- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

The S&P 500 Reached 4800. Multi-Year Top?

First, we wish all our readers, old and new, a Happy New Year. Second, to those new to our work, we reviewed our forecasts since August in our last update of 2023, showing we anticipated most market moves correctly, albeit sometimes inevitably missing the finer nuance.

In that update, we noted that since the October 27 low at $4103, "no pullback exceeded -1.2%. Hence, the current rally is a significant outlier that is unforeseeable when it starts. However, therefore it smells of a 5th wave. Thus, our primary expectation is for the index to top out, as we forecasted it could almost two months ago, at $4750-4795."

However, the decline from the December 28, 2023, $4793 high is now the deepest and longest since that October low, strongly suggesting the rally has ended. Allow us to explain with Figure 1.

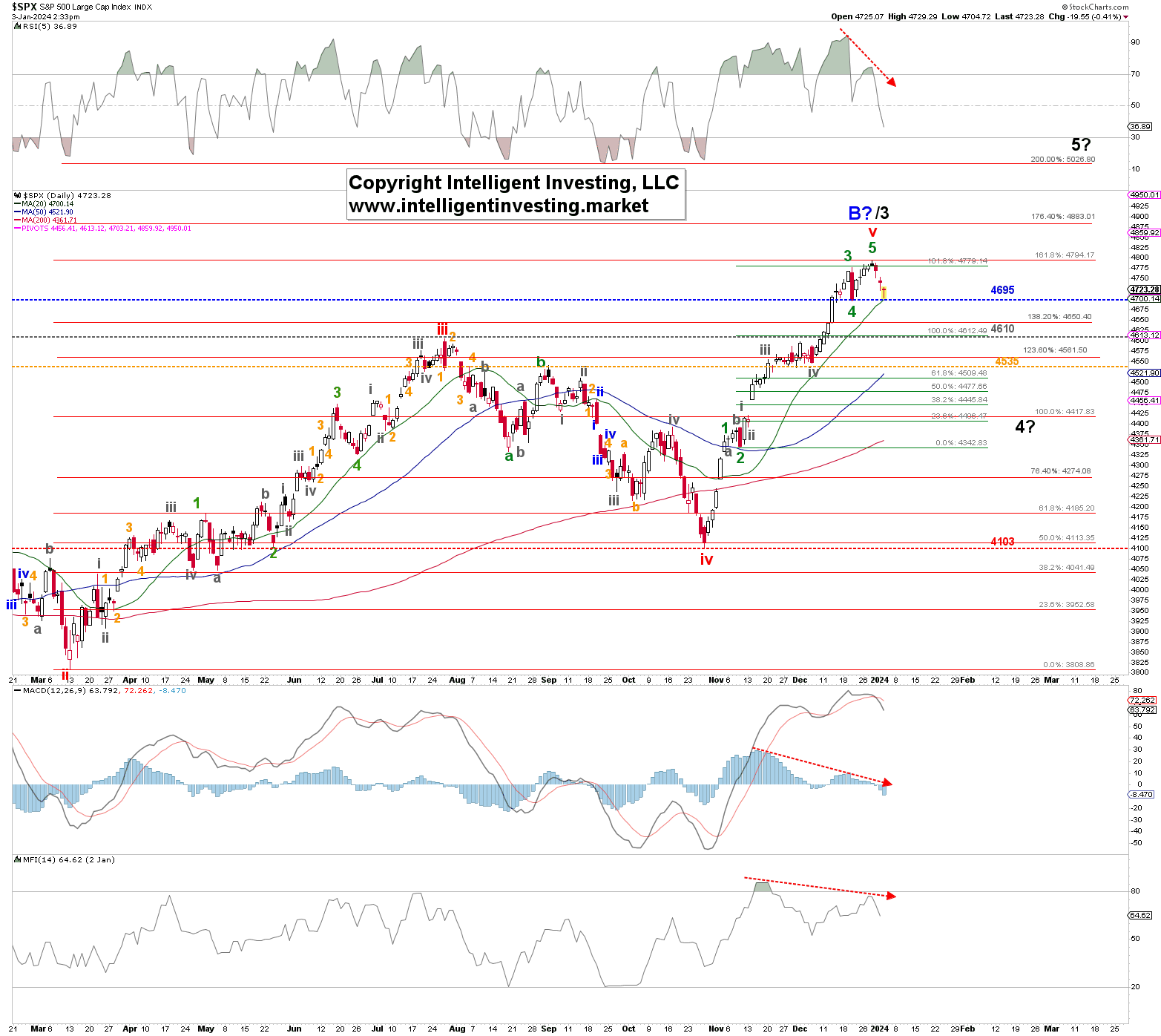

Figure 1. Daily SPX chart with detailed EWP count and technical indicators

Five waves up may have been completed.

In an Elliott Wave impulse pattern, we expect a correction to the downside to unfold after five completed waves. Five green waves were completed at the December 2023 high in this case. The first warning level for the Bulls to confirm this thesis is below the blue dotted line at last Wednesday's low: 4695. The 2nd warning is the grey level at $4610. At this stage, the Bears haven't even broken price below the blue level yet but have broken below the equivalent level on the NAS, NDX, and SOX, telling us these indexes are already further along with confirming their "the top is in."

Now the question is: what kind of top? We already discussed this in our December update, but let's recap. Figure 1 shows the blue Wave-B (W-B) and black W-3 labels. The former suggests the index has completed its counter-trend rally from the October 2022 low as a regular B-wave and is now ready to embark on a devasting C-wave to $2700-3500. However, it will ultimately require a break below the red warning level, October 2023 low at $4103, with a severe warning below the orange 3rd warning level at $4535, to tell us this potential is the case.

The latter suggests the index has "only" completed the black (major) W-3, is now in black W-4 back down to ideally $4417+/-144 before the black W-5 to ideally $4883-5026 kicks in. From there, we can then anticipate the more significant decline. It requires a break below $4535 while staying above $4103 to allow this potential.

Our alternative scenario is in Figure 2 below.

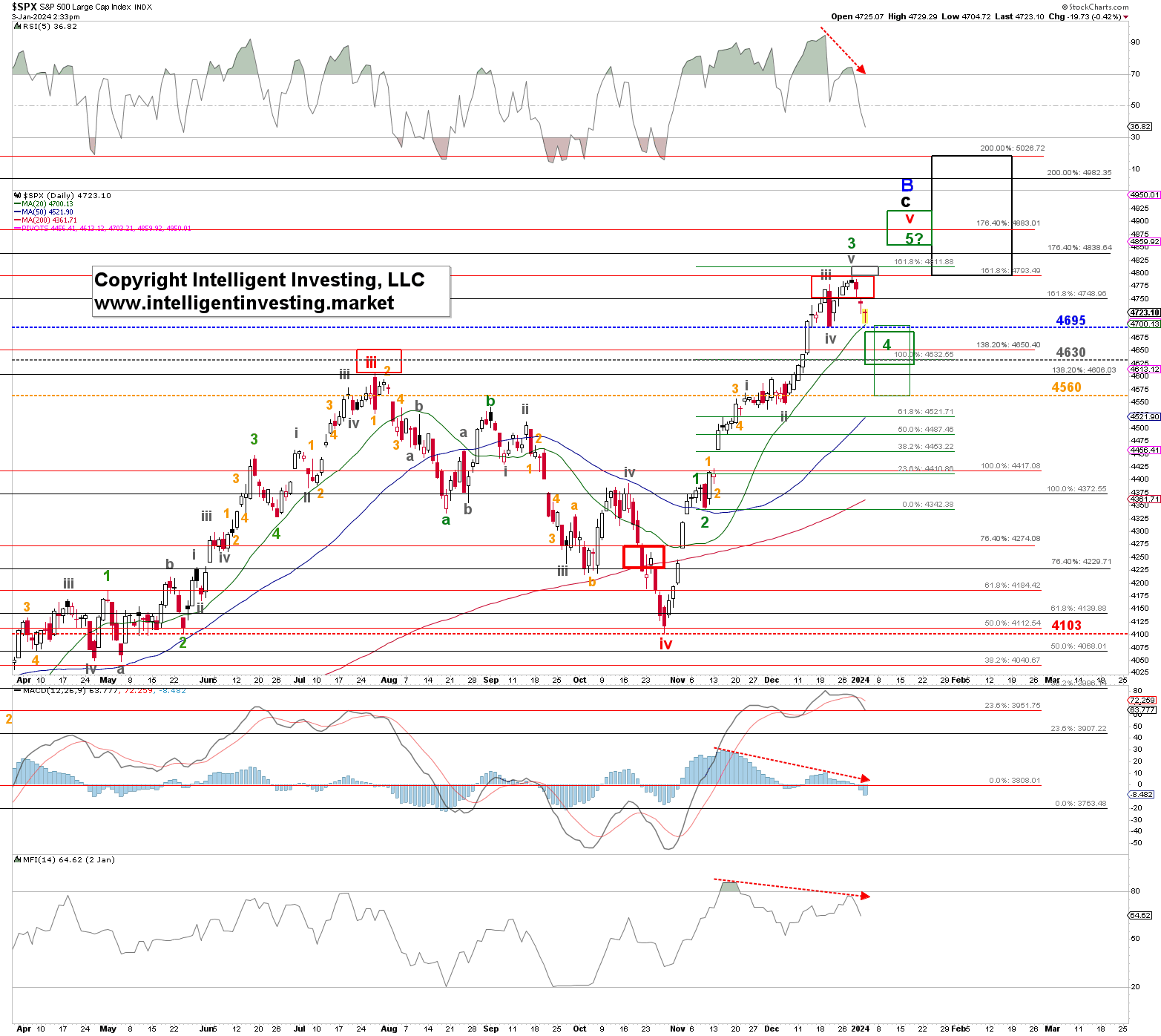

Figure 2. Daily SPX chart with detailed EWP count and technical indicators

Namely, as stated in our last update, "Since the October 27, 2023, low, the price pattern is truly out of the ordinary for stock markets, which renders the smaller wave structures less clear." We can, therefore, interpret the current decline as a potential green W-4 to ideally $4650+/-20, followed by another green W-5 to ideally $4483+/-20. This option will be invalidated below $4560 as the decline will then be too large to reliably assess it as a smaller degree (minor) 4th wave.

Thus, our primary expectation "for the index to top out, as we forecasted it could almost two months ago, at $4750-4795" was correct. As such, and as stated in December, our primary expectations remain

- Either a long-term top (blue W-B) and set course for $2700-3500 or

- A drop to ideally around $4417+/-144 for the black W-4?, before a final rally to as high as $4983-5026 for the black W-5?.

- Our alternative is for a mild correction to around $4560+/-20, from where a rally to $4883-5026 can materialize.

Unfortunately, at this stage, we can't discern between A), B), or C). We always wish things to be more transparent, but we are not dealing with a linear environment. We are not prophets. Nobody is; we can never be certain and cannot tell you which way the market will go every day. Still, we certainly can provide the most likely scenarios and the parameters, i.e., price levels to look for, so you will know what to expect.

Thus, the final statement in our last update, when the index was trading 30p higher than now, remains relevant, "Hence, at this point, it would be appropriate to assess the short- to long-term risk/reward at current price levels, and the warning levels above can be used as one's insurance policy to prevent havoc on one's portfolio."

Related Articles

One chart shows the details of an important historical analog for gold stocks Through many years of frustration among gold bugs due to the failure of gold stock prices to leverage...

I know there is the smell of fear in the air when I see my readership double as we reach a point where weekly chart factors come into play. Up until last week, markets have...

STAT The current bull market has been extraordinary. As Bridgewater reports, “Out of any 15-year period to be invested in equities dating back to 1970, the one we’ve just lived...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.