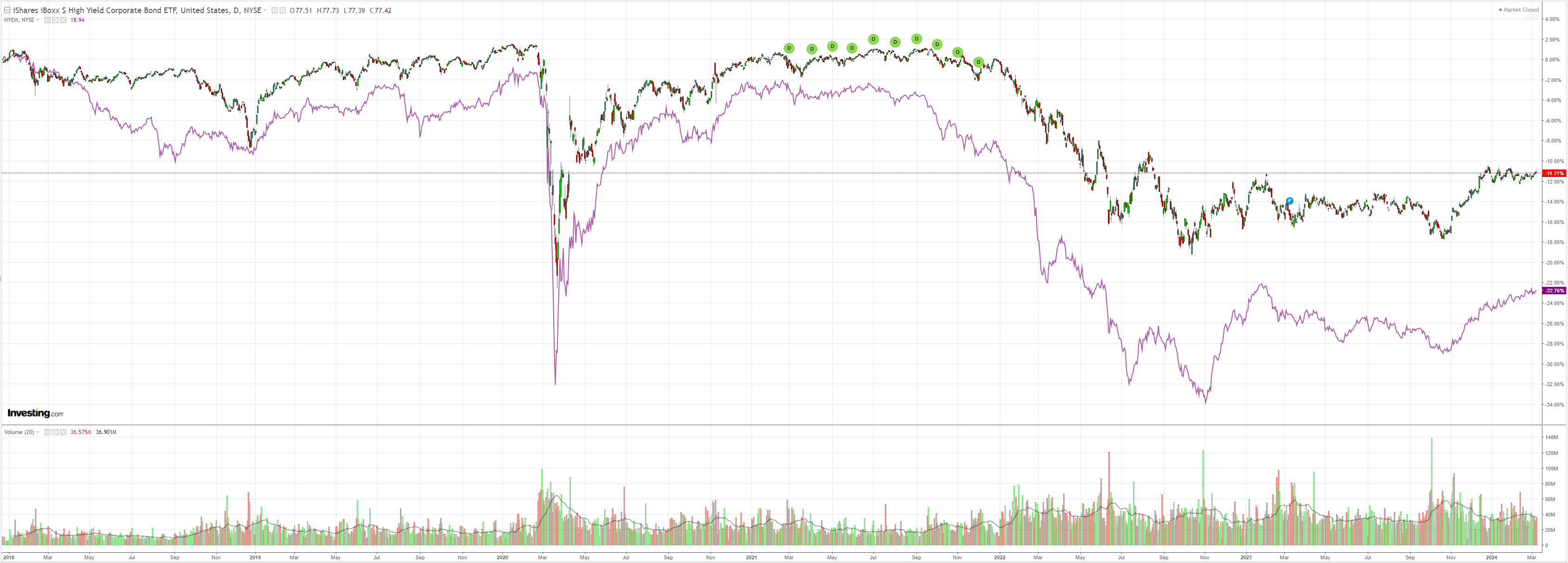

Junk firm:

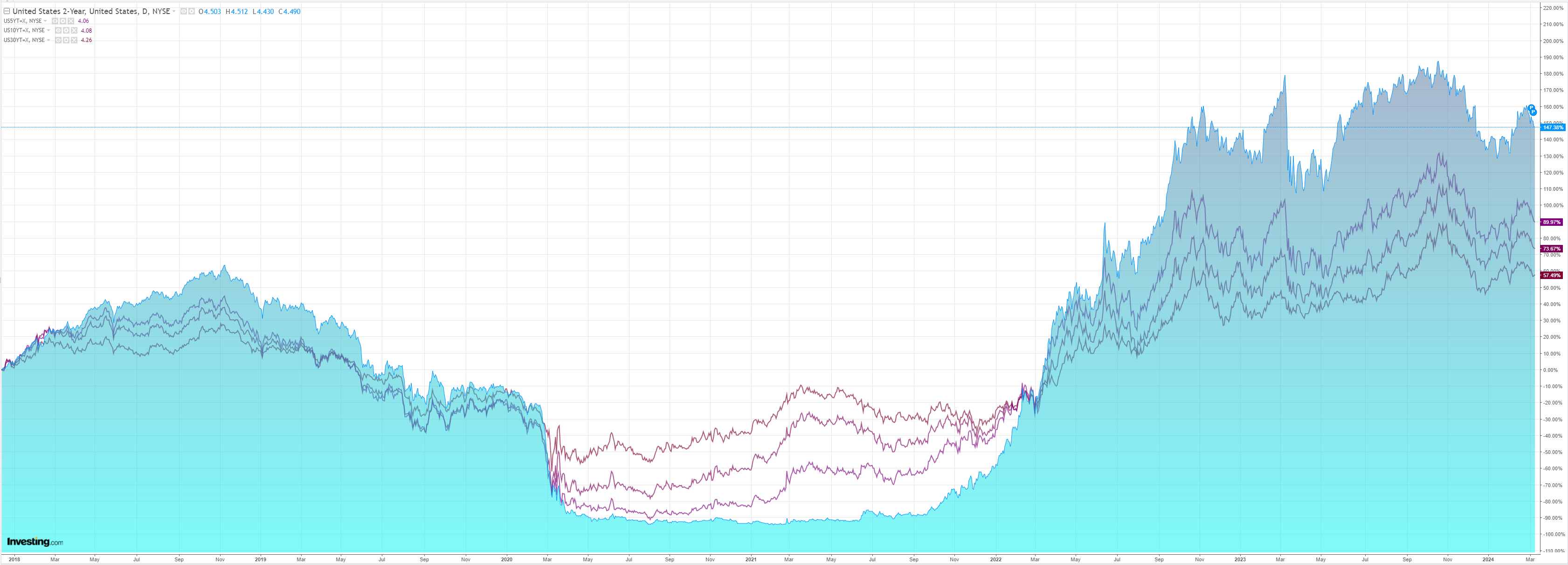

Yields eased:

Stocks fell a little:

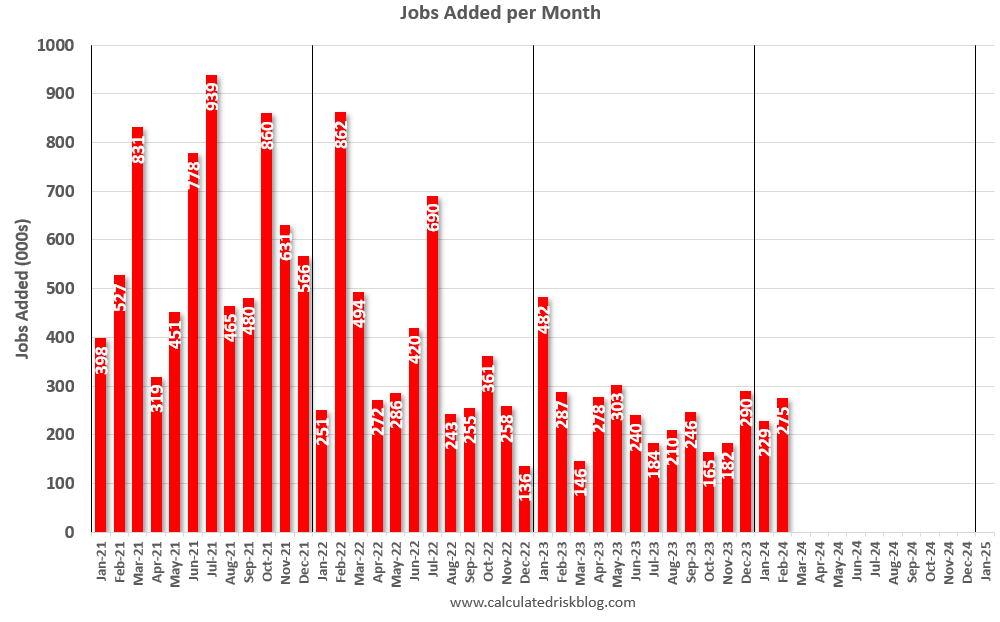

The US jobs report was another barnburner, but the revisions were heavily negative. The BLS is struggling to get its seasonal adjustments right:

Total nonfarm payroll employment rose by 275,000 in February, and the unemployment rate increased to 3.9 percent, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in health care, in government, in food services and drinking places, in social assistance, and in transportation and warehousing.

…The change in total nonfarm payroll employment for December was revised down by 43,000, from +333,000 to +290,000, and the change for January was revised down by 124,000, from +353,000 to +229,000. With these revisions, employment in December and January combined is 167,000 lower than previously reported.

Wages cooling resumed:

We are still firming towards Fed cuts sooner rather than later. While that happens, AUD is likely to rise.

But I do not expect it to get far.

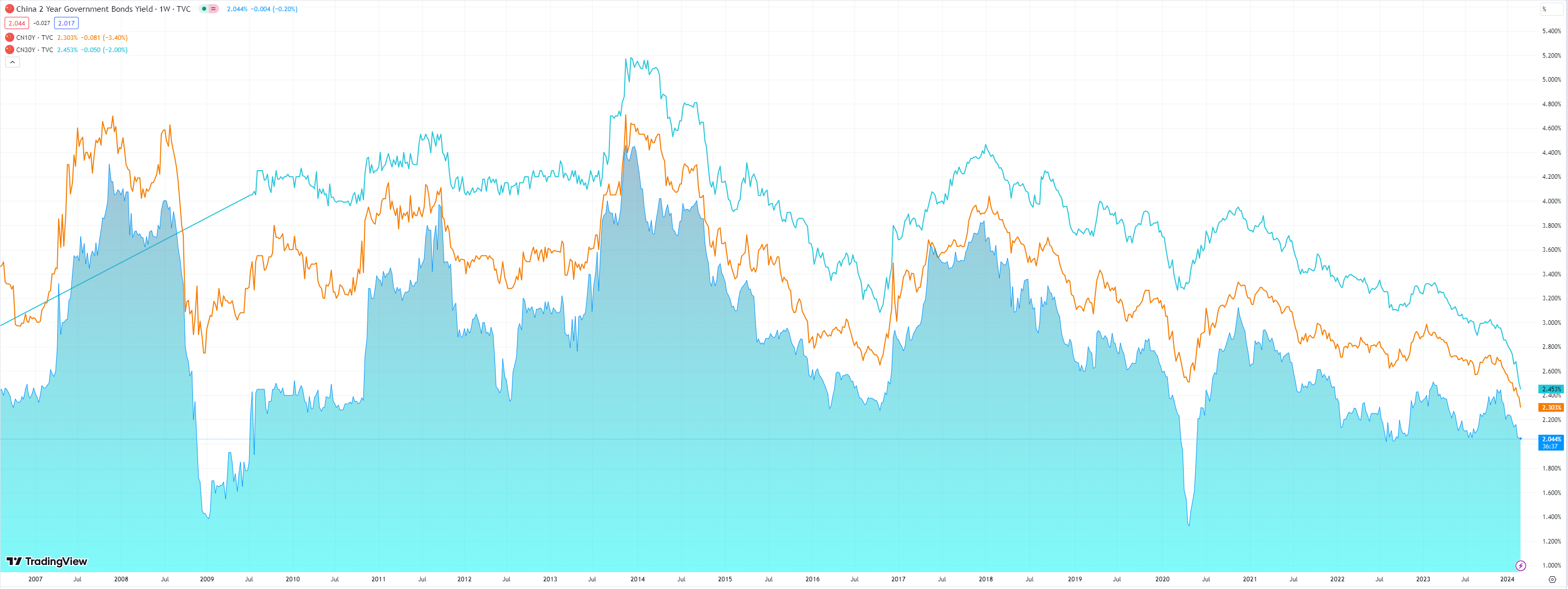

The reason is a more critical chart for the AUD this week than US jobs. It is this:

Chinese bond yields are collapsing across the curve. Long-end yields are already at unprecedented levels and falling like a comet. The short-end is about to break to levels never seen outside of an outright economic crisis.

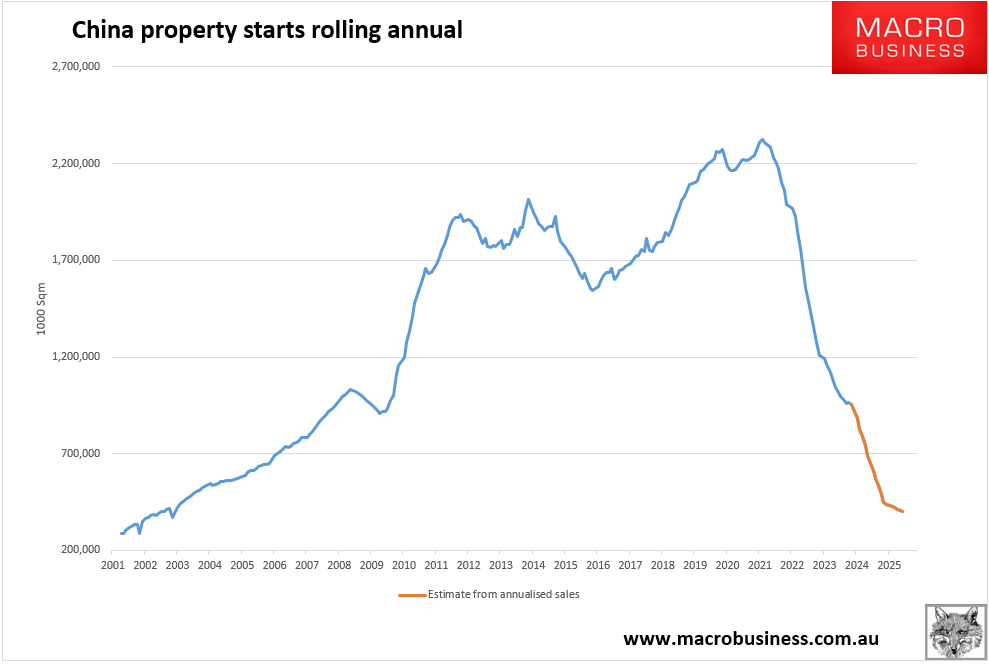

Depression economics is taking hold in China as the property catastrophe guts consumption of everything from steel to toasters as the private sector ramps saving in lieu of balance sheet wealth.

Hilariously, Pooh Bear of Beijing doesn’t even know:

Chinese regulators are scrutinizing regional banks’ bond investments amid concern that they are speculating on the securities rather than lending to boost the economy, according to people familiar with the matter.

Policymakers this week requested information from rural lenders including their bond-trading activities over the past three years, their major counterparties and the necessity of the investments, the people said, asking not to be named discussing private matters. The regulators have asked banks to explain how they’ll focus on their key business of supporting small companies, the people added.

Herein is the classic liquidity trap. They have credit, but nobody wants it, so they bid up bonds instead.

Beijing should cheer them on! China needs much lower yields. It needs zero interest rates to accelerate the household deleveraging process and prevent the savings impulse from getting out of hand.

The problem is property. For the uninitiated, the last few weeks of sales by floor area are staggering:

In due course, this will render iron ore and coking coal worthless dirt, and the AUD will fall a very long way to compensate.