- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Big Banks to Kick Off Q3 Earnings Season Amid 20-Year High Yields: What to Expect

- Financial behemoths JP Morgan, BlackRock and Wells Fargo are set to kick off earnings season

- JP Morgan looks set to continue positive earnings streak as BlackRock's stock approaches key support area ahead of earnings

- Meanwhile, will Wells Fargo's stock experience its typical post-earnings jump this time around?

Q3 earnings season shifts into high gear this upcoming Friday as financial giants of the likes of JP Morgan (NYSE:JPM), BlackRock (NYSE:BLK), and Wells Fargo (NYSE:WFC) release their financial results for the quarter marked by a jump in treasury yields.

JP Morgan's outlook is particularly optimistic, with the bank poised for yet another quarter of EPS growth. This reflects the bank's strong financial standing, evident not only in its earnings but also in its stock price, which continues its upward trajectory, even in the face of broader market corrections.

Meanwhile, earnings estimates for BlackRock and Wells Fargo, on the other hand, don't paint a positive picture. Their charts show their stocks testing technically significant areas and no definite upward trend.

As we await these earnings reports, it's worth keeping a close watch on US inflation data. This data will be crucial in determining the Federal Reserve's next decision on interest rates, making it a critical factor for the broader market's direction.

JP Morgan: Stock's Recent Correction a Buying Opportunity?

Examining the earnings per share (EPS) ratio curve on the chart, we can observe steady growth over the past year, suggesting the potential for continued positive results with the Q3 earnings report expected this Friday.

Additionally, it's worth highlighting that there have been 10 upward analyst revisions, with no downward revisions, indicating a positive sentiment surrounding the bank's performance.

Source: InvestingPro

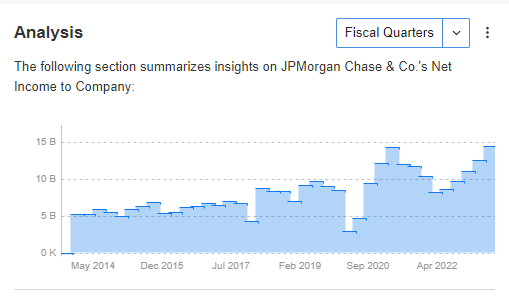

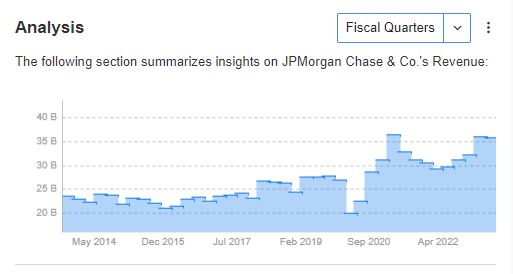

The underlying financial data reaffirms the strong fundamentals of this financial giant. It indicates a consistent improvement in net profits and revenue since Q2 2022, and this positive trend has been evident since Q1 2022.

Source: InvestingPro

The bank is undoubtedly benefiting from relatively high rates, and even if the rates are not raised further, the expectation is that they will remain at their current levels for an extended period, as per the Fed's narrative.

BlackRock: Could Stock Head Below $630?

BlackRock stands out as the largest asset management and financial advisory service provider. In recent quarters, the company has benefited from the growing interest in ETFs, in which BlackRock holds a significant position.

Additionally, the acquisition of Kreos Kapital, a firm specializing in financing for technology and healthcare companies, is anticipated to bolster BlackRock's position as an international credit asset manager.

As we look ahead to Friday's release, the projected earnings per share stand at $8.47 with revenues of $4.56 billion. These quarterly results could play a pivotal role in defending a crucial support level situated around the $630 area.

Should the demand persist, the initial target for buyers would be the nearby resistance at around $370 per share. Conversely, a shift in the scenario and a break of support could pave the way for lower targets, possibly dropping below $600 per share.

Wells Fargo Stock to Jump Post Earnings

Wells Fargo's Q3 2023 results will be compared to the previous earnings of $1.23 per share and revenue of $20.98 billion.

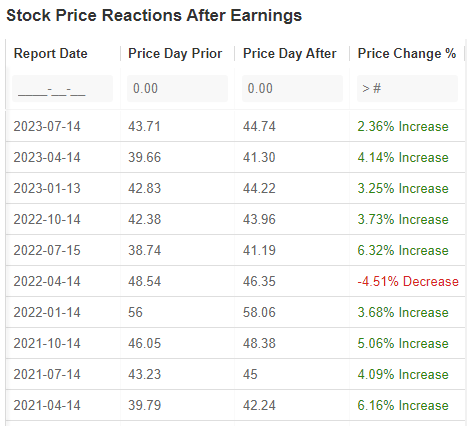

Examining the stock price's reaction on the day of release, it's noteworthy that over the past 2 years, there has been only one instance of a decline in the stock price. In other quarters, there have been smaller or larger increases, ranging from 2% to 6%.

Source: InvestingPro

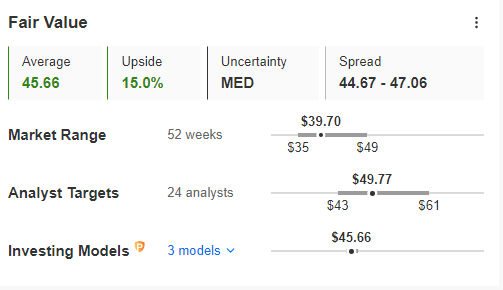

It's important to remember this data if you're considering day trading based on the day's results. Another factor favoring the possibility of increases is the fair value index, which has a score of 15%, the highest among the three stocks discussed in this article.

Source: InvestingPro

***

Disclosure: The author holds no positions in the securities mentioned in this report.

Related Articles

DOGE is unlikely to cause a US recession, but its "move fast and break things" approach raises the risks. Narratives about the U.S. economic outlook have darkened in the past...

The risk of a recession in the U.S. is not zero. This is particularly true as the current Administration tackles Government bloat and implements tariffs. However, before we...

Stocks finished the day sharply lower, just one day ahead of the most important jobs report ever. Yes, that’s right—the VIX 1-day rose and closed at 31.2 yesterday. The market...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.