Sovereign Metals Ltd has presented the Kasiya Rutile-Graphite Project in Malawi as a potentially major critical minerals project with an extremely low carbon footprint in a pre-feasibility study (PFS) underpinned by significant economic returns.

Kasiya, in central Malawi, is the largest natural rutile deposit and second-largest flake graphite deposit in the world.

According to Sovereign, the current global supply deficit in natural rutile is forecast to worsen considerably in the next five years, while the natural graphite market will undoubtedly move into deficit as demand grows rapidly in the lithium-ion battery and electric vehicle sectors.

Key PFS outcomes

The PFS is modelled on a life-of-mine (LOM) of 25 years, with initial probable ore reserves of 538 million tonnes, representing a conversion of only 30% of the total mineral resource.

Sovereign has proposed a large-scale operation that will process 24 million tonnes of ore per annum to produce about 245,000 tonnes of natural rutile and 288,000 tonnes of natural graphite annually once at a steady state.

The operation will commence in the southern section of the ore reserve, initially with a 12 million tonnes per annum (Mtpa) throughput plant, expanding to 24 Mtpa from the sixth year.

Kasiya is forecast to become the world’s largest rutile producer at 222,000 tonnes per annum and potentially one of the world’s largest natural graphite producers outside of China at 244,000 tonnes per annum.

Sovereign believes there is potential to substantially increase Kasiya’s production rate and mine life given the LOM of only 25 years.

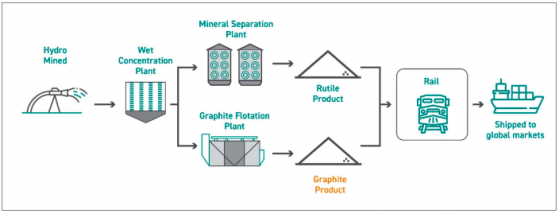

Additionally, the project will incorporate climate-smart attributes, including hydro-mining with renewable power solutions, making it an extremely low carbon footprint operation.

As well, its low-impact operation with mineralisation at surface, zero-strip ratio, low reagent usage, simple process flowsheet and progressive land rehabilitation position Kasiya as the lowest-cost producer of rutile and graphite globally.

High-level schematic of the planned Kasiya Rutile-Graphite Project.

Base case economics

Under the PFS, the cash operating costs have been estimated at US$404 per tonne of product based on the project’s excellent surrounding infrastructure, including sealed roads, a high-quality rail line connecting to the deep-water port of Nacala on the Indian Ocean and hydro-sourced grid power.

Products will be exported to global markets via the deep water port of Nacala along the existing Nacala Logistics Rail Corridor (NLC).

Its close proximity to Malawi’s capital city Lilongwe provides it access to a skilled workforce and industrial services.

The study forecasts total revenue at US$16 billion and average annual EBITDA of US$415 million for the initial 25 years modelled.

“Compelling economics”

“The release of the Kasiya PFS marks another important step towards unlocking a major source of two critical minerals required to decarbonise global supply chains and to achieve net-zero,” Sovereign managing director Dr Julian Stephens said.

“The project benefits from existing high-quality infrastructure and inherent ESG advantages.

“Natural rutile has a far lower carbon footprint compared to other titanium feedstocks used in the pigment industry, and natural graphite is a key component in lithium-ion batteries – crucial to de-carbonising the global economy.

“The high-quality of work completed and the results of the PFS demonstrates that Kasiya is a globally significant project that has the potential to deliver a valuable long-term source of low-CO2 products and generate substantial economic returns.

“The project is well positioned to be a large-scale, multi-generational asset with significant opportunity for further upside as only 30% of the current mineral resource is utilised in the PFS model.

“Kasiya’s compelling economics demonstrate the potential for industry-leading returns, even against the backdrop of global cost inflation.

“The company is looking forward to conducting an optimisation review in collaboration with new strategic investor, Rio Tinto (ASX:RIO) and progressing to the definitive feasibility study.”

Rio Tinto’s timely investment

Both Sovereign and the project enjoy strong support from the Malawian government as Kasiya has the potential to deliver significant social and economic benefits for the country, including fiscal returns, job creation, skills transfer and sustainable community development initiatives.

Rio Tinto’s 15% investment in Sovereign, announced in July, was applauded by the government as a milestone towards realising the country’s aspirations of growing the mining industry as promoted in the Malawi Vision 2063.

The mining giant will provide assistance and advice on technical and marketing aspects of Kasiya, including Sovereign’s graphite co-product, with a primary focus on spherical purified graphite for the lithium-ion battery anode market.

A technical committee to formally commence the working relationship with Rio Tinto will be set up imminently.

Read more on Proactive Investors AU