- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Natural Gas: Will Triple-Digit Injections Neutralize $3 Gas?

In an atypical mid-spring breakout, US natural gas hit the $3 sweet spot six times in May.

But weekly injections of gas into storage—the balance that gets stowed away after the portion burned for power generation and cooling—are nearing the key 100 bcf, or billion cubic feet, level.

That sparks the debate on how long the $3 per mmBtu, or million metric British thermal units, phenomenon will last.

As Houston-based gas markets consultancy Gelber & Associate said in a note to its clients on Wednesday:

“These rallies past $3 were inspired by multiple reasons, some of which include lower than expected storage injections as a result of stronger weather, stagnating production at 90 bcf daily, and slight demand pullbacks from liquefied natural gas exports prompted by spring maintenance.”

“Subsequent drops in price that followed these rallies were the result of intense fuel switching to coal … in response to overextended natural gas prices.”

Source: Gelber & Associates

In Wednesday’s trade, natural gas futures for July delivery on the New York Mercantile Exchange’s Henry Hub settled at $3.03 per mmBtu, rising 6 cents, or 2% on the day.

The balance of Henry Hub strip for summer through March 2022, or spring next year, also settled above $3.

Those settlements came ahead of the Energy Information Administration’s weekly storage report on natural gas, due at 10:30 AM ET (14:30 GMT) today, that forecast an injection nearer to seasonal norm after weeks of abnormally low builds.

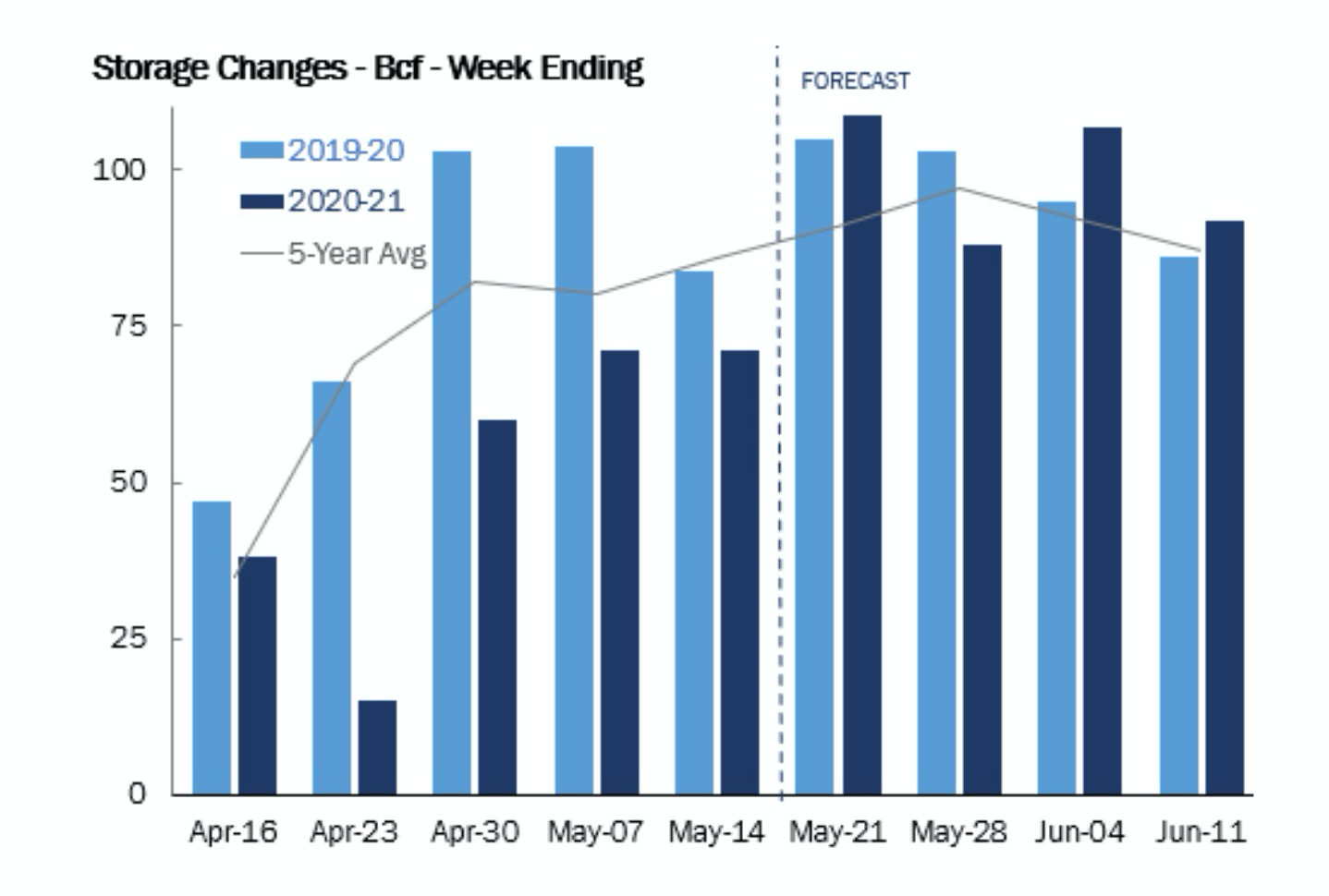

A consensus of analysts tracked by Investing.com are forecasting an injection of 104 bcf into storage for the week ended May 21 versus the 105 bcf during the same week a year ago and a five-year (2016-2020) average of 91 bcf.

In the week to May 14, utilities injected 71 bcf of gas into storage.

If analysts are on target, the injection during the week ended May 21 would take stockpiles up to 2.204 tcf, or trillion cubic feet, some 3.2% below the five-year average and 15.1% below the same week a year ago.

Temperatures were a little warmer than normal last week with just 13 HDDs, or heating degree days, versus a 30-year average of 28 HDDs for the period.

HDDs are used to estimate demand to heat homes and businesses, measuring the number of degrees a day's average temperature is below 65 degrees Fahrenheit (18 degrees Celsius).

100-Bcf Injections Coming

“Triple-digit injections have made their way back on the forecast,” Gelber & Associates said.

“Despite a relatively neutral supply/demand balance, it is anticipated that increased fuel switching will drive the supply/demand balance slightly upwards, leading to higher-than-expected storage injections in the near term,” the gas markets’ consultancy said, predicting a 107-bcf for the final week of this month.

In terms of demand for natural gas to cool homes and businesses, forecasts on Wednesday improved from earlier in the week, with more intense heat likely next week in the Midwest and East, Bespoke Weather Services said in a forecast carried by industry portal naturalgasintel.com.

Both the East and Midwest are key regions for natural gas consumption.

“The forecast has stepped warmer overall,” Bespoke said.

It added that while cooler air was still expected in the nation’s midsection and in the Northeast over the looming Memorial Day weekend, any chills “look quite brief before upper level ridging sets up shop once again in the eastern US." This keeps total demand over the next 15 days as a whole above normal, even with the cooler period in play.

The next couple of weeks fit perfectly into the theme as well, the forecaster said.

“While we get some variability, the bias of the pattern, on the national scale, is to the hotter side of normal, with above normal heat in the East, and out West, and some weakness in the central US,” Bespoke said.

LNG Feeding Henry Hub’s Momentum

On the LNG—or liquefied natural gas—front, feed gas volumes dipped below 10 bcf on Wednesday, well off the robust 11 bcf level that had become the norm over April and early

EBW Analytics Group said Henry Hub’s July contract may also need support from renewed LNG momentum.

“After averaging 11.4 bcf/d for the first 10 days of May, LNG feed gas demand has wavered over the past two weeks—averaging only 10.5 Bcf/d—amid seasonal maintenance outages, pipeline outages” and weather-induced interruptions, EBW said in the blog carried by naturalgasintel.com.

Maintenance outages at several Gulf Coast export facilities “may continue over the next week or two” and then “the primary impediment to LNG feed gas demand will soon become tropical storms,” EBW said.

It said the good news was that demand for US LNG remains elevated and, barring prolonged storm interruptions, export volumes were likely to return soon to the 11 bcf level—or higher—and remain there much of the summer. Demand for US exports of the super-chilled fuel is steady from both Europe and Asia.

Disclaimer: Barani Krishnan uses a range of views outside his own to bring diversity to his analysis of any market. For neutrality, he sometimes presents contrarian views and market variables. He does not hold a position in the commodities and securities he writes about.

Related Articles

I recognize that there is a good case for gold at a time when the price level is rising steadily and there are upside risks to inflation and downside risks to the dollar. Let me...

Upon analysis of the wobbly moves since Tuesday, when the natural gas futures tested the two-year high at $4.55, Thursday might be a cozy one, as the inventory announcements after...

Energy prices remain under pressure amid demand concerns, while copper prices get a boost from tariff uncertainty Energy- Brent Breaks Below $70/bbl Sentiment remains negative in...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.