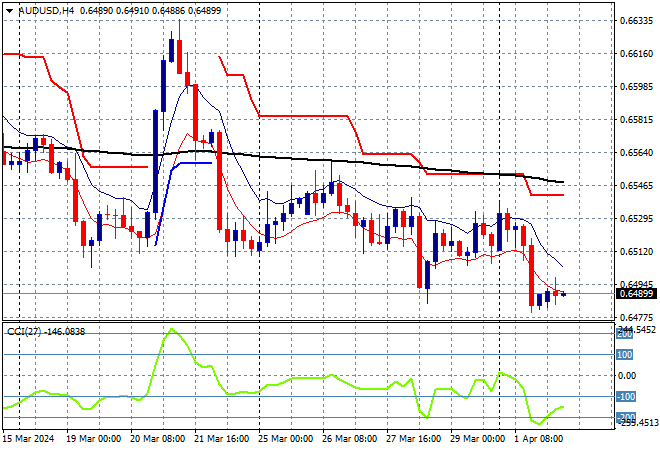

Asian share markets are still in mixed conditions despite some strong economic catalysts after the Easter break with a somewhat weak lead from Wall Street not helping local stocks as much as thought. The high USD and higher bond yields continue to dominate currency markets as the Australian dollar for example remains depressed below the 65 handle.

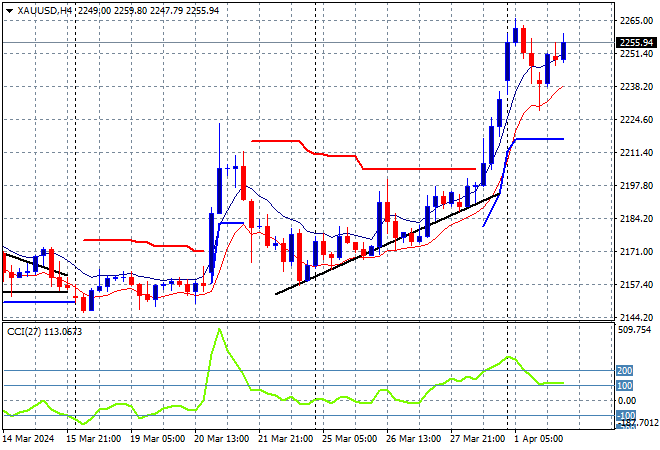

Oil prices are holding on to their post weekend gains with Brent crude still well above previous weekly resistance, about to exceed the $88USD per barrel level while gold continues to regain strength as it tries to match last week’s high above the $2250 level:

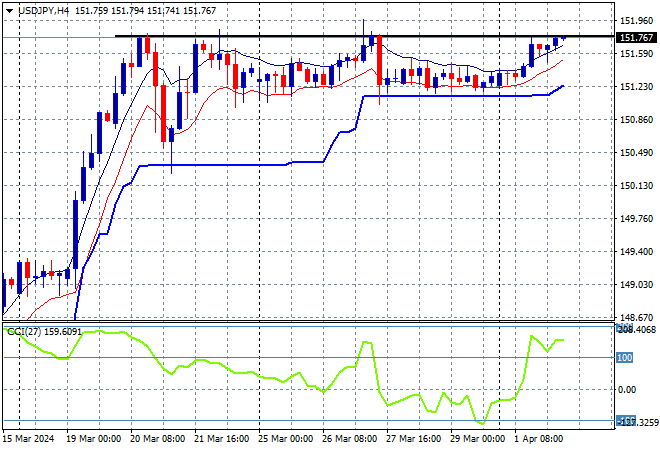

Mainland and offshore Chinese share markets are going in different directions with the Shanghai Composite still well above the 3000 point level but unable to make any headway while the Hang Seng has surged more than 2% higher, currently at 16931 points. Japanese stock markets are also quite flat, with the Nikkei 225 closing just 0.2% higher at 39827 points while the USDJPY pair continues to build above the 151 level, matching the previous weekly highs:

Australian stocks were supposed to perform better but the ASX200 actually closed 0.1% lower to 7886 points while the Australian dollar remains unable to get back above the 65 cent level after last week’s volatility:

S&P and Eurostoxx futures are pulling back from their Friday night highs as we head into the London session with the S&P500 four hourly chart showing price action still below the 5300 point level as short term support comes under threat:

The economic calendar will include the latest German inflation print and then US factory order data for February.