- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

As Markets Await Powell, Gold Bugs Want To Know: Is $1500/Oz Still On?

It’s the classic antidote for the gold investor: Just when you think there’s no stopping the yellow metal’s rise, suddenly the rally comes undone and it may be time to dump instead of pump.

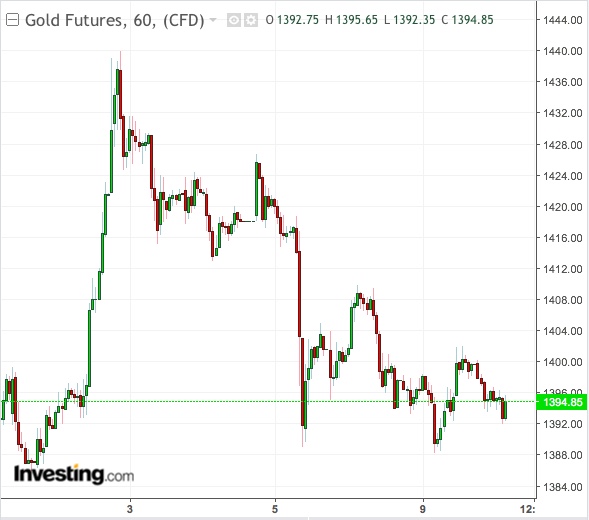

At just under $1,395 an ounce in gold futures at the time of writing, there’s no threat yet of that happening, considering that the near six-year high of $1,439.99 hit a week ago is just about 3% away.

While returning to $1,400 might not be the problem here, what remains an enigma is whether $1,500 pricing and beyond—the gold bug’s sweet spot—is attainable.

That will depend primarily on what the Fed says about rates, beginning with Chairman Jerome Powell’s two-day testimony to Congress beginning today.

Investing.com's Fed Rate Monitor Tool still suggests a 100% chance the Fed will cut its key federal funds rate from 2.25%-2.5% to 2%-2.25% when it meets July 30-31.

Yet, some market participants have scaled back expectations for this after a 224,000-strong jobs growth in June signaled the economy may be too strong for an easing. The forecast jobs expansion for last month was only 160,000.

Fed Chief’s Testimony Will Be Turned Inside Out For Clues On Rate Cut

Powell’s testimony is expected to be perused word-for-word by gold traders looking for clues on how the Fed chief will be voting at this month’s Federal Open Market Committee meeting.

Aside from Powell’s address to Congress, the other major driver for gold on Wednesday will be the FOMC’s release of its June meeting minutes. This will spell out more clearly what prompted the committee’s members to vote the way they did when they decided to hold rates last month.

In June, the FOMC removed the word “patient” from the statement it typically issues after its monthly meetings, signaling to investors that instead of being reactive to incoming data, it might take proactive action to keep the U.S. economy’s record expansion of nearly a decade on track.

Powell also said in a recent speech that “an ounce of prevention is worth more than a pound of cure”, a hint that the central bank might lean toward a so-called insurance cut to head off a potential economic slowdown.

Yet, if history is a guide, then the Fed has always been known to err on the side of caution—meaning it might withhold the minimum 25 basis points cut the market expects in July, just to see how U.S. jobs perform this month. While some gold traders have lofty expectations for a 50 basis points reduction, few are holding their breath on that.

Investing.com analyst Jesse Cohen said:

“Powell could either reinforce market expectations for a rate cut or rein them in.”

“The level of certainty that the Fed will cut rates in July is far from justified, so I'd be looking for Powell to push back against the dovish message that markets have priced in.”

Other Fed bankers lined up to speak this week are New York Fed President John Williams, St Louis Fed president James Bullard, Fed Atlanta President Raphael Bostic, Fed Vice Chair for Supervision Randal Quarles, Richmond Fed President Thomas Barkin and Minneapolis Fed President Neel Kashkari.

Of these, the most closely watched would be Bullard, who was the only dissenting voice at the June Fed meeting, when the central bank decided to hold rates. Overall, the St. Louis Fed president is one of the more dovish members of the FOMC.

$1,500 Gold Is Happening - The Question Is When

Bank of America Merrill Lynch (NYSE:BAC) said it was bullish on $1,500 and above gold, but wary about near-term risks associated with precious metals.

In a commentary late last week, the Wall Street bank said:

“The Fed turning more dovish at the same time as global macroeconomic headwinds have intensified should push the yellow metal to $1,500/oz in the next twelve months. However, we are somewhat concerned about the speed with which the market has re-assessed the likelihood of rate cuts by the US central bank.”

“Any delays in delivering easier monetary conditions, potentially exacerbated by a constructive G20 summit, could push gold prices lower near-term.”

Precious metas strategists at UBS concur on this, saying:

“A few years and several false starts later, we think the macro backdrop has now started moving more convincingly in gold’s favor … though the route for gold is unlikely to be a straight path higher.”

UBS expects gold to end the year below $1,400 and settle 2020 at $1,450.

Only from 2021 to 2023, it expects the price to end at or slightly above $1,500.

Related Articles

Gold stays near highs with $3K within reach. US inflation data could fuel the next gold rally. Key levels: Support at $2900, resistance at $2950-$3K. Get the AI-powered list of...

Oil prices started the week under pressure as Saudi Arabia cut prices and deflationary signals from China hurt sentiment Energy - Saudis Cut Crude Prices Downward pressure on US...

I recognize that there is a good case for gold at a time when the price level is rising steadily and there are upside risks to inflation and downside risks to the dollar. Let me...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.