Friday night was a consolidation session for risk markets as they digested all the interest rate meetings of the week, with US bond yields falling slightly while the USD held sway over the currency majors. Wall Street stumbled a little bit but held on to their gains while European stocks were all over the place as tensions increased in Eastern Europe. The Australian dollar remains under the pump and at a monthly low, nearly crossing below the 65 cent level again.

10 year Treasury yields fell slightly to the 4.2% level, off of their four month high, while Brent crude pulled back again to just above the $85USD per barrel level. Meanwhile gold had significant intrasession volatility to eventually close just below the $2170USD per ounce level.

Looking at markets from Friday’s session in Asia, where mainland and offshore Chinese share markets are breaking down after failing to get back on track with the Shanghai Composite off by more than 0.7% while the Hang Seng is down more than 2% at 16418 points.

The daily chart was starting to look more optimistic with price action bunching up at the 16000 point level before breaking out in the previous session trying to make a run for the end of 2023 highs at 17000 points with the downtrend line broken. However this has been thwarted as monthly resistance levels are kicking in:

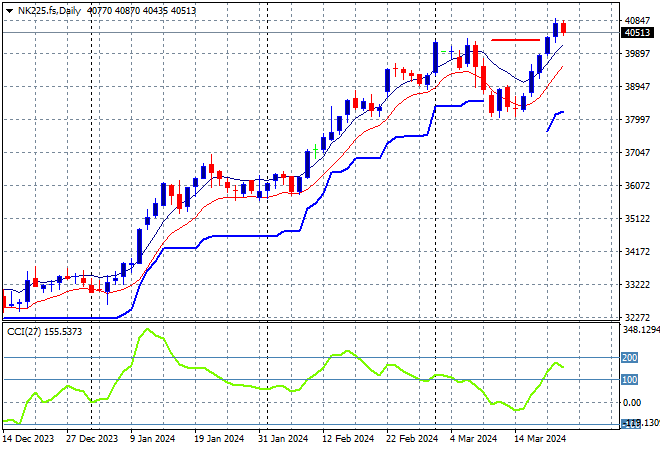

Japanese stock markets were the only bright note in the region, with the Nikkei 225 closing 0.4% higher at 40981 points.

Trailing ATR daily support was never threatened by price action after this bounce went beyond the September highs at the 33000 point level with daily momentum getting back to overbought readings with a significant breakout. Last week saw this reversed as momentum goes negative and the selloff back to ATR support at 38000 points taking the wind out of this trend. This reversal has given new life here however:

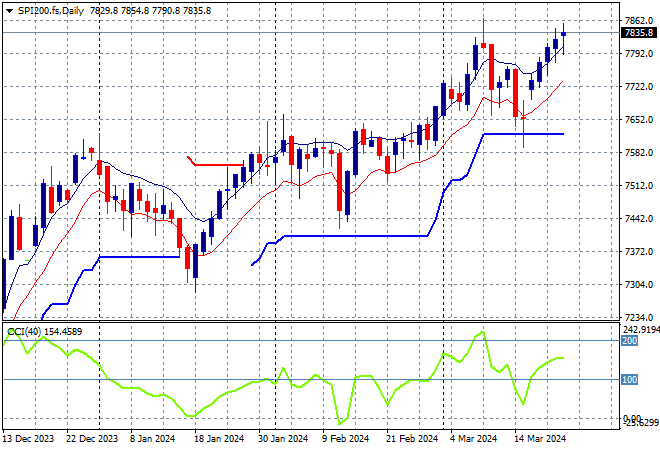

Australian stocks were the laggards again with a poor showing by the ASX200 which closed 0.1% lower at 7770 points.

SPI futures are up just 0.1% despite the solid showing on Wall Street overnight. The daily chart was looking firmer with the medium term uptrend and short term price action coming together to take out the previous December highs. As I said previously, watching for any continued dip below the low moving average could see a significant pullback but watch ATR support which has been defended so far:

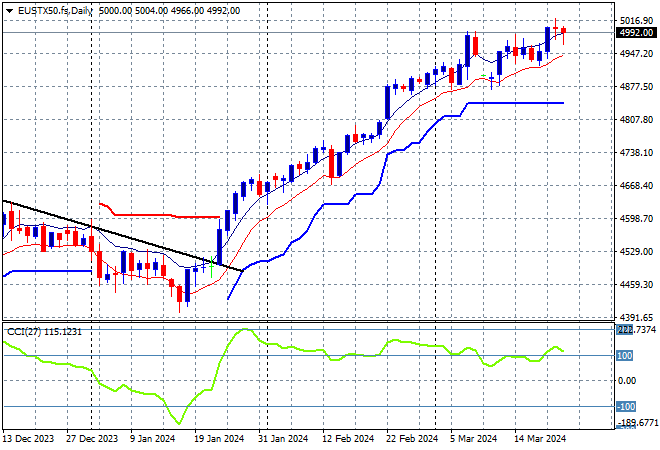

European markets were all over the place on Friday night with disparate moves across the continent, with the Eurostoxx 50 Index eventually finishing 0.4% lower at 5031 points.

The daily chart shows price action still on trend after breaching the early December 4600 point highs but daily momentum retracing slightly out of an overbought phase. This is looking to turn into a larger breakout although futures indicate another pause for tonight’s session:

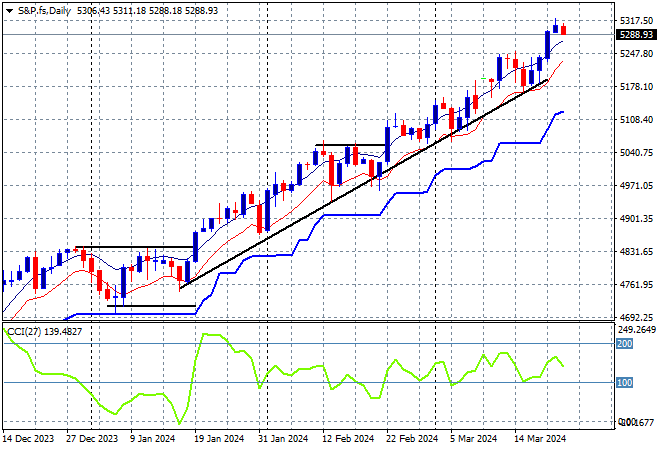

Wall Street couldn’t continue its upbeat mood with minor moves lower as the NASDAQ finished up 0.2% while the S&P500 lost about the same amount, closing the week out at 5234 points.

The daily chart still shows a fantastic 2024 trading season so far even it if looks slightly overcooked, with the Fed basically giving the go ahead for more upside from here, but momentum is still on the overbought side to say the least, so expect a retracement back to that trendline soon:

Currency markets saw the most volatility last week in the wake of the BOE and Swiss meetings, with an initial breakout against USD that turned into a big reversal on the Swiss cut with most of the majors retreating against King Dollar. Euro led the charge with a break back below the 1.09 level that almost resulted in a test of the 1.08 level on Friday night.

The union currency seems to have support anchored at the 1.08 level which is where it ended up but the short term price action is suggesting a breakout is possible here as momentum is well overextended:

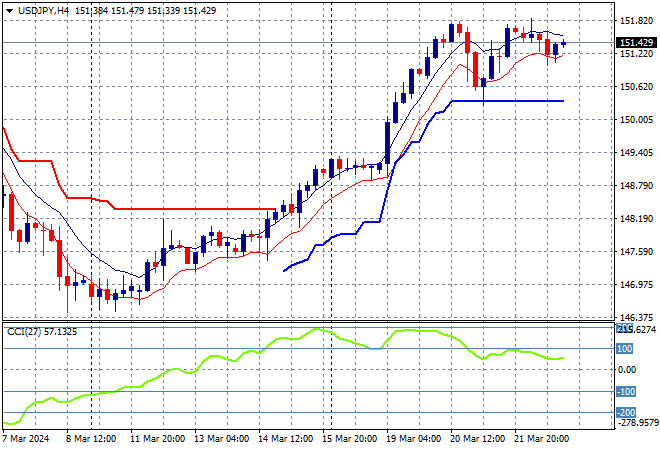

The USDJPY pair was able to nearly get back to its pre-Fed meeting high with a minor bounce up to but not above the mid 151 level on Friday night.

The medium term picture was looking very optimistic as Yen sold off due to BOJ meanderings but momentum is now trying to get back into overbought mode while ATR support remains firm at the 150 handle proper:

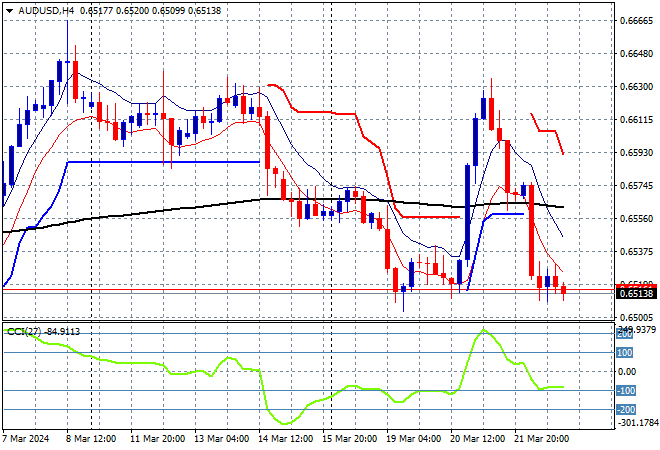

The Australian dollar wanted to return to its weekly highs but failed again with a pullback to short term support and below the 66 cent level as it now dices with longer support at the 65 cent area.

The Aussie has been under medium and long term pressure for sometime before the RBA and Fed meetings and while this surge looked strong, it wasn’t overbought on the four hourly chart and had not surpassed support from last week’s consolidation phase. Watch for the 66 cent handle to firm as resistance here:

Oil markets are pausing their breakouts following the attacks on Russian refineries with Brent crude pushed slightly lower to settle just above the $85USD per barrel level, still well above the previous weekly highs.

After retracing down to trailing ATR daily support at the $77 level, price had been bunching up around the February highs at the $84 level with short term momentum definitely overbought and signalling potential upside from here:

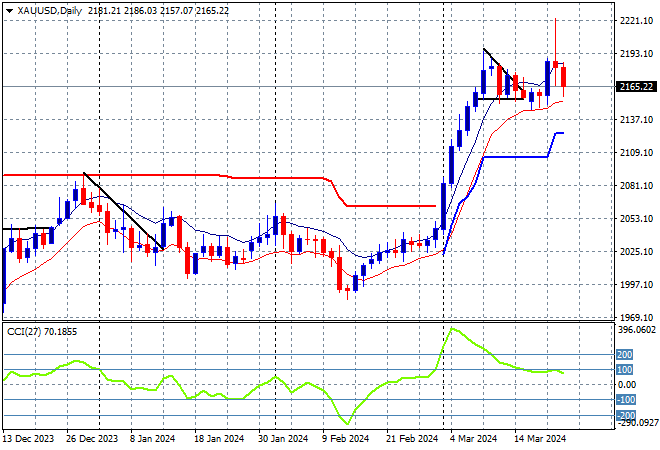

Gold had previously surged above the $2200USD per ounce level in the wake of the soft Fed meeting outcome but this has been thwarted somewhat on the Swiss cut last week with a series of very volatile sessions that has seen it return back to the $2160 level for a possibly more sustainable trajectory.

Last week daily momentum was nearly off the charts – never a good sign – with short term support at the $2000 level turning to what could be rock solid medium term support but still the critical area to watch ahead on a likely pullback due to excessive volatility: