- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

ECB Preview: Draghi’s Big Problem

By Kathy Lien, Managing Director of FX Strategy for BK Asset Management.

Before we preview Thursday’s European Central Bank monetary policy meeting, it's important to talk about what affected Wednesday's U.S. dollar. U.S. Treasury Secretary Steven Mnuchin outlined the president’s tax-reform plan and investors were disappointed. There was nothing new in Wednesday’s announcement and more importantly, the market was not convinced that the tax cuts would “pay for themselves in growth, reduction in deduction and closing loopholes” as Mnuchin indicated. Trump’s goal is to lower the corporate tax rate to 15% from 35% and reduce individual income tax brackets to 3% from 7% with the highest tax rate at 35%. That top rate is slightly higher than the levels previously floated, which ranged from 25% to 33%. Also, instead of offering details, “throughout the month of May, Trump’s team will work with the House and Senate to develop the details of the plan.” In other words, the big announcement surprised no one and was virtually the same as the one released last fall. Having rejected the 50-day SMA near 111.80, USD/JPY is struggling to hold onto its gains.

There were no major U.S. economic reports released Wednesday but according to Paul Ryan, Congress is getting closer to health-care reform, which is essential to tax reform. But for now, its number-one priority is avoiding a government shutdown. We would be surprised if there wasn’t a deal reached by Friday's midnight deadline. If lawmakers finalize a deal to keep the government running through September it would be more favorable for the U.S. dollar than another stop-gap funding measure. Yet according to Reuters, which quotes a House Republican source, we’ll probably get a one-week government funding bill.

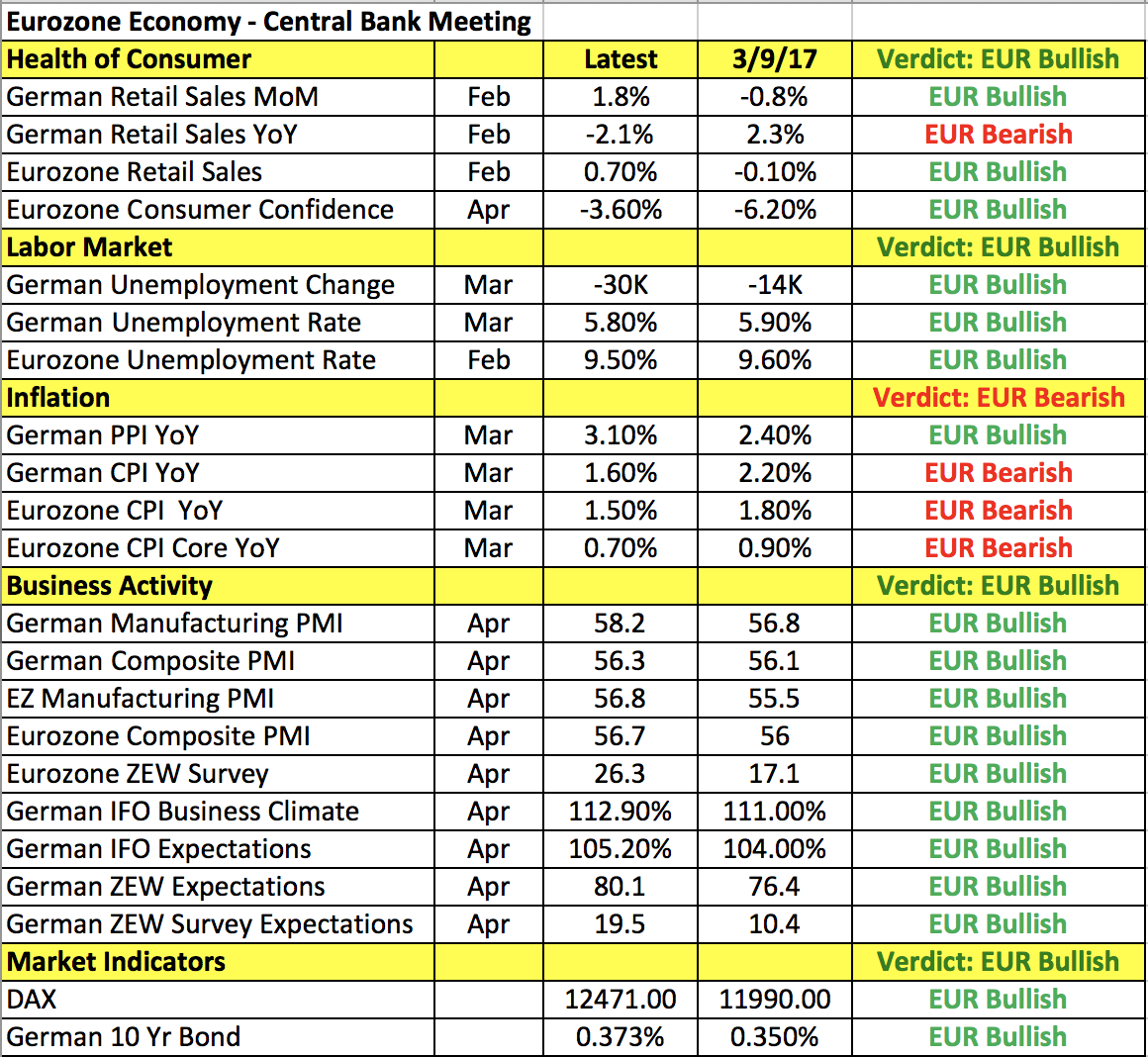

As the deadline approaches, the market’s focus will shift temporarily to the European Central Bank’s monetary policy announcement. Since the last policy meeting, we’ve seen widespread improvements in the Eurozone economy. The following table shows how consumer spending, labor-market conditions, manufacturing- and service-sector activity along with investor and business confidence increased in April. Unfortunately, the biggest problem for the central bank isn’t growth but inflation. Price pressures have been easing and the rising euro makes it even more difficult for the central bank to achieve its inflation target. Mario Draghi won’t be happy that the market interpreted his last monetary policy announcement as less dovish and went out of his way to say last week that there’s no confidence that inflation pick-up is durable and as such “a very substantial degree of monetary accommodation is still needed.” FX traders are holding out hope that Draghi will downplay inflation, focus on growth and suggest that rates could start rising soon. Although Draghi could recognize the improvements in the economy, we don't think he'll put a rate hike on the table.

All three of Wednesday's commodity currencies traded lower against the greenback despite steady commodity prices. Although a decline in retail sales prevented the Canadian dollar from rallying, reports from Politico that the U.S. is moving to exit NAFTA with an announcement later this or early next week was the primary reason for the currency’s weakness. Canada and Mexico will be hit hard by a U.S. departure and even if Canada manages to negotiate a new trade deal, the near-term uncertainty could weigh on the currency. The Australian dollar was hit by softer-than-expected consumer price growth. Inflation increased 0.5% in the first quarter, lifting the year-over-year rate to 2.1% from 1.5%, which was just under the market’s 2.2% forecast. Credit card spending in New Zealand rose but NZD fell in sympathy with AUD.

Related Articles

This week's FX price action has been dominated by two stories: the re-rating of the euro (EUR/USD) on the back of looser fiscal and tighter monetary policy expectations and the...

The US Dollar Index rallied sharply into inauguration day. Since then, it’s been very weak. Could things get worse for King Dollar? Today, we share a “weekly” chart highlighting a...

EUR/USD is trading at 1.08 following gargantuan moves in European yields. At the current level, the pair is only 1.2% overvalued in our calculation, and we’d be cautious to pick a...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.