- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Draghi Stokes Easing Expectations; Australia Employment Soars

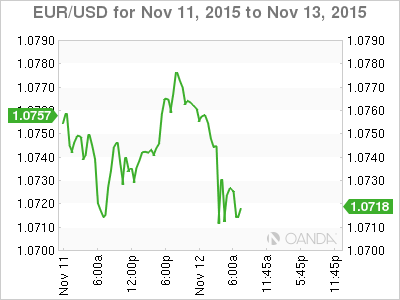

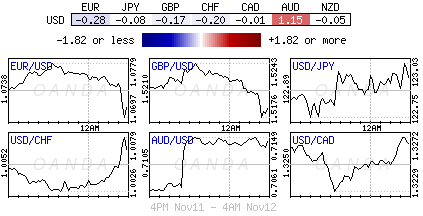

Despite the EUR being confined to a tight trading range since last Friday’s upbeat non-farm payroll (NFP) report (€1.0681-1.0790), today’s well-timed dovish rhetoric delivered by Draghi is keeping capital markets on its toes. However, he is not the only one, later this morning no fewer than five Fed speakers are due to hit the wires (Bullard, Yellen, Lacker, Evans, Dudley and Fischer) and anyone not sticking to the ‘script’ could make market moves rather interesting. All FOMC speakers are expected to tout the prospect of a December rate liftoff.

Draghi keeps door ajar: The EUR again has backed away from its highly publicized resistance level, just shy of the psychological €1.08 handle, helped by Draghi’s prepared testimony to the European parliament this morning. None of his rhetoric was new, but it is providing further hints that the ECB’s December’s meet could well see an expansion of the ECB’s QE program. Fixed income dealers certainly believe so as they are aggressively repricing short-dated debt. German two-year Schatz has managed to print a fresh low (-0.37%) this morning, pressured further by a mix of eurozone growth (IP -0.3%) and inflation data. With inflation running well below the ECB’s desired target level has markets pricing in an expansion to the ECB’s QE program (currently €60b per month) and possibly a -10 to -15bp cut in the ECB’s deposit rate (currently -0.20%).

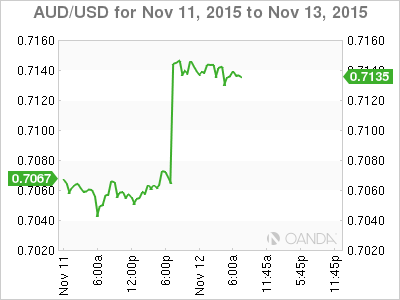

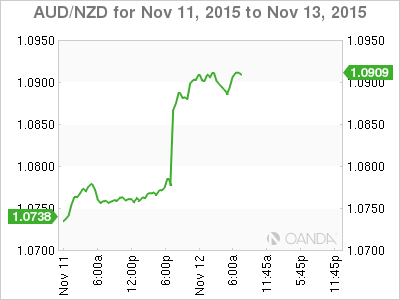

Australia employment soars, sending AUD and bond rates higher: The Aussie labor market has made some massive strides of late, surprising everyone, and certainly diminishes the possibility of further rate cuts from the Reserve Bank of Australia (RBA) any time soon (the bearish of forecasters were calling for two rate cuts in 2016). Last night’s Aussie employment change of +58.6K new jobs was the biggest in the past 42-months, while unemployment matched the lowest level in nearly two-years (+5.9% vs. +6.2%). Even the participation rate was not sacrificed by the net gains, rising to +65.0%. It’s worth mentioning that Aussie employment data has certainly come under some scrutiny in recent times. There is a pattern that the last few episodes of monthly falls have been followed by some very large gains, so one report does not a trend make. Do not be surprised to see a large revision being reported next time about. Nevertheless, the closely tracked “Hours Worked” component also saw the biggest increase in nearly a year. Not a surprise, the AUD has spiked, trading comfortably with a new handle higher (A$0.7150), while short term debt yields have backed up (3’s +5bps to +2.15%) to a five-month high as traders repriced the odds of an RBA cut in Q1/2016 (currently +20% probability for H1).

Risks highlighted down under: In the Reserve Bank of New Zealand (RBNZ) semi-annual financial stability report the bank saw a rise in the risks to their financial system, particularly in the property space where policy makers see the potential for a “damaging” correction. The bank also noted there was an increased risk in the dairy sector given the rising indebtedness of farms, but added that “credit losses on dairy exposure were manageable” thanks to low-rate loans, granted to farmers by Fonterra. Naturally, the market was looking for hints about a change in monetary policy. Governor Wheeler commented on the report, but deflected any comments on monetary policy to the next decision on December 9. The central bank did not adjust interest rates in October, leaving the benchmark rate at +2.75% (N$0.6549). The barriers to lower kiwi rates seem to be getting higher. FI continues to price in a small probability of the OCR being cut below +2.50% by mid of next year.

BoK on hold, while CBR could move: Overnight as expected, Bank of Korea held rates unchanged at +1.5% for the fifth consecutive month. Officials did note that economic sentiment have somewhat improved, but also warned about the risks around a possible U.S rate liftoff next month and of course the fallout of a China economic slowdown. The decision was unanimous. In Russia, consumer inflation ran at +0.2% for the fifth consecutive week, but more importantly, annual inflation seems to be slowing down (+15.4% vs. +15.6%). Assuming there is no inflation shocks on the horizon, there is a strong possibility that the Central Bank of Russia (CBR) could resume their easing cycle as early as next month’s meeting (December 11). The current OCR rate is now at +11%.

Related Articles

The BOJ’s policy shift continues to strengthen the yen, keeping USD/JPY under pressure. Rising Japanese bond yields signal further tightening ahead, reinforcing the bearish...

Today marks a further large step into Donald Trump's America First Agenda. Substantial tariffs are being imposed on Canada and Mexico. Additional tariffs have gone in on China....

As markets assess the implications of the Zelenskyy-Trump clash on Friday, the focus today is whether US tariffs on Mexico and Canada will go ahead. The FX market is not pricing...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.