Investing.com - Graincorp Ltd (ASX:GNC) released its H1 2024 results on Thursday, which align with the company's profit warning issued the previous week. The underlying EBITDA for H1 2024 stood at $164m, and the underlying NPAT was $57m. The company also declared a fully franked interim dividend of 14 cents per share, complemented by a 10 cents per share special dividend.

Key Insights:

• FY24 Guidance: The company reiterated its recent update (May 2024) that anticipates an underlying EBITDA of $250-280m and an underlying NPAT of $60-80m, excluding business transformation costs. In the near term, the grain and oilseed margin environment is expected to stay challenging for FY24. Dry conditions in Western Australia are impacting exportable volumes and margins, while crush volumes are expected to remain strong.

• 2025 Winter Crop Outlook: The 2024/25 winter crop outlook suggests a rebound, with early indications showing that recent rainfall and a healthy soil moisture profile have supported a strong planting period in Eastern Australia. Northern regions are expected to rebound from the 2023/24 season.

• Update to TTC EBITDA: The company has increased its through-the-cycle (TTC) EBITDA guidance by $10 million to $320 million, following the acquisition of XF Australia.

• New Crush Facility Update: The feasibility study for a new crush facility indicates a minimum capital expenditure of $500m for a facility with a capacity of 750k-1.0mt.

• Agribusiness: The Agribusiness sector reported an EBITDA of $101m, down 55% YoY and 20% HoH, with an EBITDA margin of 4%. The sector witnessed a decline in grain sales and margins internationally and lower winter crop production in Western Australia.

• Nutrition and Energy: The Nutrition and Energy sector reported an EBITDA of $76m, down 42% YoY but up 9% HoH, with an EBITDA margin of 8%. The Human Nutrition segment saw increased crush volumes and half-year improvements, while Animal Nutrition experienced increased sale volumes in Australia.

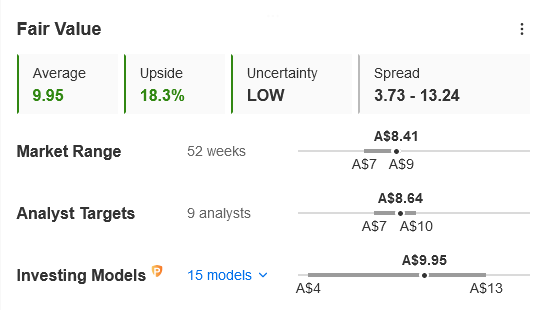

Despite the challenges faced in H1 2024, GrainCorp's stock has been trading near multi-month highs. As of Friday's trading session, the company was up 3.9% to 8.46 AUD.