Stocks on Wall Street ended last week on a high note, with the S&P 500 closing at a new record amid easing worries about a sudden tapering of stimulus by the Federal Reserve.

Between another batch of important economic data, mainly the latest monthly US employment report and the ISM manufacturing survey, the week ahead is expected to be a busy one on Wall Street.

Regardless of which direction the market goes, below we highlight one stock likely to be in demand and another which could see additional downside.

Remember though, our timeframe is just for the upcoming week.

Stock To Buy: Nucor

Negotiations on an infrastructure spending plan between White House officials and a bipartisan group of U.S. Senators will continue in Washington D.C. this week. That could result in more positive action for Nucor (NYSE:NUE), the largest American steel producer.

U.S. President, Joe Biden,announced Thursday that the White House had reached a tentative agreement on an infrastructure spending package with a group of 21 Senators, including 11 Republicans.

The plan, which includes substantial added investments to repair and improve the nation’s deteriorated roads, highways, and bridges, is valued at $1.2 trillion over eight years, of which $579 billion is new spending.

In a positive development, Biden over the weekend withdrew his threat to veto the bill unless a separate Democratic spending plan—one which is strongly opposed by the Republican party—also passes Congress.

“I intend to pursue the passage of that plan, which Democrats and Republicans agreed to on Thursday, with vigor,” Biden said in a statement on Saturday. “It would be good for the economy, good for our country, good for our people. I fully stand behind it without reservation or hesitation,” he added.

Nucor manufactures steel and steel products, such as bars, beams, sheets, and plates, potentially making it one of the biggest beneficiaries from the expected boom in construction resulting from the new infrastructure bill.

NUE stock, which has gained roughly 82% year-to-date and 138% in the last 12 months, ended at $96.69 by close of trade on Friday. At current levels, the Charlotte, North Carolina-based steel products company has a market cap of $28.9 billion.

Nucor is scheduled to next report earnings on July 22. Consensus estimates call for EPS of $4.36 on record high revenue of $8.32 billion. If confirmed, that would represent year-over-year growth of more than 1,100% in earnings and 92% in sales, reflecting strong steel market fundamentals and a favorable demand environment.

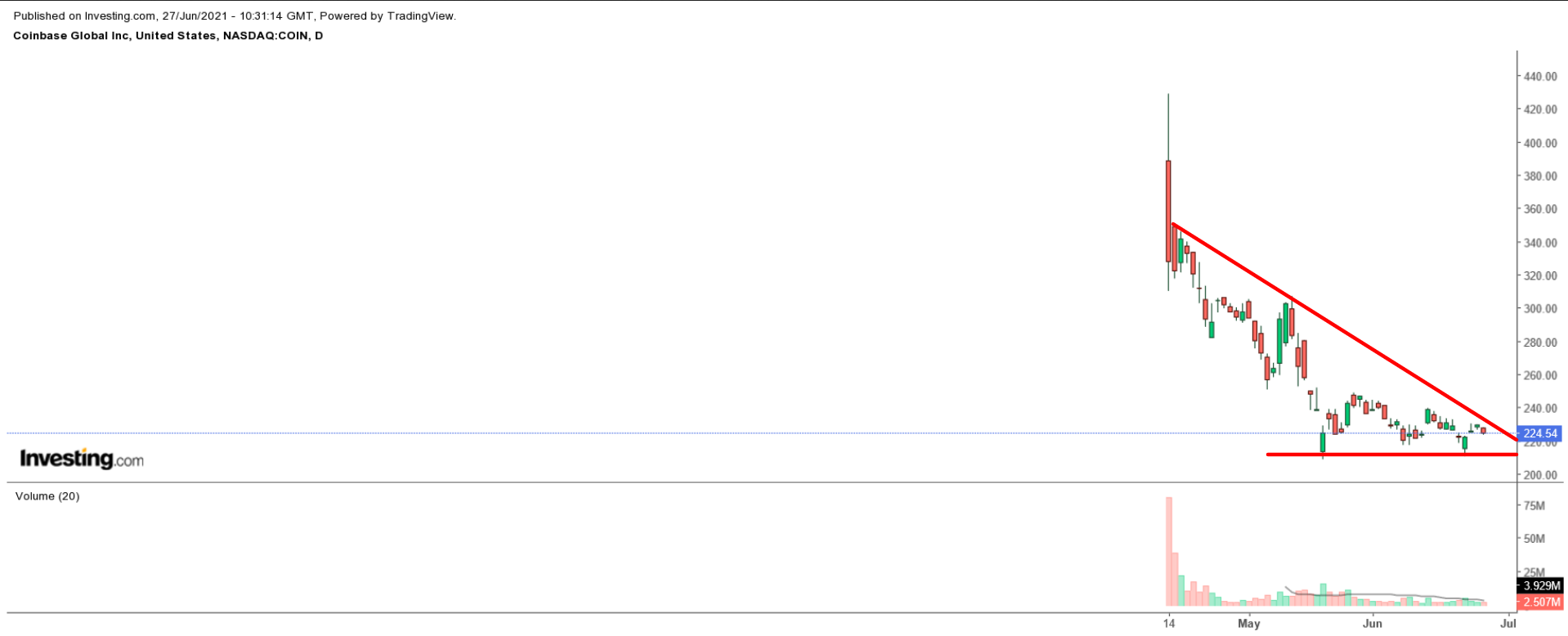

Stock To Dump: Coinbase Global

Shares of recently IPO'd cryptocurrency exchange operator Coinbase Global (NASDAQ:COIN) are expected to suffer another volatile week as the correction in the crypto market continues.

Bitcoin sank below the key $30,000-level on Tuesday, at one point briefly erasing all its 2021 year-to-date gains, due to fears of an escalating crackdown in China after the country’s central bank announced new regulations and trading restrictions.

The world’s most expensive digital currency recovered to climb back above the $35,000 threshold by Friday night, before a Saturday selloff drove prices back down towards $30,000.

BTC—which peaked at around $65,000 in mid-April—last changed hands at $32,700 in early morning Sunday trading.

Several other popular cryptocurrencies such as Ethereum, Cardano, Litecoin, and Dogecoin, which can all be bought and sold on Coinbase, also experienced heightened volatility in weekend trade, resulting in the term “#CryptoCrash” trending on Twitter.

Taking that into account, Coinbase shares, which made their blockbuster trading debut on Apr.14 following a direct-listing IPO at $250 per share, could fall further in the days ahead, as investors react to the violent swings in crypto prices.

After rallying to an all-time high of $428.93 in its first day of trade, COIN stock has since come under heavy selling pressure, losing nearly half its value in the last three months.

Coinbase shares closed Friday’s session at $224.54, earning the crypto exchange platform operator a valuation of $47.3 billion.