- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Fed Chop And Change. Not Like Anyone Is Listening, Right?

Fed Chop & Change. Not Like Anyone is Listening, Right?:

Following this morning’s FOMC statement, the Federal Reserve have done their best to put the December meeting in play.

“…determine whether it will be appropriate to raise the target range at its next meeting.”

This line saw aggressive USD buying with each of the majors getting slapped down hard off the news as markets tried to reprice following the perceived hawkish guidance.

But the question raised is whether the Fed actually is believing what it is saying here. After the SLEW of terrible data out of US including multiple drops in the all important NFP numbers, not to mention global issues that while dropping off the first page of major news outlets, haven’t exactly disappeared, how can the Fed just chop back to December is play?

“Even with a slower pace of recent job gains, labor market indicators, on balance, show that underutilisation of labor resources has diminished since early this year.”

The whole situation has been handled terribly by the Fed, chopping and changing from month to month while the data they once said they were dependent on stays consistently bad.

May as well just be watching CNBC…

RBNZ:

Almost forgotten among the FOMC madness, The Reserve Bank of New Zealand also met to determine interest rate policy this morning in Wellington. The decision was that the central bank will leave interest rates on hold for another month after three straight cuts, but is likely to cut again in the near future.

“Some further reduction in the OCR seems likely.”

“This will continue to depend on the emerging flow of economic data. It is appropriate at present to watch and wait.”

The narrative out of the RBNZ is at least consistent, with Wheeler concerned about fueling a housing bubble in the key Auckland market, while battling growth and inflation problems caused by China and a recently appreciating New Zealand Dollar.

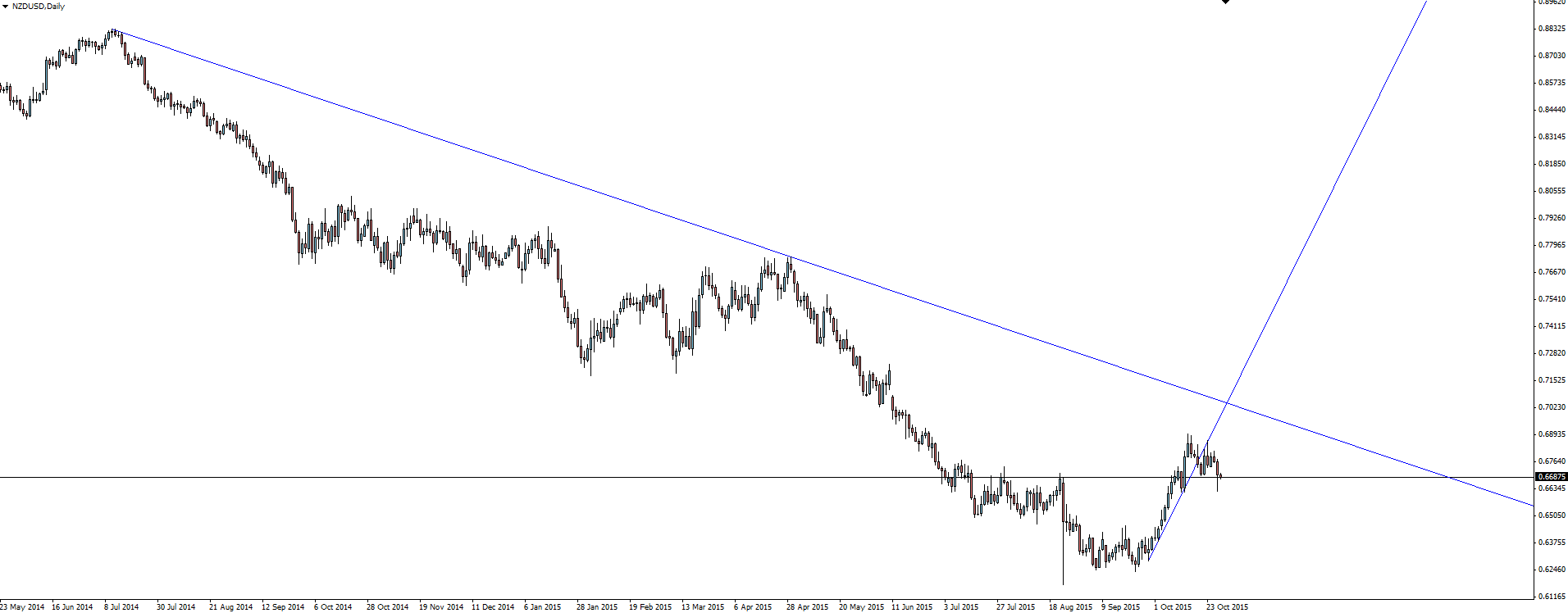

NZD/USD Daily:

Click on chart to see a larger view.

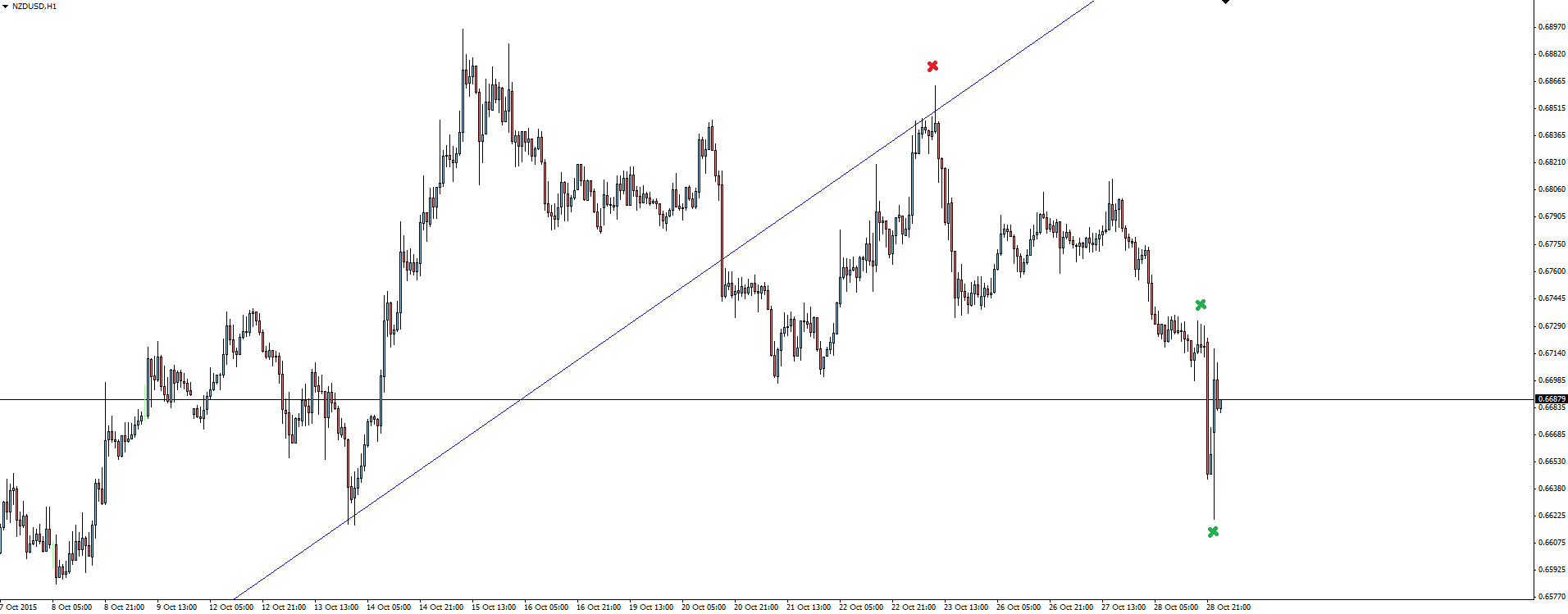

NZD/USD Hourly:

Click on chart to see a larger view.

I wanted to highlight the perfect short term trend line retest in the direction of the overall trend as well as the most recent overnight price action giving us the up and down chop on both USD and NZD sensitive news.

Going with the overall trend and consistent narrative out of the RBNZ, it would be safer to continue to short into rallies from here. I can even hear Wheeler thanking the Fed for their work from across the Tasman!

———

On the Calendar Thursday:

NZD Official Cash Rate (On hold at 2.75% as expected)

NZD RBNZ Rate Statement

USD Advance GDP q/q

USD Unemployment Claims

———-

Chart of the Day:

A post FOMC look at one of the most highly sensitive pairs and how to go about playing it from here.

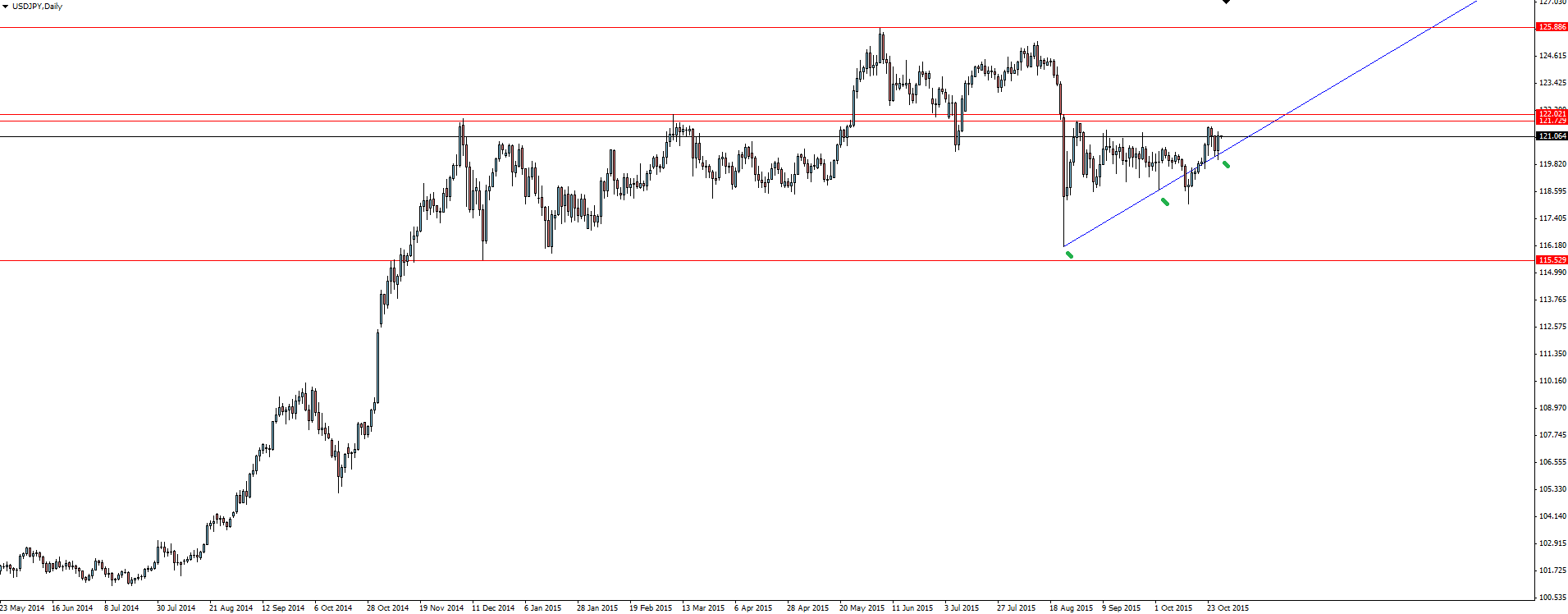

USD/JPY Daily:

Click on chart to see a larger view.

Every man and his dog has been watching this USD/JPY daily range for weeks. Possible triangle after possible triangle has failed to sustain any breakout pressure. On this blog we’ve discussed fading the edges of the range being the safer option than playing for the sustained breakout in either direction and that strategy has been holding us in good stead.

The range has continued on with trend line support changing and dropping in gradient as price moves. This means that the price action and studies printed here are shown very much in hindsight, but at the same time could offer some risk management guidance heading forward.

Even with the FOMC candle, it’s the 122 handle that’s the key level for me. Do you really think December is actually in play after the slew of rubbish numbers that the US has printed over the last couple of months? This morning’s statement is nothing but another chop and change from a Fed who doesn’t know how to manage its PR.

The edges of the range are still in play and fading them is still the safer option.

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Australian Forex broker Vantage FX Pty Ltd, does not contain a record of our prices, or an offer of, or solicitation for, a transaction in any financial instrument. The research contained in this report should not be construed as a solicitation to trade. All opinions, Forex News Centre, research, analysis, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently any person opening a trading account and acting on it does so entirely at their own risk. The experts writers express their personal opinions and will not assume any responsibility whatsoever for the actions of the reader. We always aim for maximum accuracy and timeliness and Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.

Related Articles

Recent headlines appear to have shaken investor sentiment. It’s premature to read too much into a few days of weaker-than-expected survey numbers. More importantly, the latest...

The stock market sold off on a decline in February's Consumer Confidence Index (CCI), confirming a similar decline in February's Consumer Sentiment Index (CSI), which was reported...

The EU’s most costly budgets, bitcoin’s market swings, and rising US bankruptcies. Each week, the Syz investment team takes you through the last seven days in seven charts. 1. The...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.