- 3M's growth trajectory changed dramatically, erasing a decade of gains, due to liability issues.

- The recent $10.3 billion settlement brings some positivity for 3M investors.

- Despite challenges, 3M still shows potential for upside based on its fundamentals.

- InvestingPro Summer Sale is on: Check out our massive discounts on subscription plans!

- Monthly: Save 20% and get the flexibility of a month-to-month subscription.

- Annual: Save an amazing 50% and secure your financial future with a full year of InvestingPro at an unbeatable price.

- Bi-Annual (Web Special): Save an amazing 52% and maximize your profits with our exclusive web offer.

When I first started investing in stocks back in 2013, 3M (NYSE:MMM) was my first purchase. The Minneapolis, Minnesota-based industrial giant had everything I looked for in a stock: an internationally recognizable brand, strong fundamentals, low volatility, and a hefty dividend yield with solid growth for over 50 years.

For five years, I just sat and watched the stock grow a solid 150% while receiving another 6% safe yearly dividend on top of it. Sure, it wasn't Apple-like growth, but neither was I looking for emotion.

But then something snapped, and 3M's growth trajectory changed for good. The company got caught in an endless stream of liability, damaging its reputation and balance sheet, ultimately erasing a decade of gains—which so happens to be one of the decades of more significant growth for U.S. stocks.

The stock now trades at the level I first bought it in 2013. Throughout the course of the 3M's long bear market, I managed to sell my positions at an average of $170/share, far from the stock's $250 top but still much better than the current ~$100 price.

Throughout the course of the 3M's long bear market, I managed to sell my positions at an average of $170/share, far from the stock's $250 top but still much better than the current ~$100 price.

However, this week, 3M investors finally got one positive breakthrough: the company reached a $10.3 billion settlement for its 'forever chemicals' suit.

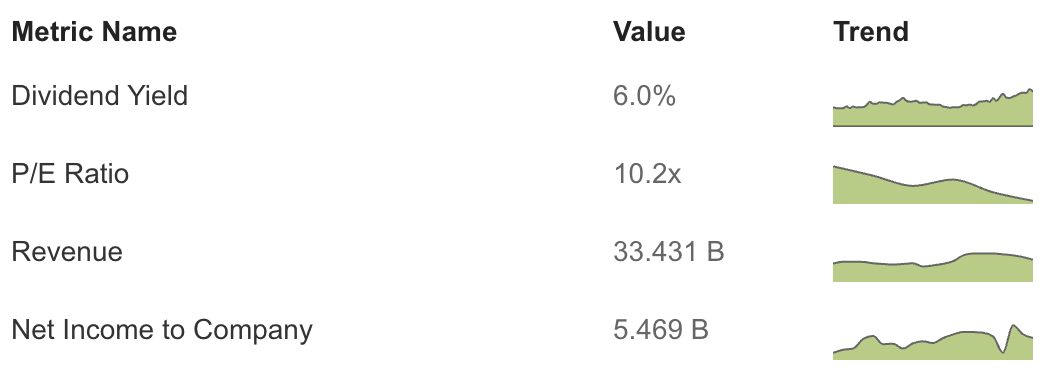

With the stock running at a very interesting 10.2 PE with solid profitability, the question running through investors' minds is: is enough finally enough for the industrial giant?  Source: InvestingPro

Source: InvestingPro

To answer that question, let's dive into 3M's fundamentals and the company's latest news with InvestingPro.

By the way, InvestingPro is currently hosting its Summer Sale, offering massive discounts on subscription plans. This is your chance to access cutting-edge tools, real-time market analysis, and expert opinions at a fraction of the price.

Enjoy incredible discounts on our subscription plans:

'The Solution to Pollution Is Dilution'

Back in the 70s, 3M executives would famously quote the above sentence to sweep their problems under the rug—or rather, to dilute them in the water. But then came the 2010s, and things didn't turn out to be quite like that, as the company got caught in a plethora of legal actions.

In fact, the knowledge of 3M's board of directors of the company's polluting past has led to an additional shareholder lawsuit against the board of directors—which I participated in.

On top of those cases, 3M is also battling the largest mass tort in U.S. history due to allegedly providing ineffective earplugs to the U.S. military, damaging the hearing of hundreds of thousands of combat soldiers. According to Reuters, the case has 330,000 cases filed and approximately 260,000 pending cases.

In a recent negative decision for 3M, U.S. Bankruptcy Judge Jeffrey Graham rejected the company's effort to resolve the lawsuits by filing for bankruptcy of its subsidiary, Aearo Technologies—which 3M claims to be the actual maker of the allegedly defective earplugs.

However, as the 'forever chemicals' lawsuit appears to be nearing an ending, investors begin to wonder if 3M's liability is a 'forever problem' for the 121-year-old company.

Let's take a look at the company's financials for more clues to that question.

Is 3M Undervalued?

To flatly answer the question above from a strictly fundamental point of view, yes—especially in a market that's beginning to show signs of exhaustion after jumping this year.

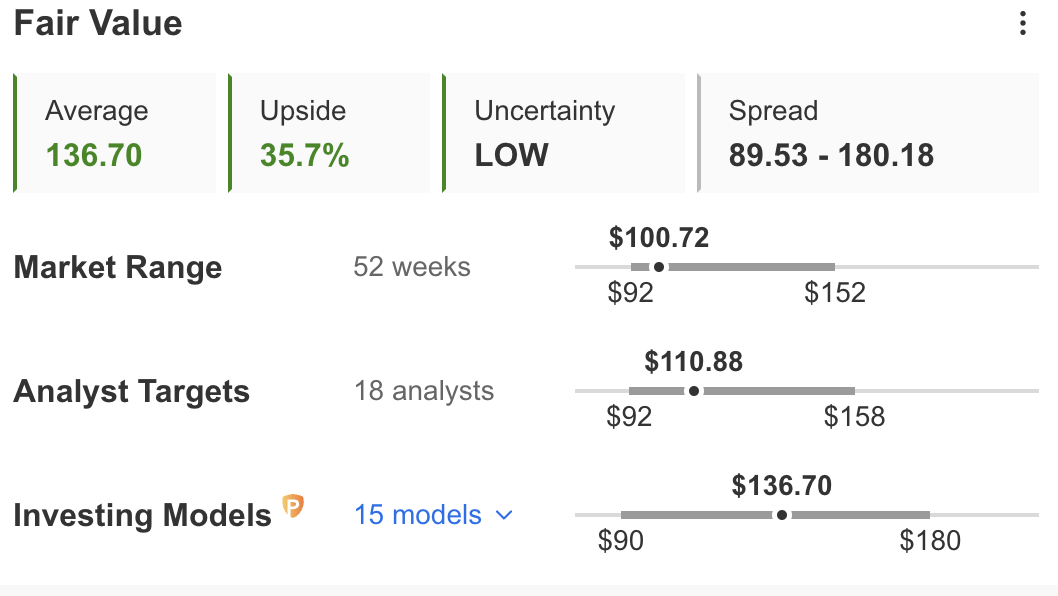

According to InvestingPro's 15 models, the stock has a potential 35.7% upside potential in the next few months with low uncertainty.

Source: InvestingPro

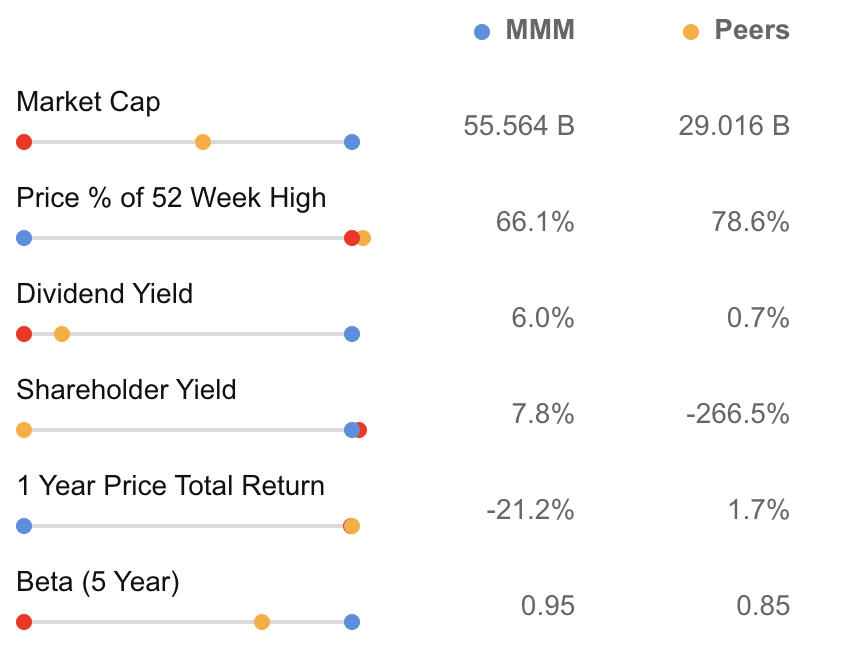

Furthermore, the company is trading further away from its 52-week high with a greater beta than its sector peers, implying that it would likely rise faster and further in an uptrend.

Source: InvestingPro

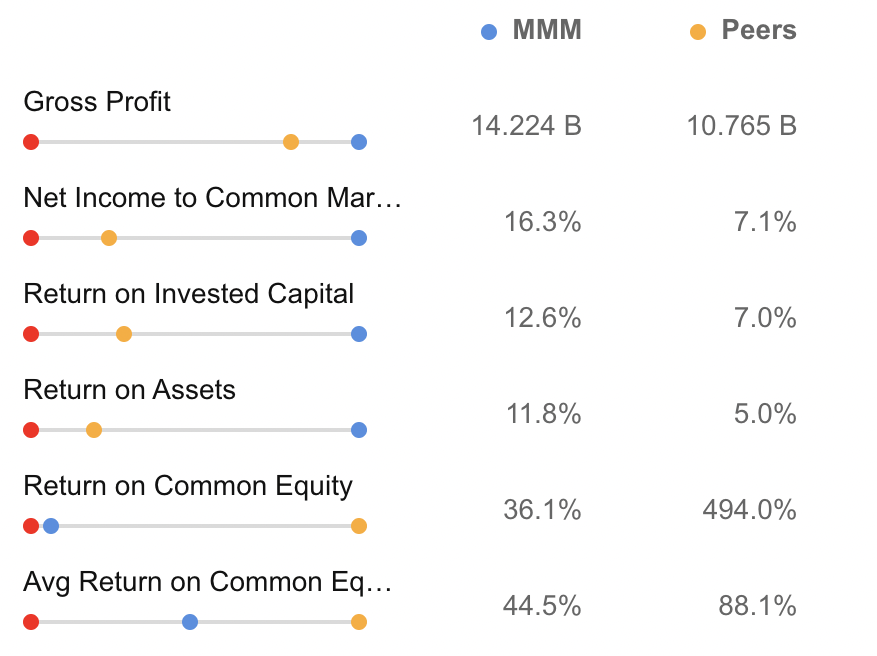

Moreover, the Minnesota-based company is way ahead of the competition in gross profit, net income margin, return on invested capital, and return on assets.

Source: InvestingPro

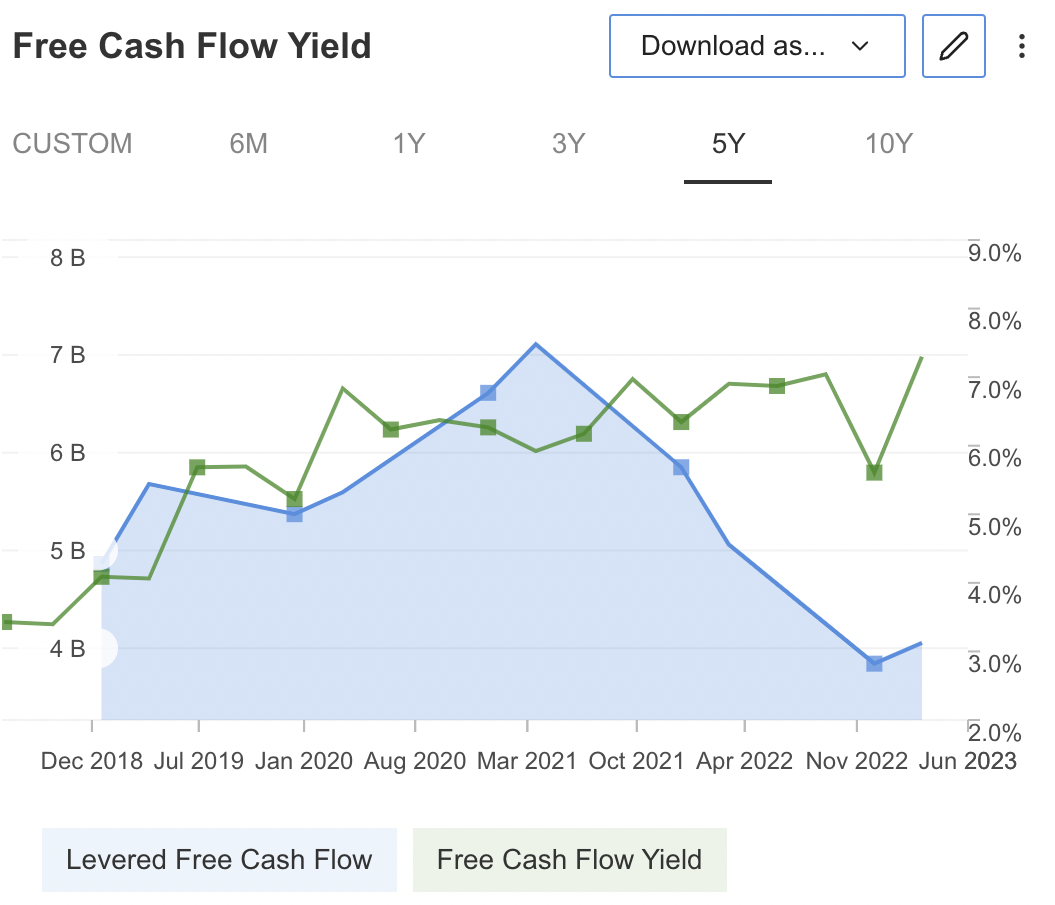

As InvestingPro data shows, the company has also been growing its free cash flow yield while keeping leveraged cash flow significantly low, implying financial resilience against a macroeconomic crisis, such as a potential incoming recession.

Source: InvestingPro

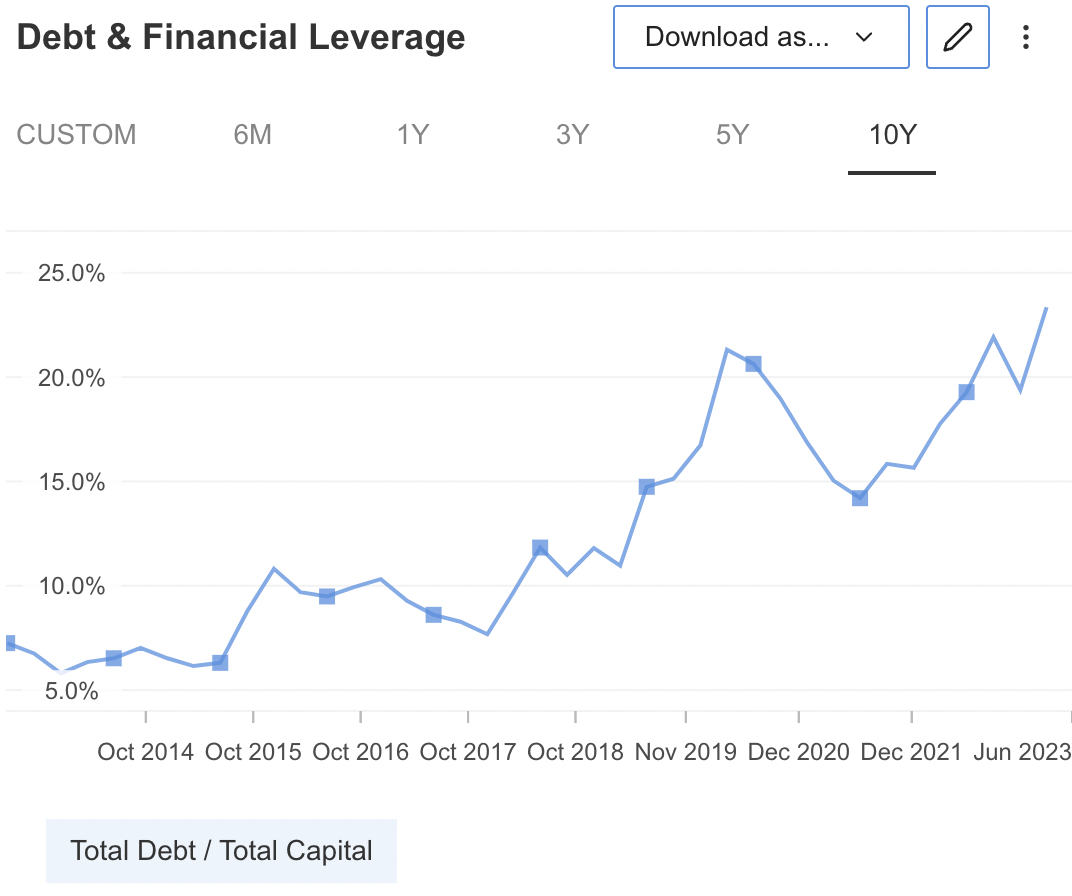

However, as a consequence of the legal battles, 3M's debt to total capital has been on a steady uptrend for the past decade.  Source: InvestingPro

Source: InvestingPro

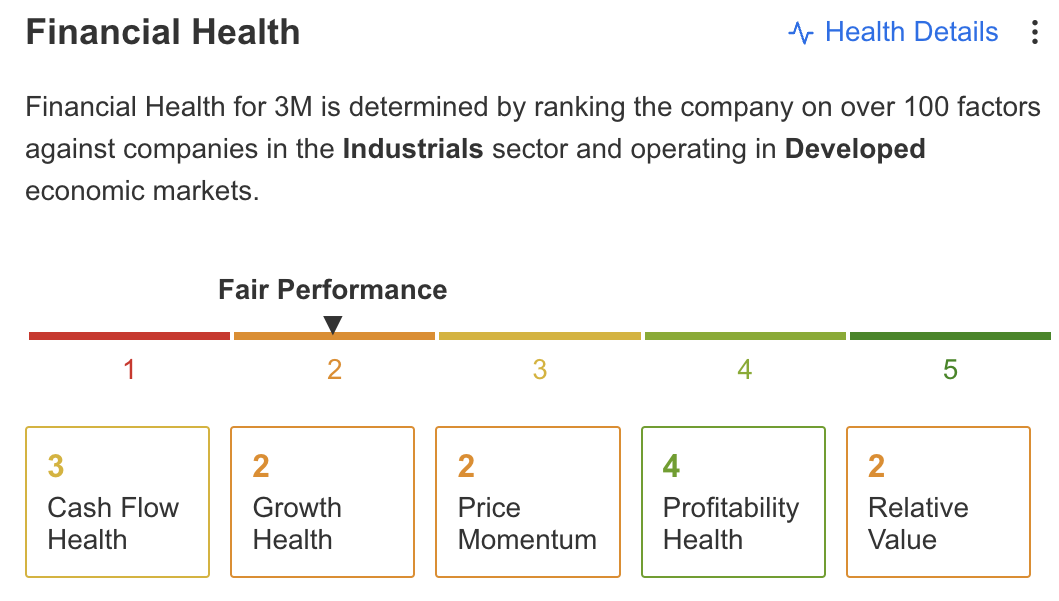

The company's growing debt, combined with its slowing price momentum, has led to a low financial health score on InvestingPro.  Source: InvestingPro

Source: InvestingPro

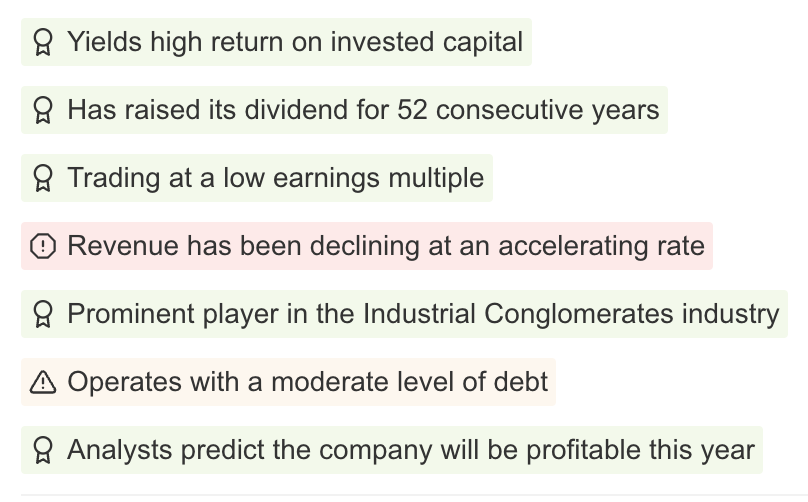

However, liability aside, 3M has more upside than downside potential, according to InvestingPro.

Source: InvestingPro

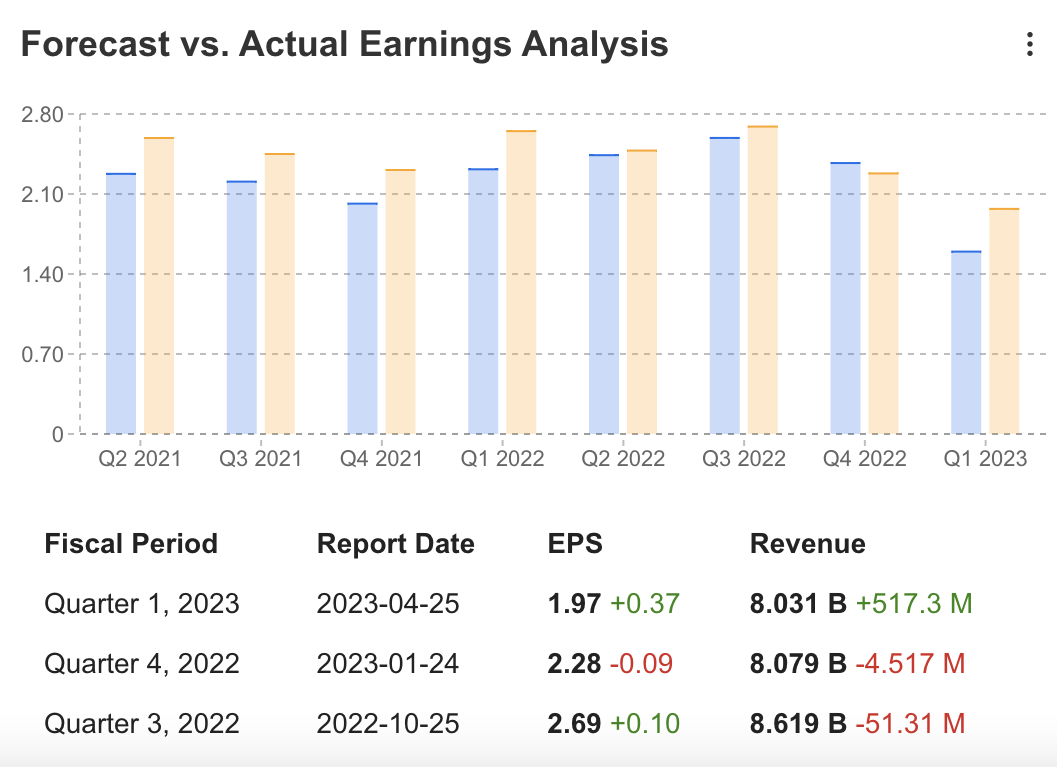

Furthermore, despite the declining revenue trend—primarily due to the macroeconomic environment—3M posted better-than-expected figures on its latest earnings report.  Source: InvestingPro

Source: InvestingPro

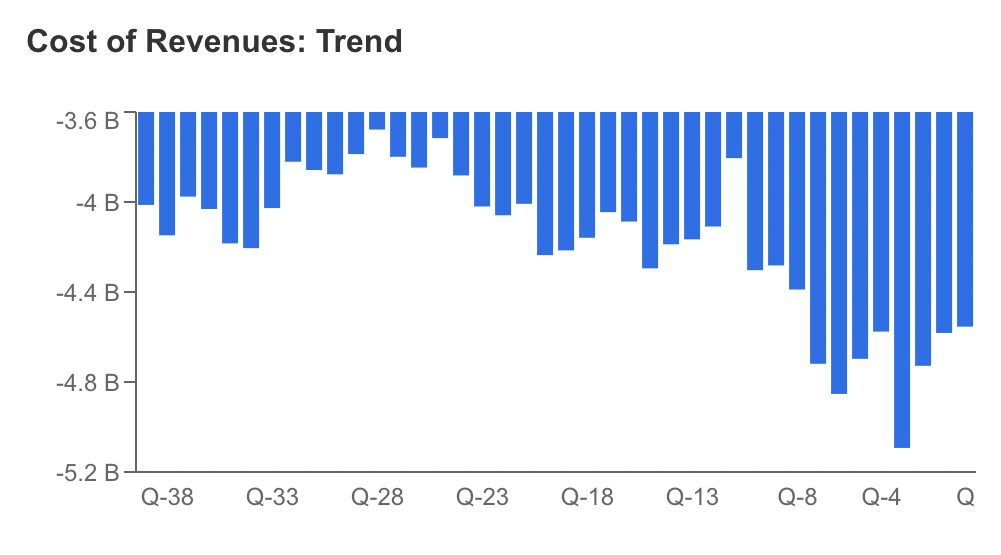

That's mainly because the cost of revenue has been trending much lower—mainly due to the company's cost-cutting initiatives, mainly in place since last year.

Source: InvestingPro

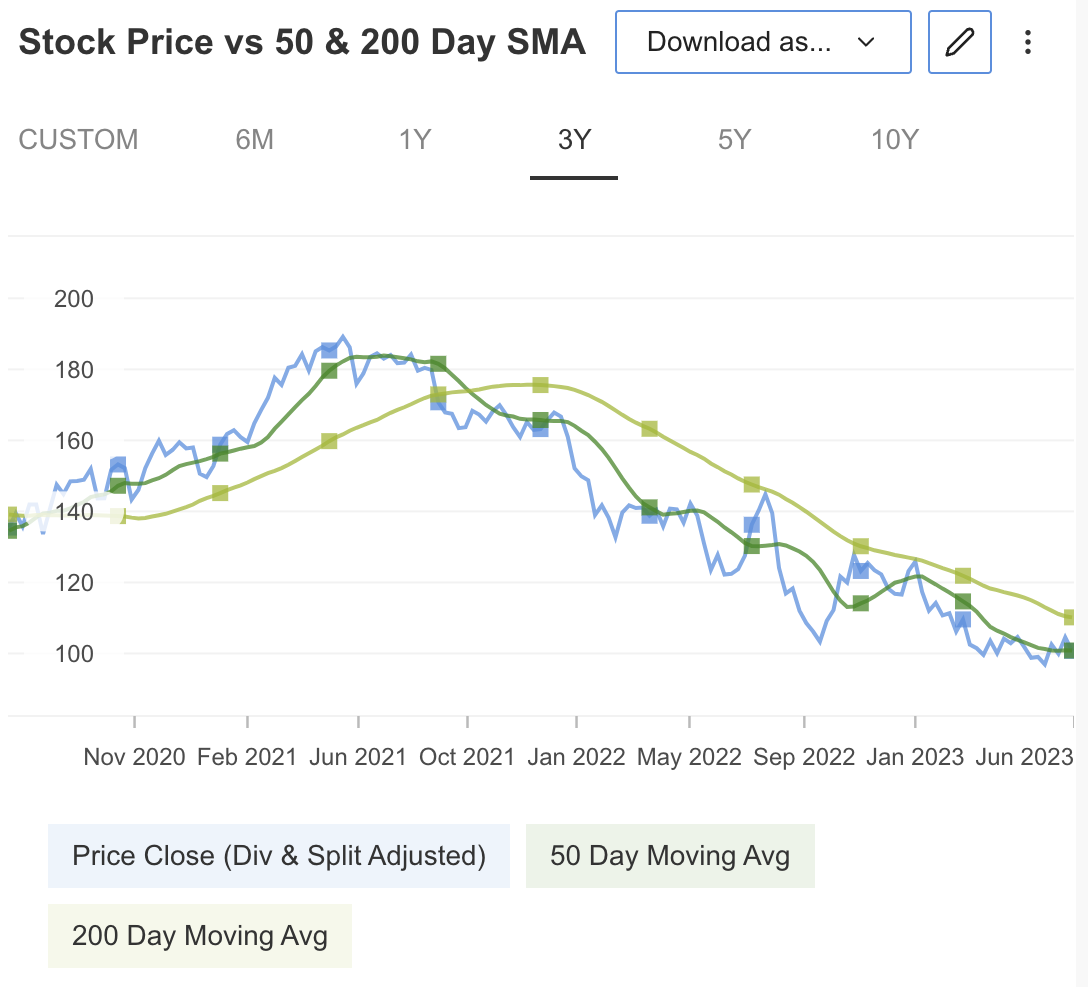

On the technical side, the stock is currently sitting at its 50-day moving average, and a move lower would likely create a safe entry point.  Source: InvestingPro

Source: InvestingPro

Bottom Line

From a fundamental perspective, 3M should be trading at much higher levels than it currently is—even despite the growing damage to its balance sheet incoming from legal liability.

Moreover, it appears safe to bet that the 120-year-old company will survive this dark period in its history and see better days again in the future.

The question lies in which levels are worth buying the stock in the face of its continuous risks. I would say anything below 95$ could be worth a try, with sub-$85 prices indicating a downright buy.

Maybe enough isn't yet enough for 3M, but fundamentals indicate that we are getting very close to that.

***

Don't miss this limited-time opportunity to access cutting-edge tools, real-time market analysis, and the best expert opinions.

Join InvestingPro today and unleash your investment potential. Hurry, the Summer Sale won't last forever!

Disclosure: As of this writing, the author doesn't own any positions in 3M. He may consider buying the stock at the levels mentioned in this report.