- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

3 Stocks Expected to Deliver 30%+ Growth in the Coming Year

- As a 2023 bullish draws to a close, investors are already setting their sights on stocks to buy for 2024.

- The market gives these 3 stocks more than +32% growth potential in the coming year

- Let's take a look at these three stocks in detail.

As 2023 draws to a close, investors are shifting their focus to the upcoming fiscal year.

In today's analysis, we'll explore three stocks that have captured the market's attention and are poised for substantial growth of over 32% in the next fiscal year.

Additionally, we'll delve into the underlying factors driving their respective potentials, leveraging data from the InvestingPro professional tool.

1. First Solar

First Solar (NASDAQ:FSLR) offers solar photovoltaic energy solutions in the United States, Japan, France, Canada, India, and Australia.

The company designs manufactures and sells solar modules that convert sunlight into electricity.

It was formerly known as First Solar Holdings and changed its name to First Solar in 2006.

First Solar reports its quarterly results on February 22. Its earnings per share (EPS) are expected to increase by +60.34% and actual revenues by +22%.

Looking ahead to 2024, EPS forecasts are for an increase of +63.7% and revenue of +31.4%.

Source: InvestingPro

First Solar has become a prominent player in its sector and has attracted the attention of Wall Street for its strategic positioning and financial performance.

In addition to the promising earnings forecasts for 2024, the stock has several favorable factors in its corner.

These include a robust order backlog extending until 2026, a solid balance sheet, and an anticipated growth in gross margins from 18% in 2023 to 25% in 2025.

Source: InvestingPro

In addition, its focus on utilities rather than residential solar sets it apart from its competitors, insulating it from industry challenges such as weak residential demand and interest rate volatility.

The utility-scale solar demand is ever-increasing increasing in the U.S. market as the shift to carbon-neutral energy sources takes hold.

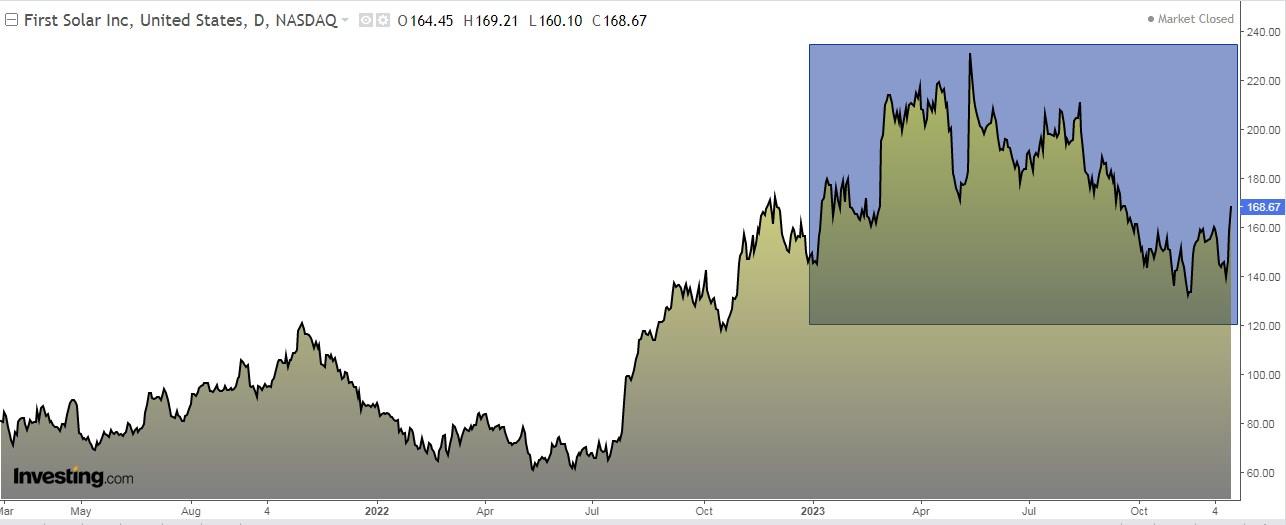

The company's stock is up +10.60% for the year. The conservative side of the market sees a 12-month potential of +36% at $229.63. In contrast, the more aggressive side believes the potential is +50-55%.

Source: InvestingPro

2. Schlumberger

Schlumberger (NYSE:SLB) is engaged in the supply of technology for the energy industry worldwide. Schlumberger was founded in 1926 and is headquartered in Houston, Texas.

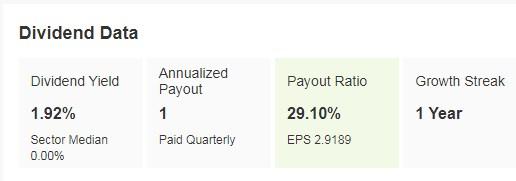

Its dividend yield is +1.92%.

Source: InvestingPro

It will report its numbers for the quarter on January 19 and its revenue could rise by almost +4%.

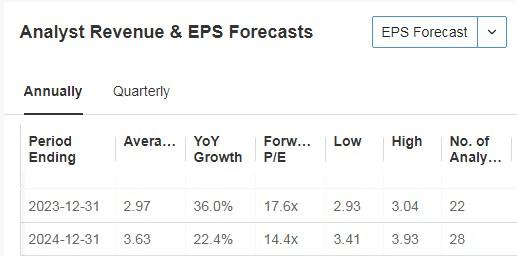

The company's earnings per share are expected to increase by +36% in 20234 and +22.4% in 2024. Regarding revenues, an increase of +17.9% this year and +13.1% for the following fiscal year.

Source: InvestingPro

Its shares are down 2% for the year. It presents 31 ratings, of which 28 are buy, 3 are hold and none are sell.

Source: InvestingPro

The market gives it a 12-month forward potential of +32%.

Source: InvestingPro

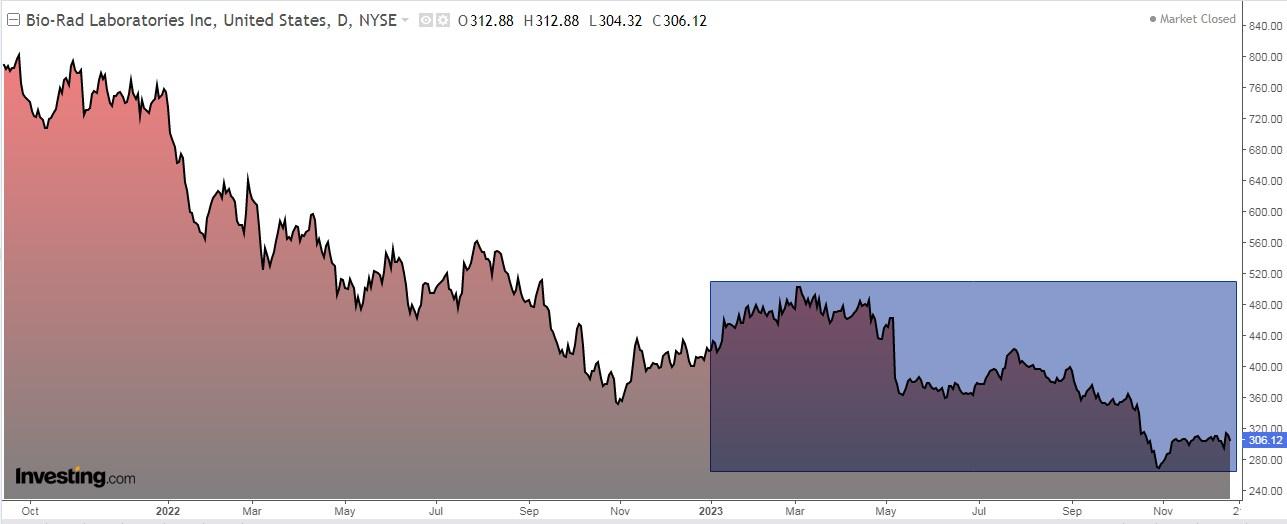

3. Bio Rad Laboratories

Bio-Rad Laboratories (NYSE:BIO) manufactures and distributes clinical diagnostic products and laboratory devices and instruments that are used in research techniques in the United States, Europe, Asia, Canada, and Latin America.

It was founded in 1952 and is headquartered in Hercules, California.

On February 8 it presents its accounts for the quarter. For 2024, it forecasts an increase in earnings per share and revenue of +2.6% and +2.8%, respectively.

Source: InvestingPro

The company's margin expansion opportunity is a positive. The spread between lagging operating margins and margins on volume growth is high, a fact that should position the company for a fairly strong expansion.

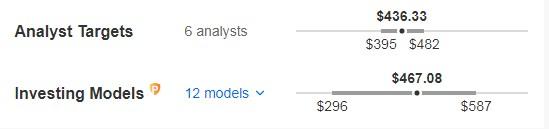

The market sees a 12-month +42.5% potential at $436.33. For their part, InvestingPro models raise it to +52% (the $467.08).

Source: InvestingPro

Source: InvestingPro

***

You can easily determine whether a company is suitable for your risk profile by conducting a detailed fundamental analysis on InvestingPro according to your criteria. This way, you will get highly professional help in shaping your portfolio.

In addition, you can sign up for InvestingPro, one of the most comprehensive platforms in the market for portfolio management and fundamental analysis, much cheaper with the biggest discount of the year (up to 60%), by taking advantage of our extended Cyber Monday deal.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.

Related Articles

Following the latest IM-2 mission news, Intuitive Machines Inc (NASDAQ:LUNR) stock is down 54% over the month. Presently holding at $8.95 per share, LUNR stock leveled down to an...

Using the Elliott Wave Principle (EWP), we have been tracking the most likely path forward for the Nasdaq 100 (NDX). Although there are many ways to navigate the markets and to...

There was some modest buying today from the open, but volume was light and markets are below trading range support established during the latter part of 2024. It's hard to see...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.