- After recent market rebound, focus shifts to earnings reports from tech giants like Meta and Microsoft.

- The resurgence in tech optimism has buoyed stocks, notably Tesla, which saw a significant surge in after-hours trading despite mixed quarterly results.

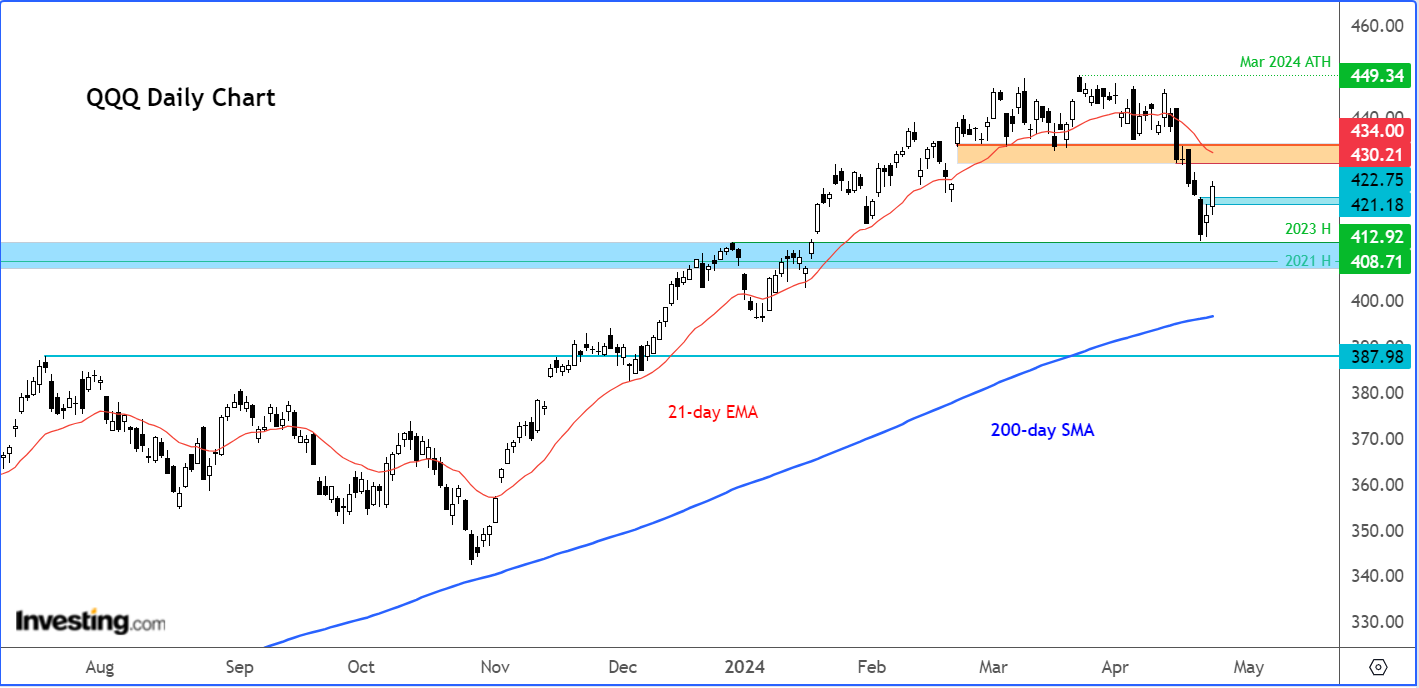

- Against this backdrop, the QQQ is approaching a crucial resistance area.

- Invest like the big funds for under $9/month with our AI-powered ProPicks stock selection tool. Learn more here>>

After last week’s slump, we have seen a sharp two-day rally in the equity markets at the start of this week, which has eroded the bears’ control somewhat. US index futures were a touch higher following Tesla's (NASDAQ:TSLA) double-digit after-hours surge, even if the EV maker missed on both the top and bottom lines.

Meta Platforms (NASDAQ:META) is due to release its results after the close of play, ahead of more tech earnings later in the week. Investors’ focus will also return to the macro front with key US data coming up in the last couple of days of the week, namely GDP and core PCE price index.

With the market in the middle of a rebound, our predictive AI stock-picking tool can prove a game-changer. For less than $9 a month, it will update you every month with a timely selection of AI-picked buys and sells.

Subscribe now and position your portfolio one step ahead of everyone else!

Unless we see weaker numbers here, there is a risk that bond yields could rise even further as investors continue to price out the odds of rate cuts. That outcome could potentially be negative for risk assets, although for the tech sector it is earnings that will be the primary driver of the Nasdaq this week.

Before discussing those and more, let’s quickly have a look at the chart of QQQ, which tracks the performance of the Nasdaq 100, to remind ourselves where we stand following all the volatility in the last couple of weeks, and what to expect from a technical point of view at least.

QQQ technical analysis and trade ideas

After a sharp two-day rally in the markets, QQQ has broken above a couple of short-term resistance levels to loosen the bears’ control of price action. However, the index is still not back above the broken 21-day exponential moving average to signal a complete reversal back in the direction of the long-term bull trend. That may happen later this week, should QQQ get past a pivotal area between 430.21 to 434.00, which is now the most important resistance area to watch.

Until that happens, and given the sharp two-day rally, I would now proceed with a bit of extra care as profit-taking has the potential to send the index back lower again. Short-term support now comes in around 422.75 to 421.18, marking the highs from Friday and Monday, respectively.

It is essential that this support area holds now, else we could see another dip into the longer-term support zone between 408.71 to 412.92 (the highs from 2021 and 20223). Although QQQ didn’t quite touch this area on Friday, the corresponding zone held on the underlying Nasdaq 100 futures when it tested the upper end of its long-term support range on the same day.

Tesla shares surge in after hours, but can it hold its gains?

The positive sentiment surrounding a resurgence in the US technology sector has bolstered stocks. Tesla’s stock made a sharp comeback in after-hours trading after the company said it is speeding up the rollout of more affordable vehicles in an effort to rejuvenate waning demand after another disappointing quarter.

The electric vehicle manufacturer plans to commence production of these new models as early as this year, a significant advancement from its previous commitment of late 2025. This decision led to a 13% surge in shares late Tuesday. The announcement overshadowed considerable shortcomings in the company's first-quarter earnings, sales, and margins.

Elon Musk described Tesla as an AI company during a conference call, which seems to have helped its shares. He expressed the company’s ambition to operate fleets of robotaxis and facilitate owners in renting out their vehicles.

More earning to come this week

The positive sentiment in the tech sector continued in Europe, with ASM International (AS:ASMI) reporting higher-than-expected orders. This comes after an upbeat outlook by US peer Texas Instruments (NASDAQ:TXN). More earnings are on the way from both sides of the Atlantic.

Microsoft Corporation (NASDAQ:MSFT), Meta and Alphabet (NASDAQ:GOOGL) are also due to report earnings this week. Profits for the “Magnificent Seven” group are forecast to rise about 40% in the first quarter from a year ago, according to Bloomberg.

Focus turns to macroeconomics

Investors will shift their attention back to the macroeconomic landscape as key US data, including GDP and the core PCE price index, are scheduled for release in the latter part of the week. Unless these indicators show weakness, there's a possibility that bond yields might climb higher as investors adjust their expectations regarding rate cuts. Such a scenario could have a detrimental effect on risk assets, although for the tech sector, the focus will primarily be on earnings, influencing the trajectory of the Nasdaq this week.

GDP is expected to print 2.5% in Q1 on an annualized format on Thursday, which together with core PCE that will be released a day later, will put the focus back on the interest rates outlook. Core PCE is expected to print another strong 0.3% month-over-month reading on Friday. If so, this will likely mean elevated interest rates are going to stay with us for longer. The PCE data will influence the Fed’s upcoming policy decisions. After a strong US CPI print, they will be looking – hoping, even – for a weaker print on the PCE measure of inflation.

Strong growth and sticky inflation data have helped to rein in rate-cut bets in recent weeks. But most of the hawkish repricing may be factored in by now. Thus, if we start to see weakness in US data again, then this will reduce recent concerns over the Fed’s ability to cut rates. A potentially weaker PCE data, in particular, could be welcomed by stock investors on Friday.

US interest payments continue to rise but investor demand remains insatiable

The US government managed to successfully sell $69 billion of two-year notes on Tuesday at a yield of 4.898%, which was slightly lower than the yield in pre-auction, which is a sign that demand was higher than expected. Today more debt will be supplied to the tune of $70 billion of five-year notes. This will be followed by $44 billion of seven-year notes on Thursday.

Driven by robust economic data and persistent inflation, traders have demanded higher yields for holding government debt as they have revised down their expectations of Federal Reserve rate cuts for the year.

But the rising yields means the cost of interest on US Federal debt is starting to get out of control. The annual payment on interest expense alone is now at a staggering $1.1 trillion. Just a few years back, it was less than half this figure. With interest rates high and debt levels breaking record levels, thanks to continued deficit spending, the US appears to be on an unsustainable fiscal path.

Tax rises and cuts in government spending is the only solution to help get things back under some sort of control. If not addressed, this is something that could ultimately cause a severe recession and impact stocks in a significant way.

For now, though, stock investors appear to be ignoring these risks.

***

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. As with any investment, it's crucial to research extensively before making any decisions.

InvestingPro empowers investors to make informed decisions by providing a comprehensive analysis of undervalued stocks with the potential for significant upside in the market.

Subscribe here for under $9/month and never miss a bull market again!

Don't forget your free gift! Use coupon codes OAPRO1 and OAPRO2 at checkout to claim an extra 10% off on the Pro yearly and bi-yearly plans.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.