P/E (Price/Earnings) and PBV (Price-to-Book Value) ratios are two metrics that are often used by new investors to measure the intrinsic value of a stock. In addition, there are many content creators and even media that relied on these two ratios to assess whether a stock is "undervalued" or "overvalued".

Unfortunately, this is potentially misleading because measuring intrinsic value must be done by analyzing various aspects, not just one side. Here are some of the main limitations of fundamental analysis that only relies on P/E (Price-to-Earnings) and PBV (Price-to-Book Value) ratios:

1. Ignoring the company's financial condition by not looking at debt

A company may have high earnings, but if these earnings are driven by excessive debt, both short-term and long-term, the company's overall financial health may be much riskier than implied by the P/E ratio.

2. Simplifying industry trends

P/E and PBV are based on historical data and performance. A company in a declining industry may have a low or good P/E; even though its earnings are stagnant. This company is still not a good long-term investment if the industry as a whole has poor future prospects. Conversely, innovative companies in high-growth sectors may have very high P/Es and are therefore considered "expensive," but this may be justified if future growth expectations are strong. So, don't rely solely on P/E and PBV to assess whether a company is "undervalued" or "overvalued".

3. Simplifying growth prospects and the economic cycle

A company's earnings in one year can be affected by extraordinary events or non-recurring events in the following year, such as the sale of assets, the consequences of a lawsuit, commodity price movements, or exchange rate movements. In fact, there are even certain seasons that affect certain industries, such as the tourism industry being highly affected by economic conditions; the banking industry being highly affected by interest rates.

In addition to the three points above, there are many other reasons why using P/E and PBV to measure the intrinsic value of a stock is very simplistic. Other things that should be considered to complement P/E and PBV are:

Growth Rate: Analyze earnings growth, profit growth, and projected growth to understand the company's future potential.

Debt Level: Look at the debt-to-equity ratio to assess the company's financial risk.

Profit Margin: Check operating margin, profit margin, and return on equity (ROE) for insights into profitability.

Qualitative Factors: Consider management quality, competitive advantages, industry trends, and the regulatory environment.

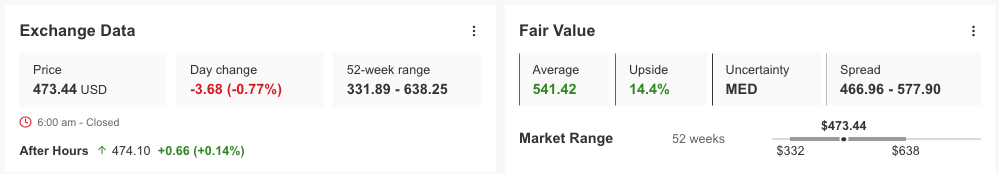

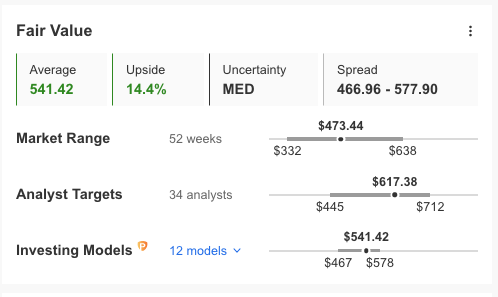

These four points should ideally also be considered to see the intrinsic value or fair price of a stock. Well, to make it easier for you to analyze stock values quickly and accurately, you can also use InvestingPro's Fair Value formula. Here is an example of using Fair Value on Adobe (NASDAQ:ADBE) stock:

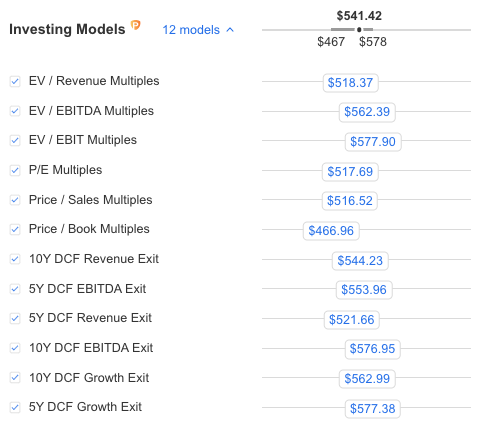

The InvestingPro’s Fair Value is derived from an aggregate of 12 to 14 financial metrics that are used simultaneously to reduce bias and see the intrinsic value of a company holistically.

In the case of ADBE, the 12 financial metrics that's used to formulate its Fair Value are:

And that's how, with InvestingPro's Fair Value formula, you can quickly and accurately understand the fair value of a stock. Its far easier and at the same time reduce the potential of bias if you only rely on 1-2 metrics only.

Stop relying on just one or two metrics to value stocks and start utilizing InvestingPro's Fair Value. Subscribe now and get over 40% discount on your annual plan! Click here.

- English (USA)

- English (UK)

- English (India)

- English (Canada)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

The Limitations of P/E and PBV Ratios and Why InvestingPro's Fair Value Matters

Published 26/04/2024, 01:17 pm

The Limitations of P/E and PBV Ratios and Why InvestingPro's Fair Value Matters

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.