- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Global ETF Survey 2023 : Results and Insights

Earlier this year, we requested support from you, the readers at Investing.com, to gather your insights for a survey related to ETFs.

In addition to generating valuable insights around the ETF investment landscape, the initiative by Trackinsight, in partnership with J.P. Morgan Asset Management, State Street (NYSE:STT), and Investing.com, helped raise funds for the victims of the earthquake in Turkey.

With your support, we were able to raise approximately US$5,500 to donate to this initiative.

We would like to take the time to thank you for your input, and share some of the key insights gathered.

The survey provides a comprehensive overview of the current usage of ETFs and insights

into how the industry is expected to evolve in the coming years. Here are highlights drawn

from the data:

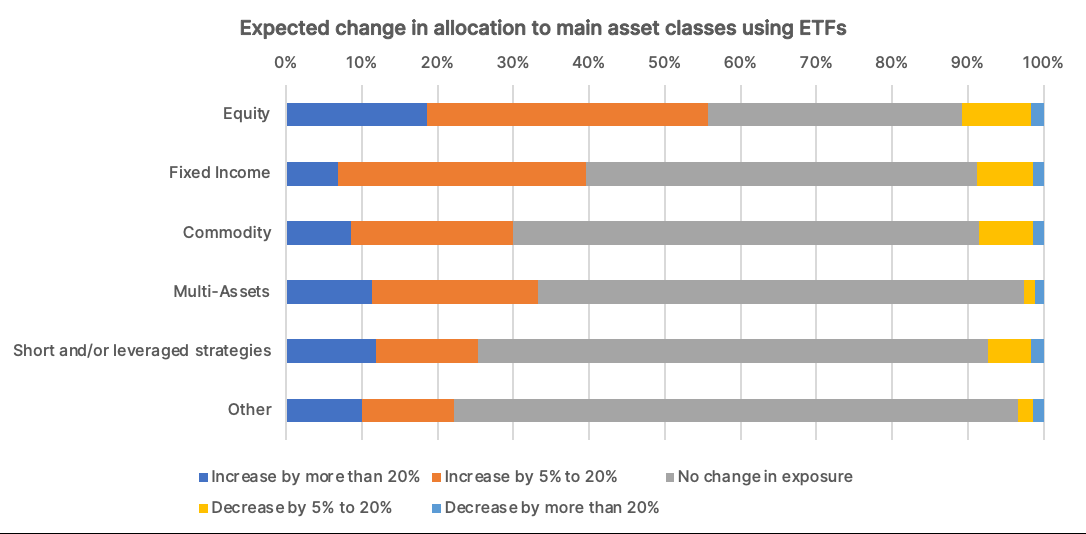

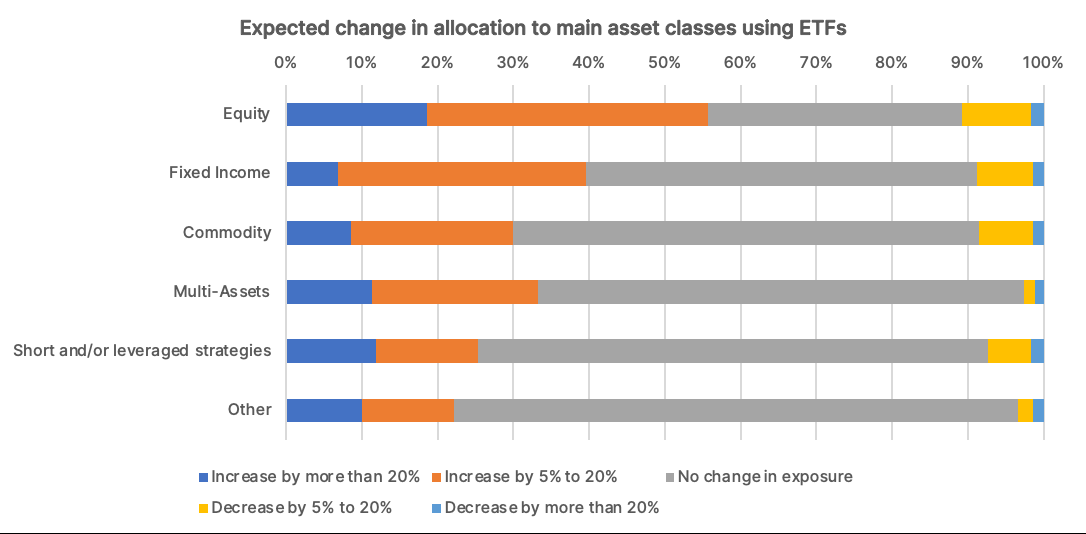

● Investors’ interest in ETFs remains high, with 56% of respondents planning to

increase their exposure to Equity ETFs and 40% to Fixed Income in the next 2 to 3

years.

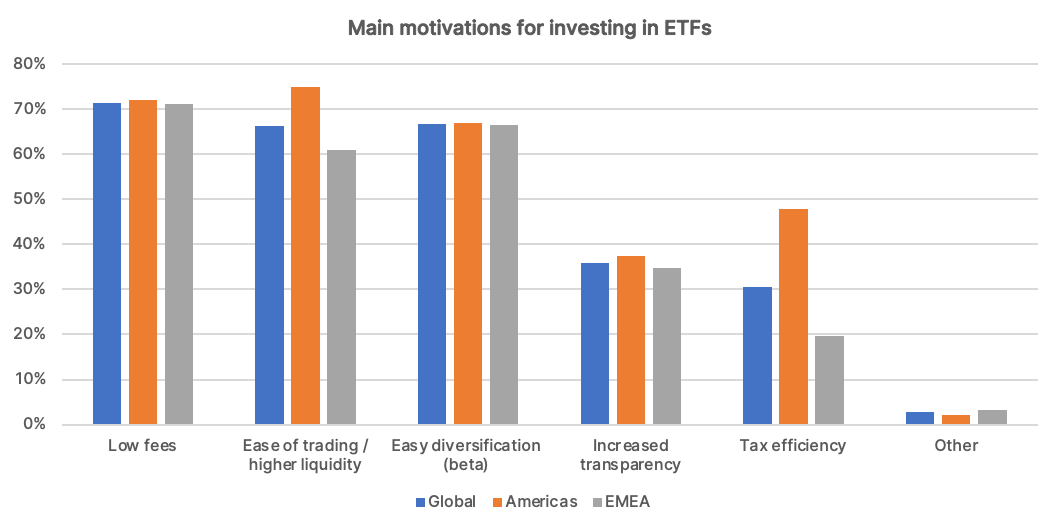

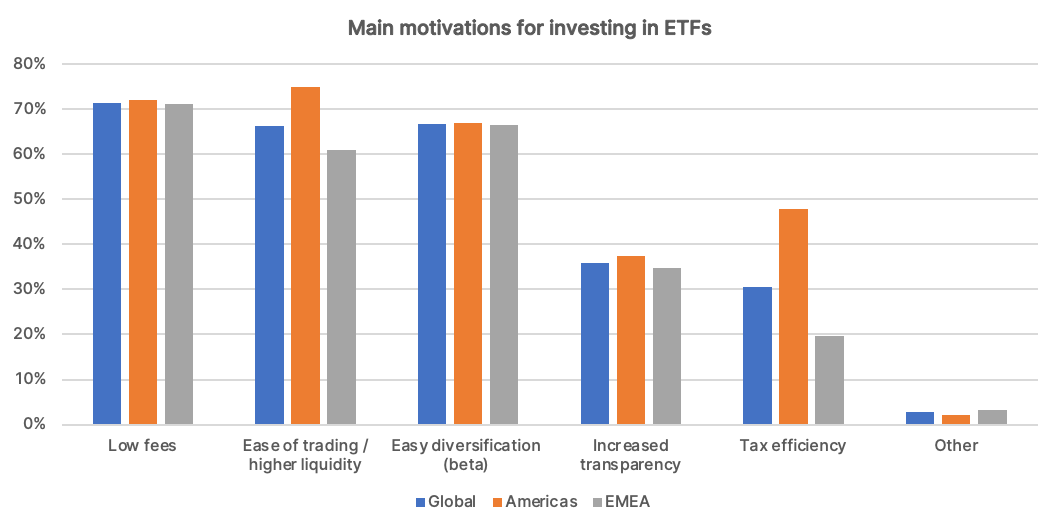

● ETFs have gained popularity among investors because they offer attractive features

like low fees, easy diversification, and accessibility. Tax efficiency also plays an

important role in ETF popularity in the Americas.

● Active strategies continue to build pace globally. The percentage of respondents

having between 6% and 40% of their portfolio invested in actively managed ETFs is

higher than ever.

● Investors are ready for Active ETFs, especially in the Americas, where they also use

these products for Fixed Income and Thematic investing, while interest is mainly on

equity in Europe. Nearly 80% of respondents in the Americas stated they would be

more inclined to invest in an active strategy if packaged as an ETF rather than a

mutual fund.

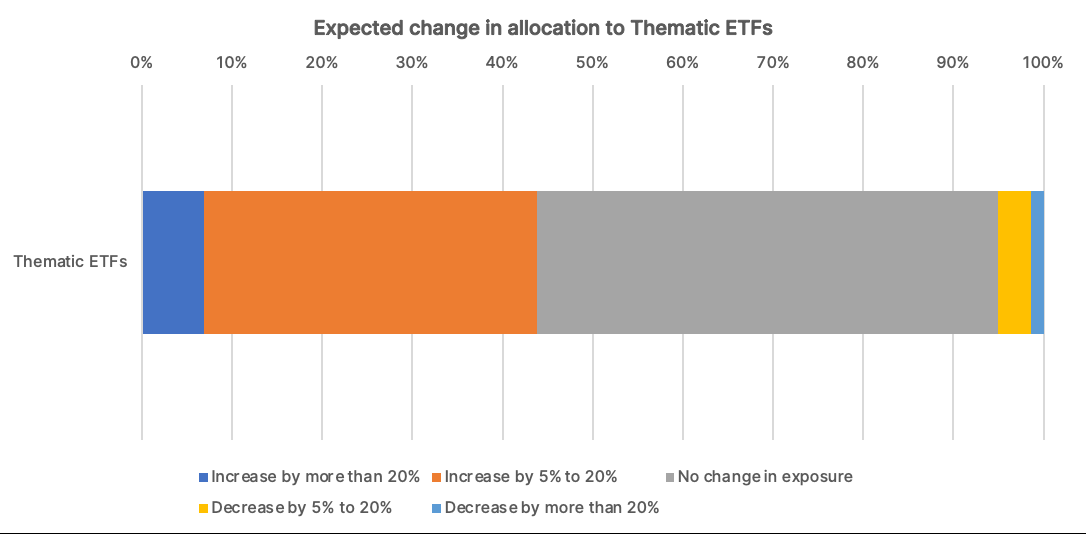

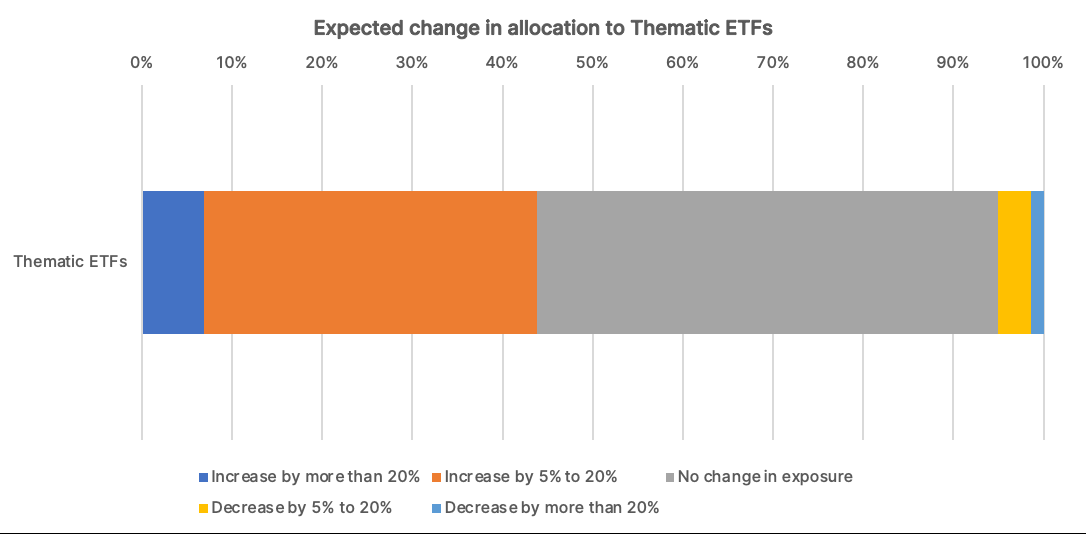

● Thematic investing strategies are all the rage, with 40% of respondents anticipating

an increase in their allocation over the next few years, mainly for diversification and

long-term strategies.

● ESG investing faces greenwashing concerns, and investors expect increased

transparency; 60% of respondents have cited the inconsistencies of ESG analytical

grids and guidelines as the main hurdle to investment.

● Investors look for Crypto solutions (single and multi-cryptocurrencies strategies)

wrapped into ETPs as an easy way to access this market and get rid of wallet

management issues.

The full report, available for free on etfcentral.com, details the key findings and ETF trends from over 500 professional investors who manage almost $900 billion of assets through ETFs.

Earlier this year, we requested support from you, the readers at Investing.com, to gather your insights for a survey related to ETFs.

In addition to generating valuable insights around the ETF investment landscape, the initiative by Trackinsight, in partnership with J.P. Morgan Asset Management, State Street (NYSE:STT), and Investing.com, helped raise funds for the victims of the earthquake in Turkey.

With your support, we were able to raise approximately US$5,500 to donate to this initiative.

We would like to take the time to thank you for your input, and share some of the key insights gathered.

The survey provides a comprehensive overview of the current usage of ETFs and insights

into how the industry is expected to evolve in the coming years. Here are highlights drawn

from the data:

● Investors’ interest in ETFs remains high, with 56% of respondents planning to

increase their exposure to Equity ETFs and 40% to Fixed Income in the next 2 to 3

years.

● ETFs have gained popularity among investors because they offer attractive features

like low fees, easy diversification, and accessibility. Tax efficiency also plays an

important role in ETF popularity in the Americas.

● Active strategies continue to build pace globally. The percentage of respondents

having between 6% and 40% of their portfolio invested in actively managed ETFs is

higher than ever.

● Investors are ready for Active ETFs, especially in the Americas, where they also use

these products for Fixed Income and Thematic investing, while interest is mainly on

equity in Europe. Nearly 80% of respondents in the Americas stated they would be

more inclined to invest in an active strategy if packaged as an ETF rather than a

mutual fund.

● Thematic investing strategies are all the rage, with 40% of respondents anticipating

an increase in their allocation over the next few years, mainly for diversification and

long-term strategies.

● ESG investing faces greenwashing concerns, and investors expect increased

transparency; 60% of respondents have cited the inconsistencies of ESG analytical

grids and guidelines as the main hurdle to investment.

● Investors look for Crypto solutions (single and multi-cryptocurrencies strategies)

wrapped into ETPs as an easy way to access this market and get rid of wallet

management issues.

The full report, available for free on etfcentral.com, details the key findings and ETF trends from over 500 professional investors who manage almost $900 billion of assets through ETFs.

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.