- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Aussie Dollar Leads, Benefitting From Commodity Bounce

The start of the week stuttered yesterday with an uneventful economic calendar leading to sideways chop as the majors consolidated at their highs. Nobody likes Mondays so how about we join forex markets and just skip through that one? The preview of central bank action throughout Asia in yesterday’s Daily Market Update stays relevant so definitely give that blog a read if you missed it.

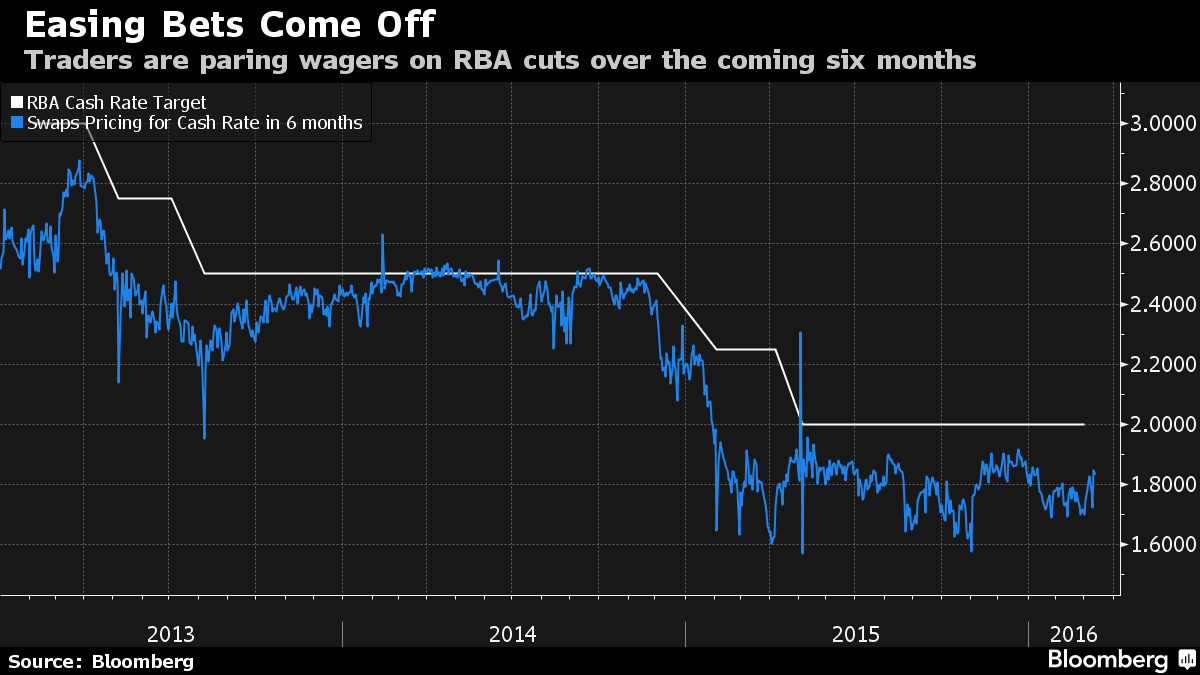

With Monetary Policy Meeting Minutes out of Australia first up, this Bloomberg article and subsequent charts caught my eye. The Aussie dollar really has been the best performer over the past month or so, bucking the trend with moderately good economic data reflecting positively on the domestic economy, but most of all benefiting from commodity prices bouncing off lows and easing in Europe and NZ meaning money is flowing into Australian assets in search of yield.

“The swaps market is pricing in just 13 basis points of interest-rate reductions in the coming six months. That compares with 28 basis points as recently as March 9.”

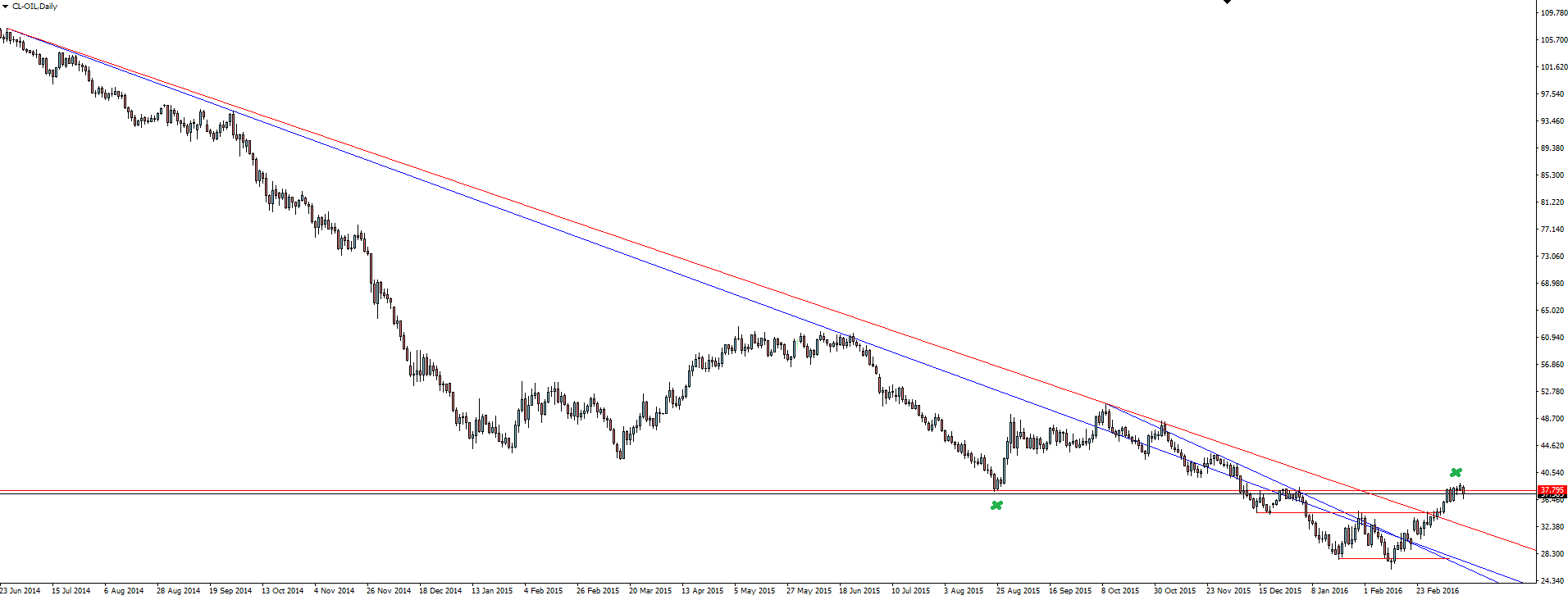

Speaking of commodity prices bouncing off lows, no chart reflects this better than the oil daily:

Oil Daily:

But in saying that, price is still capped by resistance from the most obvious swing low (former support now acting as resistance). I really don’t mean to sound like a perma-bear when it comes to oil, I swear… But that level is hard to miss when you bring up a chart. Just saying.

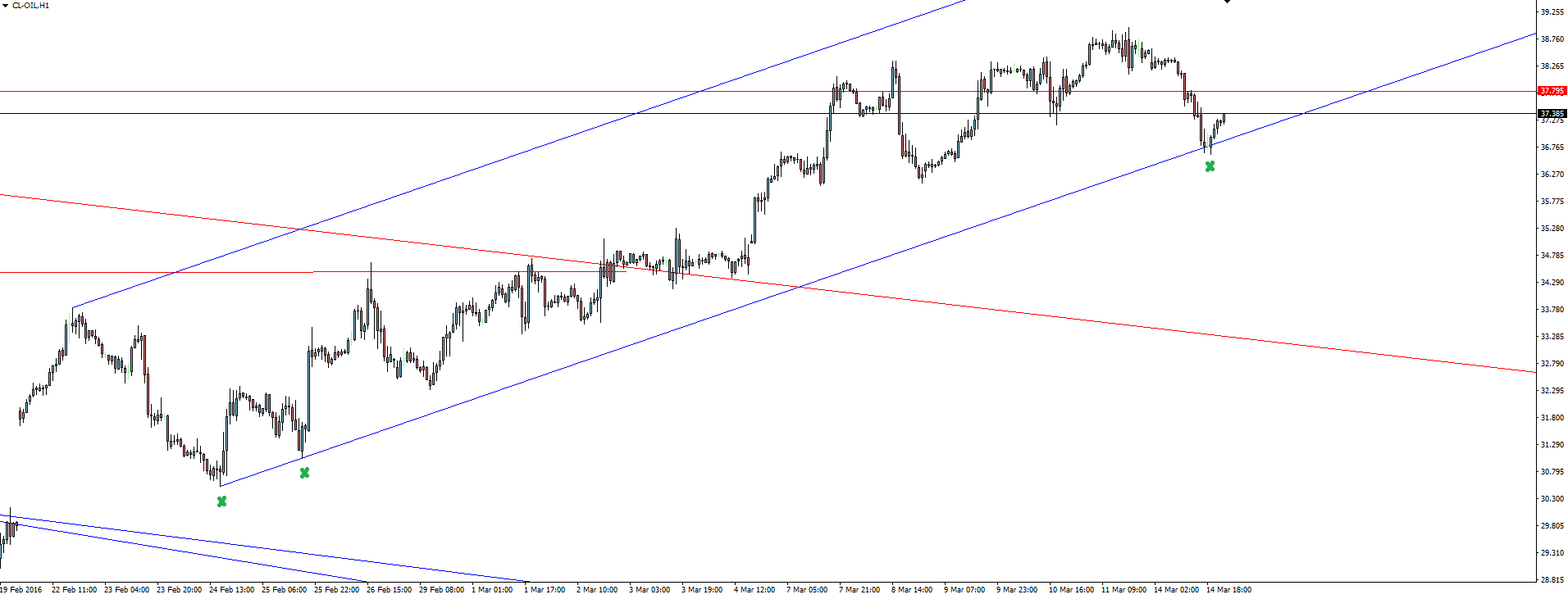

Oil Hourly:

Zooming into the hourly and you can see that price is in a short term bullish channel. With price just bouncing off support here, if you are bullish commodities such as oil then this is your level to manage your risk around to play from the long side. There, see!

Chart of the Day:

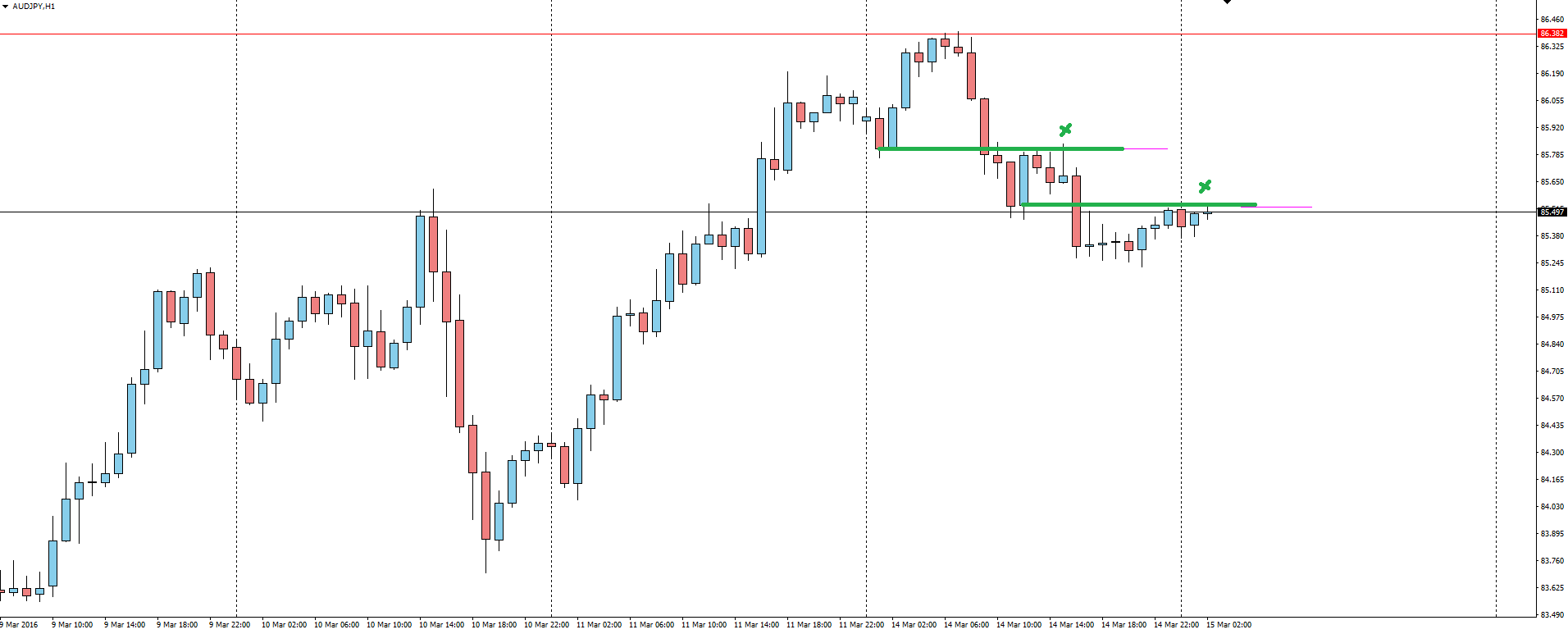

With the topical AUD/USD and USD/JPY charts used in yesterday’s Central Banks’ Right of Reply blog, we have to move to the crosses today to find our key levels.

In the technical context of the above commodity prices, taking a contrarian view on the Aussie up here wouldn’t be a terrible play.

AUD/JPY Weekly:

The AUD/JPY weekly highlights the key resistance level that price has pushed into on the higher time frame chart.

AUD/JPY Hourly:

Zoom into the hourly chart and I’ve highlighted a few places that price is giving you a chance to manage your risk around.

REMEMBER RBA MONETARY POLICY MEETING MINUTES THIS MORNING.

On the Calendar Tuesday:

NZD RBNZ Gov Wheeler Speaks

AUD Monetary Policy Meeting Minutes

JPY Monetary Policy Statement

JPY BOJ Press Conference

USD Core Retail Sales m/m

USD PPI m/m

USD Retail Sales m/m

NZD GDT Price Index

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Forex broker Vantage FX Pty Ltd does not contain a record of our ECN Forex prices or solicitation to trade. All opinions, news, research, prices or other information is provided as general news and marketing communication – not as investment advice. Consequently any person acting on it does so entirely at their own risk. The experts writers express their personal opinions and will not assume any responsibility whatsoever for the actions of the reader. We always aim for maximum accuracy and timeliness, and Vantage FX on the MT4 platform, shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.

Related Articles

Recent headlines appear to have shaken investor sentiment. It’s premature to read too much into a few days of weaker-than-expected survey numbers. More importantly, the latest...

The stock market sold off on a decline in February's Consumer Confidence Index (CCI), confirming a similar decline in February's Consumer Sentiment Index (CSI), which was reported...

The EU’s most costly budgets, bitcoin’s market swings, and rising US bankruptcies. Each week, the Syz investment team takes you through the last seven days in seven charts. 1. The...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.