Continued war jitters across the Middle East plus further Fedspeak overnight is not helping risk to stabilise, although Wall Street was able to put in only minor losses with Asian markets still reeling from yesterday’s wider selloff. The USD continues to push back against the undollars, although gold remains unflappable while bond yields jumped to new highs across the curve. The Australian dollar made new lows to almost cross below the 64 cent level.

10 year Treasury yields briefly touched the 4.7% level, while oil prices were range bound as Brent crude stayed around the $90USD per barrel level again. Meanwhile gold was able to clawback its recent setback, finishing at the $2385USD per ounce level.

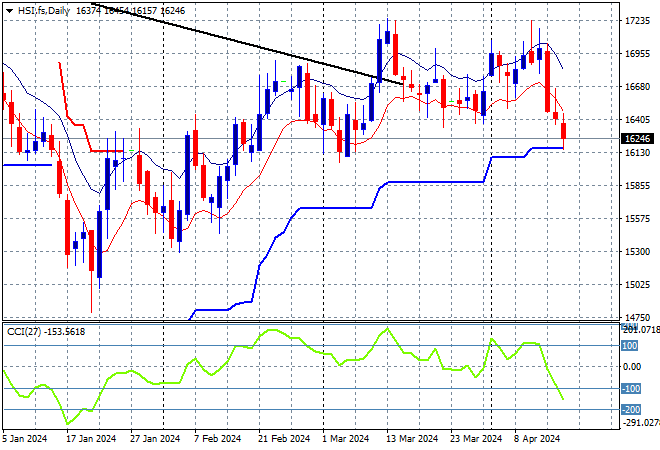

Looking at markets from yesterday’s session in Asia, where mainland and offshore Chinese share markets fell in unison with the Shanghai Composite down more than 1.6% while the Hang Seng Index is off by at least 2% to 16279 points.

The Hang Seng Index daily chart was starting to look more optimistic with price action bunching up at the 16000 point level before breaking out in the previous session as it tried to make a run for the end of 2023 highs at 17000 points with the downtrend line broken. However this has been thwarted as monthly resistance levels are kicking in, although support at the 16400 point area is the area to watch next to come under threat:

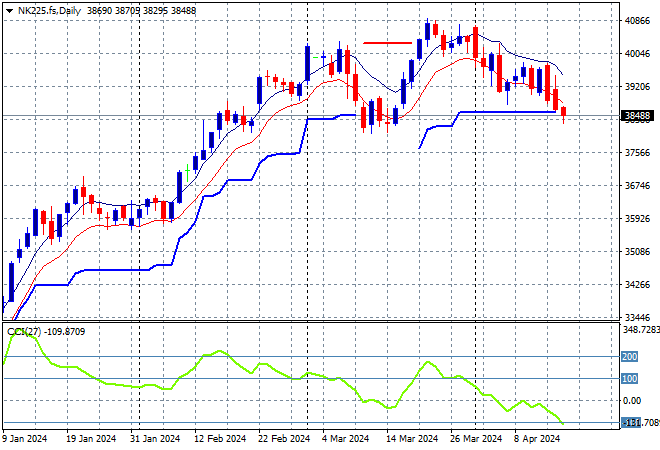

Japanese stock markets led the selloff however with the Nikkei 225 down nearly 2% at 38471 points.

Price action had been indicating a rounding top on the daily chart with daily momentum retracing away from overbought readings with the breakout last month above the 40000 point level almost in full remission. Short term resistance has been defended with short term price action now retracing to support at the 39000 point level. Watch the 38000 level for signs of a true breakdown as futures don’t look good:

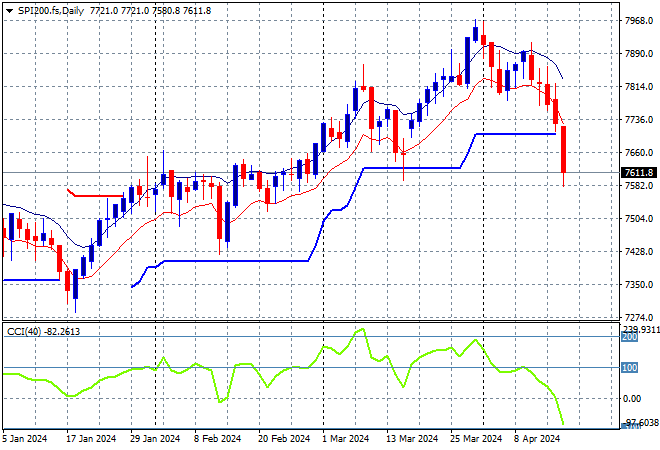

Australian stocks couldn’t escape the carnage with the ASX200 down more than 1.8% to close at 7611 points.

SPI futures are off at least 0.3% as Wall Street stabilised somewhat overnight but there remains significant downwards volatility. The daily chart was looking firmer with the medium term uptrend and short term price action coming together to take out the previous December highs. ATR daily support has now been broken, which is significant, taking price action back to the February support levels, although momentum is not yet oversold:

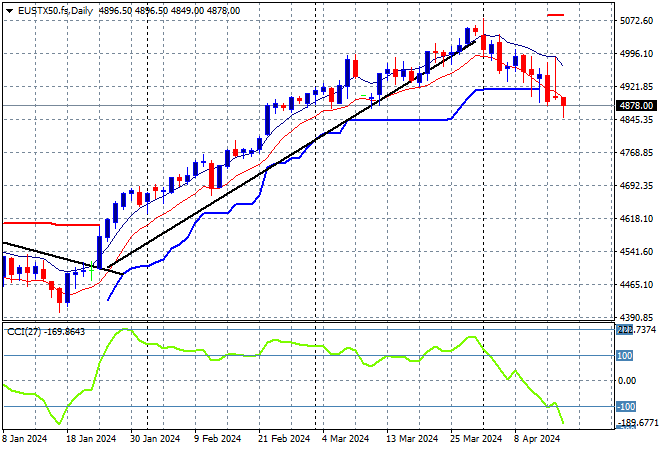

European markets were unable to escape the selling, with broad losses across the continent as the Eurostoxx 50 Index finished 1.3% lower at 4912 points.

The daily chart shows price action off trend after breaching the early December 4600 point highs with daily momentum retracing well into an oversold phase. This was looking to turn into a larger breakout but this retracement below short term support could turn into a larger reversal with futures showing a clear break of support at the 4900 point level next:

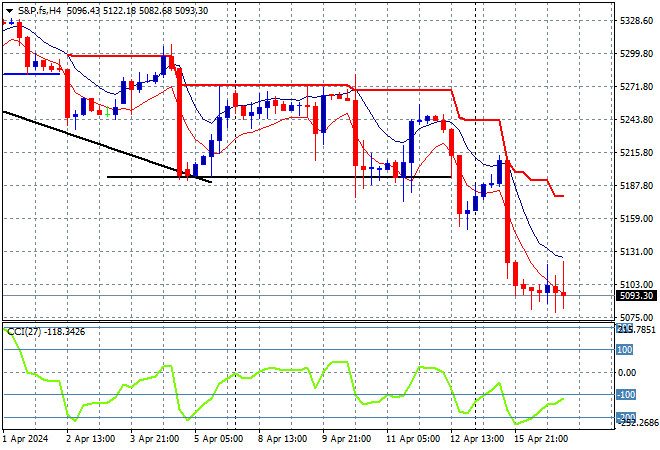

Wall Street still had down sessions but are trying to stabilise with the NASDAQ off by just 0.1% while the S&P500 finished only 0.2% lower to retrace to 5051 points.

The daily chart previously showed a consolidation that could have turned into a proper reversal here as price action broke below short term support as momentum became somewhat oversold. As I said previously, this break below the 5240 point area has setup for further downside. Watch firm support at 5000 points as a possible pausing point here:

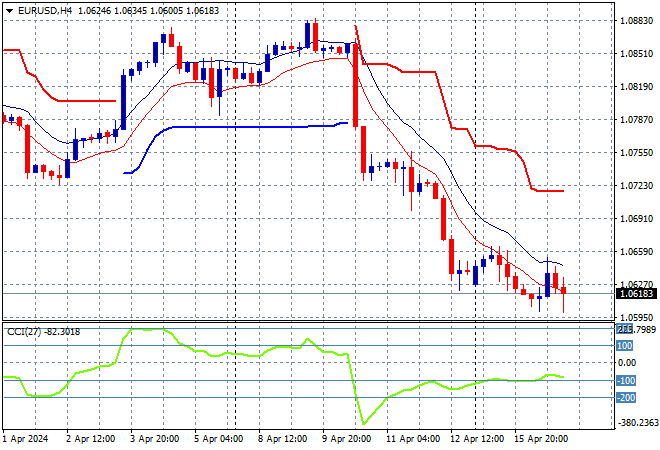

Currency markets were already in the thrall of King Dollar on the back of the US CPI print before this macro volatility with safe haven buying in USD continuing, with minor abatement here and there. Euro is under the pump, almost breaking below the 1.06 handle but holding for now.

The union currency had previously bottomed out at the 1.07 level at the start of April as medium term price action with a reprieving reversal in price action back towards the 1.09 level before last week’s inflation print. Short term support at the 1.0740 has been rejected with a breakdown below that may have more downside this week:

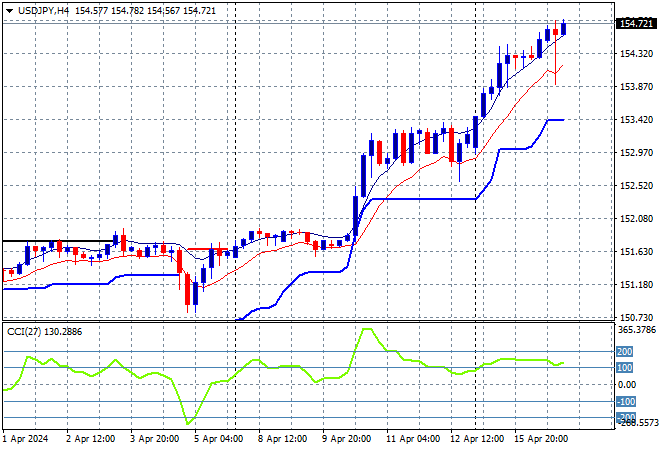

The USDJPY pair continues to pile on breakout after breakout, managing to push aside the 154 handle at the start of the week and pushing further higher overnight.

The medium term picture was always somewhat optimistic as Yen sold off due to BOJ meanderings but momentum had been building before the CPI print, positive for all of the last week at least with ATR support upgraded throughout. This is likely overcooked in the short term but sets up for potential gains from here:

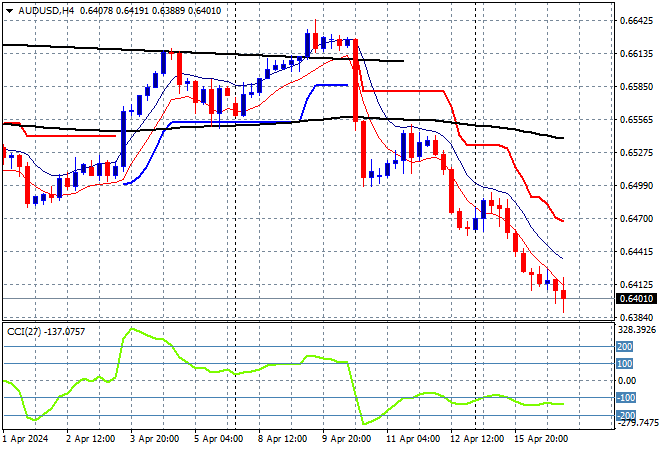

The Australian dollar continues to crack below recent weekly support to settle just above the 64 handle as risk unwinds from the commodity currency.

The Aussie has been under medium and long term pressure for sometime before the RBA and Fed meetings and while the previous temporary surge looked strong, it wasn’t overbought on the four hourly chart and had not surpassed support from last week’s consolidation phase. Watch for further downside below here as momentum remains oversold:

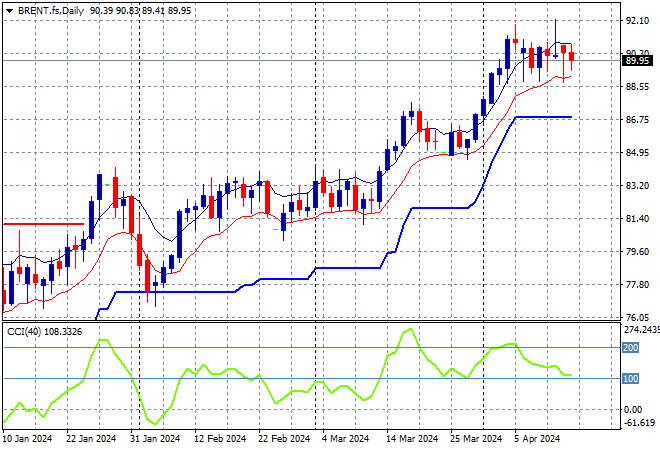

Oil markets are in a flux to say the least on Middle East conflicts with some session volatility, but Brent crude is holding fast at the $90USD per barrel level.

After retracing down to trailing ATR daily support at the $77 level, price had been bunching up around the February highs at the $84 level with short term momentum definitely overbought and signalling potential upside from here, although now well overextended. I expect a volatile breakout here soon, with probability to the upside:

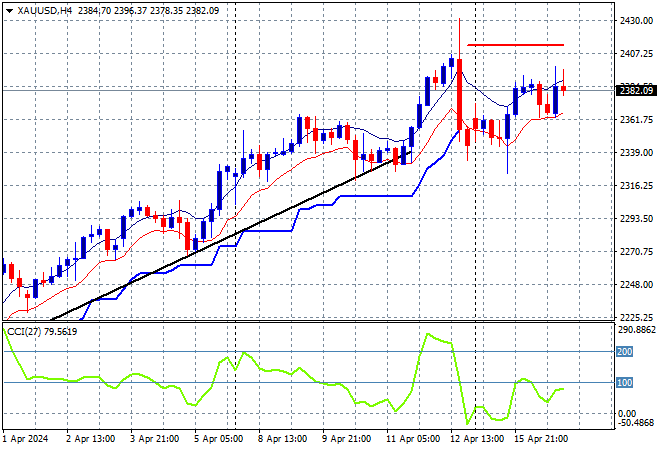

Gold has so far defended its large uptrend after a minor retracement back to the $2300USD per ounce level with a move back to the $2380 level overnight.

In the previous week momentum was nearly off the charts – never a good sign – with short term support at the $2200 level turning to what could be rock solid medium term support but still the critical area to watch ahead on a likely pullback due to excessive volatility.