Kingston Resources Ltd (ASX:KSN) has considerably upgraded the open pit mineral resource estimate at Pearse North deposit within the Mineral Hill precinct in central New South Wales.

New resource estimate

The updated mineral resource estimate (MRE) now stands at 292,000 tonnes, grading 3.2 g/t gold and 34 g/t silver, which translates to 30,000 ounces of gold and 318,000 ounces of silver.

This represents an increase of 30% for gold and 67% for silver compared to the 2022 estimates, highlighting not only higher resource volumes but also improved confidence in the deposit's continuity and geometry.

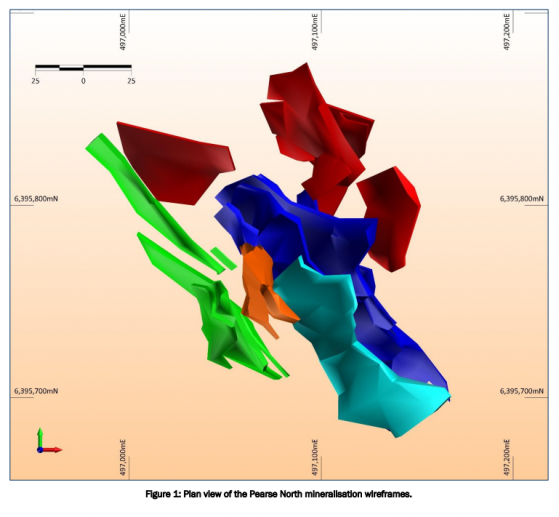

A review and adjustment of mineralisation orientation have revealed better spatial continuity than previously modelled, with updated 3D wireframe models showing a steeper dip and extended strike length.

“We are excited about the transition from tailings mining to open pit mining at our Pearse North Project,” said managing director Andrew Corbett.

Expansion in gold production

“This shift will allow us to significantly expand our gold production over the coming year, while also increasing operating cash flow.

“The high-grade nature of the pits and the momentum in the gold price provide a strong backdrop for maximising margins from this highly lucrative resource.

“The entire technical team has done a fantastic job ensuring the project has access to high-quality mineral resources and ore reserves necessary to support a successful mine plan.”

The company is re-optimising the mine plan to capitalise on the favourable gold market conditions.

Mining operations are scheduled to start within the current quarter, with expectations of a material impact on Kingston’s financials once production commences.

In addition to Pearse North, Kingston is progressing with a processing plant refurbishment, which is on schedule and budget, preparing for the upcoming treatment of ore from the Pearse deposits.

The company also highlighted ongoing operations at its Mineral Hill mine and the development of the Misima Gold Project in Papua New Guinea, part of its plan to cement its position as a mid-tier gold and base metals producer.

At Mineral Hill, mineral resources for the adjacent Pearse South deposit have also been updated and demonstrate a robust profile of high-grade gold and silver resources, which will be mined in parallel with Pearse North.

Pearse South contains 204,000 tonnes at 3.8 g/t gold and 69 g/t silver for 25,000 ounces of gold and 457,000 ounces of silver.

Further updates are anticipated as the new mining schedule is finalised.