By Josh Ye and Urvi Manoj Dugar

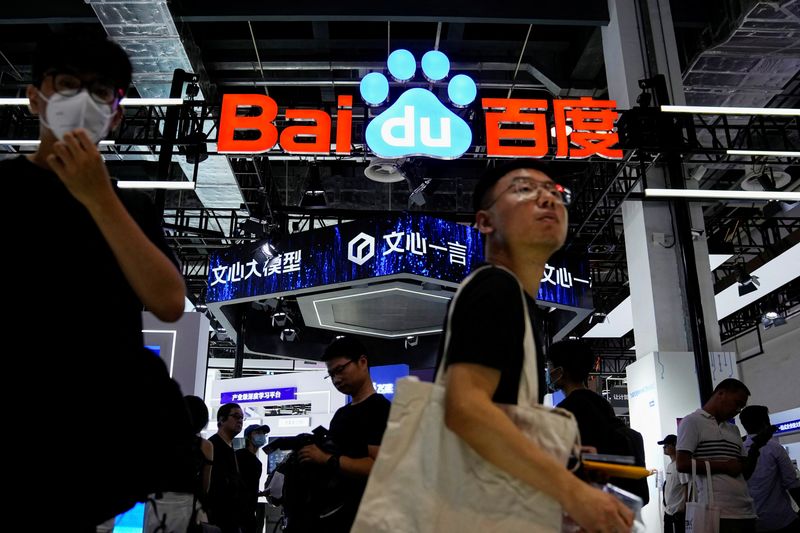

(Reuters) -Five Chinese tech firms, including Baidu Inc (NASDAQ:BIDU) and SenseTime Group, on Thursday launched their artificial intelligence (AI) chatbots to the public after receiving government approval, as China's government pushes to widen the use of such products amid competition with the United States.

Baidu, China's leading online search provider, said in a statement that its ChatGPT-like chatbot, Ernie Bot, was now fully accessible to the public. A SenseTime spokesperson told Reuters via email that its chatbot, SenseChat, was also now "fully available to serve all users".

Three AI start-ups, Baichuan Intelligent Technology, Zhipu AI and MiniMax, also announced similar public launches on Thursday.

Shares in Baidu and SenseTime jumped in Hong Kong trade, gaining 2.1% and 2.3% respectively in a broader market that was trading 0.55% lower.

Unlike other countries, China requires companies to submit security assessments and receive clearance before releasing mass-market AI products.

Authorities have recently accelerated efforts to support companies developing AI as the technology increasingly becomes a focus of competition with the United States.

Chinese media reported that a total of 11 firms had received approvals from the government, including TikTok owner ByteDance and Tencent Holdings. Neither company immediately responded to requests for comment about their AI plans.

Baidu's CEO Robin Li said on Thursday that by making Ernie Bot widely available, Baidu would "collect massive amount of valuable real-world human feedback" to further improve the chatbot.

Baidu also plans on releasing a series of "AI-native apps", the company said.

EARLY MOVER ADVANTAGE

It is unclear whether Alibaba (NYSE:BABA) has received approval as of this week. But an Alibaba Cloud spokesperson told Reuters that the company had completed filings for its AI model, Tongyi Qianwen, and that the model was awaiting its official launch.

The person also said the company expected the regulators to release a list of companies with approvals within the coming week.

Being the first to market in China is considered critical for the country's cut-throat internet industry. Baidu's Ernie Bot topped the free app category on Apple (NASDAQ:AAPL)'s App Store in China on Thursday after the announcement.

"I think the ones that got approved have an early mover advantage to be able to fine-tune their product faster than competitors," Kai Wang, an analyst at Morningstar.

ChatGPT-maker OpenAI, which is backed by Microsoft (NASDAQ:MSFT), is on track to generate more than $1 billion in revenue over the next 12 months, tech-focused publication The Information reported on Tuesday.

The approvals were widely anticipated after China published a set of interim rules aimed at regulating generative AI products for the public that went into effect on Aug. 15.

Previously, companies were only allowed to conduct small-scale public tests of AI products but with the new rules, companies have widened their AI product tests by enabling more features and engaging in more marketing. Prior government approval is not needed for products targeting businesses.

Shawn Yang, an analyst at Blue Lotus Capital Advisors, said the government's move to greenlight AI products could spark consolidation in the industry.

"Many people were rushing into the large language model business," he said, "But the industry may soon consolidate. Only those with data and tech capability will be able to push forward."