Key Points:

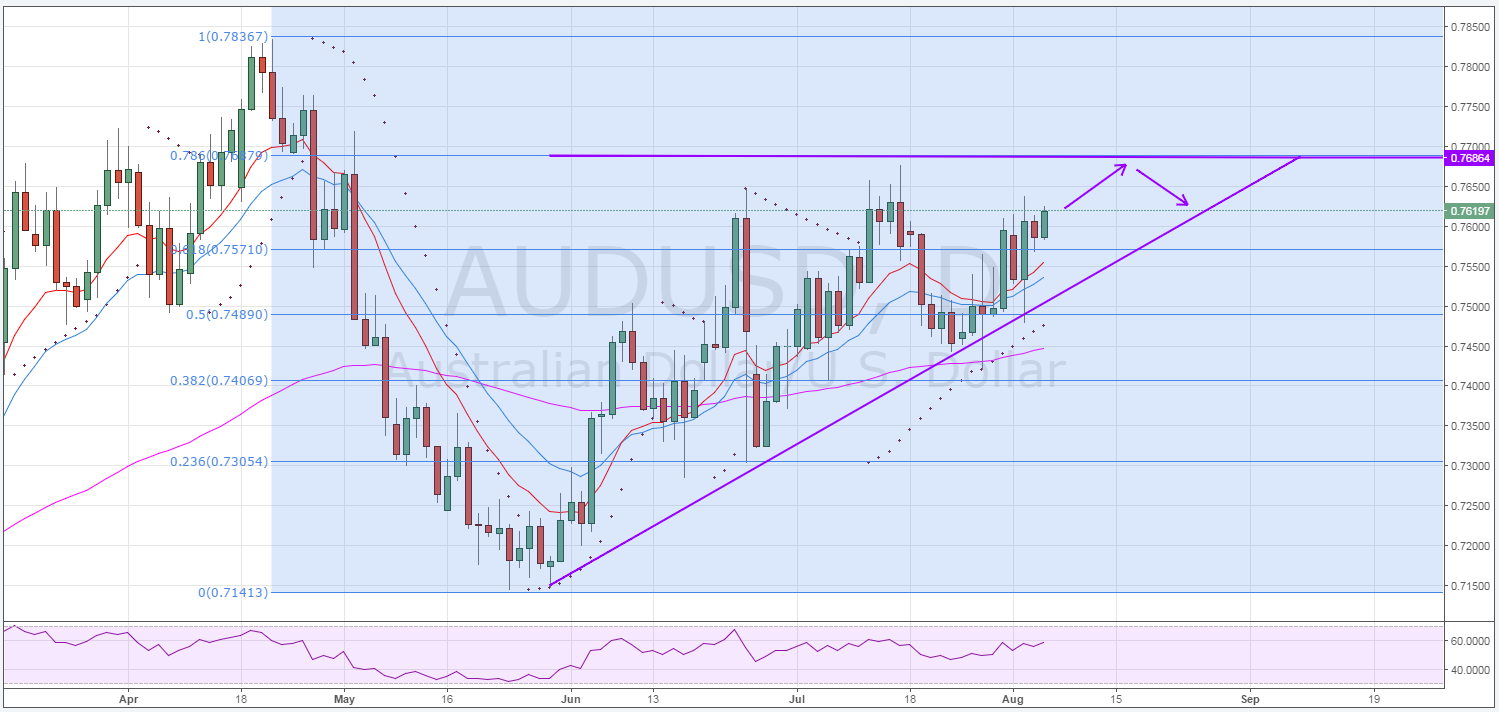

- Ascending Triangle pattern.

- Bullish EMA Activity and Parabolic SAR readings.

- Upside constraint unlikely to be broken.

After largely shrugging off the 25bps cut to the Australian Cash Rate and remaining bullish, the Aussie Dollar is likely moving into the final stages of its restrictive acceding triangle trend. Consequently, there could be a bumpy few sessions in store for the pair as it bounces between the converging upper and lower constraints.

First and foremost, the bullish configuration of the daily EMA’s and the Parabolic SAR are signalling that the Aussie Dollar should remain in an uptrend going forward. As shown above, the bullishness of the 12, 20, and 100 day EMA’s is fairly self-evident. Equally bullishis the Parabolic SAR which is still highly suggestive of a continued upward movement over the coming sessions. Furthermore, the H4 chart’s EMA activity and Parabolic SAR share this bias and are similarly bullish. In addition to these readings, the relative neutrality of the RSI leaves the pair with some room to move in either direction.

Despite the overall bullishness of the pair, the AUD hastypically been running into resistance around the 0.7626 and 0.7686 levels. The latter of these two levels represents a rather robust zone which coincides with the 78.6% Fibonacci retracement. As a result, it forms the upside constraint of the ascending triangle and this is unlikely to be broken in the absence of some strong fundamental data. On the other hand, the 0.7626 level looks likely to be challenged and, ultimately, broken over the next few sessions.

After breaking through the 0.7626 level and testing the 0.7686 level, the pair should reverse and seek out support along the downside constraint of the triangle pattern. This slip will largely be the result of the stochastics moving squarely into overbought territory as the pair reaches the 0.7686 mark. After this eventual decline, it will be worth keeping a close eye on the pair as a breakout will become highly probable given the nature of the ascending triangle pattern.

Ultimately, the completion of said pattern will be contingent on the slew of influential US results being released as the week comes to a close. Notably, the Non-Farm Employment Change, Trade Balance, and Unemployment Rate figures are all due by week’s end. Consequently, keep an eye out for any surprises in the data as the Aussie Dollar nears the constraints of its triangle pattern as they could provide the spark needed for a breakout.