Volt Resources Ltd (ASX:VRC, OTC:VLTRF) is advancing two high-quality graphite assets to become an integrated natural graphite anode producer – a critical material used in lithium-ion batteries.

- Zavalievsky Graphite LLC (ZG) is the only significant operational graphite mine and processing plant in the European catchment area; and

- Bunyu Graphite Project in Tanzania is one of the world’s biggest undeveloped greenfield natural graphite projects.

Volt has a 70% interest in the ZG business in Ukraine. The ZG mine and processing facilities have been in operation since 1934 and are near key markets with significant developments in lithium-ion battery production.

Read: Volt Resources subsidiary starts second ZG production campaign

ZG has started generating revenue from the graphite produced and as of July 31, 2023, had generated product revenues of about €992,000 or about A$1.7 million.

Graphite poised for the next bull market

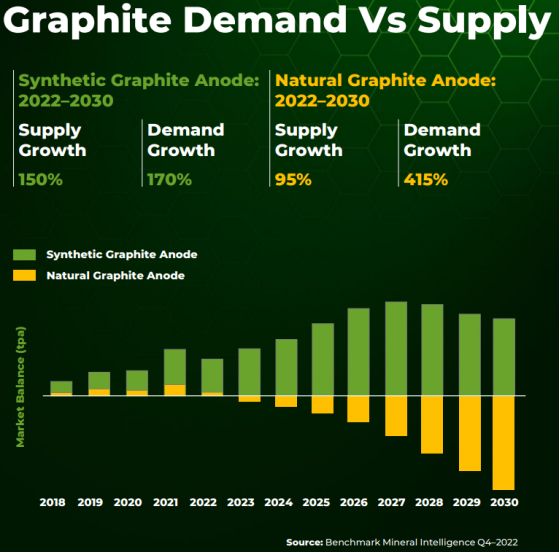

Graphite price is down 29% in 2023, however, the fundamentals of graphite demand vs supply haven’t changed and remain supportive.

While China is likely to be dominated by synthetic graphite, in North American and EU markets, natural graphite is expected to dominate.

2023 highlights at ZG

- Growth opportunity in garnet ore

- Volt has garnet in stockpile and in mine; estimated opportunity size of over $100 million revenue

- Positive feedback from a large customer, 500 kilograms sample requested

- LOI signed with M2i Global, Inc. for potential supply of up to 20 ktpa graphite to US Government

- Generated revenue of €992,000 during January – July 2023

- ZG won €600,000 government grant & was identified as a strategic asset by EIT (European Institute of Technology) and ERMA (European Raw Materials Association)

- First production campaign was successful (1,015 tonnes produced), 2nd underway with 400 tonnes produced.

Bunyu Graphite Project

Volt’s Bunyu Graphite Project in Tanzania, located 140 kilometres from Mtwara port, is one of the largest graphite deposits in the world.

Bunyu natural graphite product is suitable for a range of end-use applications including battery anode material, refractories, foils, gaskets, dry lubricants, graphene and other applications.

Volt has planned a two-stage development with stage 1 significantly de-risking the development of the stage 2 expansion project.

Read: Volt Resources’ feasibility study update highlights improved economics of Bunyu Graphite Project Stage 1

Stage 1 will produce 24,780 tpa (tonnes per annum) flake graphite and stage 2 expansion increases annual production to 170,000 tpa flake graphite.

Interestingly, the projected stage 2 graphite production is enough for about 2.8 million electric vehicles per year.

Read: Volt Resources inks exclusive agreement with American Energy Technologies Co; eyes US DOE funding

Earlier this month, Volt and American Energy Technologies Co. (AETC) fortified their partnership with a limited scope exclusivity agreement, setting sights on the United States Department of Energy (DOE) funding for a proposed 7,500-tonne per annum natural graphite anode plant.

Major milestones reached for Bunyu, ZG and battery anode plant.

The proposed natural graphite anode plant plant represents an opportunity to reduce the US's dependency on Chinese-dominated supply chains, particularly in the realm of spheroidal graphite processing.

Transformation of Volt is underway.

Read more on Proactive Investors AU