Tin explorers and developers are positioning themselves to take advantage of the strong growth in semiconductor sales and a forecast supply shortfall of tin.

World semiconductor sales, a proxy for tin usage in soldering, have notched up month-on-month growth for six consecutive months from March 2023.

Semiconductor Industry Association president and CEO John Neuffer said: “Global semiconductor sales ticked up on a month-to-month basis for the sixth consecutive month in August, demonstrating a slow-and-steady increase in market demand during the middle of the year.”

Tin mining ban in Myanmar

The United Wa State Army (UWSA), the largest of Myanmar's ethnic groups, ordered a ban on all mining and processing activity at the start of August for a wide-ranging audit of the tin sector.

The Wa mines account for more than 70% of tin production in Myanmar, which is the world's third-largest tin producer and the dominant supplier to China's smelters.

This has contributed to the shortage of tin supplies to global markets including China, the world's largest tin consumer.

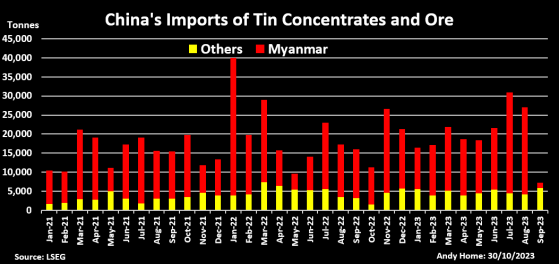

China's imports of tin concentrates from Myanmar and other sources.

China has not had much success in diversifying its raw materials supply, meaning the loss of material from Myanmar will become ever more significant the longer the ban lasts.

The Democratic Republic of Congo (DRC) has been China’s second-largest supplier after Myanmar in recent years, and imports from the DRC rose by 24% year-on-year to 21,600 tonnes in January-September.

However, that's still a low number relative to the 137,000 tonnes imported from Myanmar by China this year.

Although Chinese buyers have stepped up imports from other sources such as Bolivia, Brazil and Russia volumes have been modest and nowhere near high enough to compensate for the loss of Wa material.

Small cap plays making moves

Tin explorers are looking to take advantage of the supply shortage and expected demand growth, with several ASX-listers making inroads in the September quarter. Let’s also look at a few companies advancing silver, manganese, high-purity alumina (HPA), magnesium and kaolin projects. Here’s what they did during the quarter.

Venture Minerals

Venture Minerals Limited (ASX:VMS, OTC:VTMLF) is advancing the Mount Lindsay Tin-Tungsten Project, one of the world's largest undeveloped tin-tungsten deposits, in northwest Tasmania.

During the quarter, Venture engaged Curtin University to start the next stage of metallurgical test work on the Mount Lindsay tin-rich borates.

This program will follow on from the stage 1 work successfully completed by CSIRO.

The program will investigate the extraction of tin, boron and iron from tin-iron borates, potentially significantly increasing the tin recovery and producing a high-value boron by-product resulting in another revenue stream for the Mount Lindsay project.

Venture believes the inclusion of tin-rich borates into the current underground feasibility studies could deliver a major economic benefit to the study through the recovery of boron and additional tin and iron from the tailings circuit of the current processing flowsheet, which has the economic advantage of already been mined and processed.

The company aims to deliver results from this test work within the coming months.

Elementos

Elementos Ltd (ASX:ELT, OTC:ELTLF) is a tin development company with assets in highly regulated and stable mining jurisdictions in Andalucía, Spain and Tasmania, Australia.

The company is primarily focused on developing the Oropesa Tin Project in Andalucía where it is undertaking a definitive feasibility study (DFS) with the aim of delivering the first major tin mine for the European market.

While its primary focus at Oropesa continues to be the project’s tin, Elementos has picked up on significant zinc mineralisation within the mineral resource wireframes at Oropesa.

The breakthrough came during the September quarter after a comprehensive study to evaluate the potential of producing a secondary by-product concentrate from the Oropesa site.

Stellar Resources

Stellar Resources Ltd (ASX:SRZ)’s 100%-owned tin projects are within the well-established mining district on the west coast of Tasmania.

The company’s flagship Heemskirk Tin Project is just 18 kilometres to the southwest of the Renison tin mine, the largest and most productive tin mine in Australia.

During the quarter, Stellar defined an updated indicated resource of 3.52 million tonnes at 1.05% tin (36,991 tonnes contained tin) for the Heemskirk Tin Project.

Stellar executive director Gary Fietz said: “Over the past 18 months, our Phase 2A and Phase 2B infill drilling programs have focused on increasing the indicated mineral resource at Severn.

“Our strategy has been vindicated with the results from these successful drilling campaigns, resulting in a 58% increase in contained tin in the Heemskirk Tin Project’s indicated mineral resource from the 2019 MRE.

FYI Resources

FYI Resources Ltd (ASX:FYI, OTCQX:FYIRF)’s innovative process flowsheet to produce ultra-high quality HPA (high purity alumina) continued to advance during the September quarter.

The company’s HPA process has been demonstrated through extensive pilot plant trials supporting the project’s definitive feasibility study (DFS) results.

Read: FYI Resources receives A$3 million grant for HPA project development

Following FYI announcing its intention to enter the rare earths sector via the option to purchase Minhub Operations Pty Ltd in May), the company has committed to the development of Minhub - a Darwin-based mineral sands and rare earth separation plant in joint development with project partner, Arafura Rare Earths Ltd (ASX:ARU, OTC:ARAFF).

Under an MOU with Arafura, the Minhub rare earth project plans to process third-party mineral sands concentrate to separate the high-grade rare-earth minerals xenotime and monazite (for neodymium and praseodymium) from other valuable mineral sands products such as zircon.

Silver Mines

The Bowdens Silver Project is the largest undeveloped silver deposit in Australia and lies within Exploration Licence 5920, which is 100% held by Silver Mines Ltd (ASX:SVL, OTC:SLVMF).

Silver Mines is advancing an optimisation program for updating the Bowdens Silver Feasibility Study completed in 2018.

Read: Silver Mines brings in new MD to help it transition into a mid-tier mining company

The optimisation program is examining all aspects of the development including ore reserves, mine design, metallurgy, process design and economic and market considerations.

The optimisation program is scheduled for completion in early 2024.

Meanwhile, two diamond drill rigs have continued drilling at Bowdens, focusing on potential extensions to the mineral resource estimate - particularly on the high-grade sections.

Element 25

Element 25 Ltd (ASX:E25) is moving towards construction of the first North American commercial-scale battery-grade high-purity manganese sulphate monohydrate (HPMSM) processing facility to produce key raw materials for electric vehicle battery manufacture in the USA.

The company is targeting commissioning in 2025 to produce HPMSM in the USA using raw material from its 100%-owned Butcherbird Manganese Project in Western Australia.

The project is supported by key offtake and funding agreements in place with General Motors (NYSE:GM) and Stellantis which are contributing a combined US$115 million dollars in project funding through a combination of equity, pre-payment and senior debt alongside offtake for ~65% of the planned HPMSM production from the first production train.

Construction is expected to begin in the first half of 2024.

Latrobe Magnesium

Latrobe Magnesium Ltd (ASX:LMG, OTC:LTRBF) is making strong progress towards construction of its 1,000-tonne-per-annum magnesium demonstration plant in Victoria’s Latrobe Valley - targeting first magnesium production in March 2024.

The company’s magnesium oxide (MgO) production strategy is on track with construction labour expanded to more than 40, with local trade contractors engaged onsite.

Latrobe is currently focused on fast-tracking the construction of key areas, including ash handling, leaching, pyrohydrolysis and magnesite, to produce one-tonne bulk bags of MgO, an intermediate product for customer sales, prior to the production of magnesium metal.

The fabrication and assembly of the spray roaster reactor vessel has been successfully completed by the local contractor, Stable Engineering, and the vessel has been transported to LMG’s site for final installation.

Spray Roaster reactor vessel workshop fabrication complete.

Cobalt Blue Holdings

Cobalt Blue Holdings Ltd (ASX:COB, OTC:CBBHF) is making strong progress with its integrated Australian cobalt supply strategy with work at present focusing on a refinery development program and a DFS for the Broken Hill Cobalt Project (BHCP) utilising results from a demonstration plant.

The strategy incorporates a refinery at Kwinana in Western Australia where cobalt sulphate will be produced for export utilising the cobalt MHP (mixed hydroxide precipitate) from the BHCP in Broken Hill, Far West New South Wales.

This comes at a time of increased focus in the US and Europe on developing critical minerals supply chains to serve the burgeoning electric vehicle and clean, green energy sectors.

Andromeda Metals

Andromeda Metals Ltd (ASX:ADN) delivered a 65% increase in the net present value (NPV) of the world-class Great White Project (GWP) to reach $1.01 billion following a commercial review of the construction-ready South Australian kaolin project during the quarter.

The results of the review, contained in an updated DFS, also delivered a 59% higher average annual earnings before interest tax depreciation and amortisation (EBITDA) of $130 million.

The commercial reassessment underlined the potential use of Andromeda's core kaolin products, Great White CRM and the Great White KCM 90, in established and burgeoning segments such as high-quality ceramic tiles and porcelain tableware.

Additionally, the emerging low-carbon concrete product market has been identified as another area where the Great White HRM, a complementary product, can be commercialised.

The 2023 DFS also identified the construction and infrastructure sectors as newly identified markets for the company’s industrial sand co-products.