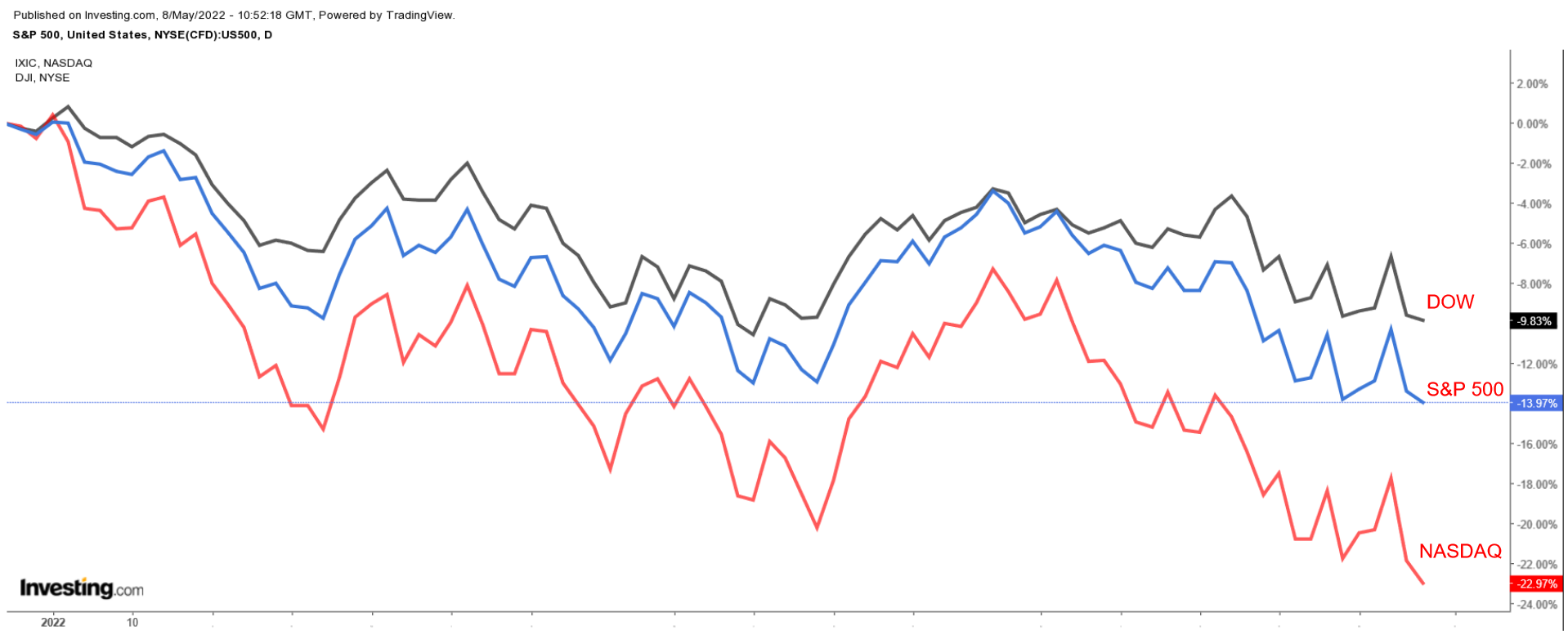

Stocks on Wall Street tumbled on Friday, capping off another tumultuous week, with the benchmark S&P 500 suffering its fifth straight weekly loss as investors continued to worry about the Federal Reserve's plans to raise interest rates.

The coming week is expected to be another busy one amid more earnings from high-profile companies like Walt Disney (NYSE:DIS), AMC Entertainment (NYSE:AMC), Palantir Technologies (NYSE:PLTR), Peloton (NASDAQ:PTON), Rivian Automotive (NASDAQ:RIVN), and Coinbase Global (NASDAQ:COIN).

This week will also see important economic data, including the latest consumer price inflation report for April.

Given all of the market volatility, investors have recently experienced, below we highlight one stock likely to be in demand and another which could see further downside, no matter which direction the market may take moving forward.

Remember though, our timeframe is just for the upcoming week.

Stock To Buy: Occidental Petroleum

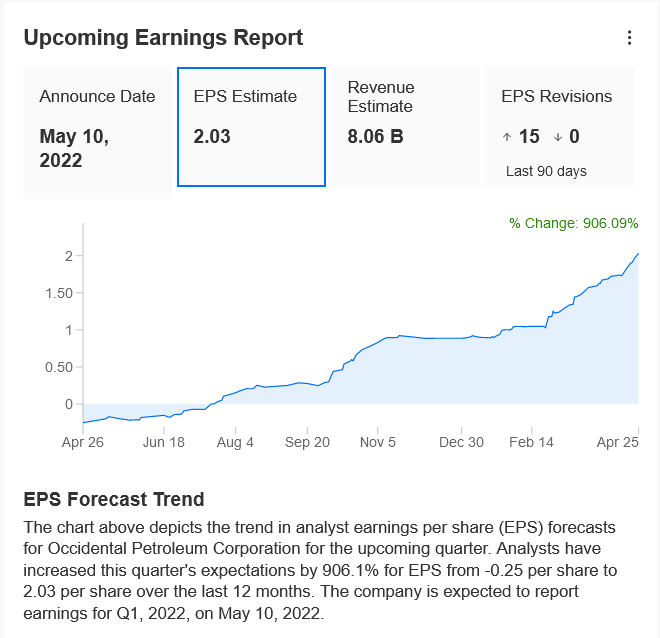

Occidental Petroleum (NYSE:OXY)—which saw its shares jump to their highest level in more than two years on Friday—could see further gains in the week ahead as the thriving energy company is expected to deliver explosive earnings and revenue growth when it releases its latest financial results after the closing bell on Tuesday, May 10.

Consensus calls for the Houston, Texas-based oil-and-gas producer—which has beaten Wall Street estimates for four consecutive quarters—to report first quarter earnings per share of $2.03, improving substantially from a loss of $0.15 per share in the year-ago period.

Meanwhile, revenue is forecast to rise nearly 52% year-over-year to $8.06 billion, as it benefits from its stellar operations in the Permian Basin, while taking advantage of strong crude and natural gas prices.

Source: InvestingPro

If confirmed, Occidental’s quarterly profit and sales total would mark the highest in its history. As such, we believe Oxy’s management will boost its outlook for the months ahead to reflect the positive impact of soaring crude oil and natural gas prices on its business.

Perhaps of greater importance, market players will be eager to hear if the energy company plans to return more cash to shareholders in the form of higher dividend payouts and stock buybacks. Occidental currently pays a quarterly dividend of $0.52 a share, providing an annual yield of about 0.80%.

OXY climbed almost 18% last week to score its biggest weekly gain since late February. It closed Friday’s session at $64.94, a level not seen since April 2019.

Despite the broader market slump, OXY shares have gotten off to one of their best starts ever to a year, soaring by a whopping 124% so far in 2022 thanks to higher commodity prices and improving energy market fundamentals.

At current valuations, the U.S. oil-and-gas giant—which has outperformed other notable names in the booming sector, such as ExxonMobil (NYSE:XOM), Chevron (NYSE:CVX), ConocoPhillips (NYSE:COP), EOG Resources (NYSE:EOG), Pioneer Natural Resources (NYSE:PXD), and Devon Energy (NYSE:DVN)—has a market cap of roughly $60.8 billion.

Stock To Dump: Roblox

Roblox (NYSE:RBLX), which has seen its shares steadily collapse to a series of new record lows in recent sessions, is forecast to suffer another dismal week amid the ongoing impact of various negative factors plaguing the embattled digital entertainment company.

Year-to-date, RBLX shares have lost an astonishing 73% through the first five months of 2022, significantly underperforming the broader market, as investors dumped unprofitable technology companies with expensive valuations due to the Federal Reserve’s aggressive tightening plans.

Higher yields and expectations of tighter Fed policy tend to weigh heavily on highly valued growth names, especially those that are unprofitable or have triple-digit price-to-earnings ratios, as it threatens to erode the value of their longer-term cash flows.

RBLX—which began trading at $64.50 after it went public in a direct listing last March—ended at an all-time low of $27.81 on Friday. At current levels, the San Mateo, California-based company, which has a market cap of approximately $16.4 billion, is about 80% below its record high of $141.60 reached in November 2021.

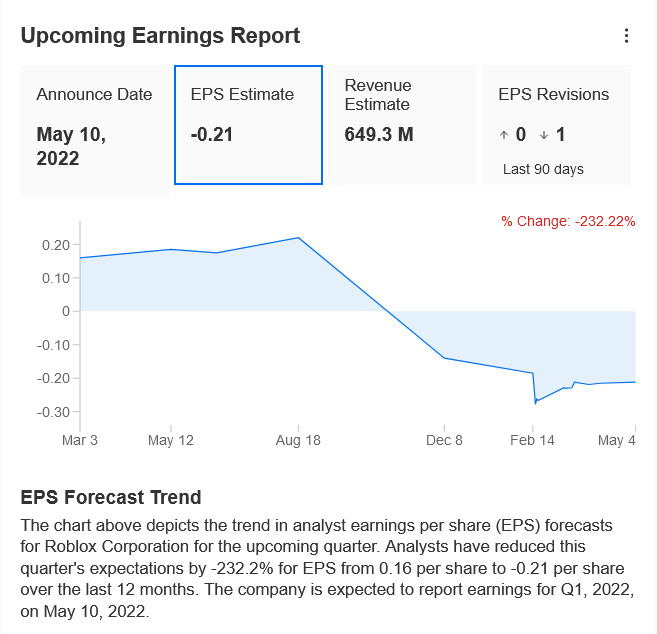

Another negative catalyst is expected to arrive when Roblox reports first quarter results after the U.S. market closes on Tuesday, May 10.

Based on moves in the options market, traders are pricing in a sizable swing for RBLX shares following the report, with a possible implied move of about 21% in either direction.

The money-losing gaming platform provider is forecast to post a loss of $0.21 per share for the first quarter. Revenue, meanwhile, is forecast to clock in at $649.3 million, down from $770.1 million in the same quarter last year.

Source: InvestingPro

If confirmed, that would mark the slowest pace of sales growth since the company’s IPO in March 2021 amid cooling demand for its online platform that allows users to easily play and develop video games in 3D virtual worlds.

Beyond the top-and-bottom line numbers, investors will pay close attention to growth in bookings, which is a form of adjusted revenue preferred by videogame analysts. The key metric missed targets in the last quarter, underlining worries over a substantial slowdown in its core business.

Interested in finding your next great idea? InvestingPro+ gives you the chance to screen through 135K+ stocks to find the fastest growing or most undervalued stocks in the world, with professional data, tools, and insights. Learn More »