“USD Non-Farm Employment Change (242K v 195K expected)”

“USD Unemployment Rate (4.9% v 4.9% expected)”

“USD Average Hourly Earnings m/m (-0.1% v 0.2% expected)”

Even amidst a huge jobs number beat of expectations (plus upward revisions!), the USD was still seen on struggle street.

Non-farm payrolls smashed expectations of 195K with an excellent headline print of 242K jobs created, continuing the recent trend of beating expectations month after month. Meanwhile, the unemployment rate also printed green, holding steady at 4.9%.

How about for the traders? Heading into the release on Friday, we discussed some of our NFP thoughts as follows:

“Remember that we have Non Farm Payrolls tonight amidst a broadly weak USD environment. With the Fed not expected to move during March, the greater risk is still to the downside for USD. Any weakness will be seen as confirmation and the USD will sell off, while a beat probably wont be enough to change the market’s views.”

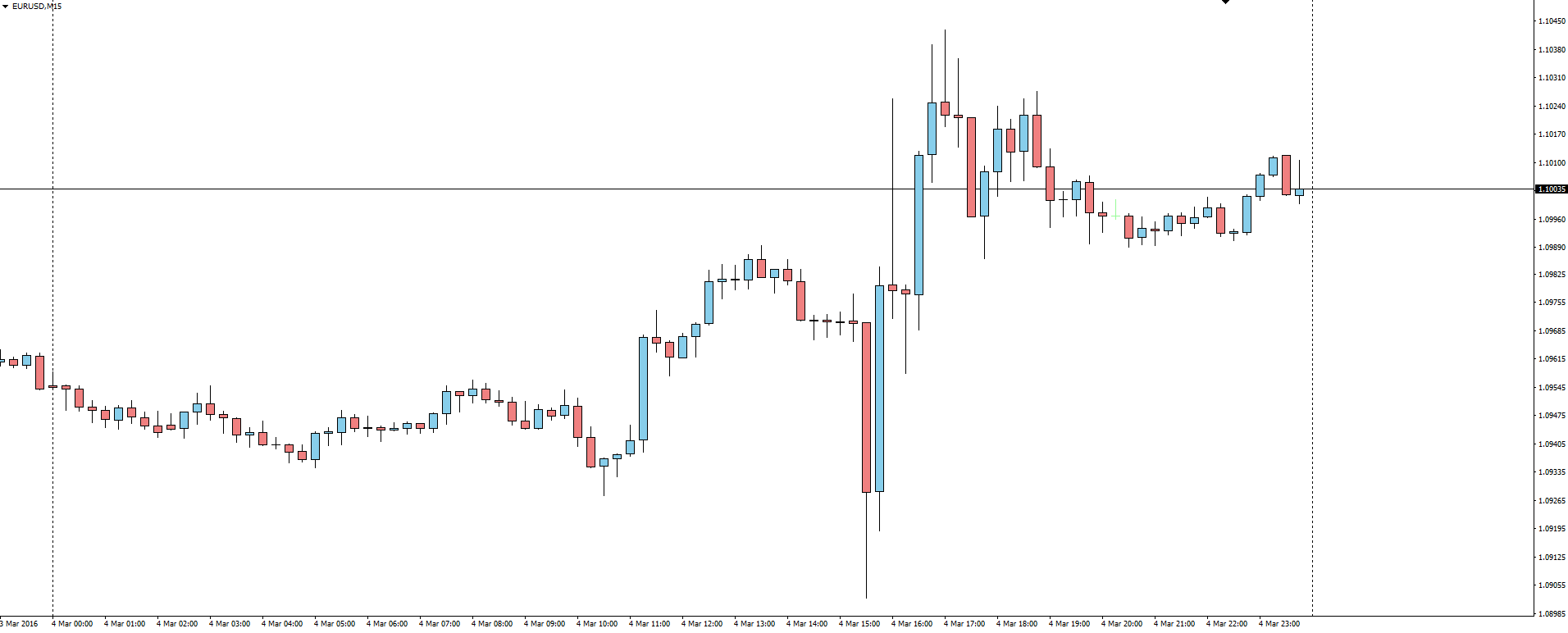

EUR/USD 15 Minute:

As you can see on the EUR/USD 15 minute chart, even with the NFP headline beat, the market instead chose to focus on the underwhelming average hourly earnings number and we got USD weakness.

This focus comes from the Fed being dependent on increased inflation to make their next interest rate hike and this cut in wages isn’t going to be enough to tick inflation into their target band.

The Fed will gather for their next two day meeting on March 15, one week from now.

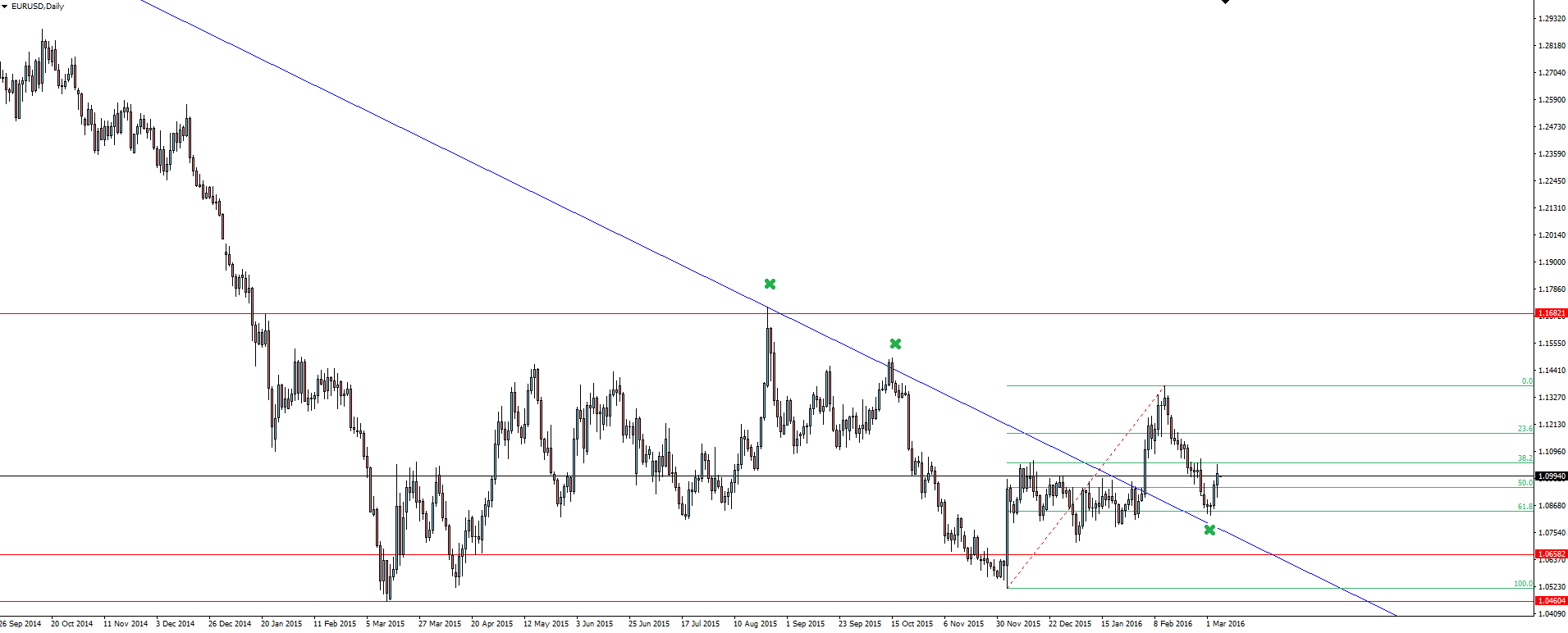

Chart of the Day:

With the above EUR/USD 15 minute chart, we have to take a step back to see where price sits on the higher time frame for some context.

On the daily, we can see the bearish trend line resistance that price has broken out of and since re-tested this time as support. Coincidently, this level lined up exactly with the 61.8% fib drawn off the two most recent swings.

So often these breakouts and re-test levels fail to break long term trends and we see consolidation or a continuation in the original direction of the trend. However, the fundamental driver of an interest rate hike re-pricing in USD, could mean this time that the pattern holds and EUR/USD continues higher.

On the Calendar Monday:

AUD AIG Construction Index

AUD ANZ Job Advertisements m/m

JPY BOJ Gov Kuroda Speaks

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Australian Forex broker Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, prices or other information is provided as general news and marketing communication – not as investment advice. Consequently any person acting on it using Forex leverage does so entirely at their own risk. The experts writers express their personal opinions and will not assume any responsibility whatsoever for the actions of the reader. We always aim for maximum accuracy and timeliness, and Vantage FX on the MT4 platform, shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.