- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Aussie Slides As RBA Surprises With Rate Cut

The Australian dollar has dropped 80 points on Tuesday, reversing the upward trend which marked the Monday session. AUD/USD is trading at 0.7580 in the European session. In economic news, the RBA surprised the markets with a rate cut, lowering the benchmark rate from 2.00% to 1.75%. Australian Building Approvals posted a sharp gain of 3.7%, easily beating expectations. There are no key events in the US on Tuesday.

Wednesday is data-heavy, which could lead to further volatility from AUD/USD. The US will release ADP Nonfarm Employment Change and the ISM Non-Manufacturing PMI. Australia will publish Retail Sales and Trade Balance.

The RBA surprised the markets on Tuesday, cutting interest rates by a quarter point to a record low of 1.75%. In recent months, the central bank had consistently sent out the message that it would not hesitate to lower rates if warranted by economic conditions, but had been shy to act. Until last week, the markets were expecting the RBA to remain on the sidelines, but a decline of -0.2% in first quarter CPI proved to be a game-changer and prodded the RBA to make a dramatic move.

Negative inflation numbers, part of the economic landscape of the US, Japanese and Eurozone economies, has reached Australia as well, and RBA Governor Glenn Stevens stated that the RBA was forced to react to soft inflation numbers. As well, the central bank has often expressed its concern about the high value of the Australian dollar, which rose as much as 15 percent since mid-January. A rate cut presented the RBA with the added benefit of weakening the currency. The Aussie dropped 140 points immediately after the RBA move, but recovered some of these losses later on Monday.

On Monday, US ISM Manufacturing PMI, a key gauge of manufacturing output, missed expectations. The index dipped to 50.8 points, shy of the estimate of 51.6 points. This reading just above the 50-point line points to near stagnation in the manufacturing sector. Last week, Core Durable Goods dropped 0.2%, well off the estimate of a 0.6% gain. This marked the fourth decline in five months. Durable Goods Orders was stronger at 0.8%, but also missed expectations, as the estimate stood at 1.9%.

Also on Monday, Final Manufacturing PMI and Construction Prices also missed expectations, but ISM Manufacturing Prices easily beat the forecast. Manufacturing remains a sore spot, as the sector continues to lag behind the economy’s generally solid performance, as the global demand for US products has taken its toll.

The first quarter of 2016 has been marked by shaky global markets and a sharp drop in oil prices, so slower growth for the US economy was not unexpected. GDP climbed 0.5% in the first quarter, shy of the estimate of 0.7%. This was considerably lower than the 1.4% gain in the fourth quarter of 2015, and marked the weakest quarter of growth in two years. Although economic growth remains moderate, the lukewarm reading will not help the cause of Fed policymakers who favor a rate hike, especially with inflation at low levels.

The markets, which were not expecting an April hike, are keeping a close eye on key numbers, looking for clues as to whether the Fed will make a move at its June policy meeting. The April policy statement sounded cautiously optimistic about the US economy, but did not provide any clues about a hike in June.

AUD/USD Fundamentals

Monday (May 2)

- 21:30 Australian Building Approvals. Estimate -1.8%. Actual 3.7%

Tuesday (May 3)

- 00:30 RBA Cash Rate. Estimate 2.00%. Actual 1.75%

- 00:30 RBA Rate Statement

- 5:30 Australian Annual Budget Release

Upcoming Key Events

Wednesday (May 4)

- 8:15 US ADP Nonfarm Employment Change. Estimate 205K

- 10:00 US ISM Non-Manufacturing PMI. Estimate 54.9

- 21:30 Australian Retail Sales. Estimate 0.3%

- 21:3o Australian Trade Balance. Estimate -2.95B

*All release times are EDT

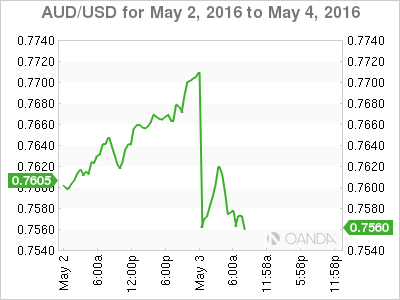

AUD/USD for Tuesday, May 3, 2016

AUD/USD May 3 at 5:40 EDT

Open: 0.7622 Low: 0.7554 High: 0.7718 Close: 0.7581

AUD/USD Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 0.7339 | 0.7472 | 0.7560 | 0.7678 | 0.7796 | 0.7913 |

- AUD/USD posted sharp gains in the Asian session and has been choppy in European trade

- 0.7560 was tested earlier in support and could break during the day

- 0.7678 has strengthened in resistance

- Current range: 0.7560 to 0.7678

Further levels in both directions:

- Below: 0.7560, 0.7472 and 0.7339

- Above: 0.7678, 0.7796, 0.7913 and 0.8054

OANDA’s Open Positions Ratio

AUD/USD ratio has shown slight movement towards short positions on Tuesday. Long and short positions are close to an even split, indicative of a lack of trader bias as to what direction AUD/USD will take next.

Related Articles

The BOJ’s policy shift continues to strengthen the yen, keeping USD/JPY under pressure. Rising Japanese bond yields signal further tightening ahead, reinforcing the bearish...

Today marks a further large step into Donald Trump's America First Agenda. Substantial tariffs are being imposed on Canada and Mexico. Additional tariffs have gone in on China....

As markets assess the implications of the Zelenskyy-Trump clash on Friday, the focus today is whether US tariffs on Mexico and Canada will go ahead. The FX market is not pricing...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.