Stocks rose sharply over the week, despite a 1% drop on Friday after a strong job report. Jay Powell was right on Wednesday when he stated that the labor market was too tight and that their data showed inflation would take time to come down. The market didn’t believe him initially, with stocks seeing a rally on Wednesday and Thursday.

Powell’s tone at the FOMC meeting seemed different, and perhaps Powell is done holding the market’s hand and is willing to let the market bet against the Fed if it wants to.

The reasons for this may be clear: as the market eases financial conditions, the economy is more likely to achieve a soft landing, and inflation will take longer to decrease. Powell may be okay with this outcome as it means that he will not only reach his goal of getting interest rates to a range of 5% to 5.25% but will also be able to keep them elevated for all of 2023.

A soft landing suggests no economic recession but also marks the start of a new rate regime where ZIRP (Zero Interest Rate Policy), NIRP (Negative Interest Rate Policy), and QE (Quantitative Easing) are a thing of the past. This may be Powell’s ultimate goal.

Powell may have also given us insight into the financial conditions index he favors. He mentioned that financial conditions remained unchanged between the December 14 and February 1 FOMC meetings. The chart below shows that the Goldman Sachs Financial Conditions Index was at 99.75 on December 13 and 99.69 on January 30, indicating that the index fluctuated but ended roughly in the same place.

Powell gets to reinforce or change his views again on Tuesday of this week when he speaks at the Economic Club of Washington.

1. Fed Funds Futures

Regardless, the impact of the FOMC meeting may not matter at this point as the job data came in much stronger than expected, causing the unemployment rate to drop to 3.4% from 3.5% in December. The 517,000 jobs added were far beyond the estimated 188,000, leading to a surge in Fed Funds futures rates. The December 2023 contract is now back to 4.70%, similar to its position on January 5, before the December job report.

If the contract breaks through the resistance level of 4.7% to 4.75%, it may indicate that the market agrees with the Fed’s stance on interest rates being over 5% for all of 2023.

2. 2-Year Treasury

If the December 2023 futures contract moves higher, then the 2-year rate will also need to increase. This was seen on Friday when the 2-year rate jumped by almost 19 basis points to finish at 4.29%. If the December 2023 contract reaches above 5%, the 2-year rate will likely return to its highs around 4.7% to 4.8%.

3. 10-Year Treasury

This likely means the 10-year rate is also heading back to around 4% to 4.1%.

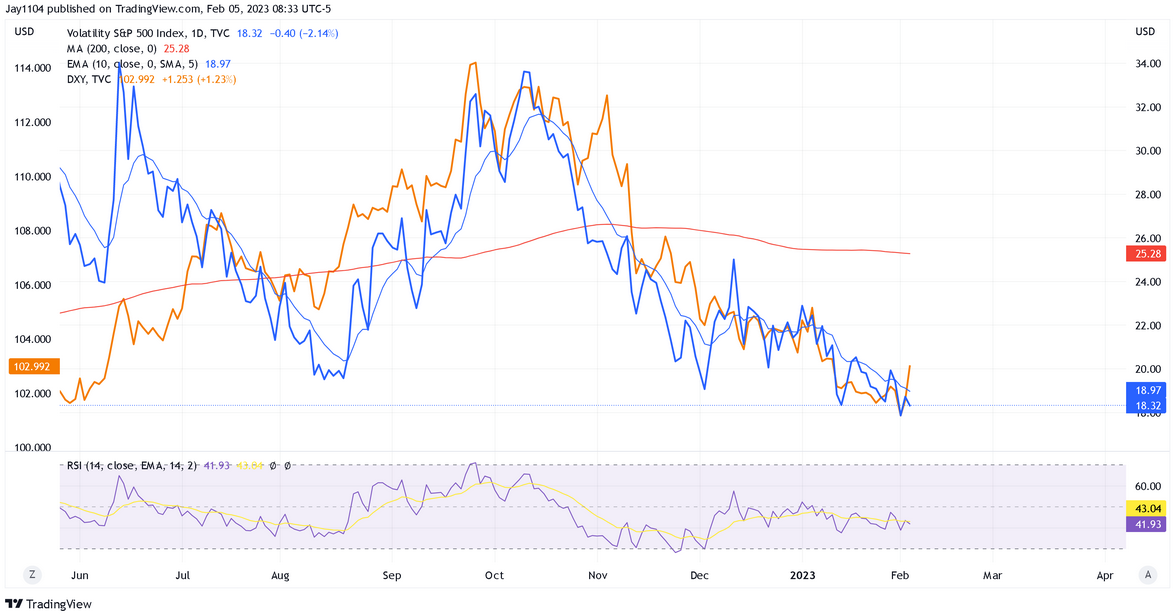

4. U.S. Dollar Index

This could indicate that the U.S. dollar index is set to rise again after breaking out of a falling wedge pattern and may be headed back to 106. Higher interest rates and a stronger dollar could result in the Goldman Sachs Financial Conditions Index rising from its current level.

5. Volatility

If the dollar and interest rates are on the rise, then it is likely that the VIX index, which measures market volatility, will also increase. Tightening financial conditions typically leads to a higher VIX index.

6. S&P 500

If the dollar, interest rates, and the VIX are all rising, and financial conditions are tightening due to stronger-than-expected job and ISM reports, then the S&P 500 is likely to decrease. The corrective phase of the bear market seems to be ending, and the S&P 500 has retraced 50% of its entire 2022 decline. Based on Elliott wave analysis and Fibonacci retracement, the current move higher appears to be corrective rather than the start of a new bull market.

7. Invesco QQQ Trust ETF

The Thursday edition of the “Reading The Markets Lite” newsletter noted that the Invesco QQQ Trust ETF (NASDAQ:QQQ) hit its 38.2% retracement level of the 2022 decline.

8. NVIDIA

In addition to the signs of a turning market, stocks such as NVIDIA (NASDAQ:NVDA) indicate a change. NVIDIA seems to have completed an ABC corrective wave off the October lows, with Wave A equaling Wave C. The RSI has also breached 70, which could indicate a potential rally to around $220, making it an ideal place for a stop and reverse.

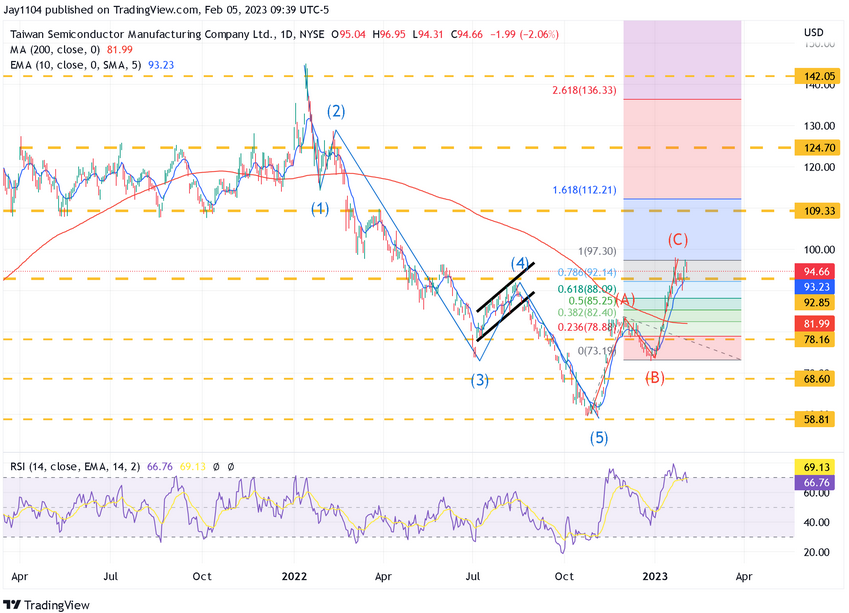

9. TSMC

Taiwan Semiconductor Manufacturing Company (NYSE:TSM) has a similar look and feel to NVIDIA with the same corrective Wave and an RSI over 70, as well as wave A equal to wave C. This would also suggest that TSMC is probably overextended, and the recent rally in the stock is near its end.

10. Target

Target Corporation (NYSE:TGT) reached resistance this week around $180 while the RSI pushed above 70. That is where the shares failed for the third time since the summer. There was a large bearish options wager on the stock earlier this week.

Have a good week!