- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Spotify Vs. Apple: How Damaging Is The European Anti-Competition Suit?

Last week, streaming music service Spotify (NYSE:SPOT) filed an antitrust complaint in the EU alleging Apple (NASDAQ:AAPL) is stifling innovation by giving its proprietary music offering, Apple Music, an unfair advantage over direct competitors within its user ecosystem. Spotify says it does so by various means, including collecting a 30% tax on any sale of third-party services through its App Store, and by blocking third party access to synergies with other Apple products, such as streaming music via Spotify through Siri, Apple's HomePod, or from the Apple Watch.

According to Daniel Ek, Spotify's CEO, in a statement published on the company's blog:

After careful consideration, Spotify has filed a complaint against Apple with the European Commission (EC) the regulatory body responsible for keeping competition fair and nondiscriminatory. In recent years, Apple has introduced rules to the App Store that purposely limit choice and stifle innovation at the expense of user experience—essentially acting as both a player and referee to deliberately disadvantage other app developers. After trying unsuccessfully to resolve the issues directly with Apple, we're now requesting that the EC take action to ensure fair competition.

This isn't some nuisance action. Antitrust complaints via the European Commission are serious. The regulatory body is regarded as particularly active among global government agency peers. Over the past two years, for example, Google parent Alphabet (NASDAQ:GOOGL) has been fined $7.6 billion dollars by the EC for prioritizing its own shopping service, as well as stifling competition for Google's products on its Android platform. Indeed, just today the EC imposed a third fine on the company, in the amount of $1.7 billion, for anticompetitive practices related to online advertising.

What's at the heart of Spotify's beef and how damaging could this be for Apple?

The 30% tax, in particular, is a thorn in Spotify’s side. Over the past few years, the pricing of music apps has found a sweet spot at $9.99 per month. Raising prices in a competitive market, as a way of building revenue, isn't effective in this arena since customers tend to switch service providers in favor of the cheapest offering. As a result, the tax ensures that Apple gets a bigger cut of revenue for each non-Apple Music app sold.

As well, the restricted access to other Apple devices is a critical barrier to competition. For users, one of the major benefits of Apple’s ecosystem is the synergy across all Apple devices. For many loyalists this convenience has become a requirement. Not being able to synchronize across multiple platforms is a deal breaker—thereby giving a competitive advantage to Apple Music over Spotify, for example.

What’s at Stake for Apple?

Being found in violation of EU antitrust laws carries a maximum fine of 10% of the company’s annual global revenue for the most severe cases. Apple’s net revenue in 2018 was $265 billion, so at most the company could risk a $26 billion fine if the violation is found to be severe. That's a bit less than half its yearly earnings.

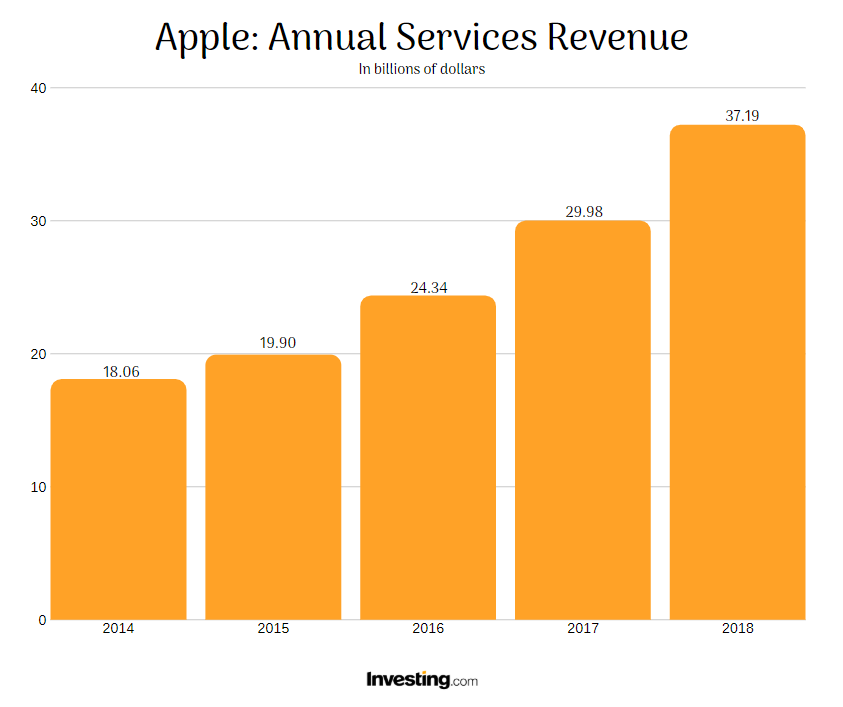

Perhaps more worrying, a ruling against Apple might weigh on future revenue from its current second largest segment, services.

Adding significance: the company expects this division to become a significant driver of future growth. In 2018, Apple brought in $37 billion via the services segment, which includes its App Store tax revenue, as well as its Apple Music revenue. App Store revenue is consistently singled out in the company's quarterly reports as a major growth contributor. Revenue from this group is estimated to be in the tens of billions.

Even if the EC doesn't rule on this complaint, Apple must figure out a better revenue model for the App Store. Spotify isn't the only company that no longer wants to play by Apple’s rules. Epic Games, creator of Fortnite, and Netflix (NASDAQ:NFLX) are also pushing back. Along with Spotify, each has pulled out of the App Store, in order to avoid paying Apple’s 30% tax.

Bridges Rather Than Moats

A quick resolution to this affair is unlikely. The Google case brought before the EC took three years to play out and that was considered short. Antitrust lawsuits are taken seriously by the EC, and careful investigations take time.

As for Spotify, which, post App Store is now selling its services on its own website, it's unlikely they'll actually have no presence on the App Store. Companies often continue to work together even as their cases remain active.

Still, given what transpired against Google during its antitrust lawsuits, the possibility of an EU fine being levied against Apple is real. Nonetheless, with $230 billion in the bank, Apple would hardly be decimated.

The real consideration is if this will erode Apple's ability to monetize its user base. For a decade, the company has worked to build a proprietary hardware ecosystem, but unit sales growth is stagnating. Sales of hardware for both the iPhone and iPad were unchanged in 2018 while Mac unit sales dropped by 5%. For this very reason, many bullish investment theses for Apple's stock requires the company to maximize revenue from its services segment while leveraging its reach to sell those services.

For now, revenue from Apple's services segment has slowed, but it was still up 19% during the last quarter, surpassing $10 billion. So for Apple, Spotify's lawsuit isn't the end of the world.

Any potential ramifications are years down the road. Even then, the iPhone manufacturer won't have any problem paying EC fines, no matter how large. Perhaps there's even an upside for Apple if they use this as an opportunity to build bridges rather than moats to the world’s biggest names in entertainment.

Apple has already built a secure empire in a cutthroat world. We believe it's well positioned to navigate any market-based challenges thrown its way.

Related Articles

This year tracks as a record for ETF launches among US issuers Investors have demanded high-yield, protection, and crypto-related funds in 2024 New strategies emerge, including...

Not too long ago, we wrote about a potential cup with handle breakout for the market-leading VanEck Semiconductor ETF (NASDAQ:SMH) Today, we examine a “monthly” chart...

Gold stocks are not yet unique within the wider macro, but that does not preclude a move to 40 by GDX (NYSE:GDX).Interestingly, however, on the day this was written (pre-market,...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.