- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Nike Earnings Preview: Will Restructuring Plan Finally Begin to Bear Fruit?

- Nike stock remains stuck in a downward trend.

- Recently, the global sportswear giant announced restructuring plans.

- Will the stock finally be able to break out post earnings today?

- InvestingPro summer sale is on. Check out our massive discounts on subscription plans!

Despite still producing one-third of the world's sportswear and nearly half of all sneakers, Nike (NYSE:NKE) shares have faced severe pressure over the last few quarters.

Factors such as a lack of innovation, rising competition, and macroeconomic hurdles have been weighing on margins, ultimately prompting the Beaverton, Oregon-based behemoth's management to undertake an extensive restructuring plan.

In this context, today's earnings release is pivotal in assessing whether these measures are effective, potentially allowing the stock to emerge from its prolonged consolidation period.

Let's take a look at the main factors investors should keep an eye on.

Nike's Plan for Resurgence

A key part of Nike's strategy includes revitalizing its relationships with retailers. After years of reducing retailer partnerships in favor of direct sales channels, Nike plans to return to its earlier model, abandoning unprofitable channels to cut costs by at least $2 billion annually.

According to the company, the benefits of these changes won't be fully realized until the second half of fiscal 2025. This makes the upcoming revenue, profit, and sales forecasts critical for investors. While long-term recovery plans dominate the narrative, Nike's upcoming quarterly earnings remain pivotal for short-term stock price movements.

The management plans to also leverage major events like the upcoming Olympic Games to boost advertising and promote innovative new products. Nike's involvement in the NBA and the European Championships, where it supplies jerseys for teams such as France, England, and Portugal, also supports its promotional efforts, albeit on a smaller scale.

As investors await the results, the market consensus will be closely watched to gauge Nike's immediate financial health and the potential success of its restructuring efforts.

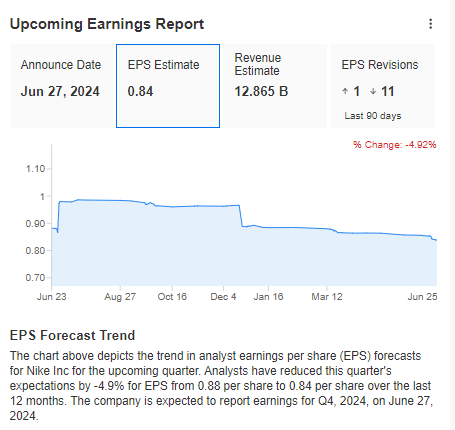

Source: InvestingPro

Following Nike's latest earnings release last quarter, a closer examination is necessary to understand the market's reaction. While the company reported net profits and revenues exceeding analyst expectations, the share price still took a tumble. This highlights the importance of analyzing earnings holistically, taking future forecasts into account.

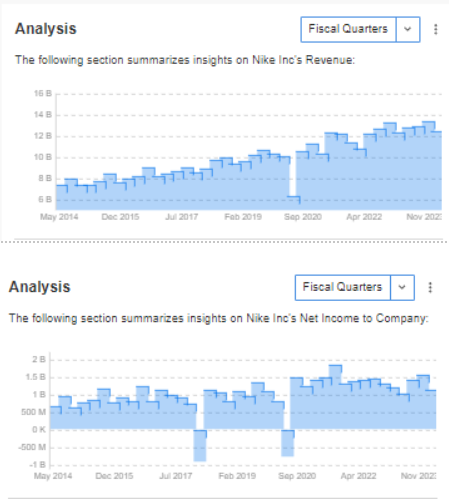

Despite the temporary dip in share price, Nike's financial health remains strong. The company boasts consistently rising revenues and consistently reported net income, demonstrating a solid foundation.

Source: InvestingPro

Technical View: Can Nike Earnings Spark a Breakout From Consolidation?

Nike's stock has been stuck in a consolidation pattern since March, trading sideways between $89 and $98 per share. This comes after an earlier downward trend. Investors are now looking to Nike's upcoming earnings report as a potential catalyst for a breakout.

Currently, there's clear buying pressure pushing the stock price toward the upper limit of the consolidation zone. If the company delivers better-than-expected quarterly results, it could provide the perfect push for an upside breakout.

If the bullish scenario is realized, the next target for buyers is the area around $105 per share, where the local resistance level lies. Conversely, a descent below $90 per share could open the way for an attack on last year's lows.

As investors await the results, the market consensus will be closely watched to gauge Nike's immediate financial health and the potential success of its restructuring efforts.

***

This summer, get exclusive discounts on our subscriptions, including annual plans for less than $7 a month!

Tired of watching the big players rake in profits while you're left on the sidelines?

InvestingPro's revolutionary AI tool, ProPicks, puts the power of Wall Street's secret weapon - AI-powered stock selection - at YOUR fingertips!

Don't miss this limited-time offer.

Subscribe to InvestingPro today and take your investing game to the next level!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.

Related Articles

Following the latest IM-2 mission news, Intuitive Machines Inc (NASDAQ:LUNR) stock is down 54% over the month. Presently holding at $8.95 per share, LUNR stock leveled down to an...

Using the Elliott Wave Principle (EWP), we have been tracking the most likely path forward for the Nasdaq 100 (NDX). Although there are many ways to navigate the markets and to...

There was some modest buying today from the open, but volume was light and markets are below trading range support established during the latter part of 2024. It's hard to see...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.