- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Australian dollar falls as COVID Frankenstein returns to its maker

DXY was up Friday night:

AUD rose on the crosses but fell versus DXY:

Oil plunged:

Metals are no longer used in China!

EM stocks (NYSE:EEM) sputtered:

Junk (NYSE:HYG) rolled:

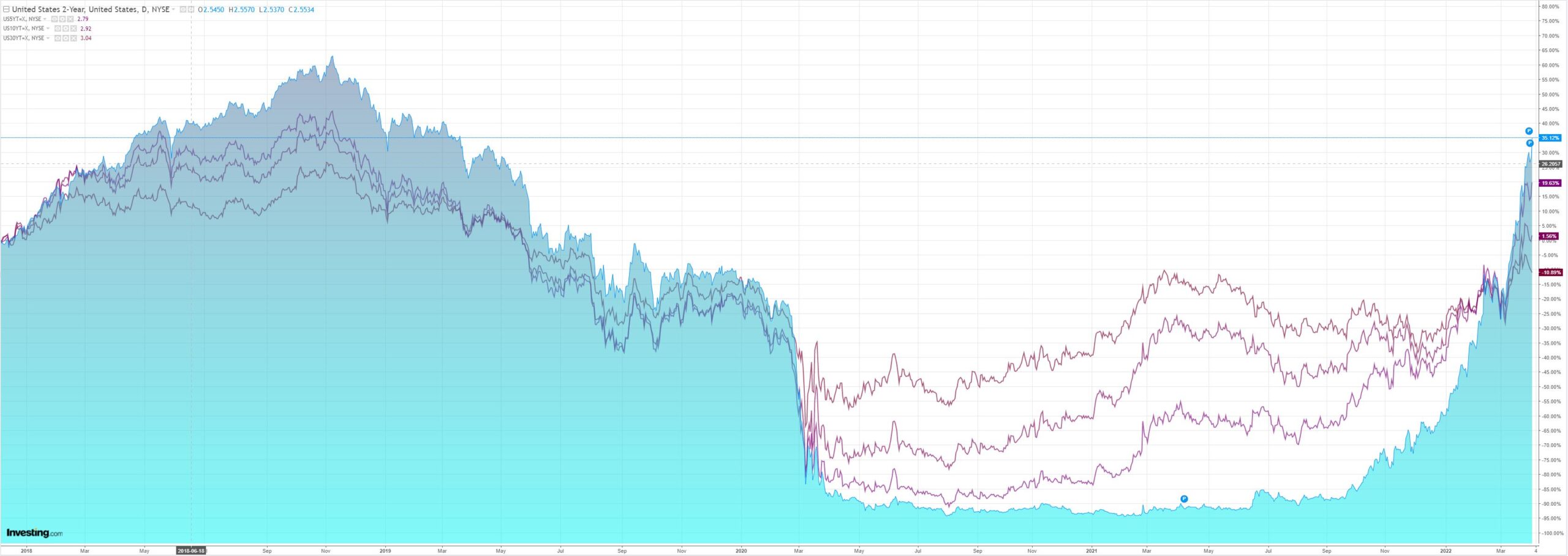

The curve was mown down and inversion deepened:

Stocks held on but recession fears are growing:

US jobs were stellar:

Total nonfarm payroll employment rose by 431,000 in March, and the unemployment rate declined to 3.6 percent, the U.S. Bureau of Labor Statistics reported today. Notable job gains continued in leisure and hospitality, professional and business services, retail trade, and manufacturing.

The change in total nonfarm payroll employment for January was revised up by 23,000, from +481,000 to +504,000, and the change for February was revised up by 72,000, from +678,000 to +750,000. With these revisions, employment in January and February combined is 95,000 higher than previously reported.

But wage growth slowed a little to 0.4% month-on-month in March, up from 0.1% in February, and 5.6% from 5.2% year-on-year.

For me, however, the bigger news is now China and its battle with its Frankenstein child returning home to seek out its maker. 13k cases of COVID cases were reported Sunday, nearly double Friday, Shanghai was locked down and Sanya paralysed.

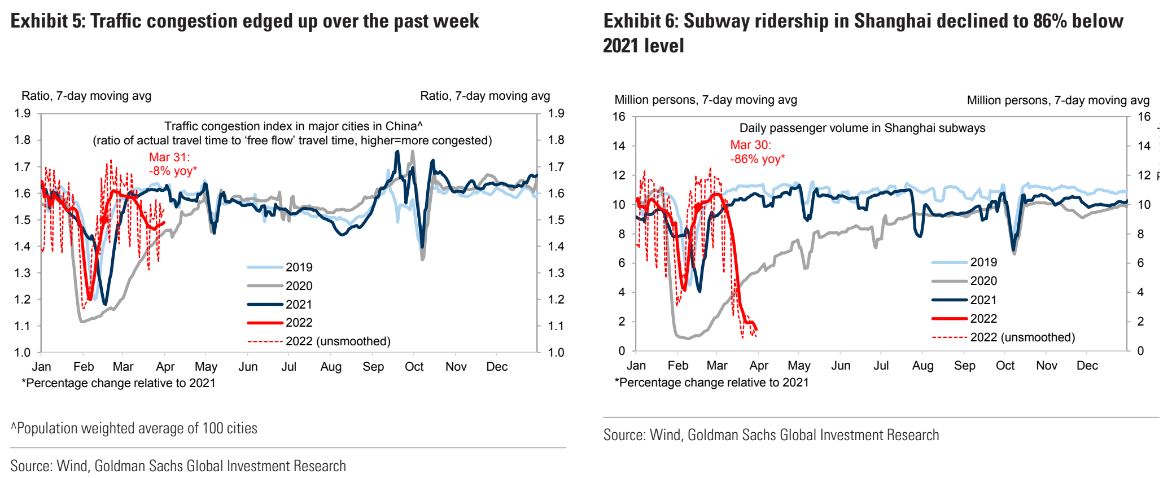

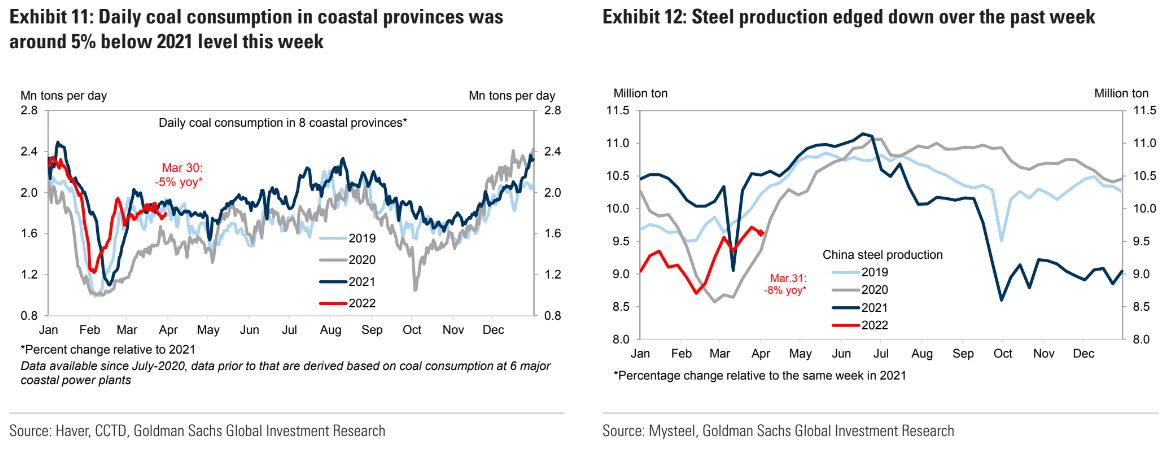

It looks to me like OMICRON will require rolling lockdowns in major cities ad nauseum and activity is already falling:

As Europe and US consumption slows sharply on their own shocks – war, energy and interest rates – and normalising services spending hits goods demand even harder, stalling Chinese domestic demand is about to be hammered with an external shock.

Buy commodities and AUD if you want!

Related Articles

The stock market sold off on a decline in February's Consumer Confidence Index (CCI), confirming a similar decline in February's Consumer Sentiment Index (CSI), which was reported...

The central bank’s job is never easier, but in the current climate, it’s unusually tricky. In addition to the usual challenges that complicate real-time monetary policy decisions,...

The EU’s most costly budgets, bitcoin’s market swings, and rising US bankruptcies. Each week, the Syz investment team takes you through the last seven days in seven charts. 1. The...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.