Key Points:

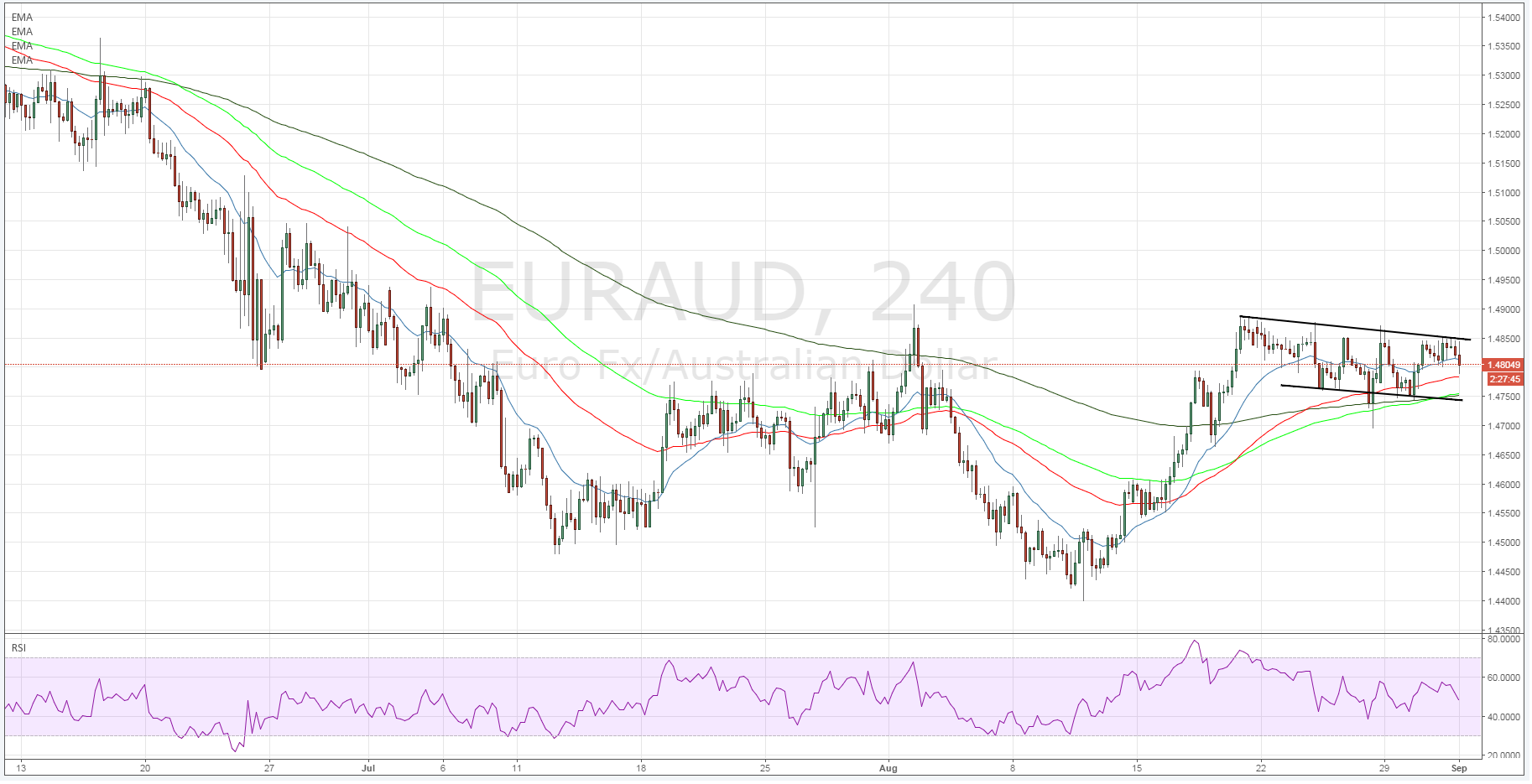

- 4-Hour timeframe shows bullish flag.

- RSI Oscillator trending higher.

- 1.5046 near term upside point.

The EUR/AUD pair has largely been bearish over the past few months as the currency pair has reacted to a range of changing macroeconomic conditions within the Eurozone. Subsequently, the pair managed to discover some support at the 1.44 handle that saw price action moving to form a new high just below the 1.49 handle. However, the EUR/AUD has recently entered a sideways consolidation phase that has subsequently formed a relatively clear bullish flag on the 4 hour timeframe.

The technical perspective provides an interesting case for a short term bullish move by the pair with the appearance of the bullish flag. In addition, the 60 period EMA has also crossed the 100MA bullishly and the moving averages are now trending higher. The RSI Oscillator is also exhibiting some interesting divergence as the indicator has recently been steadily ticking higher despite the fact that price action has been largely capped within the short run descending channel.

Subsequently, given the rising RSI Oscillator, and the appearance of the bullish flag, there are plenty of reasons to see a short term rally for the pair in the coming days. The first stumbling block that the EUR/AUD will need to surmount is the swing high at 1.4891 which any breach of could see a sharp appreciation for the Euro. As far as any form of upside target, there is a consolidation of wicks at 1.5046 that is likely to form the basis for an upside reversal point. Subsequently, watch any extension moves above that point closely as further bullishness could be short lived indeed.

Fundamentally, both the EU and AU economies have been in focus for their relative weaknesses over the past month. However, whilst the Eurozone economy remains flat and disappointing the Australian economy is actively declining due to the ongoing rout within global commodity prices. This has had a direct impact and even the latest bout of Australian Retail Sales data has demonstrated the level of declining consumer spending. Subsequently, over the medium term it is conceivable that the AUD will depreciate further.

Ultimately, timing a breakout from a bullish flag can be a difficult prospect given much of the machinations that are currently occurring within world markets. However, given the technical indicators there is a mounting case for the pair moving to the upside in the coming days. Subsequently, keep a close watch for a challenge to the swing high because that is likely to signal that the bulls are finally in control.