Westgold Resources Ltd (ASX:WGX, OTC:WTGRF) shares closed 3.45% higher at $2.1 after marking the third consecutive quarter of cash build from its Western Australian gold operations.

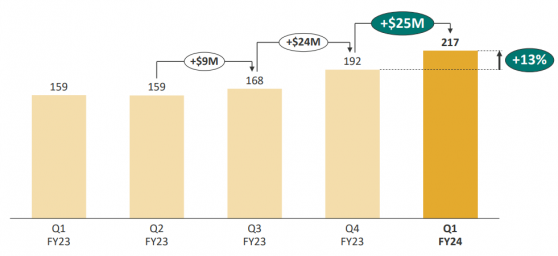

The company added $25 million in cash, bullion and liquid assets during the September quarter (Q1, FY24) to close with $217 million in its treasury.

Third consecutive quarter of cash, bullion & liquids build ($M).

Westgold operates four underground mines and three processing plants with an installed processing capacity of ~4 million tonnes per annum across 1,300 km2 of tenure in the Murchison and Bryan Basin.

The company produced 63,104 ounces (oz) at an all-in-sustaining cost (AISC) of $1,935/oz during the quarter. It sold 62,120 oz of gold at an achieved gold price of $2,888/oz, generating $179 million in revenue.

Importantly, Westgold remains debt-free, fully leveraged to the gold price and on track to deliver FY24 production and cost guidance.

“Fully funded to deliver our corporate objectives”

Westgold managing director Wayne Bramwell said: “Westgold has continued to deliver by adding a further $25M to its treasury in Q1, FY24.

“This quarter, once again characterised by strong safety statistics and operational results, represents the third consecutive quarter of cash build for Westgold – a first in its long history.

“Our treasury is strong and we are fully funded to deliver our corporate objectives through operational cash flows in FY24.

“Drilling continues in earnest across our assets and Westgold continues to invest in its high value internal growth projects, with the development of Great Fingall commencing in October.

“With our cost out programme continuing, being debt free and fully leverage to the gold price, Westgold is well poised to deliver its FY24 guidance.”

Clean energy transition

Westgold has energised three of four hybrid power facilities across the company’s operations as part of its clean energy transition.

In October 2023, the second and third hybrid power stations were commissioned at Fortnum and Big Bell.

The first facility, at Tuckabianna, has been operational since early August 2023.

Tuckabianna solar array.

Westgold has now achieved ~60% of the run rate required to achieve the targeted annualised savings of 38 million litres of diesel, 57,000 tonnes of CO2-equivalent emissions and a reduction in AISC of $60/oz at a diesel price of $1.64 per litre.

The hybrid power facilities, owned and operated by Pacific Energy, comprise gas-fuelled power stations, solar farms, and battery storage.

The last of the four new hybrid facilities, located at Bluebird, will be commissioned and operating during Q2 FY24.

Read more on Proactive Investors AU